Recently, with Binance's announcement of the launch of Usual (USUAL), the stablecoin project called Usual Money has quickly become a focus. As one of the latest projects of Binance Launchpool and Pre-Market, Usual has attracted widespread market attention. Binance's listing effect has undoubtedly increased Usual's exposure, but the complex mechanism and unique innovation points of this product are also very worthy of our attention. This article will provide a detailed analysis of the innovations and operating mechanism of Usual Money to help investors better understand the value of this project.

In the current stablecoin market, market attention to stablecoins is constantly increasing, especially against the backdrop of payment giants like Stripe acquiring stablecoin payment companies, and the Coinbase CEO mentioning that stablecoin trading volume is already approaching Visa's data, the launch of Usual Money undoubtedly has important market significance. Particularly, with the gradual clarification of regulations on the stablecoin market, Usual Money, with its innovative design and risk management mechanism, is becoming a potential leader in the future payment market.

The Core Mechanism of Usual Money: A Combination of Innovation and Stability

The core mechanism of Usual Money revolves around three important tokens: the stablecoin USD0, the four-year bond product USD0++, and the governance token Usual. These tokens not only have innovations in stability and returns, but also achieve decentralized governance through smart contracts and governance tokens.

USD0 - The Core Support of the Stablecoin

USD0 is the basic stablecoin in the Usual Money ecosystem, and it derives its value support from holding real-world assets (RWA), similar to other RWA-backed projects like Frax and Grypscope. The underlying assets include US short-term government bonds and overnight reverse repurchase bonds, ensuring the stability of USD0 and the ability to withstand market volatility.

Unlike existing stablecoins (such as Tether's USDT) that mainly rely on cash and short-term debt instruments, USD0 has improved its stability and risk resistance through a diversified RWA asset pool. In addition, the issuance and redemption mechanism of USD0 is based on pre-set rules and automated execution, reducing the impact of human factors on the coin value fluctuations. Therefore, USD0 not only has strong anti-inflation ability, but can also maintain relative stability even in large-scale market fluctuations.

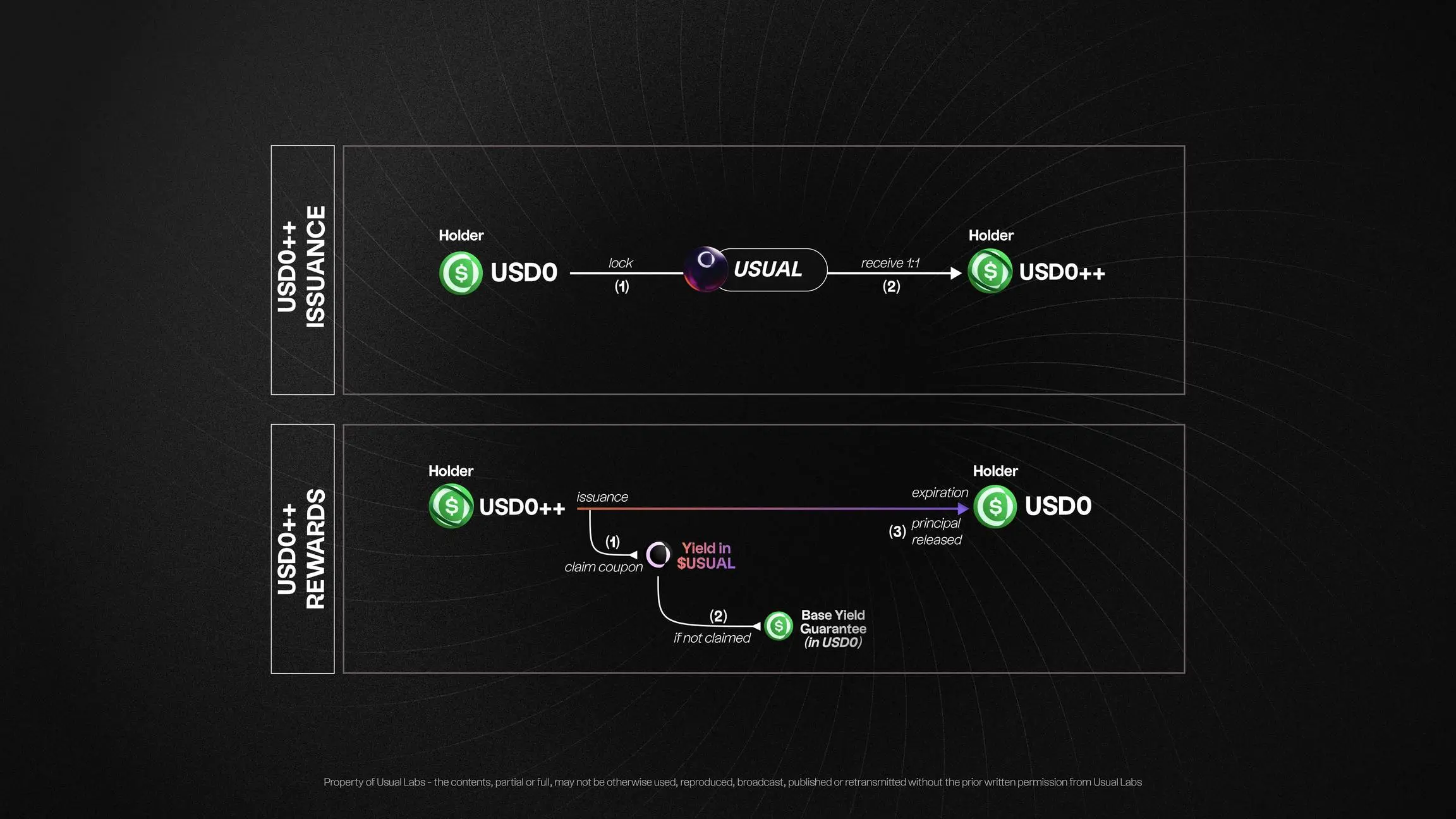

USD0++ - Enhanced Bond Product

USD0++ is Usual Money's innovative bond product, which allows users to obtain higher returns by locking up USD0 assets. Compared to traditional government bonds, USD0++ can provide users with higher returns through the amplification effect of the RWA asset returns. This product design enhances the stability of the project and provides continuous incentives for long-term investors.

Specifically, the returns of USD0++ are directly linked to the RWA assets contributed by the user, rather than the average returns of the entire reserve. This means that after users convert their funds into USD0++, the returns they receive are entirely dependent on the returns generated by the specific RWA (such as US short-term Treasury bonds) supporting those funds, rather than the pooled returns of all participants. Therefore, the user's returns are directly linked to the RWA assets they have locked, which is more transparent and personalized. This means that participants can obtain corresponding returns by holding USD0++, or choose to lock in for six months to further increase the returns, which may be paid in the form of USD0 or Usual. Through these mechanisms, Usual Money not only makes users passive holders, but also an integral part of the protocol's growth.

The design of USD0++ has two important purposes: first, to enhance the long-term stability of the funds by reducing short-term volatility risks through the locking mechanism; and second, to allow users to enjoy the potential appreciation brought by the protocol's development by holding USD0++. Throughout the process, the interests of users are closely linked to the development of the protocol.

Usual - Governance Token and Revenue Distribution

The Usual token, as a governance token, grants its holders the right to influence decision-making in the protocol, including risk management, liquidity strategies, and the development of new features. In addition, a notable feature of the Usual token is that it is linked to the protocol's revenue - all revenue from USD0++ will be distributed to Usual token holders. This makes the Usual token not only a governance tool, but also a representation of the growth in the protocol's value.

The distribution and circulation mechanism of the Usual token will be gradually adjusted according to the development of community governance, so that it can maintain a fair and effective incentive structure as it grows. Particularly in the early stage of the project, the distribution of Usual tokens will be mainly concentrated on early investors and core team members, while as the protocol expands and the community grows, the token release in the later stage will gradually slow down, ensuring the balance of market supply and demand and avoiding price volatility caused by oversupply.

Innovative Token Economics of Usual Money

The token economic design of Usual Money demonstrates significant innovation and uniqueness. By separating the functions of stablecoin and governance token, and adopting a complex incentive mechanism to attract long-term user participation, the project ensures sustainable development.

The Usual token is mainly used for governance and utility purposes. It adopts a deflationary mechanism, where early participants receive more tokens, while the token distribution gradually decreases as the total locked value (TVL) increases. Holders not only have control over the treasury, but can also participate in the decision-making process. In addition, staking the tokens supports the protocol's security and also generates returns.

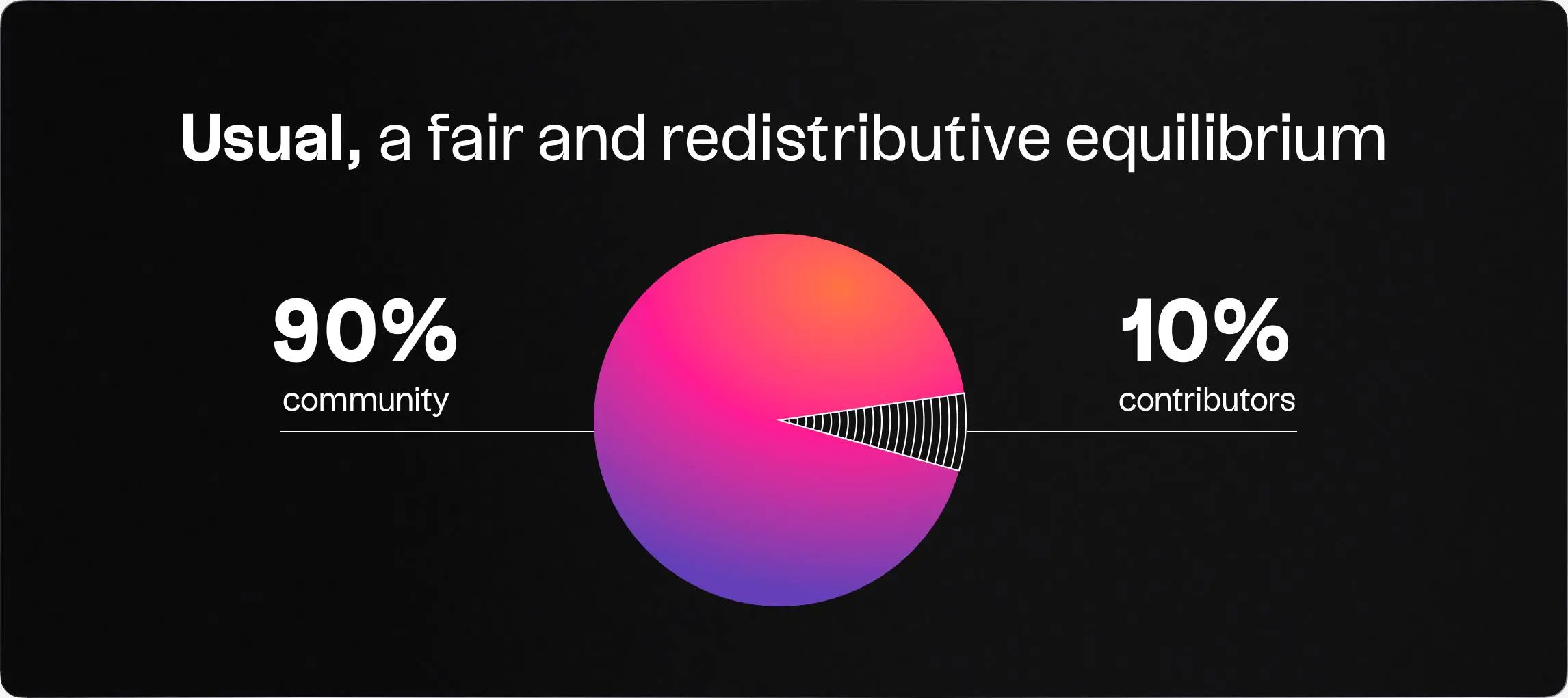

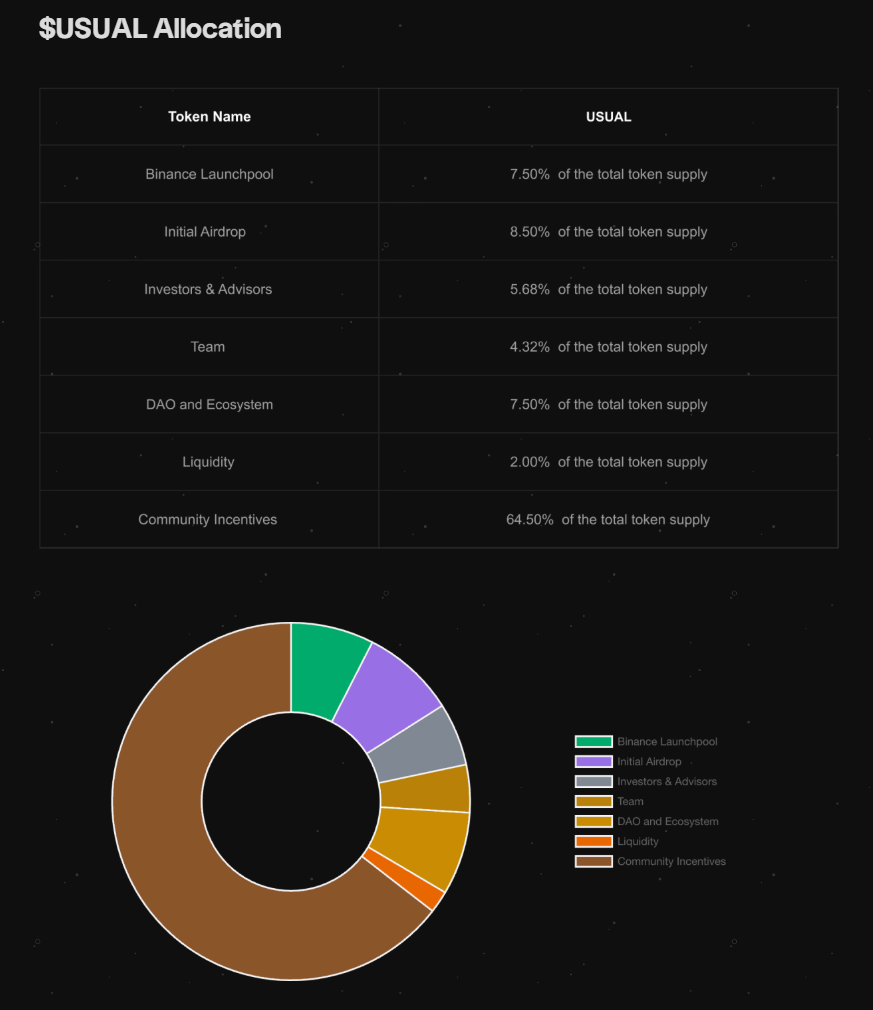

Unlike other protocols that allocate 50% of the tokens to VCs and advisors, Usual allocates 90% of the tokens to the community, with the internal team's allocation not exceeding 10% of the circulating supply. In the current rising tide of "fairness" calls, this practice highlights Usual's emphasis on the "decentralization" spirit of the community.

Inflation Control and Market Stability

Unlike traditional stablecoins (such as Tether and Circle), Usual Money separates the stablecoin (USD0) and the governance token (Usual), avoiding the concentration of returns and risks in a single token. This design not only reduces risks, but also allows Usual to be directly linked to the protocol's revenue distribution, providing users with higher long-term returns. Through meticulous asset allocation and governance mechanisms, Usual Money can control inflation and effectively incentivize community participation. Particularly in the distribution of Usual tokens, the dynamic reward mechanism linked to the protocol's revenue creates a close connection between token value and platform growth and stability.

The supply of Usual tokens will gradually increase in the early stage of the protocol, but over time, the supply growth will gradually slow down, and may even be reduced through buyback and burning to maintain token scarcity. In terms of stability, Usual Money regularly discloses its balance sheet and financial status to ensure that each issued USD0 is supported by real-world assets. This transparency not only enhances user trust, but also helps market participants better understand the health of the protocol. To avoid the impact of single asset class volatility on the stablecoin, Usual Money has adopted a diversified RWA investment strategy. In addition, the project team will also adjust the strategy in a timely manner according to market changes to ensure the long-term stability of the protocol.

Market Liquidity and Incentive Mechanism

Usual Money maintains market liquidity through multiple channels and incentivizes users to participate in the long-term development of the protocol. Its market liquidity strategy includes:

- Liquidity pool: Collaborates with multiple decentralized exchanges (DEXs) to create liquidity pools, ensuring market liquidity for USD0 and USD0++. These liquidity pools reward liquidity providers with Usual tokens and a portion of trading fees, maintaining market activity.

- Liquidity provider incentives: Establishes a dedicated reward mechanism, distributing Usual tokens to liquidity providers based on their liquidity share. This incentive model promotes Usual Money's liquidity management and helps maintain the liquidity of its stablecoin and bond products in the market.

- Combining short-term and long-term incentives: Combines short-term and long-term incentives to ensure early participants receive adequate returns, while also encouraging long-term investors to continue participating through lock-up and revenue distribution mechanisms.

- Advantages over Tether and Circle Although existing stablecoins like Tether and Circle have achieved some success, they still face many challenges, particularly in terms of transparency, resistance to bank runs, and risk management. Usual Money solves these problems through its transparent design, decentralized governance mechanism, and innovative revenue distribution model, providing users with a more robust and scalable stablecoin solution. Especially in the recent SVB crisis and the volatile crypto market, Tether and Circle's stablecoins have faced liquidity risks and credit issues. Usual Money, by eliminating single-asset dependence, has established a more stable and transparent multi-asset backing structure, allowing it to better maintain stability during market turbulence.

Market Opportunities and Team Background

Usual Money's market potential lies in its responsiveness to the demand for stablecoins. As the stablecoin market matures and the regulatory framework becomes clearer, Usual Money, as a risk-free and scalable stablecoin solution, is expected to become a core infrastructure for blockchain-based payments in the future.

Team and Vision:

The founder of Usual Money, Pierre Person, was a prominent figure in French politics, serving as a member of the French National Assembly from 2017 to 2022 and was a key member of President Macron's campaign team. Given the current political situation in France and the establishment's defeat in the elections, Person's decision to transition into the blockchain industry can be considered a wise move. This political background undoubtedly adds significant weight to the project and suggests the depth of his expectations for it.

Furthermore, the team closely monitors changes in the global regulatory environment and incorporates them into the project's strategic planning to ensure that Usual Money can develop healthily within a compliant framework in the future. Their goal is to establish Usual Money as the new benchmark for the global stablecoin market through innovative technology and compliant design.

Market Demand and Growth Opportunities:

As the demand for stablecoins continues to grow, Usual Money's design allows it to meet market demands in the trillions of dollars in the future. Particularly in the global payments and decentralized finance (DeFi) sectors, Usual Money's innovative model enables it to stand out from traditional financial infrastructure and become the gold standard in the stablecoin market.

In the context of the increasing regulation of the blockchain and cryptocurrency industry, Usual Money's transparent and decentralized design principles can attract the attention of traditional financial institutions and large investors, providing strong support for its growth in the market.

Participation Opportunities

Usual Money's unique design concept and innovative token economics demonstrate its immense potential in the stablecoin sector. Compared to traditional stablecoins like Tether, Usual Money not only has stronger stability but also achieves a long-term sustainable incentive mechanism through the separation of stablecoin and governance token functions.

For ordinary investors, in the era of low interest rates in the US, the yield on real-world assets (RWAs) tends to decline, and investing in USUAL tokens may have more potential than purchasing USD0++. The **USD0++** yield mainly comes from Treasury bills and short-term debt instruments, and its return is subject to the level of market interest rates. The low-interest-rate environment directly leads to a contraction in its returns. Although **USD0++** provides stable returns, in a low-interest-rate environment, its yield is difficult to effectively increase and may even be lower than other investment options with greater growth potential.

In contrast, the value of the USUAL token is closely related to protocol growth, market demand, and governance mechanisms, with stronger adaptability and growth potential. Even in a low-interest-rate environment, the value of the USUAL token can still be driven by factors such as community governance, protocol revenue distribution, and market expansion. Therefore, holding USUAL tokens may be a more suitable participation stance for ordinary investors.

In conclusion, Usual Money undoubtedly presents an opportunity worth attention and participation. In the fierce competition of the future stablecoin market, Usual Money, with its innovative and robust design, may become the new benchmark in this field.