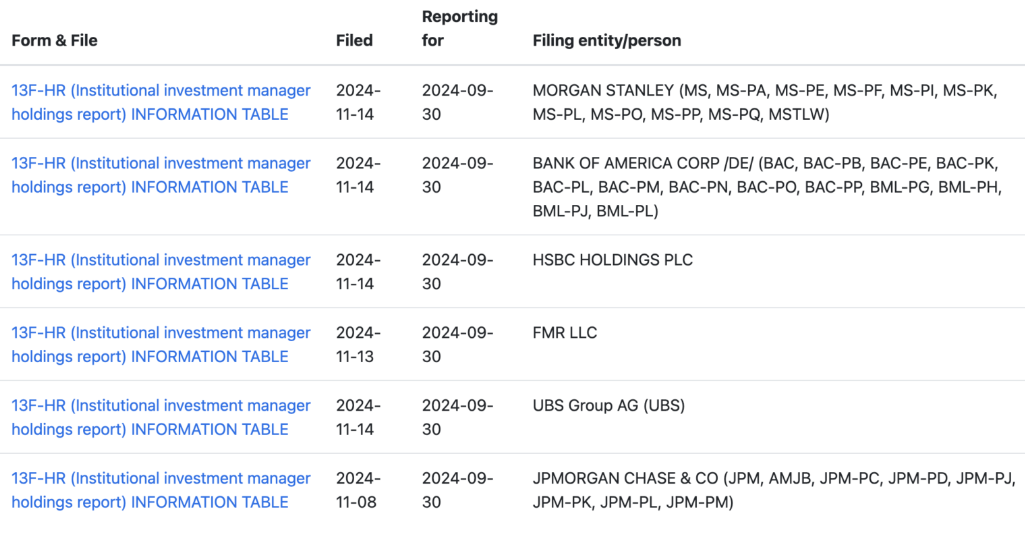

Recent 13F filings in the US have revealed that in the past quarter, 206 US-listed companies with over $100 million in assets have confirmed holdings in Bitcoin spot ETFs.

Goldman Sachs Holds Over $700 Million in Bitcoin Spot ETF

According to the 13F report, the companies holding Bitcoin spot ETFs include: JPMorgan, Goldman Sachs, Bank of Nova Scotia, HSBC, Morgan Stanley, Bank of America, UBS Group, and the Michigan Retirement System.

It's worth noting that in April this year, Sharmin Mossavar-Rahmani, the head of investment management at Goldman Sachs Wealth Management, had previously stated that she was not optimistic about cryptocurrencies, saying:

We do not view cryptocurrencies as a viable investment asset class. We are not crypto believers.

However, Goldman Sachs not only holds Bitcoin spot ETFs, but its holdings have increased from $400 million in August to over $700 million, indicating that while the institution may not be bullish, its clients' interest in Bit is growing. (Or is the institution saying one thing and doing another?)

Solidion Technology Announces Bitcoin Strategy

It's worth noting that in addition to major US banks and institutions increasing their Bit holdings, several publicly-traded companies have recently announced their embrace of Bit. For example, on November 14, US-listed battery company Solidion Technology issued a press release stating that it will allocate a significant portion of its excess cash reserves to purchase Bit.

According to the announcement, Solidion Technology's Bit strategy primarily includes:

- Allocating 60% of its excess cash to purchase Bit;

- Using the interest income from its cash holdings in money market accounts to purchase Bit;

- Raising additional funds in the future to purchase more Bit.

Solidion Technology's official statement on this is:

The recent election results have sparked renewed interest in Bit, with the Trump administration known for its support of Bit, and the recent growth of Bit spot ETFs highlighting the potential for institutions to adopt Bit in a compliant manner. Bit is poised to become the ideal asset for us to seek to hedge against inflation and achieve value preservation.

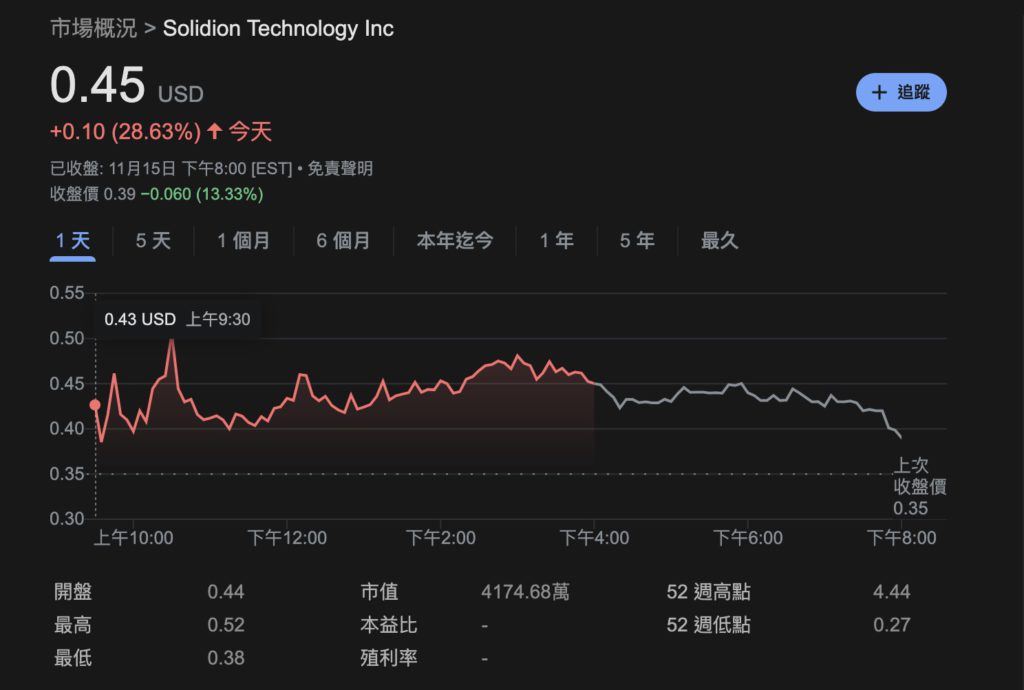

Solidion Technology Stock Price Surges 30%

Inspired by this strategy, Solidion Technology's stock price (STI) also saw a significant increase yesterday, surging over 30% after the open and closing at $0.45.

Companies that have been consistently buying Bit, such as the so-called "Japanese Microstrategy" Metaplanet, and the recent Singapore-based education company Genius Group that announced a Bit-first strategy, have also seen their stock prices rise in recent times, indicating that buying Bit has become a stock trading superpower for many companies:

- Microstrategy: Up 11.44% in the last 5 days

- Metaplanet: Up 64% in the last month

- Genius Group: Up 70% in the last 5 days