The recent trend in the cryptocurrency market has once again attracted the attention of global investors. Bitcoin (BTC) has broken through its historical high, reaching as high as $93,800 at one point, while the prices of many Altcoins remain at low levels, with market capital continuing to concentrate on Bitcoin and certain meme coins. Although there are many optimistic observers who are bullish on the current bull market, there are also pessimists who are cautious about the future trend. So, is the current market only offering Bitcoin and meme coins as investment opportunities? Will the explosion of Altcoins come?

VX: TTZS6308

Bitcoin Market Share: A Signal of Market Dominance

Bitcoin's market dominance, i.e., its market share, has always been an important indicator of the health of the cryptocurrency market.

As of the time of writing, Bitcoin's market share is around 60.7%, a new high since April 2021. Historically, each bull market has seen Bitcoin's market share grow first, meaning that hot money is flowing into Bitcoin, while the Altcoin market remains dormant; conversely, when Bitcoin's market share declines, capital may flow into other cryptocurrencies, driving the rise of the Altcoin sector.

The changes in Bitcoin's market share are still a key signal for investors to judge the direction of capital flows. Currently, it appears that Bitcoin's market share is likely to continue rising to the 63%-71% range in the foreseeable short term. If Bitcoin's market share begins to decline, the Altcoin market may enter a period of explosion.

DeFi and NFT: The Potential and Explosion of Altcoins

The growth of the DeFi and NFT markets is closely related to the rise of Altcoins. DeFi and NFT are the two fastest-growing areas in the cryptocurrency market in recent years. DeFi provides users with decentralized financial services, including lending, trading, and asset management, while NFT has driven the development of applications such as digital art, virtual goods, and gaming.

At the peak of the 2021 bull market, the total value locked (TVL) of DeFi protocols exceeded $180 billion, and the activity of the NFT market was also at its peak, with the market capitalization of various high-quality projects soaring to tens of billions of dollars. This led to the emergence of Altcoin projects such as Uniswap, Aave, and Chainlink in DeFi, as well as CryptoPunks and Bored Ape Yacht Club in NFT, with many Altcoins flourishing.

However, the current total locked value in DeFi is $108 billion, far below the $180 billion peak of the previous bull market. Therefore, although Bitcoin has broken through $90,000 to set a new historical high, this has not brought more liquidity to the market, so we can see that many Altcoins have not performed particularly well in this bull market.

The current on-chain total locked value is close to that of March this year, meaning that the overall DeFi ecosystem has not seen an optimistic transformation in the past half year.

However, DeFi is still developing rapidly, and is constantly introducing tools that may redefine traditional finance, such as yield auto-market maker protocols, yield aggregators and abstraction protocols, derivative DEXs with integrated lending markets, tokenization of real-world assets (RWA), trade and receivables financing, and so on. With the introduction of crypto policies after Trump took office, as well as the continued maturation of the DeFi ecosystem and the NFT market, capital may begin to flow into these innovative and growth-potential Altcoins.

Institutional Holdings and Market Maker Holdings: Key Indicators of Capital Flows

Institutional holdings and market maker holdings play a crucial role in the cryptocurrency market, especially at critical moments. Institutional holdings data reveals the confidence of large capital in the market and their preference for mainstream cryptocurrencies like Bitcoin. With the launch of Bitcoin ETFs and Ethereum ETFs, more and more institutional investors are starting to allocate cryptocurrency assets, which are often concentrated in Bitcoin and Ethereum.

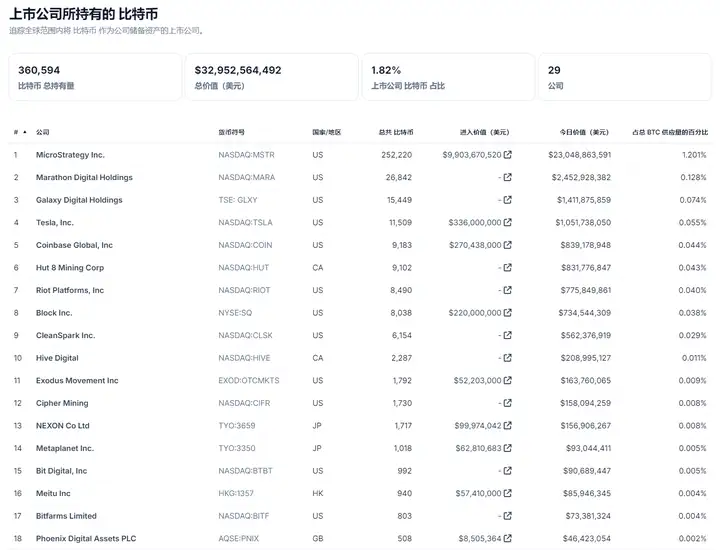

Among the publicly traded companies currently holding Bitcoin, MicroStrategy ranks first with over 250,000 BTC. Marathon holds 26,800 BTC, ranking second. In addition, listed companies such as Galaxy, Tesla, Riot, and CleanSpark have also been holding Bitcoin, indicating that the inclusion of Bitcoin in corporate balance sheets has become a trend.

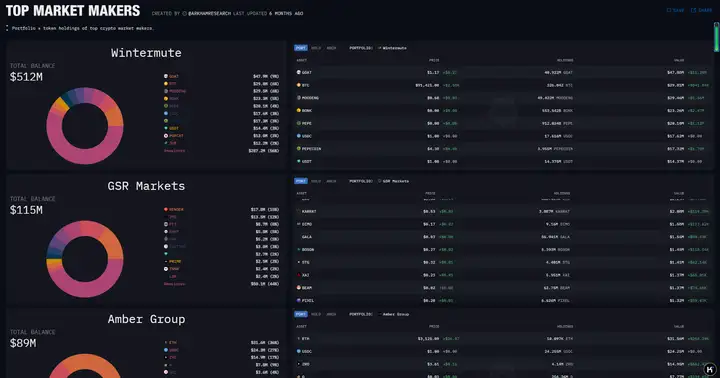

At the same time, the role of market makers in the cryptocurrency market cannot be ignored. Market makers provide liquidity to maintain the effective operation of the market and ensure that buy and sell orders can be executed smoothly. Currently, the holdings data of market makers reflects their positions in Bitcoin, Ethereum, and some promising Altcoins.

The data shows that market makers have a large position in Bitcoin, but maintain a cautious attitude towards some high-volatility and high-risk Altcoins, which also affects the capital flow in the Altcoin market.

However, market makers seem to be less interested in making markets for meme coins. For example, Wintermute, which has a total position of over $500 million, has the largest positions in GOAT (9%), MOODENG (6%), and MEME (over 70%), with its Bitcoin position only accounting for 6%.

The capital flows of institutions and market makers can be an important basis for judging market trends and investment opportunities. If these funds start to flow into the Altcoin and DeFi sectors, it may signal the imminent explosion of Altcoins.

Conversely, if the capital remains concentrated on Bitcoin and Ethereum, the Altcoin market may continue to remain dormant. Based on the holdings data of the top 10 market makers, the vast majority are still mainly in BTC and MEME.

The Opportunity for Altcoins Still Needs Time

In the foreseeable future of the next 3 to 6 months, Bitcoin and meme coins will continue to dominate the market capital flows.

This is mainly due to Bitcoin's safe-haven properties and the continued inflow of institutional capital, as well as the ability of meme coins to attract short-term speculative capital with their high volatility and community-driven power. With the advancement of Bitcoin spot ETFs, the further development of options products, and the uncertainty of the macroeconomic environment, Bitcoin's position as a market bellwether will be further strengthened. At the same time, meme coins will remain a hot spot for market capital due to their high-frequency and short-term trading characteristics.

However, the explosion of Altcoins may require a longer time window. The historical pattern of the market shows that each round of capital rotation starts with Bitcoin and then gradually spreads to more innovative and potential projects. From the current situation, the lack of capital and the lack of clear hot spots in the Altcoin sector indicate that the market has not yet reached the critical point to trigger the next round of capital rotation.

In the next 6 months to 1 year, as Bitcoin's market share gradually declines, and the Layer1 protocols, DeFi ecosystem, NFT market, and the integration of AI and blockchain continue to mature, the opportunities for Altcoins will gradually emerge. Particularly, projects with technological innovation and real application scenarios, such as the yield aggregators in DeFi, new lending protocols, and the NFT ecosystem that drives the digital economy, may become the focus of the next round of market capital pursuit.

In the short term, the heat of Bitcoin and meme coins will undoubtedly continue, but from a longer-term perspective, technological innovation and policy support will be the key driving factors for the rise of Altcoins. For investors, while enjoying the short-term gains brought by Bitcoin and meme coins, it is an important strategy to lay the groundwork for Altcoin projects with long-term growth potential.

The good news today is that HUAHUA has increased 15 times.

HUAHUA was originally recommended internally at 200K, and is now 3M, a 15-fold profit. For those who have already sold, it's over, but for those who haven't, you can reduce your position by half or 80%, and keep a small position to hold on. Since it has been pulled up, let's see how high it can fly.

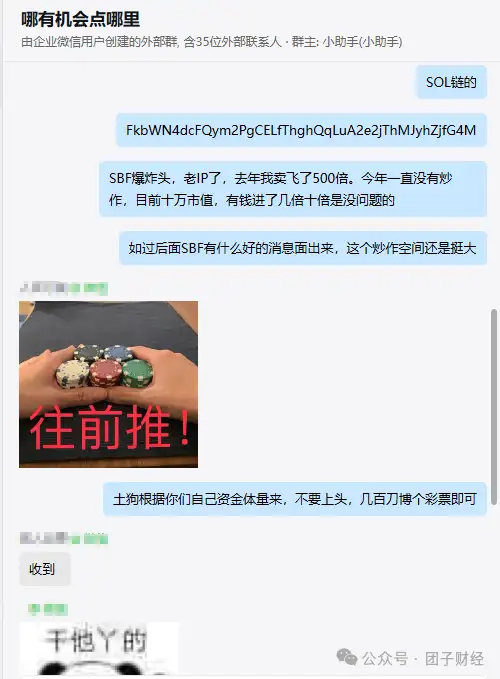

Additionally, I'm giving everyone a benefit, which is also the on-chain meme recommended in the internal group today. Those who can buy it can go and ambush some.

SBF

Contract address: FkbWN4dcFQym2PgCELfThghQqLuA2e2jThMJyhZjfG4M

SBF with an explosion head, an old IP, last year I sold it for 500 times. The current market value is 100,000, and it's no problem to make a few times or tens of times if you have money. If there is any good news about SBF in the future, there is still a lot of room for hype.

The on-chain meme is based on your own capital size, don't get carried away, a few hundred dollars is enough to play the lottery.

I plan to take two one-on-one sessions at the end, and then I won't take any more, to be honest, I can't take care of too many. After all, my energy is limited.

Currently, the basic retail investors of BTC basically don't have good opportunities to get on board, the focus is to layout high-quality Altcoins in the later stage, and strive to achieve an overall return of not less than 10 times this year.

If you are currently fully invested or have a relatively heavy position, and don't know what to do, you can also contact me to see if your position needs to be adjusted.