"BTC price based on quantitative analysis, $13,500"

The risk of excessive leverage in the futures market is also emphasized

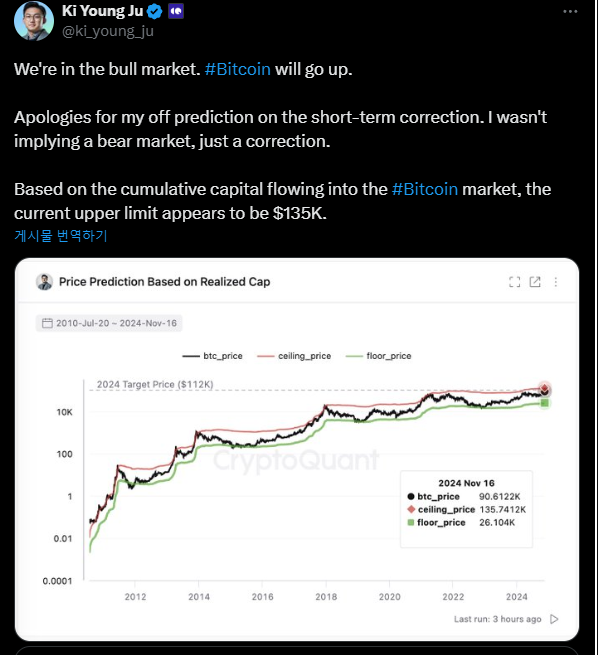

Based on the quantitative analysis of the recent BTC price movements driven by the capital inflows into BTC through exchange-traded funds (ETFs) and products in the US, the target price for BTC in 2024 is set at $13,500.

He emphasized, "BTC is in a bull market" and "the current ceiling based on the accumulated capital inflows to the market appears to be $13,500."

The CEO stated that his prediction is just a prediction and it may also be wrong. He cautioned, "Note that BTC has risen without correction" and "while a long-term bullish trend is predicted, the excessive leverage in the futures market should be monitored as it can lead to a sharp BTC price drop upon liquidation."

The CEO pointed out that the leverage ratio in the BTC futures market has increased by about 2.7 times compared to the beginning of 2024 bull market. The excessive buildup of long leverage positions can directly trigger a sharp BTC price decline upon liquidation.

Previously, the CEO had predicted a BTC decline, but contrary to his prediction, BTC set new highs last week.

The CEO apologized for the "wrong short-term correction prediction" and clarified that it was not a prediction of a bearish market, but rather a prediction of a correction.