Table of Contents

ToggleThe Crypto Market Enters a Volatile Period

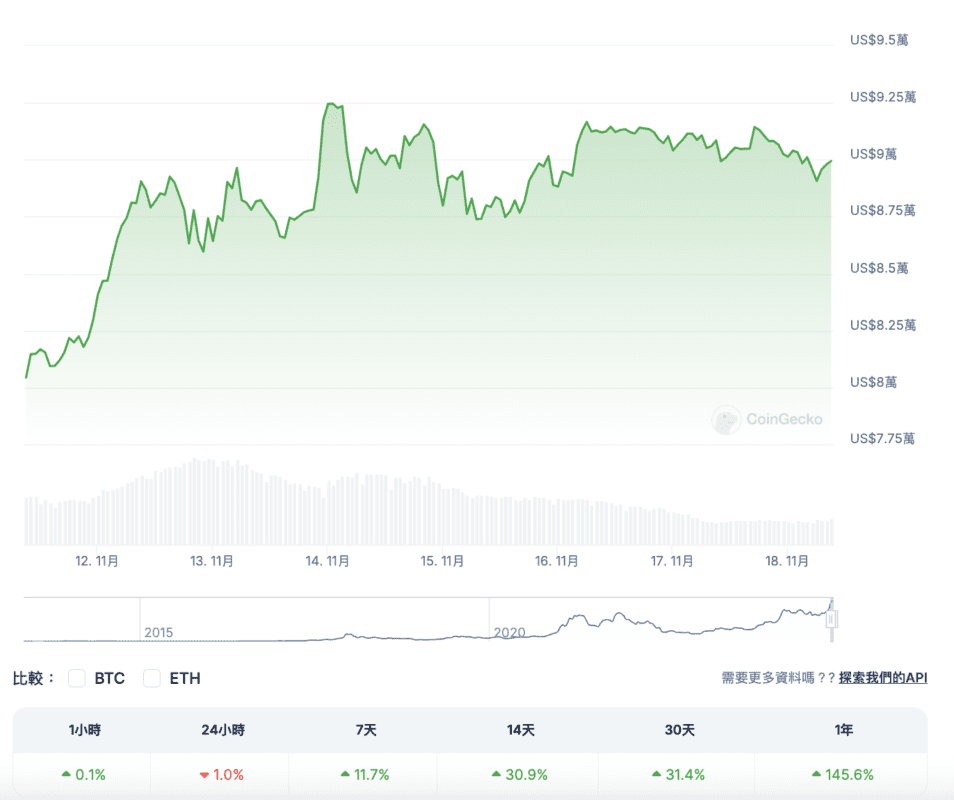

The cryptocurrency market did not see significant fluctuations over the weekend, with Bit staying in the range of around $90,000.

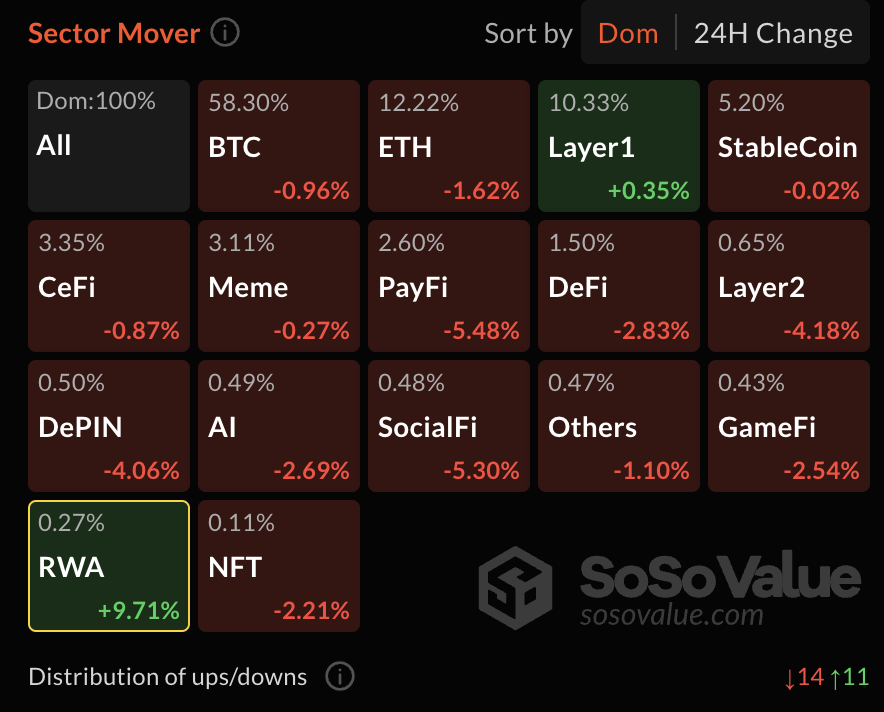

The overall market sentiment has also cooled down, with even the recently hot meme coin sector losing steam.

Is $90,000 the 'First Profit-Taking Point' for Long-Term Holders?

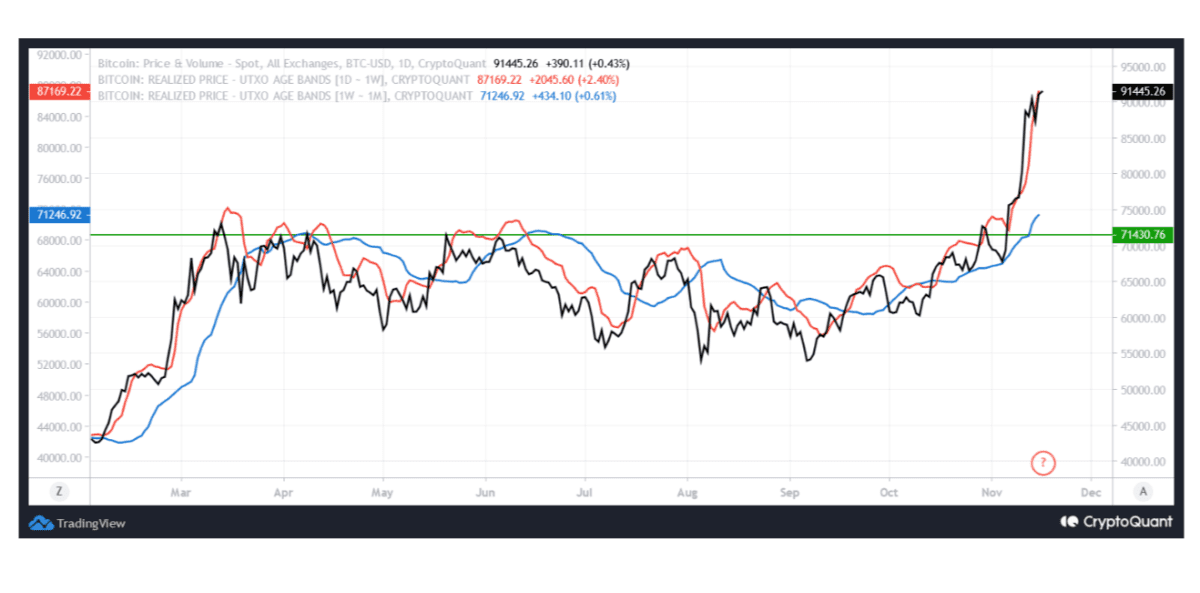

In a previous report, Percival, a contributor to CryptoQuant, stated that long-term Bit holders "do not see $90,000 as the enemy" and instead choose to realize partial gains at this price point. Before breaking the all-time high of $73,800 set in March 2024 on November 5, Bit had been consolidating between $53,000 and $72,000 for nearly seven months.

Percival added:

"Some of these investors have been involved for years, and for them, $90,000 is a range to realize gains. Bit first broke above $90,000 on November 12 and set a new high of $93,215 on November 13."

Percival noted that as Bit's price rises, the selling pressure from long-term holders is also increasing. However, Percival emphasized that despite the increased selling pressure, the Bit price has not been significantly affected, as ETFs have absorbed all the Bit being sold. He further stated:

"This apparent selling pressure has not had a significant impact on the market."

Another CryptoQuant analyst, BaroVirtual, suggested that Bit may enter a new consolidation phase, with a potential downside target above $70,000. BaroVirtual explained that this risk of correction is related to the trend of two moving averages (MAs), which are currently about 20% apart.

BaroVirtual pointed out that the status of the 7-day and 30-day MAs indicates that Bit has a strong and healthy buying pressure, but the problem is that the gap between the two averages has reached 19%, leading to two possible scenarios:

- Bit consolidates in the range of $87,000 to $93,000 for a period and then breaks through to the range of $104,000 to $120,000. We have observed a similar situation in the period from February to March 2024.

- Bit price corrects to the range of $71,000 to $77,000, and after a healthy mid-term cooling of the market, the local uptrend will resume.

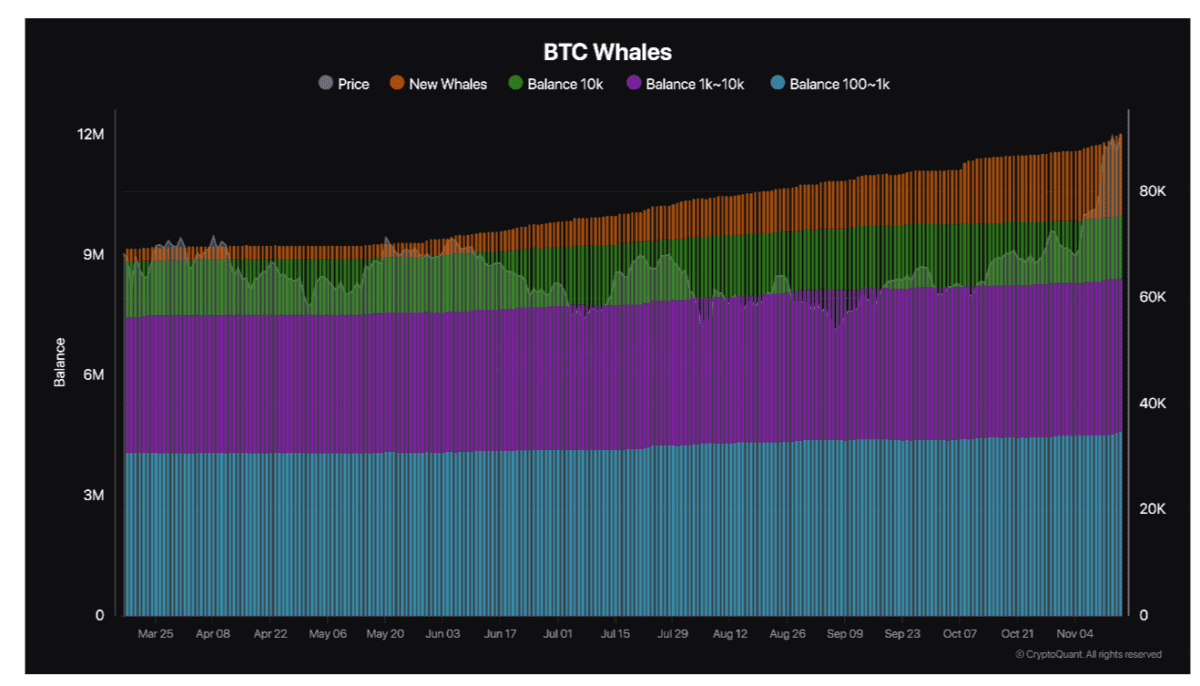

Bit Whales Show No Signs of Selling

Although more and more people believe that Bit may retest new support levels, on-chain data shows that investor confidence at the current price level remains strong, and various Bit whales continue to accumulate assets around the new highs.

CryptoQuant wrote in the report:

"Notably, the balance of new whales is increasing rapidly, which may also indicate that more whales have recently emerged... Even as Bit price approaches $90,000, they have not stopped accumulating, and most are holding, which is a sign of market confidence."