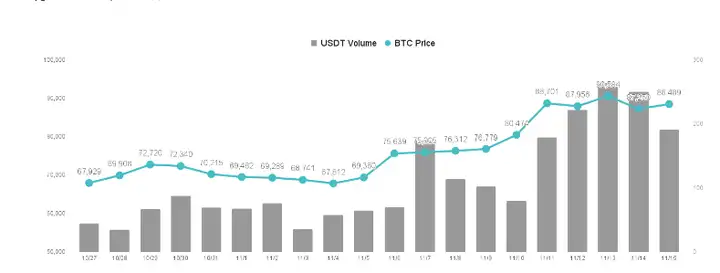

Last week, there was a crazy buying spree in the Bitcoin market, with the price rising from last week's $78,000 to a high of $93,000, a 20% weekly gain. It then fell back to $91,000, also driving up Ethereum and other cryptocurrencies by 20% weekly. The crypto market can be said to have welcomed the most gratifying week, and the main driving force behind it was the institutional investors on Wall Street.

VX: TTZS6308

After Trump's victory, institutional investors were optimistic about the Trump administration's supportive attitude towards cryptocurrencies, and invested in Bitcoin as a "Trump concept stock". In just one week, the Bitcoin spot ETF attracted nearly $5 billion in funds, but as the price approached the local high, there was a net outflow of $400 million on Thursday, the third largest single-day outflow since the ETF's inception, indicating that some institutions have already cashed out, but the market frenzy is still ongoing.

Multiple technical indicators show that Bitcoin is already overbought. In addition, as the market's FOMO (fear of missing out) sentiment is high, the pressure for correction is increasing, and Bitcoin has been experiencing a pattern of rising and then pulling back, and then rising even higher in the past two days, indicating that investors still have a lot of people choosing to cash out and get off the train, although Bitcoin is still up 17% this week, but still has a gap to the market's bet of $100,000.

The market is indeed overheated at the moment, especially with Musk's announcement of the establishment of "DOGE", which has driven Dogecoin to surge more than 20%, to some extent reflecting the short-term positive news, but the party is not over yet, institutions and hedge funds are still buying in, and this time the retail investors are relatively calm, and the institutional investors are indeed ruthless in chasing the price.

Goldman Sachs recently disclosed that it holds a Bitcoin position worth $710 million, a significant increase from about $285 million in August, with more than half of it through exposure to Bitcoin via the BlackRock IBIT fund, which has grown 83% to $461 million, indicating that high-net-worth clients are all buying Bitcoin spot ETFs through Goldman Sachs.

It is worth noting that while institutional investors are frantically increasing their positions, retail investors and miners have started to sell. On-chain data shows that a large amount of Bitcoin has recently been transferred from whale wallets to centralized exchanges, possibly to realize the recent price surge. At the same time, the selling pressure from miners is also on the rise, with some Bitcoin from wallets dating back to 2015 being transferred to exchanges. Many retail investors have chosen to temporarily withdraw from the market and wait for a correction before re-entering.

Now it is the institutions that have lost their minds and are frantically chasing the price, and waiting for the "Trump trade" to subside may lead to another round of correction, and this is a good time to cash out and realize the gains, from the various data, it is difficult to convince oneself that such a rapid rise is a healthy phenomenon in the market, Bitcoin is bullish in the long run, but the short-term rise is too fast.

As the price of Bitcoin has risen, the selling pressure from long-term holders has also increased. However, despite the increased selling pressure, the price of Bitcoin has not been significantly affected, as the ETFs have absorbed all the Bitcoin being sold. This obvious selling pressure has not had a major impact on the market.

SEC regulatory easing is the next market theme

Last week, the US released the Consumer Price Index (CPI) as expected, but the price of Bitcoin still fell after the data release, from $93,000 to $88,000, mainly because the price had risen too much, and some traders chose to cash out.

The market generally believes that a correction after a significant rise is inevitable, regardless of the inflation data. Currently, the market is driven by sentiment and the high-spirited "Trump trade", with Bitcoin's short-term trend showing high volatility and continued upward momentum. This week, the price range of Bitcoin exceeded $5,000, reflecting frequent chip exchanges, but the buying power remains strong.

As Trump is finalizing his cabinet appointments, market traders are focusing on "when Trump will appoint the SEC chairman", that is, to fire Gary Gensler, who has been strict in regulating cryptocurrencies. As soon as he steps down, it is expected that Trump will choose another crypto-friendly regulator to lead the agency, which will drive the rapid development of the US cryptocurrency industry. The market is now hoping that Chris Giancarlo can take over the position of SEC chairman.

Former Chairman of the US Commodity Futures Trading Commission, Chris, is known as the "Crypto Father". His biggest achievement during his tenure was to clearly define Bitcoin and Ethereum as "digital commodities" rather than securities, laying a critical foundation for the subsequent listing of spot ETF products. If he takes office, he may also classify more cryptocurrencies as "non-securities", triggering a surge in altcoins.

Although he has posted on social media X that he is not interested in taking on the subsequent regulatory issues as the SEC chairman, he has not directly stated that he will refuse. Since he was also the one who pointed out that Ripple (XRP) is not a security, XRP has become a hot candidate for the next spot ETF. There were previously rumors that Gary Gensler would resign, and the market is optimistic that the XRP ETF may actually appear, which has also led to a continuous rise in its price.

Currently, the crypto market is in an excellent trading condition, and it is difficult for us to know whether a top has been reached. Until Trump's cabinet decides who the new SEC chairman will be, the market will have ample imagination space to drive up the prices of the crypto market. Bitcoin is just the first major uptrend, and we can expect the uptrend of altcoins and mid-cap cryptocurrencies to follow. The fourth quarter of this year will be a very fruitful season.