Author:The Pareto Investor

Compiled by: TechFlow

Dear investors,

Today, I want to share some thoughts on the transformative power of Bitcoin and explain why I believe it is not just an investment, but the foundation of a new economic model. I will discuss three key points:

The structural challenges facing traditional asset classes.

Why Bitcoin has a unique advantage in solving these challenges.

How MicroStrategy's strategy demonstrates the leveraged effect of Bitcoin.

Challenges Facing Traditional Assets

Most asset classes struggle to keep up with monetary inflation.

"Trillions of dollars are lost each year to inflation, mismanagement, and entropy. Bonds, the bedrock of corporate finance, have lost 5% per year for the past four years. Even the most innovative companies may struggle to earn a return above their cost of capital." — Michael Saylor

Traditional strategies like stock buybacks or dividends have failed to address the core issue of preserving wealth in an inflationary environment.

Bitcoin solves the fundamental problem of capital preservation. It is the first asset in history that is immune to physical and financial entropy.

The advantages of Bitcoin are:

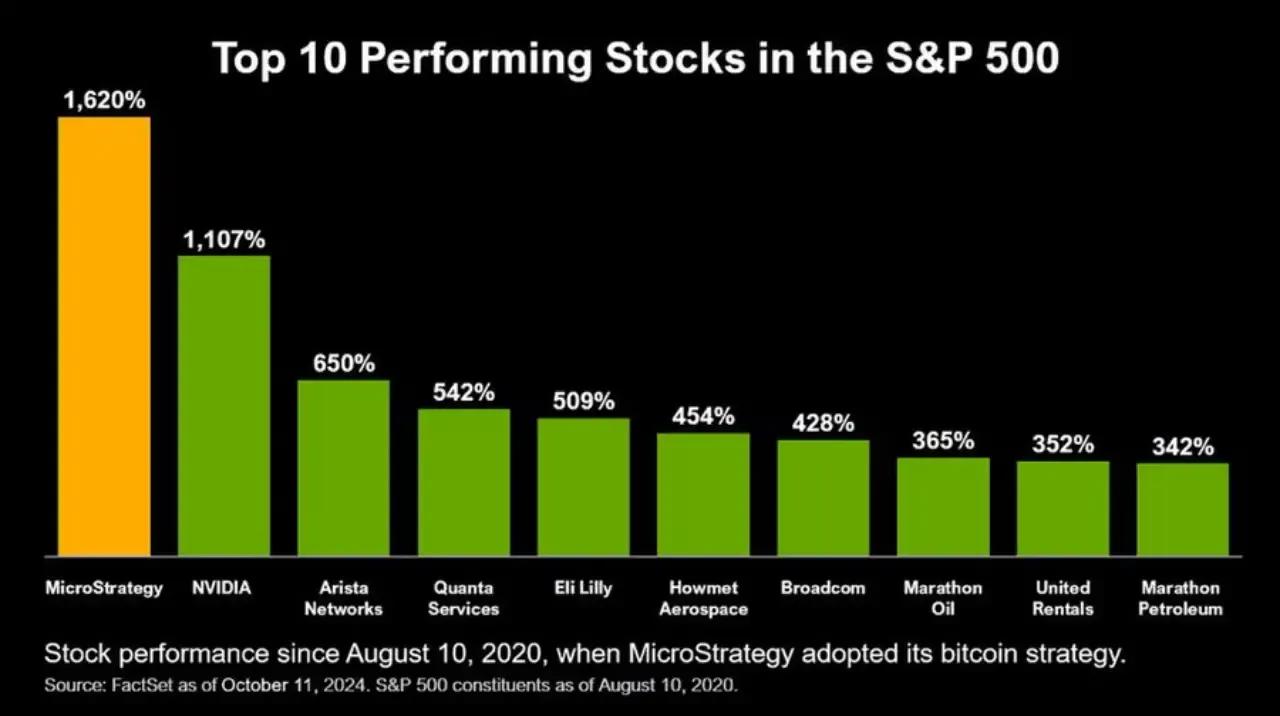

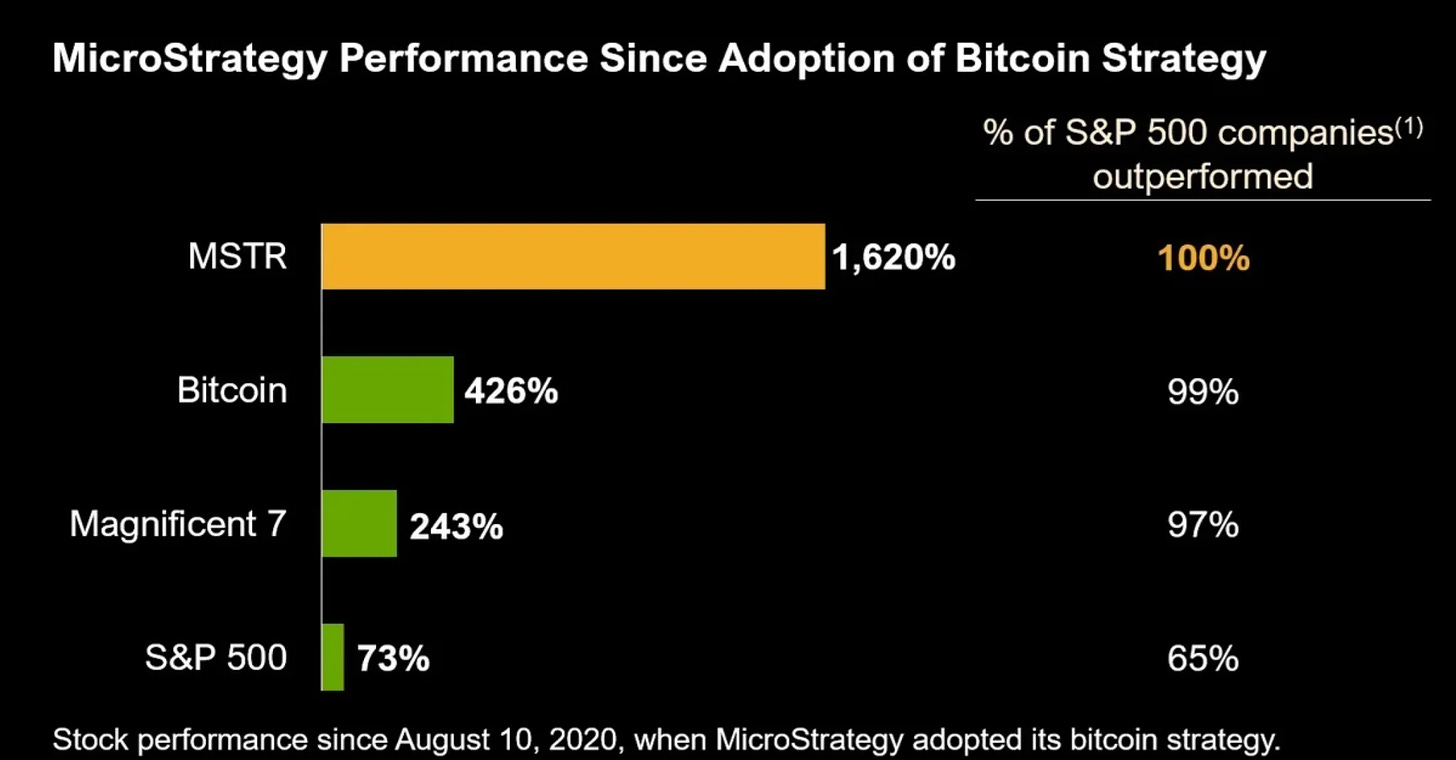

Exceptional performance: Over the past four years, Bitcoin has outperformed all major asset classes, with an average annual return of 60%, twice the performance of top stocks like Nvidia and Apple.

Uncorrelated Alpha: Bitcoin's low correlation to traditional markets makes it an ideal hedge for portfolios seeking diversification and high returns.

Digital capital: Unlike real estate or bonds, Bitcoin is not subject to risks such as property loss, taxation, or geopolitical instability. It is a "indestructible, immortal, and globally transportable form of capital".

MicroStrategy: A Model of Smart Leverage

I have long been a buy-and-hold investor.

For years, I have primarily invested in index funds and Bitcoin.

However, as my understanding of options has deepened, I have begun to explore leveraged strategies.

Since there are no high-quality options products for Bitcoin itself, I have chosen MicroStrategy, which is effectively a leveraged investment in Bitcoin.

Why MicroStrategy?

Under the leadership of Bitcoin advocate CEO Michael Saylor, MicroStrategy has transformed its corporate strategy into a bold bet on Bitcoin. The company has acquired over 150,000 bitcoins, funded in part by debt, making it one of the largest institutional holders of Bitcoin.

MicroStrategy's Approach: Practicing Smart Leverage

Leverage without liquidation risk: Unlike traditional margin trading, where sudden market drops can lead to liquidation, MicroStrategy's leveraged strategy is achieved through its equity structure. This approach reduces liquidation risk, making it a safer way to gain leveraged exposure to Bitcoin.

Performance amplification: Through strategic leverage, MicroStrategy's stock performance has consistently outperformed Bitcoin's remarkable returns, demonstrating the power of its bold and focused strategy. When Bitcoin rises, MicroStrategy typically outperforms due to its leveraged exposure. In a bull market, the potential to expand net asset value (NAV) by 3x is a realistic target, amplifying the upside potential.

Potential for options trading: MicroStrategy's stock has high liquidity in the options market, providing investors with a multi-functional platform to leverage Bitcoin's volatility without directly holding the cryptocurrency.

Bitcoin-backed bonds: MicroStrategy has created innovative bonds that generate returns exceeding Bitcoin itself, benefiting both bondholders and equity investors.

Disciplined accumulation: Michael Saylor's philosophy is simple and powerful: "We buy Bitcoin at all times, at high prices, low prices, and in between." This disciplined approach ensures a strong and growing Bitcoin reserve.

MicroStrategy's revolutionary financial strategy, combining innovation, discipline, and smart leverage, makes it an ideal choice for investors seeking to amplify their exposure to Bitcoin's potential.

2045: Bitcoin as the Global Reserve

Volatility is not the enemy, but the price we pay for vitality and opportunity. Wealth is built on assets with immense upside potential, and Bitcoin's volatility is the engine driving its unparalleled returns. The adoption trend of Bitcoin is turning favorable, likened to a red wave, a crypto renaissance. As institutional and governmental acceptance of Bitcoin continues to grow, I foresee the following three milestones:

Widespread ETF adoption: Bitcoin spot ETFs are expected to inject billions of dollars into the market.

Tokenization of equities: Companies like Apple and Tesla may tokenize their stocks, enabling 24/7 trading on blockchain networks.

Strategic Bitcoin reserves: Governments led by the United States may adopt Bitcoin as a reserve asset, further cementing its position as the foundation of the 21st-century economy.

I am confident in Bitcoin, and MicroStrategy is the best way to seize this opportunity.

With ETF approvals, macroeconomic tailwinds, and increasing institutional adoption, now is an excellent time to participate.

For investors willing to take on the calculated risk, MSTR offers a superb opportunity to ride the Bitcoin wave and enjoy higher return potential.

Half of the $450 trillion in global wealth is used for preservation.

The role of Bitcoin is simple and clear: it can protect your wealth from the impact of inflation and value erosion.

Within the next 21 years, Bitcoin could reach $13 million per coin, fundamentally reshaping the distribution of wealth.

MicroStrategy is publicly showcasing its strategic approach.

By leveraging Bitcoin intelligently, you can transform your balance sheet, outperform the market, and accumulate enduring wealth. Bitcoin is not just an investment; it is the cornerstone of a new era in capital markets.

The time to act is now.

With the proliferation of Bitcoin ETFs, the acceleration of institutional adoption, and companies like MicroStrategy leading the charge, the crypto renaissance is here and unstoppable! Keep accumulating!

Sincerely,

The Pareto Investor