Although the momentum is currently strong, XRP still needs to maintain patience and caution to solidify its position among the top tokens.

The past week has been particularly optimistic for XRP, with its performance exceeding market expectations, breaking the $1 mark for the first time in over three years, a key milestone. This achievement not only demonstrates the bullish potential of XRP but also further strengthens its importance among investors and the market.

After months of consolidation, XRP has achieved a remarkable recovery, proving its strong resilience. But the real test is now. The perfect combination of internal and external factors has driven this rebound, not only pushing XRP above the $1 level but also propelling it to the sixth position, surpassing Doge [DOGE], with its market capitalization soaring by over 10% to $60.45 billion. Therefore, the biggest question is: Can XRP continue to rise and aim for the $2 mark, or is this rebound too ambitious, with many variables still in play?

Memecoins may become unexpected obstacles

Typically, when investors rebalance their portfolios and adjust their risk, the integration phase of Bitcoin (BTC) often creates key opportunities for alternative assets to gain attention.

Consistent with past trends, the weekly gainers' leaderboard has been dominated by low and high market cap assets, with the most notable performance being that of meme tokens. Among the best-performing assets, six out of the top ten are meme-based, and although XRP has seen an 80% surge in the past week, it is easily overshadowed by the continued dominance of the top three meme coins. Some of the best-performing tokens have even achieved quadruple-digit weekly gains, adding credibility to the speculation of an impending "super cycle".

The trend also poses a challenge to XRP. Recently, the market capitalization of the largest meme coin, DOGE, has once again surpassed XRP, reclaiming the sixth position. While XRP has regained some of its advantage after the significant rebound, DOGE's potential resurgence still adds uncertainty to XRP's further increase. Ripple may need more time to reach its $2 target, especially as memecoins are gradually transitioning from highly active assets to having a more legitimate market presence.

From a technical perspective, XRP has posted a series of green candles in less than 10 trading days, with a single-day gain reaching as high as 20%. However, such a rapid ascent may suggest the risk of market overextension. If the market sentiment cannot be sustained (for example, if FOMO cannot continue), the pressure of a short-term victory ending could lead to a correction in XRP.

In this highly competitive and changing market environment, XRP needs more support to consolidate its transformation achievements and address the challenges posed by the market dominance of meme tokens.

Bulls may need to turn $1 into support

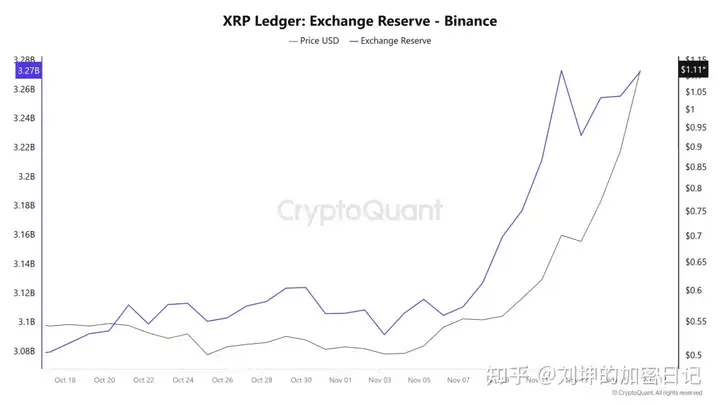

At the beginning of the month, XRP's reserves continued to rise, reaching a peak five days ago when exchanges held 3.273 billion XRP, a significant 5.41% increase from the 3.105 billion in the first week. Interestingly, in the second week, when Bitcoin soared to $90,000, driving a substantial rally in other altcoins, the price of XRP stagnated, reflected in the increase in foreign exchange reserves.

However, as the top altcoins reached an overbought state, and profit-takers began to exit, XRP's exchange reserves have declined significantly, falling to 3.228 billion. This suggests that investors, concerned about Bitcoin entering the "high-risk" zone, strategically reduced their exposure to high-risk assets. They viewed the XRP price five days ago as a "dip" and used it as an opportunity to diversify their portfolios, as most altcoins had already reached their peaks. Now, with the foreign exchange reserves increasing again, these investors appear to be shifting to other assets to capitalize on their surging funds. This indicates that unless the bulls manage to turn $1 into a solid support, the $1 milestone may only be a short-term event.

To maintain momentum, turning $1 into a support level is crucial. If the bulls succeed, monitoring whale activity will become critical, as it may signal that the price will continue to rise to $1.15. However, the persistent selling pressure, overbought RSI, and the impressive performance of memecoins pose significant challenges. If this strategy fails, XRP may retreat to its baseline.