BTC reached a low of $89,375 around 10pm last night, and then rebounded again, reaching a high of $92,644 near midnight. However, selling pressure then emerged, and BTC has been fluctuating between $9~$9.2 thousand, constantly being washed out.

As of the editorial deadline, BTC is temporarily reported at $90,989, up 0.57% in the past 24 hours.

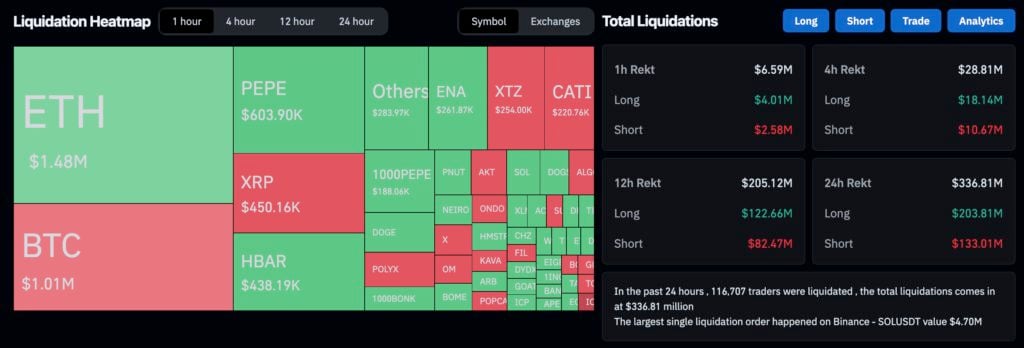

Over the past 24 hours, the entire network was liquidated for $336 million

Amid the fluctuations in BTC, according to data from Coinglass, over the past 24 hours, the total amount of crypto liquidations across the network reached $336 million, with $203 million in long liquidations and $133 million in short liquidations, affecting over 110,000 people.

MicroStrategy added to its position again

Currently, the short-term trend of BTC is still unclear, but it is worth noting that Michael Saylor, the founder of the US-listed company MicroStrategy, the largest holder of BTC, announced on the social platform X last night that MicroStrategy had again purchased 51,780 BTC for $4.6 billion at an average price of $88,627 per BTC, after announcing last week that MicroStrategy had added 27,200 BTC to its position.

MicroStrategy has acquired 51,780 BTC for ~$4.6 billion at ~$88,627 per #Bit and has achieved BTC Yield of 20.4% QTD and 41.8% YTD. As of 11/17/2024, we hodl 331,200 $BTC acquired for ~$16.5 billion at ~$49,874 per Bit. $MSTR https://t.co/SRRtRrB2jO

— Michael Saylor

(@saylor) November 18, 2024

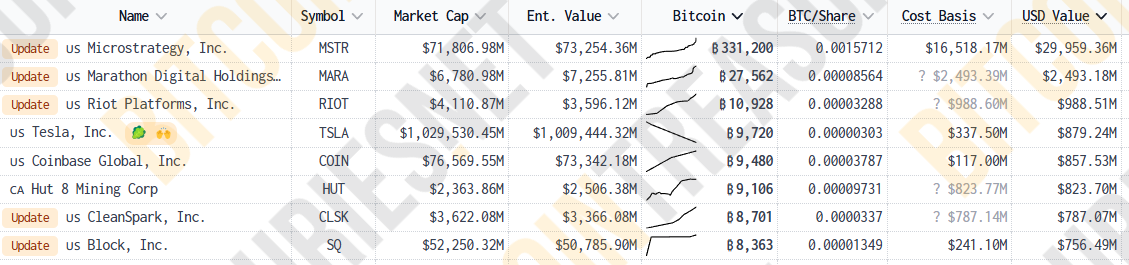

MicroStrategy's BTC holdings reached 331,200 BTC

According to the latest data from bitcointreasuries, after this latest addition, MicroStrategy's BTC holdings have reached 331,200 BTC, with a total value of $299.54 billion and a total cost of $16.518 billion, resulting in an unrealized gain of approximately $134 billion.

In addition, crypto KOL @remouherek further stated that the source of funds for MicroStrategy's BTC purchases is from the issuance and sale of its shares, i.e. MicroStrategy's ATM program. So far, MicroStrategy has used $5.7 billion from the ATM program to purchase BTC, and still has $15.3 billion in funds available for continued accumulation.

Key takeaways from the $MSTR BTC purchase announcement – 11/18/2024

1. Those 51,780 BTC were purchased between November 11, 2024 and November 17, 2024.

2. The Bit purchases were made using proceeds from the issuance and sale of shares (ATM program).

3. So far they used… https://t.co/pFKHsyrt6c

— Remo Uherek (@remouherek) November 18, 2024

MSTR has risen 59% in the past month

According to Google Finance data, along with the rise in BTC and MicroStrategy's continued accumulation, the stock price of MicroStrategy (MSTR) has been boosted, rising 59% this month to $343, with a market capitalization exceeding $70 billion.

Michael Saylor: Bit will bring about a capital revolution

Why can MicroStrategy continue to fulfill its promises and keep increasing its Bit holdings? Recently, Taiwanese Web3 YouTober "Bonnie Bit chain" had an interview with Michael Saylor, in which Michael Saylor stated that he believes the value of Bit lies not only in it being a digital currency, but also in its ability to optimize the structure of capital, disrupt the traditional financial system, and help vulnerable companies compete against today's tech giants:

Bit is not only a currency tool, but also a tool that can optimize the capital structure. If companies can incorporate Bit into their balance sheets, it will greatly increase their attractiveness in the stock market and drive the flow and growth of capital.

Bit is a digital energy. Before people realized that fire is a good thing, they were afraid of fire. Before people realized that electricity is a good thing, they were afraid of electricity. Initially, people were also skeptical about Bit, but over time, people have found that Bit will become a force driving economic and technological progress.

Cathie Wood: Bit still has a long way to go

In addition, Cathie Wood, the founder of Ark Capital and the "Goddess of Stocks", recently stated that although Bit has broken through the historical high of $90,000, in her view, Bit is still far from its price target and still has a long way to go:

We believe we still have a long way to go, even though Ark was the first asset management company to invest in Bit at $250 in 2015.

In our base case, our target is for Bit to reach $650,000 by 2030; in a bull market, Bit could reach between $1 million and $1.5 million.