Author: Cumberland Labs

TechFlow by: TechFlow

After a few weeks of watching on Discord, lurking in Telegram groups, browsing Twitter, and talking to multiple research analysts and traders, I have a comprehensive understanding of how everyone from senior algorithmic traders to my wife’s brother thinks about meme coins. My research ranges from how to improve the UI/UX of limit orders and complex order execution to asking friends if they think Moo Deng is cute or if they’ve heard of Peanut Squirrel.

Contents of the picture:

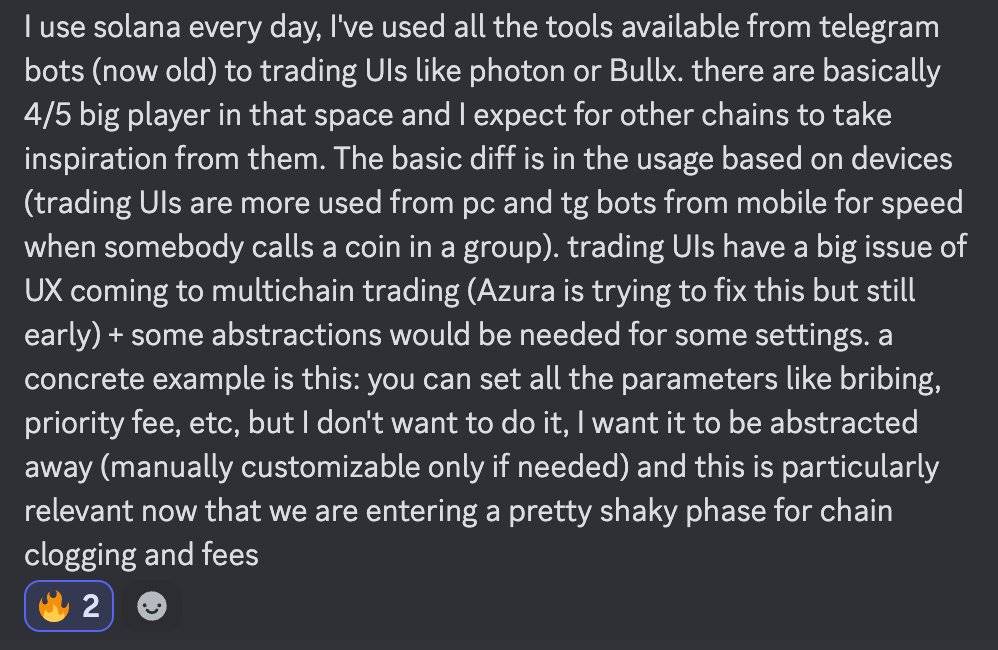

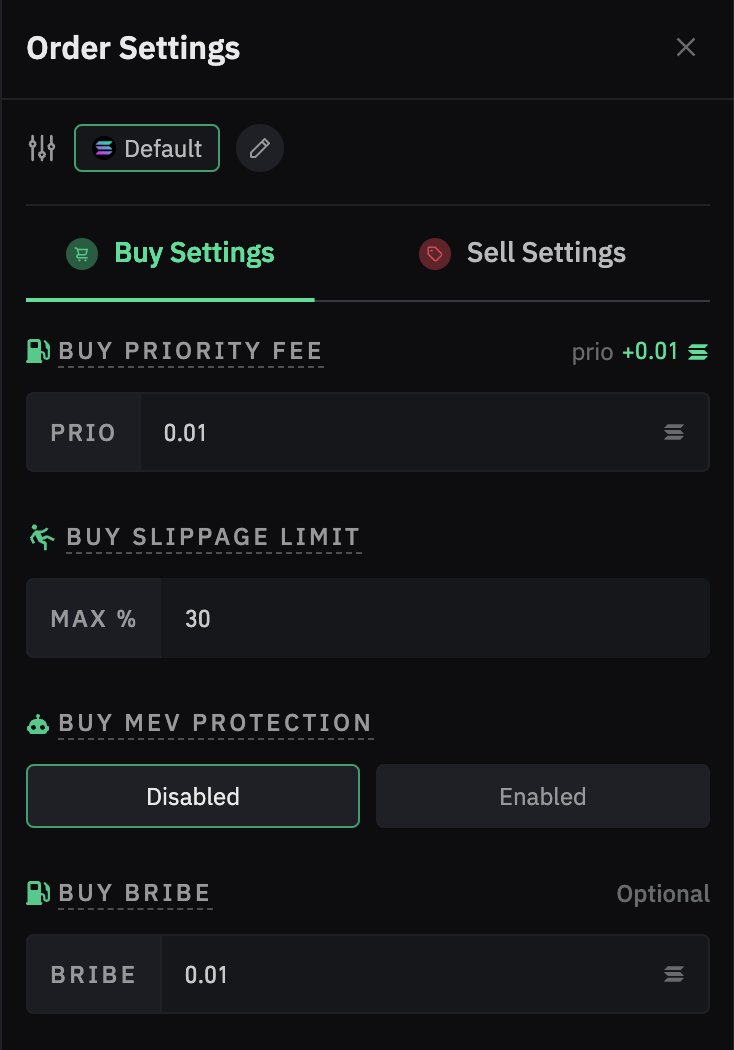

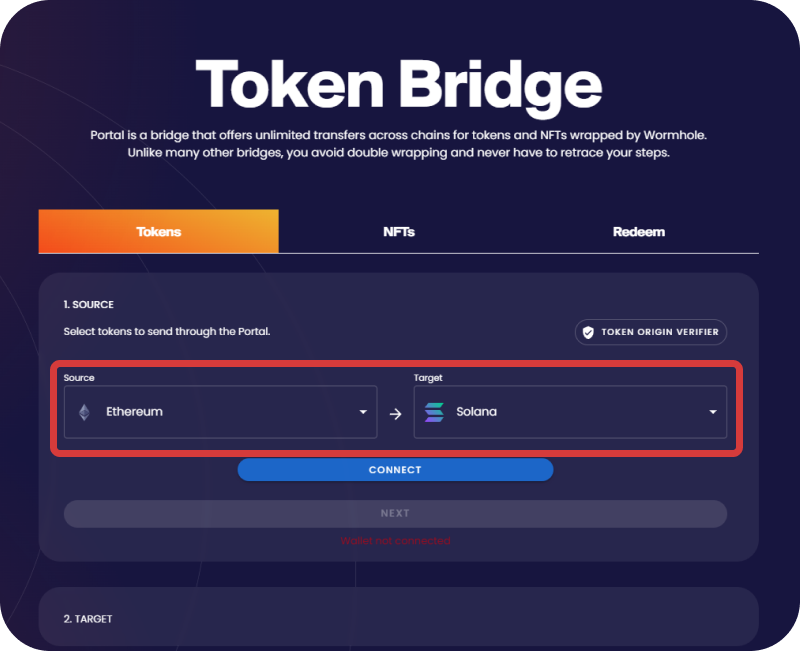

I use Solana on a daily basis and have used almost everything from old Telegram bots to trading interfaces like Photon or Bullx. There are basically four or five big players in this space and I hope other blockchains can take inspiration from them. The main difference is how the device is used (trading interfaces are usually used on PC, while Telegram bots are faster on mobile devices to quickly react when someone in the group mentions a certain coin). The trading interface has a big problem in UX in multi-chain transactions (Azura is working on it, but it's still early days), and some settings need to be more abstracted. For example: you can set all the parameters like bribe fees, priority fees, etc., but I hope these can be handled automatically (manually adjusted only when needed), which is especially important in the current stage of chain congestion and fee instability.

Survey from Discord

What you are about to read is a summary of field research, combining public data in the field with anonymous feedback on this topic. We at Cumberland Labs believe that this story is compelling and will continue to influence the market for years to come. While it may seem simple or even naive on the surface, it actually represents a shift in user behavior that will bring billions of dollars of idle funds to the blockchain, whether traders realize it or not.

Investigation from the wife

What is Meme Coin?

From the creation of DOGE as a Bitcoin imitation that attracted the attention of Elon Musk, to SHIB and PEPE that captured the imagination of the public, to today’s fair launch phenomenon based on Solana – this market is constantly reinventing itself.

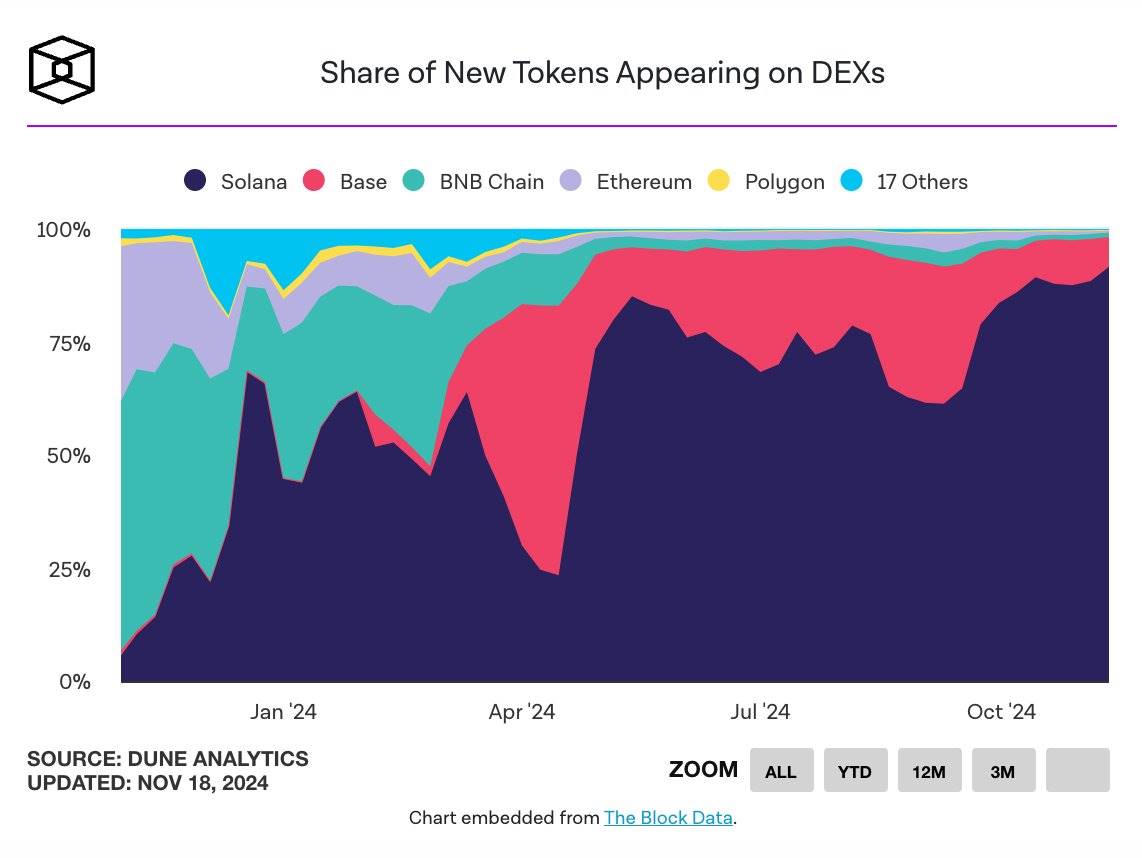

@elonmusk 's first tweet about Doge

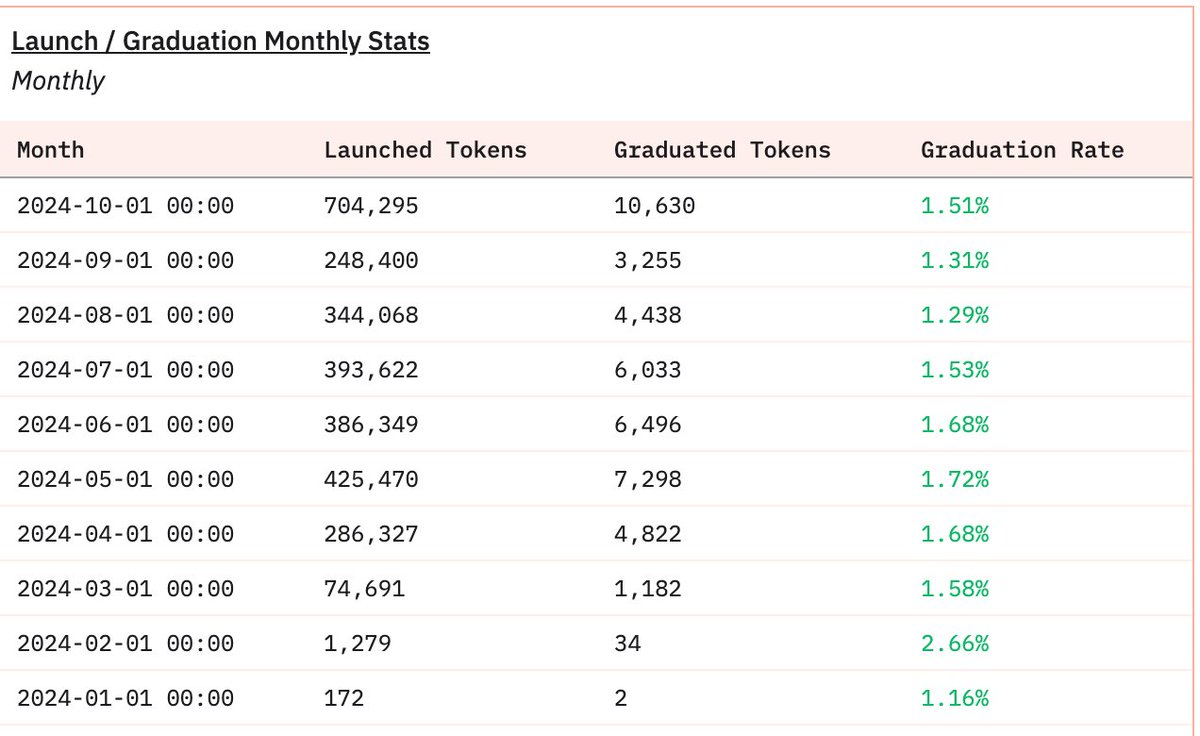

Today, Solana leads the field, driving 89% of new token issuance. Last week alone, 181,000 new tokens appeared on decentralized exchanges (DEXs). It's not just about quantity, it's about accessibility. Platforms like pump.fun allow anyone to participate in token issuance, but the success rate reveals an important reality: less than 2% of tokens are able to be listed on Raydium, and only 0.0045% of tokens can maintain a market value of more than $1 million.

Source: @TheBlock__

So, what makes a meme coin different from a “shit coin”? The key lies in its successful qualities:

From DOGE to Moo Deng, the most successful tokens share common characteristics: a strong meme effect, catalysts that attract attention, and active community participation. DOGE took advantage of Elon Musk's attention and first-mover advantage, while Moo Deng captured people's imagination through virality on social media. But most importantly, they built communities that were able to transform ordinary audiences into passionate supporters.

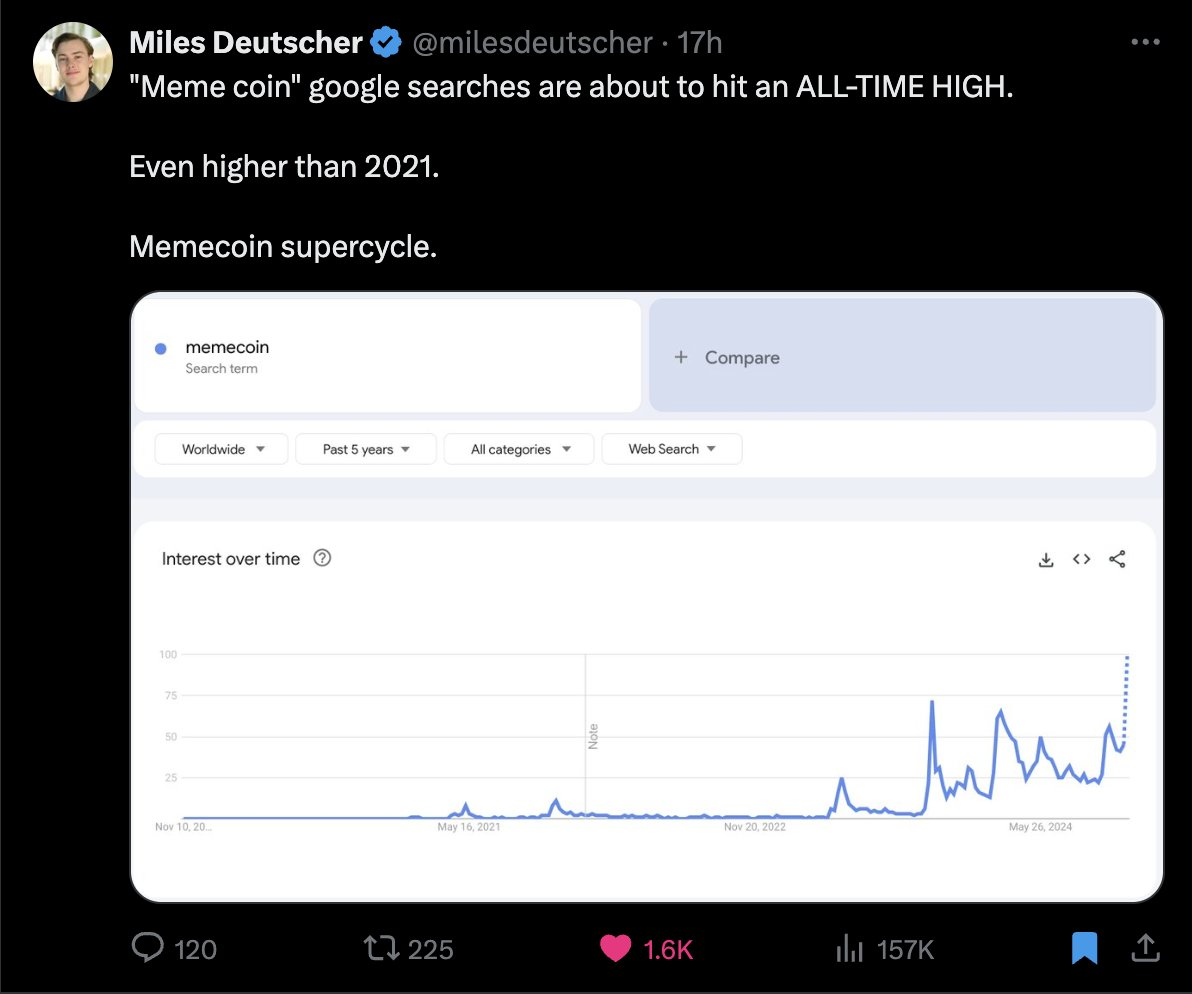

Data doesn’t lie

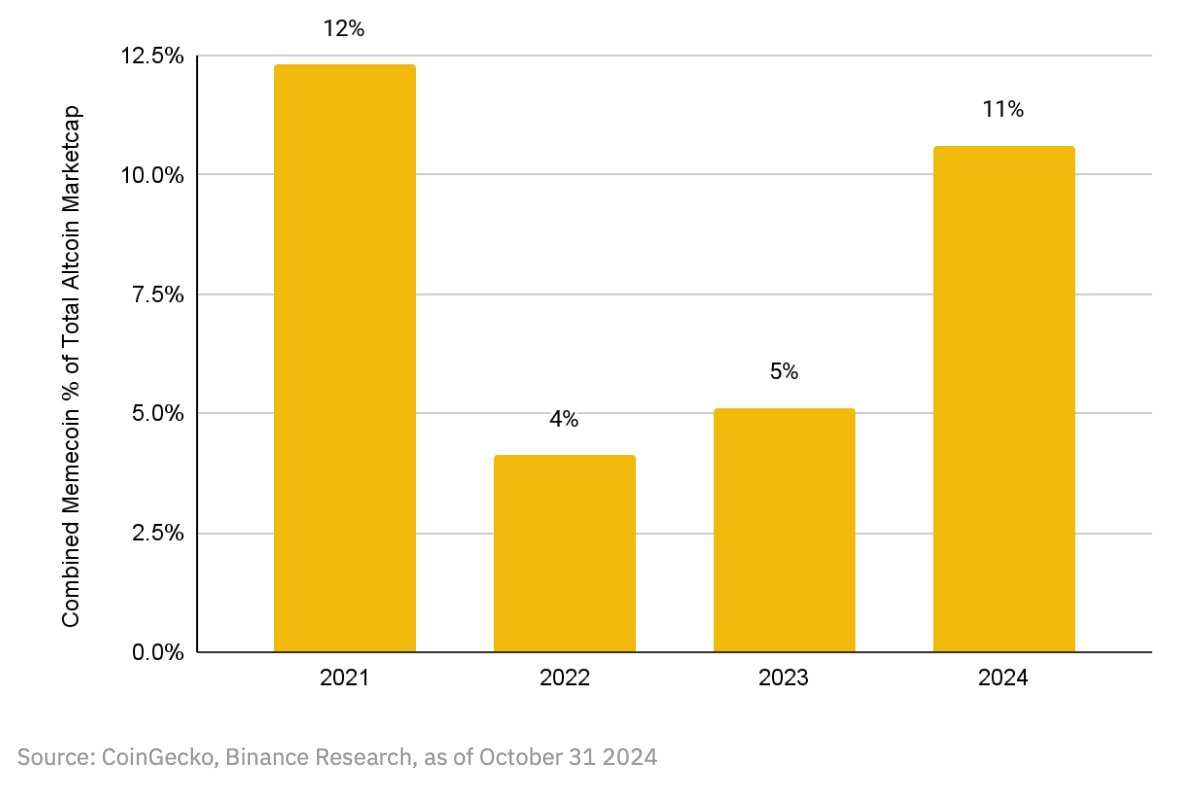

The recent growth of Meme Coin is by no means a flash in the pan. According to Binance Research, since 2022, Meme Coin’s market capitalization share in the non-BTC/ETH/stablecoin market has increased from 4% to 11%, almost tripling in a highly competitive market.

Source: @BinanceResearch

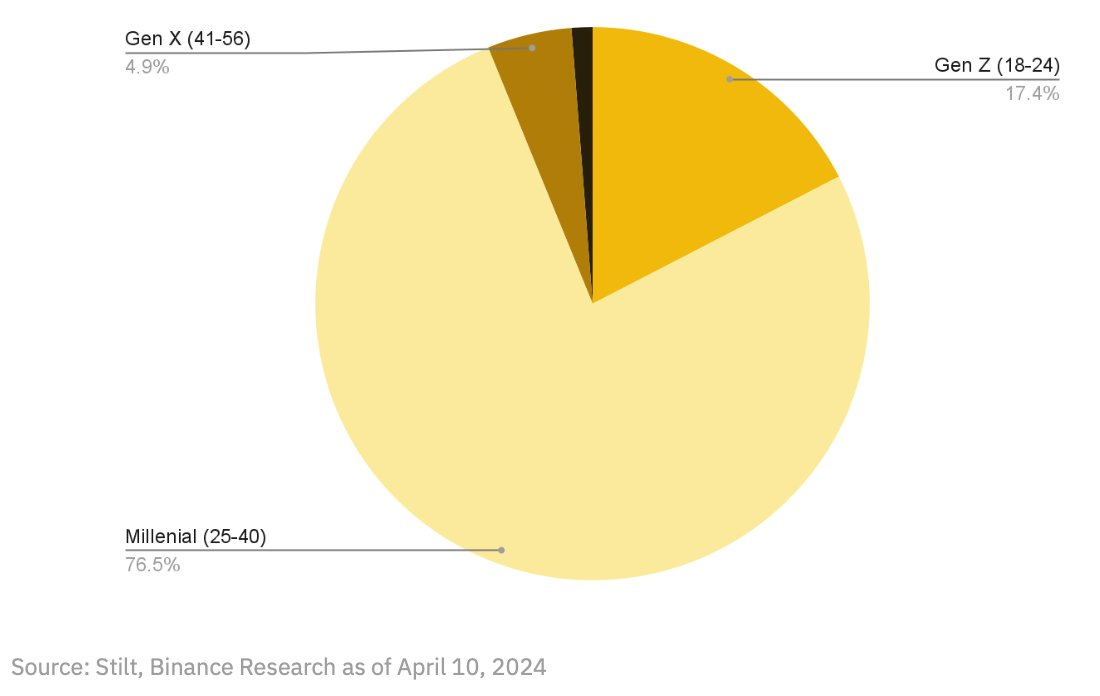

Millennials and Gen Z now make up 94% of digital asset buyers. This isn’t just a demographic fluke, it’s an entire generation responding to the environment they find themselves in. They’re not just buying tokens, they’re rejecting the traditional path to financial security that their parents took. Meme coins may seem like a joke on the surface, but for these traders, they represent a real opportunity to earn yield outside of the traditional system.

Source: @BinanceResearch

Andrew Edgecliffe-Johnson summed it up best: “If people have lost faith in getting rich slowly, it’s hard to blame them for wanting to get rich fast.” That faith has been eroding for years. In 1963, it took just 4.4 years of average wages to buy a house, now it takes 8.1 years. Add to that the surge in inflation in recent years, which hit 7% in 2021, and it explains why younger generations are looking elsewhere for financial opportunities.

This movement is not just about making a quick buck (although there is certainly an element of that). It is about using money as a protest against a lost trust in the legacy system. The meme coin phenomenon is high risk, high reward — and it is this quality that is so appealing to today’s traders. This is more than just a game; it is a vote of no confidence in the traditional way of wealth accumulation.

Exploring the Meme Coin Phenomenon

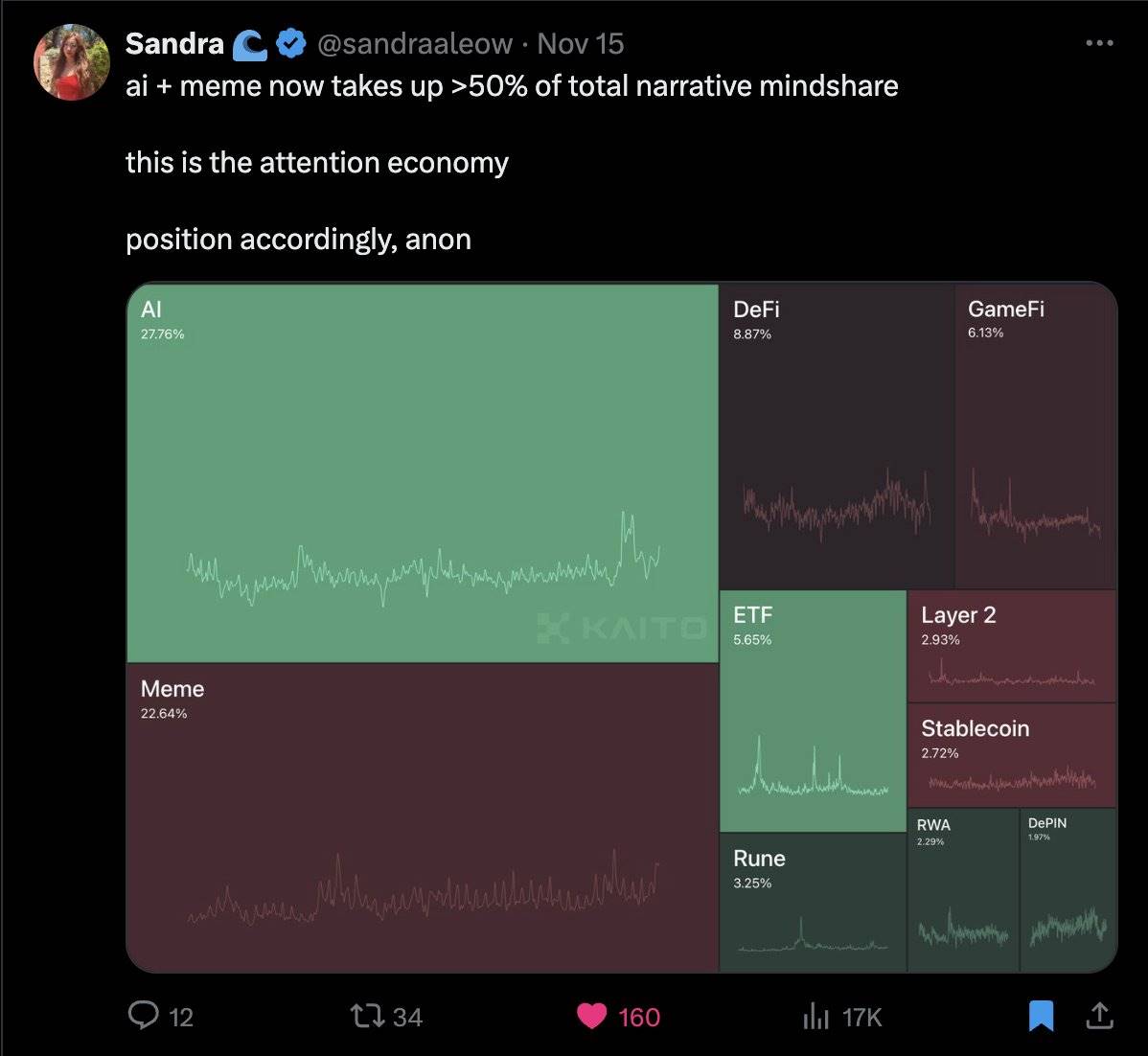

The rapid evolution of this market is astonishing. Research shows that $BOME reached a billion dollar market cap in just two days, $PNUT took 14 days, $WIF took 104 days, $SHIB took 279 days, and $DOGE took a full eight years. Attracting and keeping traders’ attention is the key to success.

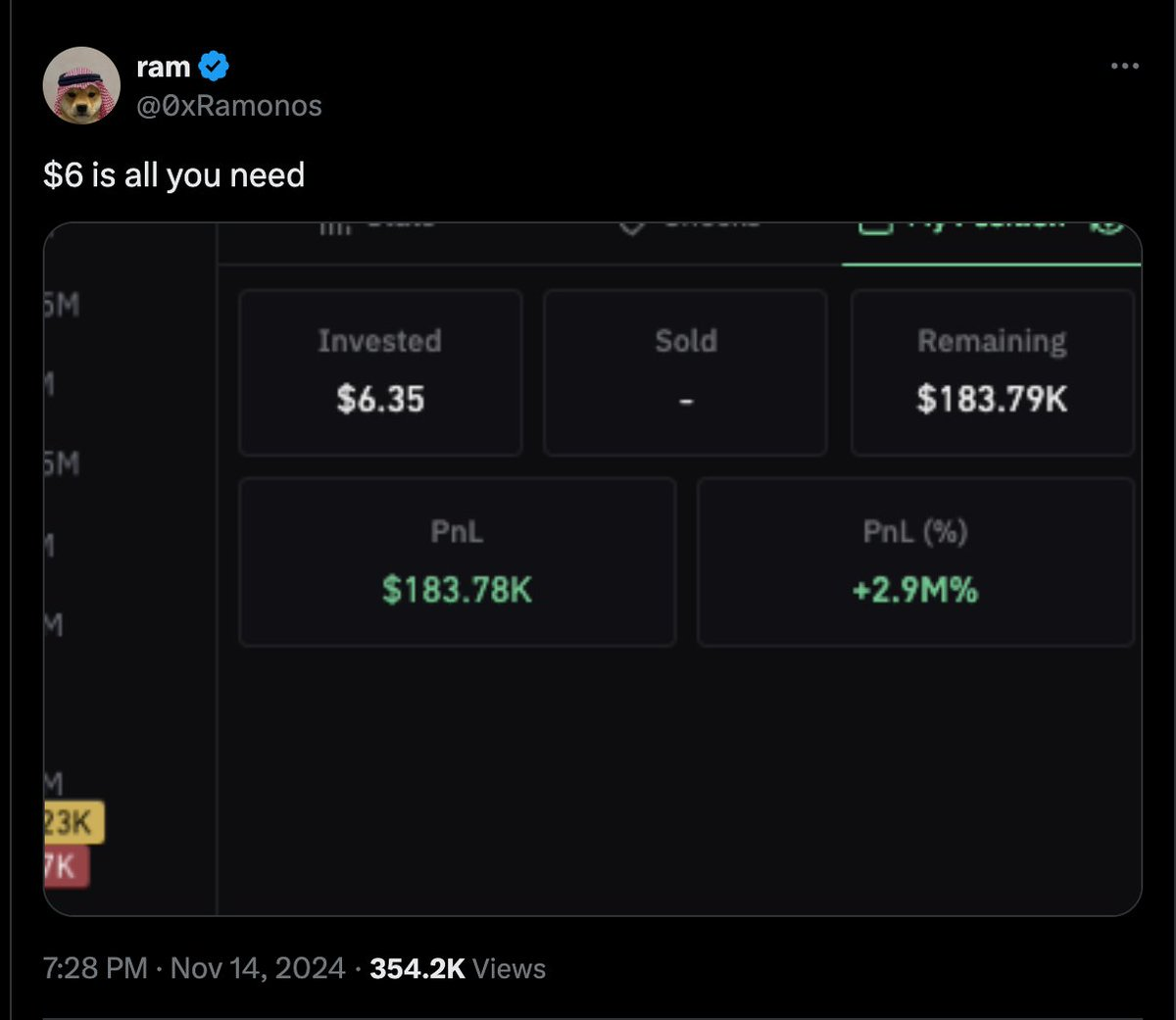

On X, screenshots of Phantom Wallet show returns of up to 633x and +10,520%, which highlights a larger theme: accessibility and fairness go to the core. In the ICO boom of 2017, universal participation was key - no private rounds, no VC allocations, and no complicated vesting schedules.

Today’s meme coin traders are fighting against what has been called the “VC exit liquidity simulator” in modern token issuance. Some new meme coins have no team allocations and are priced by the market, which harkens back to the level playing field of the early cryptocurrency era, where community and network effects were the key to success.

The meme coin craze is more understandable when viewed as an opportunity to participate in a fair competition, as there is no need to worry about VC vesting and token unlocking. People are tired of being used as exit liquidity, and fair launch platforms like pump.fun make it easy for anyone to issue coins and participate.

Breaking Gravity: The Secret to 100x Returns

What separates the winners from the many failed projects? The data is shocking - less than 2% of tokens can enter Raydium from pump.fun , and only a very small number of 0.0045% of tokens can maintain a market value of more than $1 million. But some tokens do reach the so-called "escape velocity" and successfully break through the gravity of obscurity.

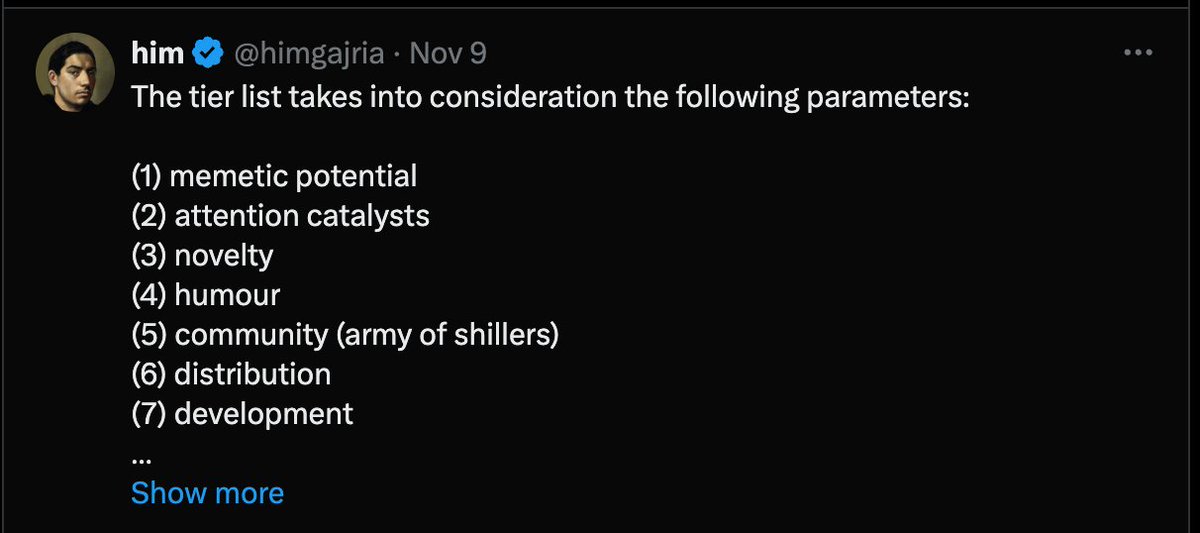

Successful meme coins tend to follow some observable patterns. The most successful tokens usually excel in at least one of seven key areas: meme potential, catalysts to attract attention, novelty, sense of humor, community, distribution, and development. Observe any successful meme coin and you will find these factors at work, with catalysts to attract attention, meme potential, community, and distribution being the most important factors.

Source: dune

Take Moo Deng for example — success was no accident. The project gained traction through social media like Twitter, Telegram, and TikTok. Its cute, easy-to-understand characters constantly appeared in the feed, creating a viral cycle of recognition and sharing. While it wasn’t particularly humorous, its strong attention catalyst and distribution strategy created momentum.

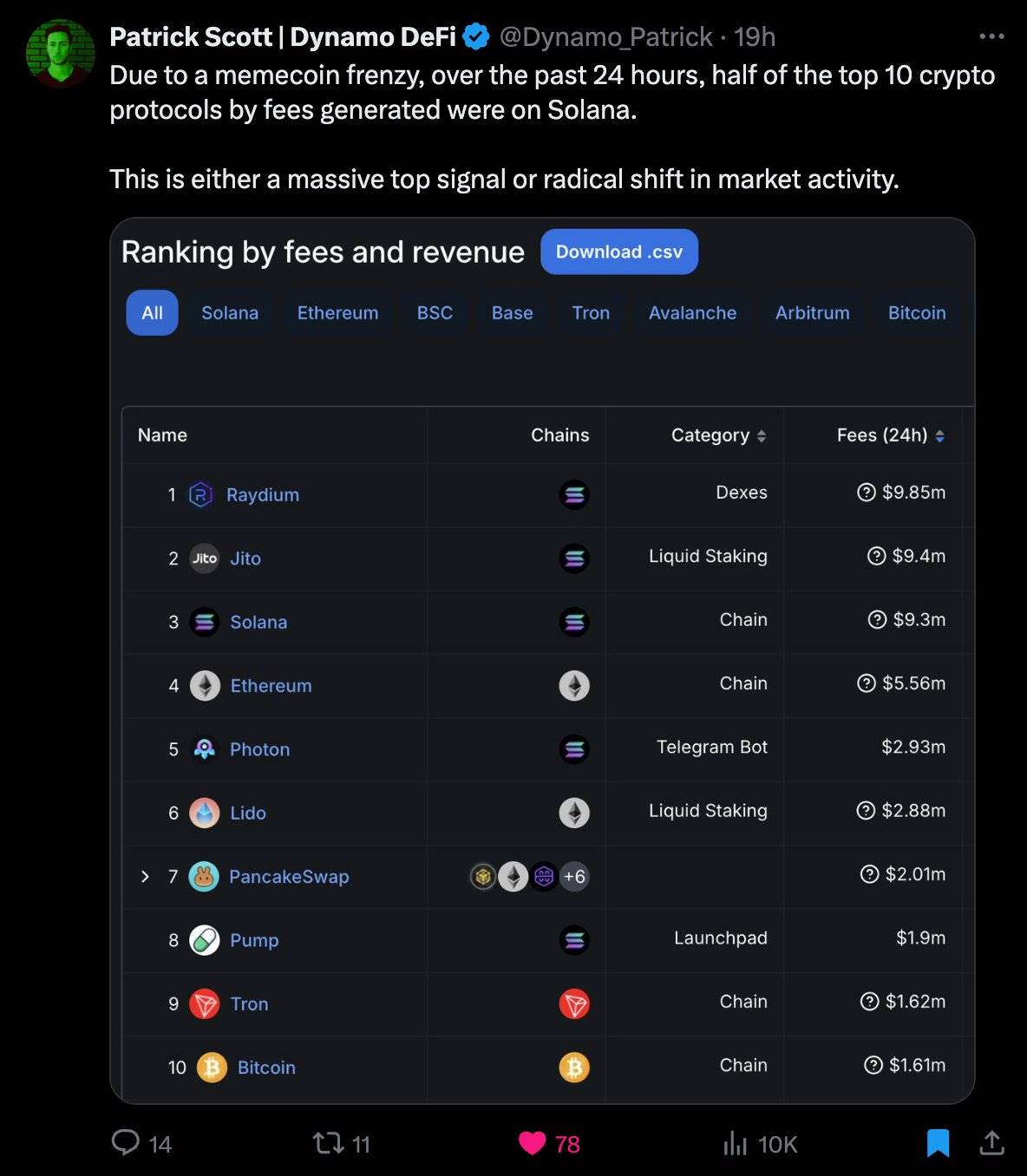

Solana has played a major role in this process. The network currently supports 89% of new token issuance and processes approximately 41 million non-voting transactions. Solana’s dominance is no accident - its low fees and fast transaction speeds make rapid experimentation possible, even if many experiments ultimately fail.

Current Market Landscape: Data Analytics

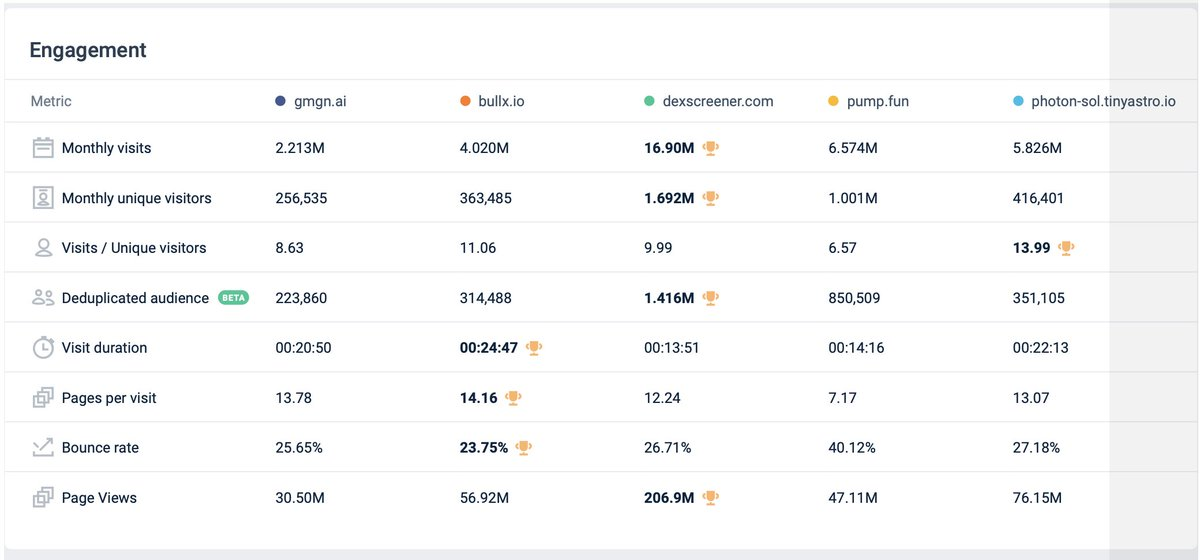

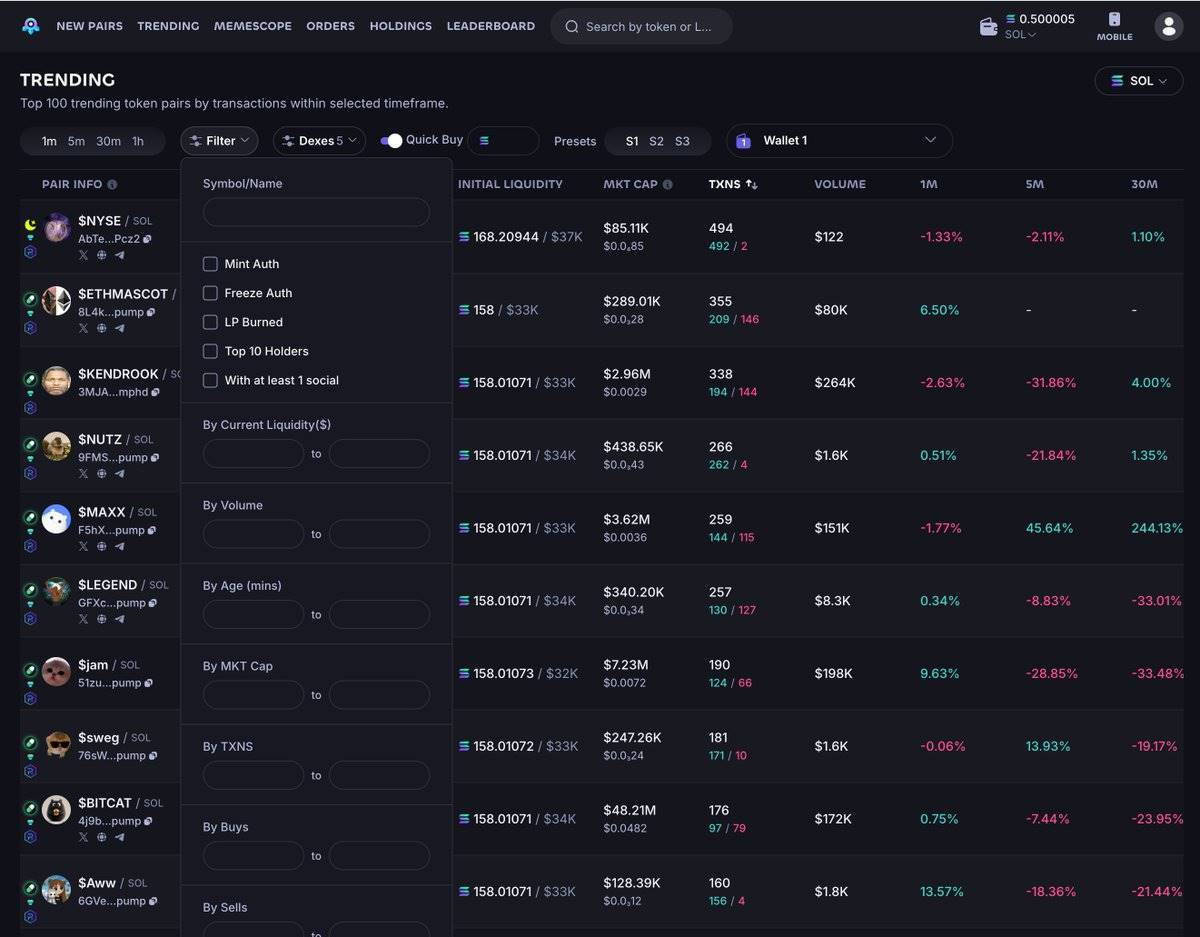

The data provides us with valuable insights into how traders interact with different Meme Coin platforms and reveals key gaps in the market.

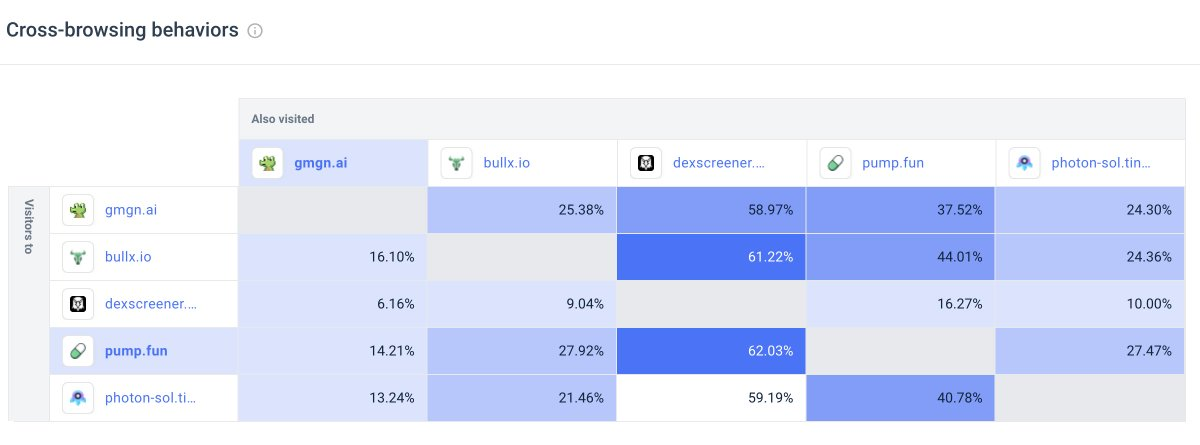

First, it is worth noting that about 60% of users still visit DexScreener after using their preferred trading terminal. They take advantage of DexScreener's insights, advanced filters, and analytical tools, which shows that existing platforms are not yet fully meeting their needs. However, only 10-12% of DexScreener users end up using trading and execution terminals, even though these terminals are better than DexScreener's interface in terms of customization and parameter settings. This reflects a gap in user satisfaction - despite the better functionality of trading terminals, they are still not fully utilized.

Source: SimilarWeb

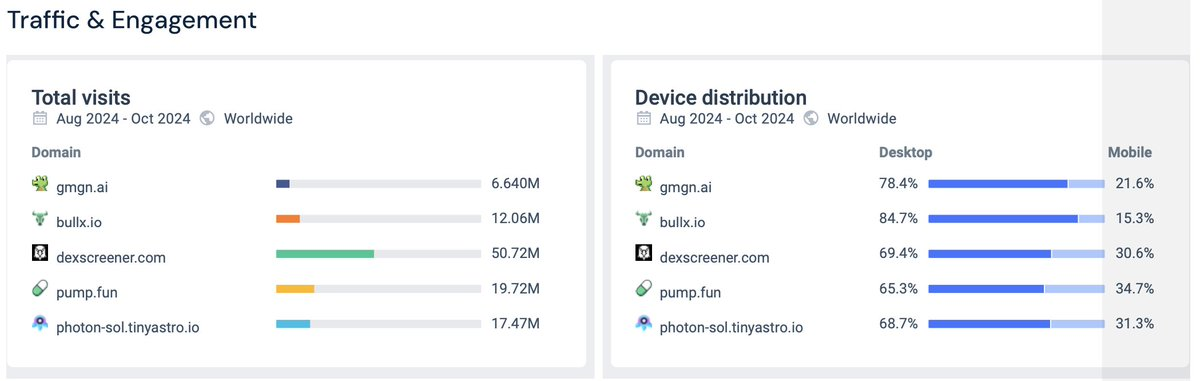

Photon stands out in the comparison of mobile and desktop usage. Of the three main trading terminals, gmgn.ai , BullX, and Photon, Photon has the highest mobile usage, while BullX has the most desktop users. Although BullX has a large desktop user base, a large part of its traffic comes from Telegram links. This shows that even when distributed through a mobile-first platform like Telegram, users ultimately use BullX on their desktop. This reflects the complexity of these terminals and shows that users prefer to operate them in an environment where they can fully manage their functions.

Source: SimilarWeb

This trend reveals a wider problem: existing trading terminals are too complex. Their dominance on desktops shows that they are inconvenient to use on mobile devices, which leaves a huge gap in the market for a trading terminal that can work seamlessly on a variety of devices. Traders want powerful tools that are easy to use on mobile devices and can switch to a simplified interface when needed. The market is in desperate need of an integrated solution - an intuitive platform that combines advanced functionality and ease of use whether the user is on desktop or mobile device.

The current fragmented experience is inefficient and inconvenient. Traders have to switch between multiple platforms to get the insights they need and execute trades effectively. A unified solution that provides depth and functionality, while having an adaptive interface on mobile devices, will greatly improve the trading experience.

Deep Dive: The Trader's Perspective

In speaking with traders, they generally want simple yet powerful tools. “I still need to set up priority fees and additional fees when the network is under high load,” said one trader. “I want smart defaults that work automatically but let me adjust when needed.”

This need for balancing simplicity and control comes up over and over again. Current platforms either oversimplify or leave complexity entirely in the hands of the user. None find the middle ground of providing depth while still being usable out of the box.

“It would be nice to have an all-in-one interface that brings together exchanges, charts, and recent trades, less clicks, and all the important information in one place,” said one large trader. Another mentioned spending a lot of time teaching the team basic concepts, such as how to optimize trading fees — time that could have been spent on actual trading.

Limit orders were a recurring complaint. “Although the order was executed, all the positive slippage was eaten up by the platform,” one trader noted. Another mentioned that limit orders on one platform always seemed to be filled faster than others, leading to an uneven playing field and confusion among everyone.

Market structure: the real challenge

Current trading platforms are designed mainly for crypto veterans and on-chain traders who are familiar with terms such as "slippage tolerance", "priority fees" and "bribes". However, most traders only care about how much they need to pay and whether the transaction can be completed smoothly. One trader who manages more than 100 wallets said that he can no longer even effectively track his positions.

The experience on mobile is even worse. While Telegram bots make up for some of the shortcomings to a certain extent, they are not a long-term solution. These are just temporary fixes for a system that needs to be completely redesigned.

This fragmentation comes with real costs. Traders frequently switch between platforms, miss opportunities due to failed trades, and suffer losses due to poor execution. The existing ecosystem forces users to choose between expensive tools and poor performance, with no compromise options.

Building solutions: Beyond temporary fixes

The current Meme coin trading environment is like a patchwork of temporary solutions. Although it temporarily meets user needs, there is obviously a lot of room for improvement. When traders say "it would be nice if there were tools to customize LP strategies", or complain about "having to adjust priorities and bribes when fees are high", or hope for better execution on stop-loss and take-profit order strategies, they are actually pointing out a fundamental problem: the existing so-called solutions are not real solutions.

Most platforms seem to be designed for users who are already familiar with on-chain transactions, bridges, and DeFi, making them complex and difficult to understand. However, through communication with multiple traders, we learned that they want to be able to choose to use complex functions in an uncomplicated interface. The existing "advanced" user interface does not provide the parameterization of functions required by advanced traders, and the default interface is too simple and ignores functions that may have a significant impact on profits and losses. For example, some traders hope that there will be a function that "automatically tells you how much this transaction (including gas and fees) will cost to ensure the transaction is successful", which will not only allow advanced users to evaluate whether the fees are reasonable, but also let ordinary users understand the fees they are about to pay.

The solution is not just to simplify the interface, but to rethink how traders interact with the market. Some people compare Meme Coin trading to "games", and they actually want the added value of a gamified experience. They need analytical tools that can show win rates, reasonable performance tracking, and tools to help understand trading patterns.

Future Directions: Cumberland Labs’ Vision

We weren’t looking to build yet another trading terminal or launch a new Telegram bot. We saw a much bigger opportunity: to build an interface that combined the simplicity of Moonshot with the power of an advanced trading terminal. A platform that could evolve as users grow, providing an easy entry point while meeting the depth and sophistication needs of experienced traders. More casual traders means higher volumes, deeper liquidity, and better opportunities for both sophisticated on-chain traders and those just dipping their toes into the space.

This means:

Simplifies complexity without sacrificing functionality—provides smart defaults and allows full customization when needed

Unified trading experience that combines charting, execution and analysis in one window

Truly effective cross-chain portfolio management

Real-time performance tracking to help traders understand their strategies

Protect against obvious risks without limiting opportunities

The current platform provides a solid foundation for today’s crypto veterans and on-chain traders. But the next wave of casual traders needs something different — a platform that starts simple and grows with them. They need an intuitive interface that guides them through the trading process and gradually introduces more complex features when they are ready. The existing “Advanced vs. Default” UI setup can be further refined to better meet the needs of different users. It’s not a matter of simplification, but creating multiple layers of complexity that users can explore at their own pace.

The meme coin market is growing faster than ever. While 75% of meme coins were created in the past year, we saw an opportunity to build tools that would both attract newcomers and empower experienced traders.

Beyond the transaction: a vision to build a community

Trading is only part of the entire ecosystem. Community building, education, and shared experiences are key to driving the development of the Meme Coin ecosystem. Although existing platforms such as Discord and Telegram have achieved a certain degree of integration, it is an innovation to bring the community directly into the trading platform. Currently, the activity of Telegram robots is higher than that of traditional trading interfaces. One of the reasons is that users can quickly copy the contract address from the Telegram group to the robot for trading, which is faster than on the trading interface.

@blknoiz06 Telegram Group

We envision a more integrated approach. Imagine being able to track your progress with other traders, share strategies over time, and build a reputation based on actual trading performance. Not just some arbitrary metric, but deep insights into which strategies are working and which are not.

This social layer is not intended to create another crypto echo chamber, but rather to provide context and understanding to help traders make more informed decisions. Whether analyzing how different entry points affect returns, understanding performance patterns before and after migrations, or learning from successful strategies, every feature is designed to improve trading results.