Today, MicroStrategy (MSTR) has a market capitalization of over $100 billion, making it the 93rd largest publicly traded company in the United States.

As of the time of writing, MSTR's trading volume has surpassed that of two major stock giants, Tesla and Nvidia, causing a frenzy in traditional stock trading communities like Wall Street Bets.

This is truly astonishing, as MicroStrategy was only a $1 billion company when it first purchased BTC as a treasury asset around four and a half years ago.

MicroStrategy's market value change since its first BTC purchase

I've been asking myself an important question: how and when will this trend end? Assuming MSTR continues to soar during this bull market, no one can predict how high its market value might climb.

However, how will the company plummet in a bear market? After all, it is essentially a leveraged BTC trade. I even dare to speculate that this time, the situation may be different - the next BTC bear market may not see a drop of over 70%.

Despite the launch of a spot BTC ETF and speculation that the US may lead a large-scale BTC purchase, I still believe BTC prices may ultimately experience a significant decline. I'm mentally preparing for a "normal" BTC bear market after the end of the bull market, which could occur within the next year or so.

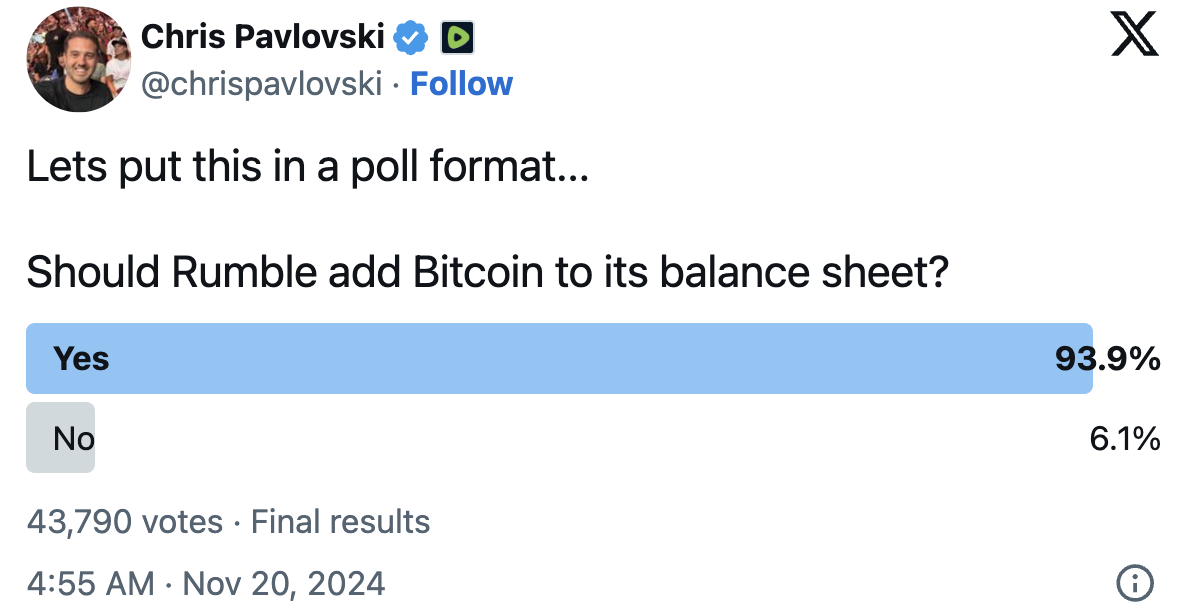

Returning to MSTR - Michael Saylor has so far proven that the "BTC corporate strategy" is operating remarkably successfully. In the past week, more and more publicly traded companies have announced that they have purchased BTC as part of their balance sheets, or plan to do so. And this trend seems set to continue. For example, the CEO of Rumble has asked his audience on the social platform X whether they should add BTC to their balance sheet, and nearly 94% of the 42,522 voters chose "yes".

Michael Saylor has even proactively offered to help explain why and how Rumble should adopt a corporate BTC strategy.

Institutional-level BTC adoption has arrived and will only continue to grow in the foreseeable future. As companies understand the logic of holding BTC as a strategic reserve asset, the number of publicly traded companies adopting this strategy will rapidly increase.

Companies that add BTC to their balance sheets will see their trading volumes surpass most others, even top tech giants, just like MicroStrategy - until all companies have BTC on their balance sheets. I try to put myself in the shoes of an informed BTC trader: "If a company doesn't have BTC on its balance sheet, why would I buy its stock?" I wouldn't, as such a stock would be too boring.

Adding BTC to the balance sheet helps create volatility, providing opportunities for stock traders, which is beneficial for traders, stock prices, and the company as a whole. If you're a publicly traded company, incorporating BTC as a treasury reserve asset is an undoubtedly wise move.