Source: Future Money

The total market capitalization of cryptocurrencies has shown an overall upward trend, and with BTC making another push upward, entering a new round of upward cycle, more AI projects will turn to the Meme issuance model to emerge in the public eye.

Crypto Market Summary

1. The decentralized AI concept is still the mainstream narrative in the industry, with top-tier AI seeking market profits to interpret the feasibility of their business models; more AI projects will turn to the Meme issuance model to emerge in the public eye.

2. DeSci (Decentralized Science) is a narrative that was born at the same time as DePIN, but in the early part of this year it was overshadowed by DePIN in terms of hype. It has been lukewarm, but at the end of this year, with CZ's attention to DeSci and the hot Meme market, the logic of raising funds through Meme to complete scientific research has been established.

3. The Solana ecosystem is still the current Meme hotspot, with Pump.fun protocol revenue reaching $210 million. At the same time, Meme-focused funds that use Meme as their main holding and fundraising method have emerged, such as ai16z, which has become the largest Meme fund at present through the effective use of the internal and external plate rules of Pump.fun and the profit-sharing rules of Daos.fun, with a return on investment as high as 75 times.

4. With BTC making another push upward and entering a new round of upward cycle, the Meme narrative has a risk of cooling down recently, and investment needs to be cautious.

I. Market Overview

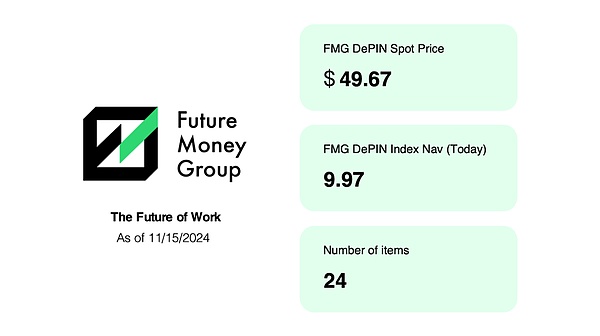

1.1 FutureMoney Group DePIN Index

The FutureMoney Group DePIN Index is a DePIN quality portfolio token index constructed by FutureMoney, selecting the most representative 24 DePIN projects. Compared to the previous report, the NAV has increased significantly, from 8.31 to 9.97. The Spot Price has fallen to a certain extent, which is due to the fact that in this round of upward movement, BitTensor, which occupies a large position in the Index, has entered a volatile period and the upward trend is not obvious, being diluted by the gains of other holdings such as Render (59%), GRT (44%), AKT (60%), and AIOZ (68%). Overall, we can feel that the AI concept has generally outperformed the DePIN concept, and AI application-type projects with actual landing scenarios will outperform large infrastructure-type projects.

1.2 Crypto Market Data

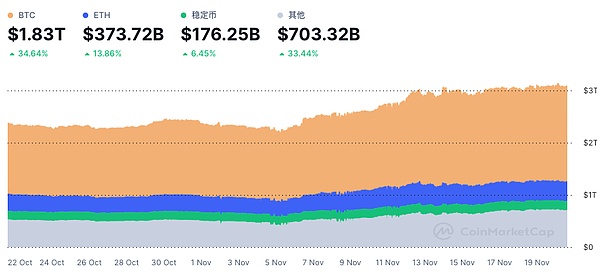

From October 31 to November 15, the total market capitalization of cryptocurrencies showed a significant upward trend. It has risen from the previous $2.45 trillion to $3.03 trillion, approaching the annual GDP of France. In terms of market share, BTC remained consistent with October, still at 59.3%. At the same time, we can see that trading volume has increased significantly, from the previous $72.5 billion to the current $179.8 billion.

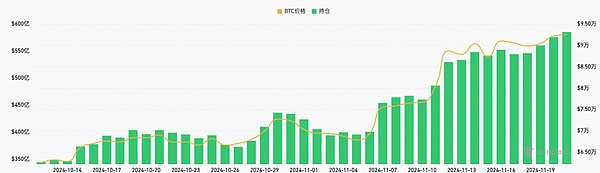

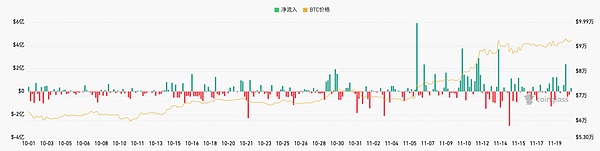

Observing the trend of Coinglass contract open interest, since October 31, the BTC contract open interest on the entire network has risen significantly, from the previous high of $43.5 billion to the current $58.5 billion, fully demonstrating that off-exchange capital and non-BTC capital have been betting on BTC in this round of upward movement.

Currently, the overall BTC trend is in the FOMO stage, and FMG previously predicted that Trump's election would be successful, and Trump's election would also bring great benefits to the entire industry. Referring to the past bull markets, BTC often completes a new high within 8 to 16 months after the halving, and it has now entered the upward channel. In the past 15 days, BTC spot net inflow has been $2.174 billion, and USDT net inflow has been $3.284 billion.

1.3 CPI and other data, as well as market response, to judge the market

1. Macro level: So far, the US unemployment rate has not changed significantly, and the number of initial jobless claims has increased slightly, from 216,000 on October 26 to 221,000 on November 9. Since the Democratic Party is still in power, the proposals of the Trump administration to stimulate the economy and employment have not yet formed policies, and the subsequent performance of the unemployment rate under Trump's administration will have more obvious changes.

2. Crypto side: Over the past two weeks, BTC has continued to test new highs, reaching a historical high of over $94,000 on November 20, as there have been reports that Donald Trump's social media company is in negotiations to acquire the crypto trading company Bakkt, which has increased people's hope for a crypto-friendly system under the Trump administration. IG market analyst Tony Sycamore attributed this to the positive news from the Trump trade negotiations and the optimistic sentiment in the market from the launch of BlackRock's spot Bitcoin ETF options product on its first day.

3. Sectors worth investing in: The industry narrative has shifted relatively quickly in the past two weeks. In the period after BTC's first attempt to break through $94,000 from $68,000 and then fell back, the Meme and AI concepts represented by the Solana ecosystem, as well as the Meme of the DeSci concept, have become active. This has given birth to new models such as Daos.fun and ai16z. In addition, the AI reasoning model project ORA invested by FMG has achieved an excellent result of $2 billion FDV by first choosing to launch on Dex, which on the one hand verifies that the decentralized AI theme is still a focus of the crypto market, and on the other hand, the Meme narrative will become one of the mainstream narratives in the foreseeable future.

In addition, the DeSci narrative that CZ has been promoting since his release from prison has also become a major scenario for Meme.

II. Hot Market News

2.1 Trump Administration Nominates Bitcoin Supporter Howard Lutnick as U.S. Commerce Secretary

The Trump administration has nominated Wall Street bond trading giant Cantor Fitzgerald's CEO Howard Lutnick as the next U.S. Commerce Secretary. Howard Lutnick holds hundreds of millions of dollars in Bitcoin and has previously announced at a Bitcoin conference that Cantor Fitzgerald will be launching a Bitcoin financing business. Cantor Fitzgerald has been custodian of Tether's assets since late 2021.

2.2 The U.S. May Use BTC as a Strategic Reserve

As some U.S. states have proposed BTC strategic reserve bills, the possibility of the U.S. establishing a BTC reserve is increasing. Against the background of the new Trump administration team, the chances of these bills being passed are very high, and if the bills are passed, it will undoubtedly be a great boon for BTC. Just yesterday, CZ posted that all countries are competing to buy BTC as a strategic reserve, and no one wants to be the last country to enter. This indicates that the trend of BTC as a reserve asset is accelerating, and it may become the focus of national policies and market discussions in the coming months.

2.3 Solana Releases New Roadmap, Market Cap Hits New High

The Solana co-founder released the "Solana Roadmap", preliminarily disclosing that it will increase bandwidth and reduce latency, while other content is not yet known. Currently, the Solana chain is a very vibrant public chain for Meme coins, and the two are in a mutually successful, shared glory and shame relationship. Accompanied by SOL's market cap breaking through $116 billion to a new high, it is also hoped that Solana and the Meme ecosystem can become more stable and secure going forward.

2.4 Meme Market Cap Accounts for 17.05% of Total Crypto Market Cap

According to data from CoinGecko's Q3 2024 industry report, MemeCoin (17.05%), AI (9.66%) and RWA (6.47%) and 15 other narratives account for 71.7% (including 11.41% of Solana Memecoins and 1.83% of Base MemeCoins) of the crypto market share.

III. Regulatory Environment

President-elect Trump is considering appointing blockchain legal expert Teresa Goody Guillén as chair of the U.S. Securities and Exchange Commission (SEC). Guillén is currently a partner and co-head of the blockchain team at BakerHostetler law firm, having previously worked at the SEC and represented blockchain companies and traditional companies in SEC enforcement actions.

Sources say the Trump team wants to choose a pro-crypto candidate with a non-bureaucratic background to push the SEC to implement a light regulatory policy and end the "enforcement action as regulation" practice. Guillén is recognized by the industry for her strong securities law background and support for the crypto industry, and is seen as able to quickly reform the SEC. The SEC chair nominee is expected to be determined before Thanksgiving, with Guillén competing for the position with other candidates including former SEC commissioner Paul Atkins and Robinhood's chief legal officer Dan Gallagher.

Data sources: Coinglass, Rootdata, Coinmarketmap, X