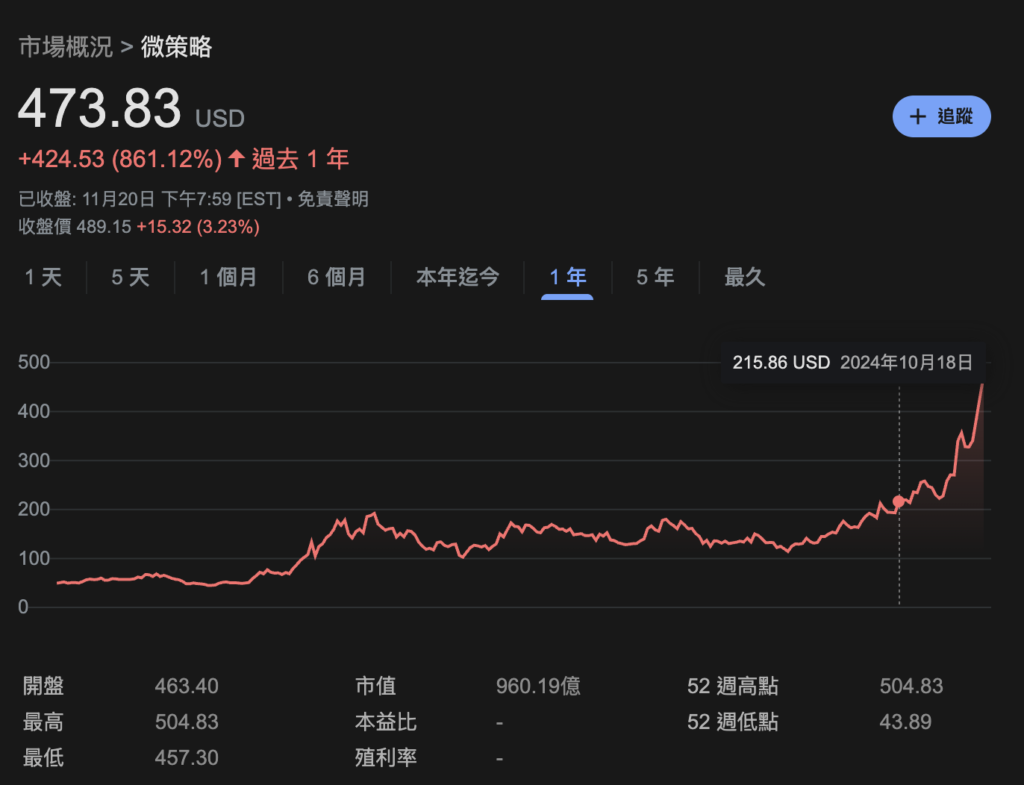

The US stock microstrategy (MSTR) has seen a sharp rise in recent times, even briefly breaking through the $500 mark on the evening of the 20th, becoming the most actively traded stock on the Nasdaq for the day. According to Nasdaq's stock price data for the past year, the annual return rate has reached 860%, far exceeding Bitcoin's 150% return rate. With the election of the Trump administration, Microstrategy's operations in Bitcoin have also become a popular market strategy for commercial companies.

However, as Microstrategy has become a hot stock, the market and community have also raised a new question: If you are bullish on Bitcoin, should you buy Microstrategy or Bitcoin? This article will analyze the differences in the nature of Microstrategy stocks and Bitcoin assets, as well as the situations where it is suitable to buy Microstrategy stocks, and the advantages of purchasing Microstrategy stocks:

The Relationship Between Microstrategy and Bitcoin

When it comes to the relationship between Microstrategy and Bitcoin, it is impossible not to mention the company's purchase of 331,000 Bitcoins, which have generated an unrealized gain of nearly $14.9 billion to date. The company has also been continuously issuing debt to increase its Bitcoin holdings, a strategy that many other companies have emulated. Therefore, investors believe that the main connection between Microstrategy and Bitcoin lies in the company's holdings on its balance sheet.

However, the reality is not that simple, because the company has only converted a portion of its assets into Bitcoin. Theoretically, it is unlikely that Microstrategy would see a price increase that exceeds the rise of Bitcoin.

Tokenized Securities on Bitcoin's Second Layer

A deeper examination of Microstrategy's Bitcoin strategy reveals that it is much more complex than you might think. One of the key aspects is the cMSTR token issued on the Bitcoin second layer Liquid Network. According to Blockstream founder Adam Back, this is a technology developed by Microstrategy itself, where one token represents 100 shares of MSTR stock, and it is issued by the Luxembourg securities company Stocker, allowing for legal on-chain trading and redemption for MSTR shares.

Recently, Stocker has also split the CMSDR unit 9 times, effectively increasing the token supply tenfold. This means that as long as the issuer is willing, the circulating supply of the tokens can be greatly increased, achieving greater flexibility in splitting and circulation compared to traditional stocks. The CMSDR also has some financial tools that allow users to hedge against Bitcoin, and these tools operate 24/7 like cryptocurrencies.

This innovation has allowed Microstrategy to enter the era of securities tokenization on the blockchain ahead of the rest of the world, with ultra-high liquidity and settlement efficiency, serving as a better demonstration for improving the traditional financial system within the Bitcoin ecosystem.

Therefore, from the first perspective, it is quite reasonable for a company that has actively brought its own stocks onto the blockchain market to have a certain technical premium. Microstrategy not only represents the strategic value of the company's leveraged Bitcoin, but also the future market potential of the widespread adoption of Bitcoin technology.

- Microstrategy has invested in the Bitcoin ecosystem, establishing the Lightning Network and other infrastructure in close collaboration with Blockstream, giving it first-mover advantages in the ecosystem.

Further Reading: The Full Text of Adam Back's Speech in Taiwan: Bitcoin Outperforms Gold, with an Ideal Allocation of 9.5%

Bitcoin Itself is an Asset, Unable to Generate Active Profits

Just like gold and diamonds, you would not expect to earn interest after purchasing them, but due to their scarcity in the market, people can expect their prices to rise in the limited future, as the market cannot find more of the same homogeneous commodities.

However, Microstrategy itself is a company that, through certain operations and investments in the Bitcoin ecosystem, can achieve a high degree of correlation with Bitcoin's price and profits. The key is that Microstrategy is a company that continues to generate profits and has made significant technical investments in the Bitcoin ecosystem, which results in many different characteristics compared to simply holding Bitcoin:

- MicroStrategy has been profitable every year, and it has been continuously investing in Bitcoin, which has created a compounding effect between the capital market and the crypto market. This means that the relationship between MicroStrategy and Bitcoin may not be linear, but rather a trend that slows down after reaching a certain exponential level. In simple terms, MicroStrategy is leveraging Bitcoin with the company's assets and profits.

MicroStrategy stock is a better option for the general public

Compared to people operating wallets, exchanges, and going through KYC to deposit and buy Bitcoin, people who have FOMO for Bitcoin may find purchasing MicroStrategy to be a lower-cost choice. Because the US stock market is already a very mature market, the transfer of market funds is also very fast. The fact that MicroStrategy set a new single-day trading volume record on the Nasdaq today proves one thing: it is difficult to get the general public to put their money into buying Bitcoin, but it is much simpler for the US stock market participants to buy MicroStrategy, and the scale of funds is also much larger.

Therefore, this may form a phenomenon where, due to the lower transaction and operation thresholds, people who have short-term interest but are unwilling to learn more will to a certain extent choose to purchase MicroStrategy stocks. This forms a vision that the crypto community has always hoped to see:

- A large amount of traditional finance capital flows painlessly into cryptocurrencies (Bitcoin), but the gateway is now MicroStrategy.

Compared to the lengthy communication processes such as alliance chains, technical integration, and cooperation between banks and decentralized protocols, MicroStrategy has completed the vision that the crypto community has been trying to achieve for more than a decade in a simple and brutal way, which was unimaginable just a few years ago.

The relative risk of MicroStrategy stock

However, after discussing so many advantages of MicroStrategy stock, does it mean that simply holding Bitcoin is useless? In fact, this is not the case, because now is a time of continuous rise in Bitcoin (bull market), which has also made many people easily overlook the advantages of simply holding Bitcoin.

First, the users with the highest historical returns are those who have long-term pure holdings of Bitcoin, because they will not be affected by any market fluctuations, and simply enjoy the miracles brought by Bitcoin and Satoshi Nakamoto, which will not be distorted by financial instruments and risks.

As a company, MicroStrategy is greatly influenced by human factors, and we cannot guarantee in the long run that MicroStrategy's interests will always be consistent with Bitcoin's, or at least at certain times, its interests may be temporarily inconsistent with pure Bitcoin holdings.

Additionally, as a US company, geopolitical and other risks must also be considered, while pure Bitcoin holders do not need to consider these risks, and can truly achieve a "lying flat and making money" strategy.

- MicroStrategy is affected by human factors and geopolitical factors, and holding it is not as simple as holding Bitcoin

Furthermore, the inevitable deleveraging of the economic cycle will certainly come. Currently, MicroStrategy is actually deploying a wave of policies to leverage Bitcoin holdings with corporate debt in the pre-bull market. Such policies will inevitably lead to a disastrous result when Bitcoin experiences a large-scale decline, so MicroStrategy will definitely need to perform "defusing" and other deleveraging actions at the high point in the future.

- MicroStrategy is actually leveraging Bitcoin, so it will inevitably face the risk of deleveraging in the future

Finally, there is the investment in the Bitcoin ecosystem. In fact, over the past two or three years, no one thought that the Bitcoin ecosystem would be so fierce, and it might even become a mainstream existence. Currently, Bitcoin accounts for 61% of the cryptocurrency market, which is also one of the reasons for MicroStrategy's success so far.

However, the crypto market is changing rapidly, and no one knows whether the current mainstream public chains can maintain their position in the future applications. Therefore, MicroStrategy's current over-investment in the Bitcoin ecosystem may also have greater risks compared to the asset-only nature of Bitcoin.

- Compared to Bitcoin, MicroStrategy may be more sensitive to the price of Bitcoin based on whether the Bitcoin ecosystem is prosperous

In any case, in the short term, MicroStrategy is almost unstoppable, but from an economic logic and situation perspective, MicroStrategy still faces many challenges in relying on its Bitcoin strategy to maintain this position in the long run.