Article author: Karen Shen Article compiler: Block unicorn

In this article, we will explore the potential opportunities for collaboration between cryptocurrencies and consumer AI (artificial intelligence). This article is divided into three parts:

Why Crypto x Consumer AI?

Overview of the Traditional Consumer AI Market

The Crypto x Consumer AI Opportunity

Why Crypto x Consumer AI

Over the past year, the intersection of AI and cryptocurrency has become a hot area of consumer interest, and this trend has driven the launch of a large number of new projects. The vast majority of attention and capital are focused on the infrastructure level of AI, such as computing power, training process, reasoning technology, intelligent agent models, and data infrastructure.

While many of these projects are ambitious and could lead to large-scale results, the technology is not yet production-grade (yet) and is unlikely to be widely commercialized in the near term. This leaves a gap in the market for more directly impactful technology applications, especially at the consumer level.

Consumer AI refers to AI products designed for everyday users rather than enterprise or business-specific applications. These products include AI-driven general assistants and recommendation systems, generative tools, and creative software. With the rapid development of AI technology, consumer applications are becoming more intuitive, personalized, and easier for ordinary users to use.

Popular consumer AI applications today

Unlike enterprise AI, which typically requires precision and deterministic results, consumer AI benefits from flexibility, creativity, and adaptability — areas where AI currently excels.

Although still in its early stages, the marriage of crypto and consumer AI is certainly a fascinating topic. It’s rare to see two technologies move toward maturity at the same time, so it’s worth exploring—even if the results are hard to predict.

In the crypto space, there is a pressing need for more consumer-facing applications that provide new and interesting ways to interact with the underlying technology. Over the past decade, blockchain investment has driven significant advances in infrastructure, including faster block generation, lower gas fees, better user experience (UX), and a significant reduction in user entry barriers that were common just a few years ago.

You only need to try out apps like Moonshot, which lets you instantly buy Meme Coins with Apple Pay, to get a feel for how far the industry has come. However, there is still a lack of founders and developers willing to solve interesting consumer crypto problems.

At the same time, consumer-grade AI is market-ready, providing a ripe opportunity for developers to combine the two technologies to build applications that shape the way we interact with, own, and engage with digital assets and AI systems.

Overview of the Traditional Consumer AI Market

First, let’s leverage two resources to help us quickly understand experiments in the traditional (non-crypto) consumer AI space:

a16z's Top Consumer Products by Web Traffic (3rd Edition)

YC team's latest W24 project batch

a16z’s Top Consumer Products by Web Traffic

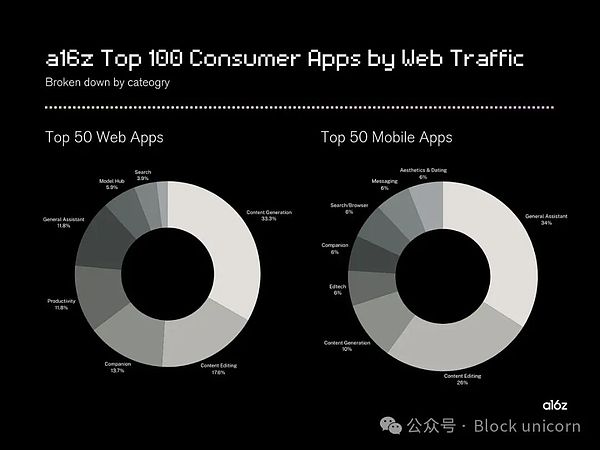

The a16z report ranks the most visited consumer AI web pages and mobile apps every six months by analyzing web traffic data for consumer AI products.

By analyzing this data, they identified trends in how consumers are actively engaging with consumer AI technology, which categories are gaining traction, which categories are declining, and the early leading projects in each category.

Here are the top 100 consumer AI products by August 2024, broken down by category into web and mobile apps.

Clearly, content generation and editing tools are leading the way in consumer AI.

These apps now account for 52% of the top 50 web apps and 36% of the top 50 mobile apps. Notably, this category is expanding from text-generated images to include video and music generation, further expanding the potential for AI-driven creative expression.

Popular categories like general assistants, companion tools, and productivity tools remained stable in the top 100, reflecting continued demand. A new category, “Aesthetics & Dating,” was added to the third edition of the a16z report, with three projects in the category making the list.

It is worth mentioning that a cross-category crypto project also made it onto the list. Anime companion app Yodayo (now Moescape AI) ranked 22nd on the web app list.

Moescape AI

Comparing a16z’s latest report with previous reports shows that while the categories of core consumer AI remain stable, about 30% of the top 100 projects are new, highlighting the continued development of the field.

YC team's latest W24 project batch

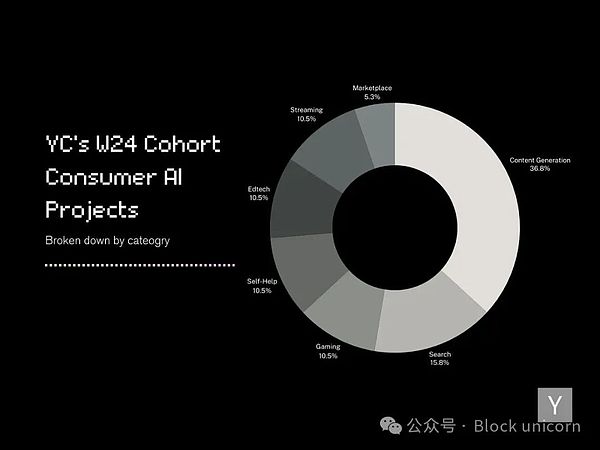

Next, let’s review YC’s W24 batch (the latest) as a resource to help identify emerging consumer AI projects and categories that have made it to market but may not have enough traction to appear on a16z’s top 100 page traffic list.

The idea here is that despite uncertainty about actual consumer demand for these products, this information can help us predict consumer AI trends over the next 6-12 months.

Of the 235 recent projects, 63% focus on the AI space, with 70% built on the application layer. Only about 14% of application layer projects are identified as consumer-centric.

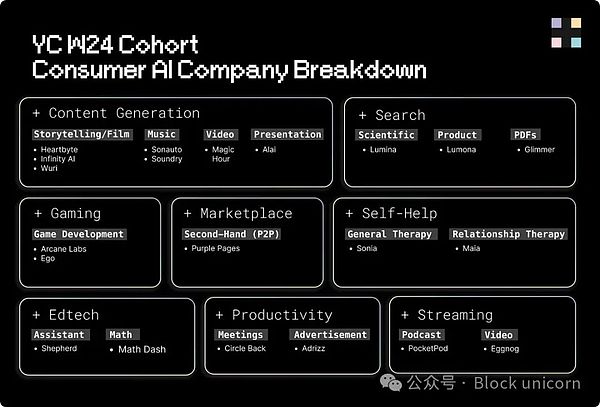

Here’s our attempt to categorize consumer AI projects.

Likewise, content generation remains the most popular category among founders, with new projects continually pushing the boundaries of creative possibility.

Similar to trends in the a16z report, YC’s latest batch of entrepreneurs are exploring advanced content types, including storytelling, script-to-film generation, music, video, and presentation-focused content.

In addition to content generation, founders are also focused on search, productivity, and education technology. These three categories are consistent with a16z’s report, although most of the companies in YC are developing more targeted, vertical-specific solutions in these areas.

Finally, categories like gaming, automation, marketplaces, and streaming appear in this group, signaling some new directions that don’t appear in the a16z report.

The Cryptocurrency x Consumer AI Opportunity

Now that we’ve covered the background trends in the traditional consumer AI market, let’s turn our attention to consumer crypto AI.

First, it may be helpful if we briefly describe how AI can be useful for crypto products, or how crypto can be useful for consumer-grade AI products.

Crypto and AI offer very different value propositions.

Arguably, the two technologies have conflicting values — crypto focuses on decentralization, privacy, and individual ownership, while AI tends to concentrate power and control in the hands of those who develop and own the most advanced models.

However, with the advent of decentralized and open source AI, these lines are beginning to blur.

The core innovation of AI in consumer products is to imitate and expand human creativity by generating novel content, while learning from massive data sets, using advanced neural network architectures to simulate complex relationships and produce high-quality output.

Early signs suggest that AI applications show strong user retention and monetization potential. However, they also face a “tourist problem,” where user traffic is high but conversion rates from free users to paying users are lower than usual.

On the other hand, crypto technology is a design space that encompasses decentralization, cryptoeconomic incentives, and hyper-financialization. It is a distributed ledger that allows the value of any digital object to be stored in a transparent and traceable way.

Crypto is very effective at coordinating activity, aggregating decentralized infrastructure, and creating frictionless markets, making it easy to create markets where they didn’t exist before. However, crypto has yet to create a compelling and sustainable consumer application beyond financial infrastructure.

AI could be one of the key factors in unlocking the broader consumer potential of encryption technology. A recent study highlights the rapid adoption of generative AI, which has surpassed the adoption of PCs and the Internet—approximately 32% of U.S. residents use AI on a weekly basis. Given this pace of development, developers of encryption technology for consumer applications will be at an advantage if they can experiment and innovate in sync with the accelerated adoption of AI.

We believe that breakthrough results will emerge through innovative consumer applications that combine the power of AI with the unique capabilities of decentralized and financialized networks enabled by cryptography.

Market Overview

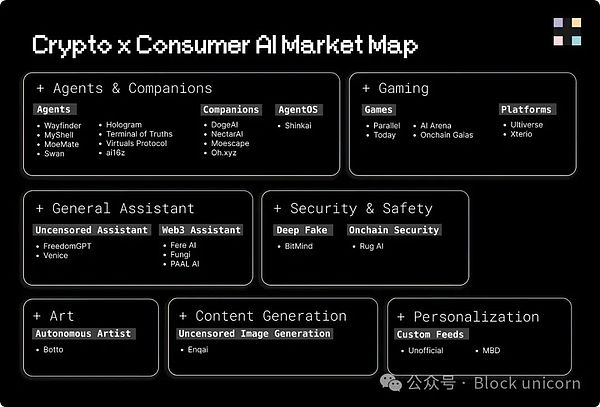

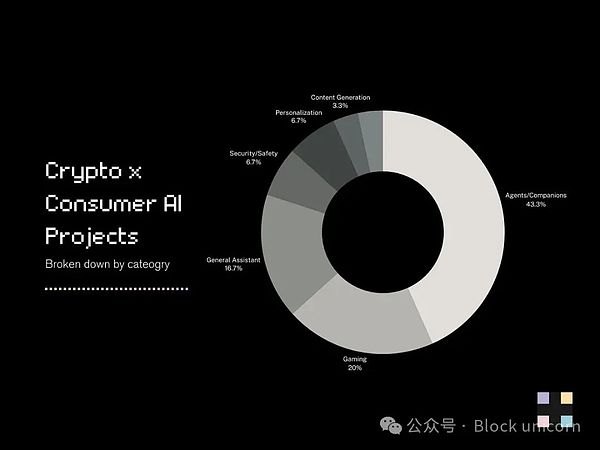

The number of consumer-focused projects operating at the intersection of crypto and AI remains relatively small, with our research estimating around 28, although this is not a definitive number.

In this crowdsourced decentralized AI market map, the consumer-grade category only accounts for about 13% of the total decentralized AI market, which shows that we still have a lot of room to grow. As a quick comparison, about 60-70% of the products in the technology market are in the application layer, and about 70-80% of them are consumer-facing applications.

While we covered only a small number of projects in this report, we were able to identify some early insights.

We have identified some early ideas that teams are looking at when integrating encryption and AI. These insights have been distilled into a few broader use cases below, some of which show potential while others may be less sustainable.

Incentive Mechanism: Cryptocurrency as a way to incentivize and reward users for activity on the AI platform/application. For example, one use of the Wayfinder native token is to reward agents and participants for creating valuable on-chain paths for AI agents as they walk on-chain. In the case of Botto, the automated AI artist asks its community for feedback on its art creations. Botto rewards this participation by distributing a portion of its art sales in the form of $BOTTO tokens.

Financialization: The ability to trade, own, and generate income from AI assets on the blockchain. For example, Virtuals Protocol provides a platform where anyone can buy, own part of an AI agent, and benefit from the income generated by the AI agent they trust. Ownership is represented in the form of tokens.

Attribution: Allowing intellectual property holders to track, verify, and claim royalties on the blockchain. For example, censorship-resistant companion projects like Oh.xyz are using cryptography to create digital twins of creators on their platform as a way to verify the authenticity of content and claim royalties in the future.

In-app or in-game economy: Cryptocurrency as in-app/in-game currency. For example, games like Parallel and Today will have in-game economies where players and their AI agents will be able to trade resources using their respective tokens.

Decentralization: Decentralize networks, services, and models. For example, BitMind is a subnet on Bittensor and is building the first decentralized deepfake detection system. Using Bittensor, they are able to encourage open competition among AI developers to contribute to building the best deepfake detection model.

Censorship resistance: Remove censorship from generative AI content creation. For example, Venice is a private and permissionless generative AI assistant built on Morpheus’ decentralized universal proxy network. Unlike traditional AI assistants, Venice does not censor the AI’s content or download your conversations.

Membership: Cryptocurrency as a means of accessing premium features. For example, MyShell’s ecosystem token has multiple use cases, one of which is to grant holders access to premium features.

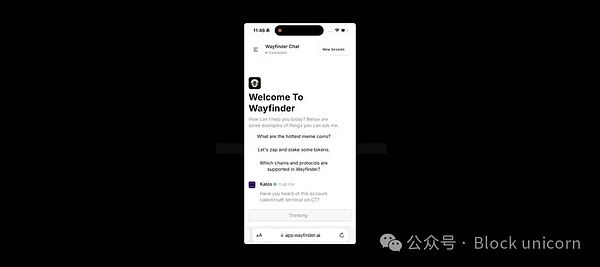

Assistants: AI is a way to make the interaction between people and cryptocurrencies easier. For example, Wayfinder, Fere AI, Fungi, and PAAL AI are vertical general assistants or bots for the cryptocurrency industry that aim to make the crypto experience more convenient for end users.

Contextualization: AI is a way to contextualize and personalize content on the blockchain. For example, Unofficial aims to build a discovery engine for on-chain social interaction on Farcaster using zkTLS and RAG.

After reviewing the current cryptocurrency and consumer AI markets, including the application of cryptocurrency and AI, as well as the status of established and emerging categories in the traditional consumer AI space, the next section will explore the design spaces with the most potential in this intersection for developers to consider.

Games and Agents /Companions

There’s a reason why games and agents/companions are two of the most popular categories among founders at this intersection. They provide the best environments for experimenting with AI and cryptocurrency.

Games and agents often operate in a fictional realm with the goal of entertaining consumers. Their results usually do not need to be definitive and often have little impact on real life. Therefore, this provides perfect conditions for experimentation.

Today's Hyper-Realistic Gaming Environment

So far, games like Parallel Colony and Today have used AI as the core experience of the product, that is, the AI NPC characters in the game behave like real humans, have autonomy and are able to have conversations.

Cryptocurrencies are being used as financial conduits for in-game payments, agent-to-agent payments, or unlocking character ownership.

Crucially, this new digital economy is the advantage these crypto games have over the multitude of AI games that are coming to market.

AI is a transformative technology that will undoubtedly become a critical part of future game development and gaming experiences—but we believe that teams building AI games with the digital native economy in mind will have the greatest competitive advantage.

AI agents in games are fun, but what cryptocurrencies unlock is the ability for games to introduce economic systems that replicate the human experience for the first time. NPCs in games simply cannot open their own bank accounts, conduct transactions, and make real economic decisions. As a result, many behaviors and opportunities that have never been seen before can emerge.

As Parallel founder Kalos said on Twitter:

Today, this is best demonstrated in fictional environments such as games.

Projects building AI agents and companions share similarities in their use of AI and cryptocurrency — AI as the core experience, cryptocurrency as financial infrastructure. However, unlike agents in games, which operate in a limited environment, allow for more complex interactions, and have few real-life consequences, agents and companions are currently limited to one-to-one or one-to-many relationships.

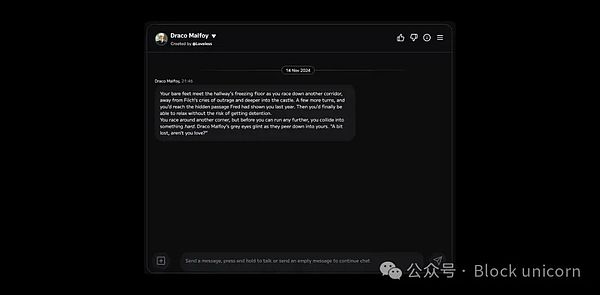

For example, with MyShell, Virtuals Protocol, or MoeMate, the end user interacts with an AI chatbot via chat or voice functionality - the interaction is limited to you and the chatbot (or other medium). Chatbots are LLM wrappers with limited features that can be customized by the creator of the bot, such as the tone of communication, the appearance of the agent, etc. Therefore, your interactions with these chatbots are also limited in creativity.

Experience with MoeMate’s Draco Malfoy AI Chatbot

While similar to its competitors, ai16z takes an open-source, bottom-up approach focused on building on-chain AI agent infrastructure that provides tools for a multi-agent future.

In both areas, there is still much to explore, such as multi-agent experiences or infinite game modes. Consumer experiences involving many-to-many AI agents interacting with humans, while complex, could lead to more dynamic and engaging interactive experiences, as well as more complex crypto-economic systems. This area remains underexplored outside of gaming environments.

We continue to believe this is one of the areas of greatest interest to founders, and we can’t wait to see what innovations the future will bring.

General assistant and content generation tool

General assistants and content generation tools dominate the traditional consumer AI space. However, fierce competition makes entering this market challenging and costly, which explains why these categories are not as strongly represented on the crypto market map as they are in traditional AI.

Despite this, demand for these tools remains strong, consistently ranking at the top of a16z’s network traffic analysis. For founders at the intersection of crypto and AI, these categories remain promising, especially products tailored specifically for crypto users. By focusing on the specific needs of the crypto space, it is possible to create unique value without having to compete in saturated traditional markets.

Here are some examples:

AI-enabled Crypto Assistant: Crypto is notoriously difficult to navigate. Whether you’re trying to purchase or exchange tokens on-chain, or meet the requirements required to participate in a game or social experience, there are many obstacles.

Are you on the right network? How do I switch networks? Do I have the right gas tokens? How do I transfer funds to the target network?

For newcomers, the learning curve is high, and even for those who are familiar with cryptocurrencies, these tasks can be time-consuming.

While the industry has so far focused on improvements in account abstraction, intents, and other UI/UX, AI is more likely to integrate these developments and drive these changes forward. Several teams, such as Wayfinder, Fungi, PAAL AI, and Fere AI, are already exploring solutions, although no one team has made significant progress yet - leaving room for more competitors and specialization.

Wayfinder's Crypto Assistant at a Glance

An experienced Solidity developer’s needs may differ from a newbie. We believe teams that build with a specific user group in mind (tailoring the experience exactly to that user group’s problems), provide a refined user experience (leveraging advances in account abstraction and intent), and personalize services (based on the user’s previous on-chain activity) are most likely to succeed.

AI-enabled asset generation: In the crypto space, content generation can be considered asset generation. These assets can be tokens and digital assets in ERC20, ERC721, ERC1155, or other standard forms, and the ways they can be generated are almost endless. Similar to how Midjourney and DALL-E generate images, or how SUNO composes music, AI can also play a key role in crypto asset generation.

Tokens like Truth Terminal’s $GOAT token, Wayfinder’s asset deployment agent, Swan’s upcoming gamified asset generation marketplace, and Virtuals Protocol’s AI agent launchpad are all early examples of AI-driven crypto asset generation.

In addition to generating assets, AI can also shape narratives, market assets, and give them a “voice.” For specific asset types like Meme Coins (which have no external dependencies), AI is able to efficiently streamline the end-to-end asset development process.

In a world where AI agents can generate countless crypto assets without friction, the opportunity for developers lies in identifying where value and attention are flowing. For example, the strategy taken by Virtuals Protocol is to shift speculation to the creator level, allowing consumers to predict the ability of AI agents to attract attention and create interesting assets.

We are currently in the early stages of a wild new reality where AI can generate real financial value in the form of crypto assets, and humans can enjoy and speculate on the development of these assets. While the future of this trend is difficult to predict, there is a huge space for experimentation in this area, and we will be watching closely to see where it goes.

Miscellaneous

There are many categories at the intersection of crypto and consumer AI that are still largely unexplored. With the rapid advancement of AI, these categories are likely to grow and evolve rapidly. While many categories may be short-lived, and even fewer may be suitable for crypto collaboration, there is still ample room for experimentation in this space — and we welcome it!

One way to think about this is to consider crypto equivalents of traditional consumer AI projects, especially those that don’t currently have an intersection with crypto. For example, we applied crypto to two categories on the a16z and YC lists, and added an additional category to explore.

Edtech is a popular category of consumer AI that can benefit from different layers of the stack through crypto. Education covers regions, subjects, languages, education levels, and teaching methods. In this context, rather than taking a centralized approach, it is more feasible to advance Edtech through open source development and collaboration with global contributors. In this context, the Edtech-focused subnet on Bittensor can help build these models.

Crypto can also be applied to the incentive level of educational technology (Edtech) applications. Going beyond traditional gamification strategies (such as Duolingo’s daily streak mechanism), through crypto technology, teachers and students can be rewarded for their contributions and efforts on both the supply and demand sides.

For self-help , the potential of cryptocurrency to enable data ownership and monetization could be very compelling. It remains out of reach for many due to cost, social stigma, lack of awareness, and shortage of professionals. Projects like Sonia and Maia (both recent YC incubators) are showing early promise for affordable AI-driven counseling solutions. Traditionally, therapists’ notes are stored in paper or digital files in the office, with the data inaccessible. However, with AI therapists, data can be stored privately online, unlocking entirely new use cases from an individual’s mental health data.

Imagine if you could actually own the data from your AI therapy sessions. You could choose to keep it private, monetize it, or even anonymously contribute it to a health data network to support meaningful research. Crypto-native projects like Vana are making this possible by giving people a stake in their own data.

In the entertainment space , projects like Unlonely are experimenting with crypto-native live streaming, where users can speculate and influence the outcome of live streams by trading the platform’s tokens. Currently, this is limited to real-life events, but it could be expanded to AI-generated content. This could enable 24/7 live streaming, with users having greater control over the live narrative. MineTard AI is an early example that recently emerged. It’s an AI agent that streams Minecraft 24/7 on Kick, and the agent can be influenced by $MTard holders.

Last year, a viral trend emerged on TikTok where creators played as NPCs, performing specific actions based on the “gifts” they received. While this content type was short-lived, it clearly demonstrated consumer interest in interactive live experiences. As AI-driven NPC technology advances, similar gamified interactions may be suitable for crypto-native live broadcasts, where AI NPCs can respond to user input in real time.

Top NPC Trends on TikTok

These are just some rough ideas about how encryption and AI can be used in consumer applications. We have not covered all possible applications in this report, and we expect more innovations like this to emerge as the industry is rapidly evolving.

Message

As you can probably tell, we’re very excited about the possibilities at the intersection of crypto and consumer AI. The projects currently being built in this space represent only a small fraction of what’s possible.

As these two technologies develop in parallel, founders have a unique window to create a new wave of consumer applications that have the potential to change the way we interact and engage with digital assets and synthetic intelligence.

For those of you building in this space, we encourage you to continue to push the boundaries and explore unconventional applications of these technologies. We also hope that for some of you this resource will help you on your journey.