Bitcoin has just set a new record high at $98,288, marking an important milestone in the history of the world's largest cryptocurrency.

According to a recent article from Cointelegraph, Bitcoin's price has increased by 6% within 24 hours, surpassing the previous high of $93,420 set on November 20. This price surge has been driven by several key factors, including massive trading volume from traditional financial institutions and strong capital inflows from the US market.

One of the biggest drivers behind this price surge is the activity from the "Bitcoin Industrial Complex" - a financial ecosystem comprising stocks and investment instruments closely tied to Bitcoin's price. This ecosystem includes stocks like MicroStrategy (MSTR), Coinbase, Bitcoin mining companies, and Bitcoin-related ETFs. According to reports, the total trading volume within this ecosystem has reached a record $50 billion, with MicroStrategy leading the pack with a trading volume of $32 billion. This is the first time in years that MSTR has become the most traded stock in the US, surpassing even the likes of Tesla (TSLA) and Nvidia (NVDA).

MicroStrategy has also contributed significantly to this positive wave by announcing the purchase of an additional 51,780 BTC worth $4.6 billion on November 18, bringing the company's total Bitcoin holdings to 331,200 BTC. This news has created a surge of enthusiasm in the market, along with the expectation that the company will continue to buy up to $3 billion worth of Bitcoin before November 22, according to the assessment of Charles Edwards, the founder of Capriole Fund.

Additionally, Bitcoin ETFs have also recorded positive net inflows, with $773 million invested on November 20, bringing the total inflows for the week to $1.85 billion. The strong interest from institutional investors further strengthens Bitcoin's position in the financial market.

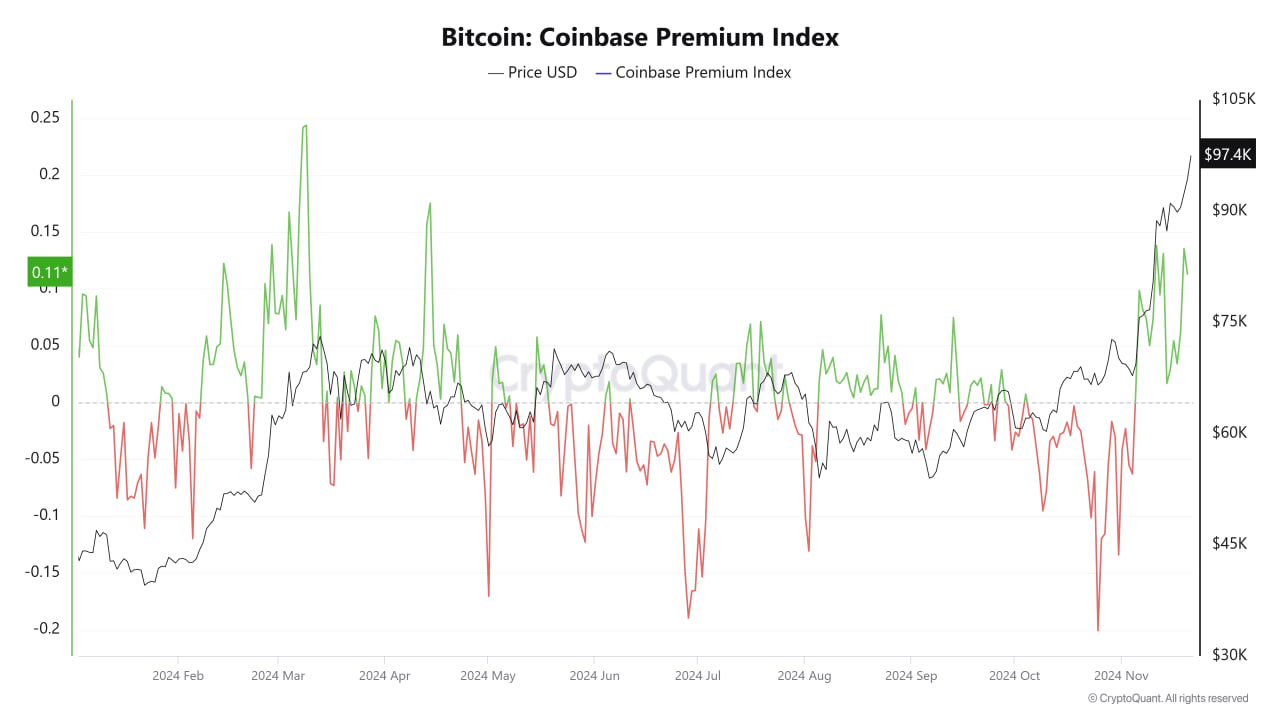

The demand for Bitcoin is particularly strong from US investors. The "Coinbase Premium" index, which reflects the price difference between Bitcoin on Coinbase and other exchanges, has risen to its highest level in the second half of 2024, indicating strong demand from investors in this market. Meanwhile, the "Korea Premium" index has been trending downward, reflecting less active participation from Asian investors compared to their Western counterparts.