BNB has maintained above $600 since November 8, but is struggling to challenge the $700 or all-time high.

This stagnation has disappointed many BNB holders and raises questions about whether BNB can set a new peak.

BNB, Reduced Volatility Above $600...Have Investor Interests Waned?

BNB is trading around $612, and the volatility around this level has kept it above $600, but it appears to have not yet achieved a significant price increase.

When an asset is described as having high volatility, it means the price experiences large fluctuations in a short period of time. High volatility indicates greater risk due to unpredictable price movements, but also the potential for higher rewards.

Therefore, if buying pressure increases during high volatility, the asset's price can rise significantly. If this volatility occurs during high selling pressure, the price can drop sharply.

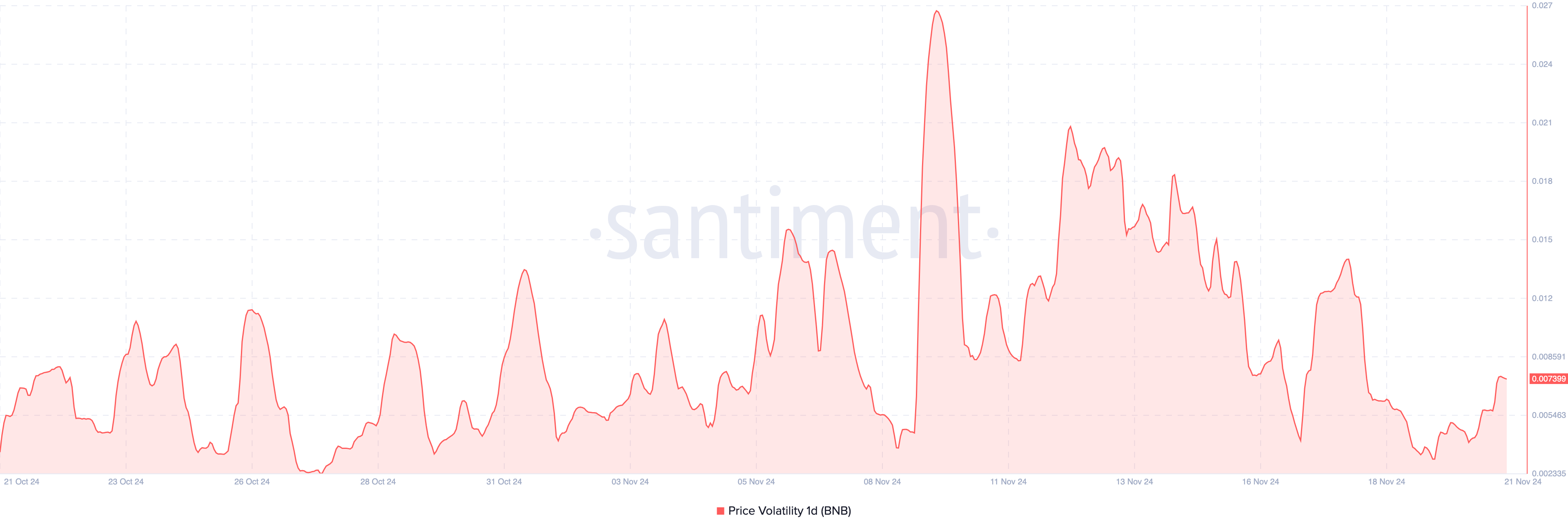

According to crypto data platform Santiment, BNB's daily volatility has decreased from recent peaks, suggesting reduced price fluctuations. This decrease in volatility may make it difficult for BNB to achieve a noticeable breakout above $600, as the market may lack the momentum needed for a big move.

Additionally, the Open Interest (OI), a metric that tracks the speculative activity in cryptocurrencies, has decreased. High OI often indicates an increase in capital inflow into contracts, which can drive price increases.

Conversely, a decrease in OI reflects reduced market liquidity and is often associated with selling pressure and potential price declines. In the case of BNB, OI has remained relatively stagnant since November 19, suggesting traders are hesitant to inject additional liquidity or enter new contracts.

Furthermore, OI is significantly lower at $532.8 million compared to November 14. This lack of speculative activity indicates a decrease in market momentum, further strengthening the possibility that BNB may struggle to break above the $600 threshold.

BNB Price Prediction: Potential Decline to $551

Similar to the Open Interest, BNB's price has been following a consistent trend since July, repeatedly facing resistance around the $612 level. This suggests the persistent efforts of bears to prevent the cryptocurrency from challenging its all-time high of $724.

With BNB currently trading near the same resistance level, a downward move is possible. Historical patterns suggest that if the coin fails to break through, it could retrace back to $551, similar to previous instances.

However, a surge in volatility and strong buying pressure could challenge this outlook. In such a scenario, BNB may not only maintain above $600 but could rise to $660 or even retest the $724 peak.