The reason for the long-term sluggishness of ETH is that: there is a view that a new round of market manipulation is underway, with Wall Street's major financial institutions becoming the new manipulators, gradually taking over the positions of the previous manipulators.

VX: TTZS6308

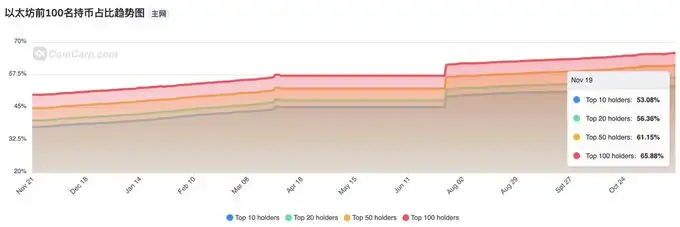

We can also verify this from the data: over the past year, the market share of the top 100 holding addresses has been on an upward trend, currently reaching 66%, especially with a significant increase after the approval of the ETH ETF listing.

This indicates that the concentration of ETH is actually getting higher and higher. The top addresses have been buying, but the ETH price has not risen, what does this mean?

On the one hand, it shows that the manipulators have been there all along, and they are continuously accumulating positions; on the other hand, it shows that there is a lot of turnover in the market, not only are the retail investors getting rid of their positions, but this group of top addresses is also doing internal turnover, that is, a change of manipulators.

You should know that ETH and BTC are the only two tokens with ETFs, and ETH has a very big advantage over BTC: staking rewards.

Once the ETF starts staking rewards or even re-staking, an annual risk-free yield of at least 3% in token terms is actually very attractive, especially compared to traditional financial products.

This is the unreleased potential of ETH, and also the potential biggest positive factor.

Of course, traditional financial institutions will not miss this cake, and they have a strong willingness and motivation to become the new manipulators of ETH.

But ETH has already been the main narrative in the past two bull-bear cycles, and there are naturally more long-term holders, and the positions are more dispersed, so the turnover of these positions will take a relatively long time, and a full wash-out is needed.

Therefore, to suppress the price of ETH in the long run, so that the previous long-term holders will drop their positions, such as switching to popular SOL, etc., in order to concentrate the positions in the hands of the new manipulators.

Only after the new manipulators have accumulated enough positions will they have the motivation to drive up the price of ETH.

This is a long-term plan.

Therefore, do not drop the truly valuable positions in your hands, that is, BTC and ETH, and get through this long and painful wash-out, so that you can get the real long-term returns you want.

Funds are constantly flowing between different tokens, which is why the altcoin season not only lasts for a week, but for months. The historical capital flow pattern is as follows:

BTC > ETH > high-cap tokens > low-cap tokens > BTC......

But this model is now outdated, and the current capital flow cycle is more subtle.

Will Altcoins Return After ETH Rises?

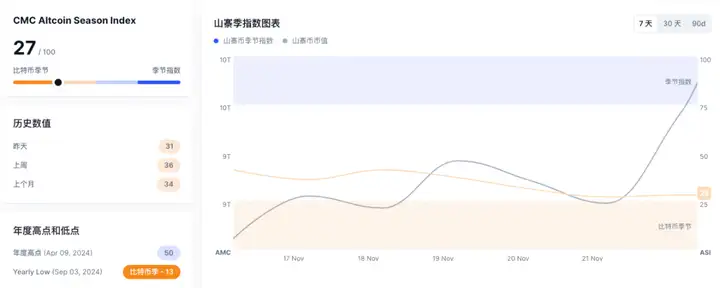

The CMC Crypto Altcoin Season Index is a real-time indicator used to determine whether the current cryptocurrency market is in an altcoin-dominated season. The index, based on the performance of the top 100 altcoins relative to Bitcoin over the past 90 days, provides detailed charts and indicators to track market trends and the market cap share of altcoins.

Looking at the charts and index data, the CMC Crypto Altcoin Season Index currently shows 27/100, indicating that the market is still mainly dominated by Bitcoin, and altcoins have not yet fully entered a strong dominant position. But the trend of change over the past 7 days is worth noting. The Altcoin Season Index has gradually risen from the low point on the 17th, and significantly jumped to 28 on the 21st, indicating that the market's interest in altcoins is recovering.

Looking at historical data, although the current index is far below the annual high of 50, it has rebounded significantly from the low of 13 earlier this month. This upward trend may mean that market funds are gradually rotating from mainstream assets like Bitcoin to the altcoin sector. Especially with the strong performance of old-school altcoins like XRP and ADA recently, this trend may be further strengthened.

At the same time, the market cap of altcoins is also steadily growing, although the growth rate has not yet reached a level that can completely reverse the market pattern, but its gradual stabilization and slight upward trend reflects the subtle changes in market sentiment. Investors are beginning to re-evaluate the value of altcoins and gradually shifting their attention to these assets.

If this trend can continue and maintain a steady upward trend in the coming weeks, the altcoin season may finally arrive.

Reading should be the most difficult and tiring during the high school stage, but sometimes I feel that it is even more difficult and tiring in the crypto world!

Buying a dog, afraid it will go to zero when sleeping

Opening a position, afraid it will be liquidated when sleeping

Buying the dips, afraid of buying the top

Selling, afraid of selling too early

Not selling, afraid of a pullback

All kinds of staying up late, etc.

And there are all kinds of wealth effects around you, making you anxious whether you lose or make money

This is a normal state

Under this normal state, the investment mindset is the first priority, cognition is the second, and operation is the third!

In a downtrend, there will be many traps, be honest, don't touch the leveraged contracts, just hold the spot, when it goes up, everyone will have a good Lunar New Year, don't blow your principal in the middle. Pullbacks are opportunities to add positions, but you must control your position size, no borrowing, no FOMO, rational operation!

Borrowing a sentence from yesterday

No need to worry, just find your own rhythm.

Investing is like a game, we make bets based on our cognition, if we're right we make money, if we're wrong we reflect, always curious, always respectful.