Shiba Inu (SHIB) seems to have broken into another bullish trend. The dog-themed asset is up by 2.9% in the daily charts, 9.1% in the weekly charts, 30.9% in the 14-day charts, and 39.1% over the previous month. The 12th-largest crypto project by market cap has increased 211.6% since November 2023.

Also Read: MicroStrategy (MSTR) Raises $3 Billion to Purchase More Bitcoin

Why Is Shiba Inu Rallying Today?

SHIB’s latest rally is likely due to Bitcoin (BTC) hitting a new all-time high of $99,261.30 earlier today. BTC’s rally has triggered a market-wide momentum, pushing other assets into a bullish run.

Also Read: PEPE: Why Surging Meme Coin Can Still Gain 25% Before 2025

BTC’s rally is likely due to talks about Donald Trump electing a “crypto czar.” Trump winning the US Presidential election has led to a significant increase in investor confidence due to his pro-crypto stance. Market participants anticipate lenient crypto regulations under Trump’s regime.

Will The Asset Hit $0.00005 Before 2025?

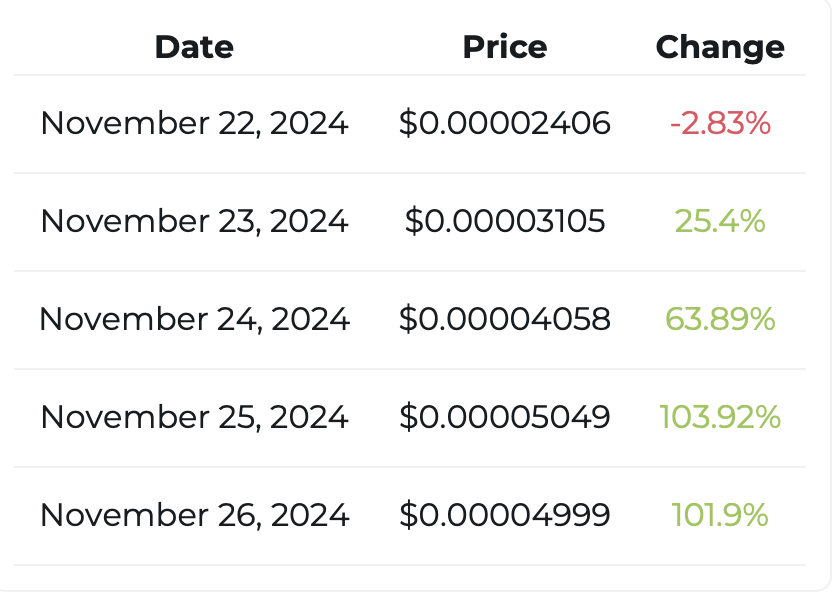

According to CoinCodex analysts, SHIB could surge to $0.00005204 on Nov. 26, 2024. The platform does not anticipate the asset’s price to hold above $0.00005 for long. CoinCodex analysts anticipate a correction for SHIB to around current levels by early December 2024.

Changelly analysts also present a similar outlook for Shiba Inu (SHIB). The platform anticipates the asset to surge to $0.00005049 on Nov. 25, 2024.

Based on the forecasts from CoinCodex and Changelly, SHIB could face a correction after its surge to $0.00005.

Also Read: Alphabet (GOOGL) Stock Falls Following Chrome Sale Concerns

One of the most significant barriers to SHIB’s price is the project’s massive supply. The team is reportedly working on a new burn mechanism, rumored to burn trillions of tokens yearly. If the team can drastically reduce SHIB’s supply, we may hit much higher price levels than predicted.