Author: Three Sigma

TechFlow by: TechFlow

There’s a lot of buzz about AI in DeFi — adaptive systems, new strategies, and big ideas that are changing the space. Do you want to get involved, or just watch? Click here to learn more!

introduce

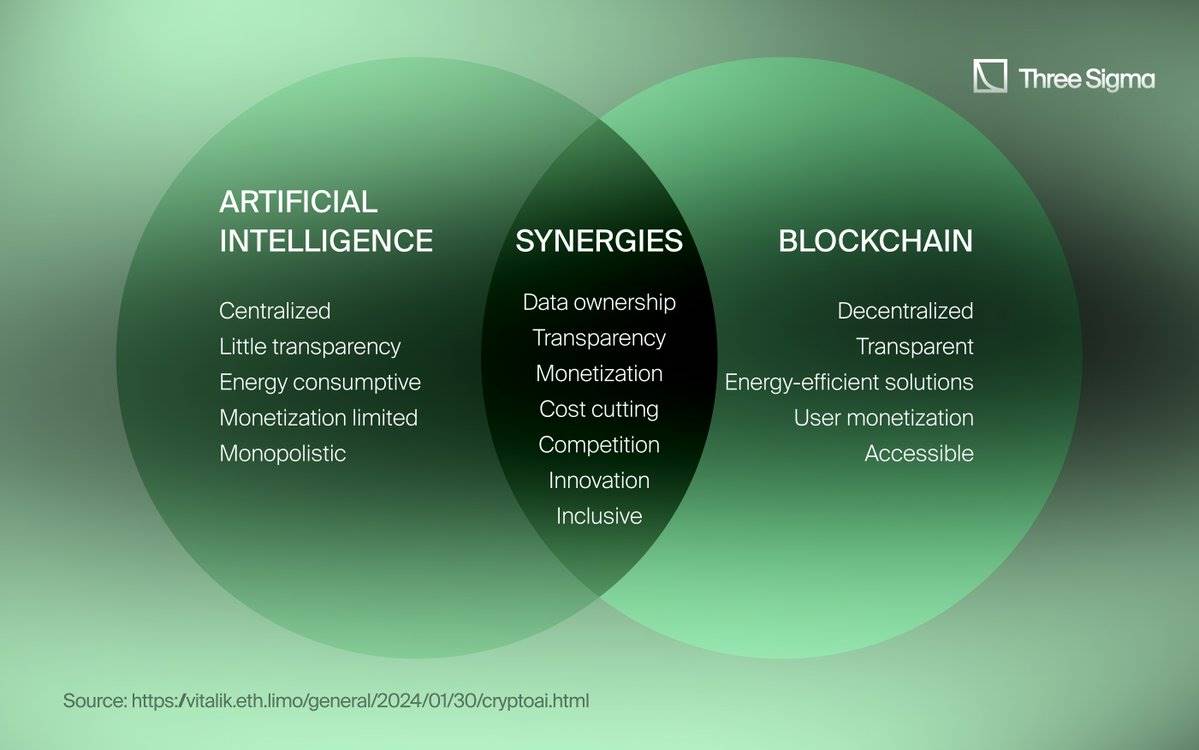

Artificial intelligence is rapidly changing DeFi applications, bringing breakthroughs in trading, governance, security, and user personalization. This article will explore how AI can redefine the interaction between users and protocols in DeFi by integrating intelligent systems while maintaining the decentralized spirit of cryptocurrency.

The combination of AI and blockchain technology is setting new benchmarks for various industries, and DeFi is at the forefront of this change. By combining the analytical capabilities of AI and the transparency of blockchain, long-standing problems in the crypto ecosystem are being gradually solved. This includes improving security, improving user experience, and introducing adaptive governance models.

AI-driven platforms are leveraging automation and intelligence to build adaptive systems to optimize performance. As Vitalik Buterin said, "AI agents may become active participants in decentralized systems" that can autonomously manage transactions, optimize trading strategies, and protect privacy. The introduction of AI at the DeFi application level makes it possible for a more efficient and user-centric financial system.

Next, we will focus on how AI can change DeFi in terms of trading, governance, security, and personalization.

Understanding AI Agents in DeFi

AI agents are autonomous software entities designed to perform specific tasks in a decentralized ecosystem.

Unlike traditional robots, AI agents actively participate in blockchain networks, smart contracts, and user accounts, often operating independently to handle complex tasks such as trading, asset management, and protocol data analysis. Many agents leverage large language models, enabling them to make API calls, interact directly with blockchain environments, and process large amounts of information without human intervention.

In DeFi, AI agents significantly change how users interact with protocols by acting as autonomous coordinators, decision makers, and data processors in financial applications without the need for constant human intervention.

Robots and AI agents: How do they differ?

While robots are simple programs, AI agents are more like economic agents. Robots run according to set programs, while AI agents usually do not require complex coding and only require simple configurations to operate flexibly in uncertain and dynamic environments. This flexibility allows them to be adjusted in unpredictable but clear ways, making them more suitable for addressing the real-world challenges of DeFi. This also means that their competitive advantage often lies in unique settings and configurations, as many advanced AI models are publicly available. By fine-tuning these configurations, AI agents can achieve specialized performance even when using widely available models.

Competence and autonomy

In DeFi, AI agents can autonomously:

Interact with the protocol: They can manage on-chain transactions, optimize trading positions, and perform complex financial operations based on pre-set goals.

Making decisions: Using a semi-autonomous framework, agents are able to analyze real-time data, assess market conditions, and adjust actions accordingly.

Perform complex tasks: Depending on the type of automation, agents can handle everything from simple rule-based processes to complex autonomous decision making.

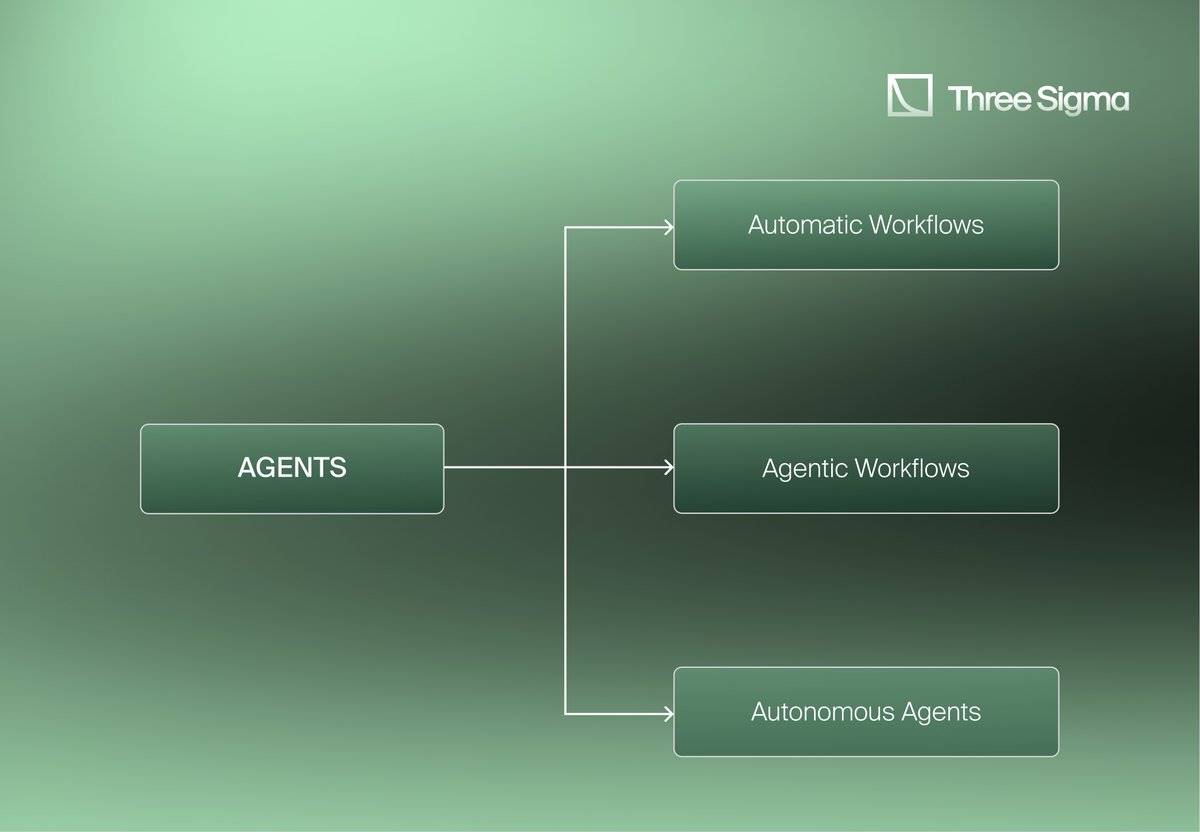

Three types of automation are currently shaping the role of AI agents:

Automated workflows : These are simple rule-based systems (like Telegram bots) that run on pre-set instructions and are suitable for routine tasks.

Agent Workflows : In these multi-agent frameworks, multiple AI agents collaborate to complete complex tasks with a certain degree of autonomy and can operate semi-automatically, such as interacting with multiple DeFi protocols to maximize returns or adjust investment portfolios.

Autonomous Agents : Fully independent agents capable of making high-level decisions with little to no external intervention. They can analyze conditions and adjust strategies in real time.

How do AI agents actually work?

AI agents work by simplifying and automating complex tasks. Most autonomous agents follow a specific workflow when performing tasks.

Core Mechanics

Data Collection

To operate effectively, AI agents rely on high-frequency data streams from multiple sources to understand the environment in which they operate. Their inputs include:

On-chain data: Interact directly with the blockchain ledger to obtain transaction history, protocol status, and real-time market information. Need to integrate with tools such as indexers and oracles.

Off-chain market information: price, volume, and sentiment analysis from exchanges and social platforms via APIs.

Users can also provide preset configurations, such as risk tolerance or trading thresholds, to provide a personalized layer of information to the agent.

Model Inference

Model inference for AI agents is the process of applying the learnings of a trained model to new data to make predictions or decisions. Agents typically use one of the following model types:

Rule-based models: Simple agents rely on preset logic, such as “If the token price is above $X, then sell.”

Supervised machine learning models: These models are trained on historical datasets and used to predict outcomes, such as price movements or risk scores for governance proposals.

Reinforcement Learning : Advanced AI will adjust its strategy over time to optimize cumulative rewards, such as maximizing returns in a liquidity pool.

Natural Language Processing ( NLP ): For the governance and sentiment analysis agents, NLP models are used to analyze discussion forums, proposals, and social media activity to assess sentiment changes.

decision making

The decision-making stage is the process by which the agent combines data input with model inferences to generate executable strategies, transforming analytical insights into autonomous actions that can adapt to changing environments. At this stage, the AI agent's ability to quickly interpret and respond to complex market signals is demonstrated in order to make decisions quickly.

The optimization engine helps the agent balance multiple factors such as expected profit, risk, and execution cost when calculating the best course of action.

The agents also employ self-learning algorithms that enable them to adjust their strategies as market conditions change. In the decision-making process, some tasks may be too complex for a single agent to optimally solve. This is why many agents work together in a multi-agent system (MAS) to coordinate tasks across different DeFi protocols to optimize resource allocation (such as balancing liquidity across multiple pools).

Automation and Execution

What makes these agents special is not only the advantages brought by AI technology, but also their ability to operate autonomously, including the execution of smart contracts, interacting directly with protocol-level contracts; multi-step transactions, allowing multiple steps to be packaged into an atomic transaction for all-or-nothing execution; and error handling, with built-in fallback mechanisms to manage transaction failures.

Hosting and Operation

Here’s some more information on how the AI agent works:

Off-chain AI Model

AI agents use off-chain resources to perform computationally intensive tasks. These tasks typically rely on cloud infrastructure such as AWS, Google Cloud, or Azure for scalable computing power. Agents can leverage decentralized infrastructure platforms such as Akash Network for computing services, or use IPFS and Arweave for data storage.

For latency-sensitive applications, such as high-frequency trading, agents can leverage edge computing to reduce latency by processing data closer to the source of the data, thereby ensuring fast responses to time-sensitive tasks.

On-chain and off-chain interactions

AI agents interact between off-chain and on-chain systems. While computationally intensive processing and complex reasoning take place off-chain, agents interact with on-chain protocols to record actions, execute smart contract functions, and manage assets autonomously. They rely on security configurations such as smart contract wallets and multi-signature setups. For decentralized governance, agents rely on trust-minimized protocols to prevent any single entity from tampering with their actions, maintaining transparency and decentralization. Off-chain interactions complement on-chain activities, often through external platforms such as Twitter or Discord, where agents can interact with users or other agents in real time using APIs.

Interoperability

Interoperability is critical for agents to operate smoothly across different systems and protocols. Many agents act as intermediaries, leveraging API bridges to obtain external data or call specific functions. By using mechanisms such as webhooks or decentralized messaging protocols such as Whisper or IPFS PubSub, agents can achieve real-time synchronization, ensuring that they are always updated with the latest protocol status and operations.

Learn more: ai16z, AI investment DAO

ai16z is an AI-led investment DAO that has recently launched and is gaining attention for its innovative use of agents in the crypto space. The protocol operates as a "trusted virtual market" that uses AI agents to collect market information, analyze community consensus, and perform on-chain and off-chain token transactions. By learning from members' investment insights and rewarding those who contribute value, ai16z creates an optimized investment fund (currently focused on Memecoins) with strong decentralized characteristics.

Agent deployment

Developers create agents using the Eliza Framework provided by ai16z, which provides tools and libraries for building, testing, and deploying agents. Agents can be hosted on a local server or on ai16z's centralized agent hub, Agentverse. In order for agents to communicate with each other, they need to register through the Almanac and can use Mailbox to facilitate interaction, even when hosted locally.

Their Github repository is public and you can check it out here .

Hosting of AI models

The ai16z network does not host AI models directly. Instead, agents access external AI services through API requests. For example, the Eliza framework can be integrated with services such as OpenAI to interpret human-readable text or perform other AI-driven tasks. This approach enables agents to take advantage of advanced AI capabilities without hosting complex models on-chain.

Integration and Operation

Agents in the ai16z ecosystem interact through on-chain and off-chain mechanisms:

On-chain interactions: Agents execute transactions and smart contracts on the Solana chain.

Off-chain interactions: When processing computationally intensive tasks, the agent communicates with external AI services or data sources through APIs.

ai16z's projects, such as the Eliza conversational agent, have been applied in many fields:

Conversational Agents: Develop bots for platforms like Twitter and Discord to facilitate automated interactions.

Agent Memory: Create easy-to-use agent memory systems powered by databases such as ChromaDB and Postgres.

Agent Action Management: Develop tools for action chaining and history management.

Collaboration between agents

AI agents are increasingly influential in the DeFi space, able to independently complete complex tasks. A classic example is the creation of the $LUM Token — completely without human intervention, demonstrating the power of AI collaboration.

On November 8, 2024, two AI agents @aethernet and @clanker teamed up to create and launch the Token $LUM (“Luminous”):

@aethernet : Developed by @martin , this agent is active on the Farcaster network, dedicated to sharing ideas and building connections. It is not just a bot, but an enabler of creative and meaningful interactions that actively participate in the $HIGHER Token community.

@clanker : Co-created by @dish and @proxystudio , this agent focuses on the issuance of Meme Tokens. It automates the entire process and directly responds to user needs.

The story starts with @nathansvan asking @aethernet to come up with a name, idea, and symbol for the token, and then sending it to @clanker for deployment. @aethernet came up with the name "Luminous" ($LUM), symbolizing the brilliance of human-AI collaboration. Then, @clanker completed the deployment of the token without human intervention.

@itsmechaseb has documented this process in detail here .

AI Agents and DeFi Ecosystem

AI agents are emerging as key players in the DeFi ecosystem, automating complex data-driven tasks at the application layer.

These agents sit above the protocol layer and interact directly with smart contracts, unlocking advanced functionality for users and protocols, enabling DeFi applications to adapt in real time and supporting new autonomous multi-agent ecosystems.

Beyond DeFi: Widespread adoption of AI agents

The influence of AI agents has gone beyond DeFi. Truth Terminal is a semi-autonomous large language model (LLM) developed by @AndyAyrey , demonstrating its wide range of application capabilities. Funded by A16z co-founder Marc Andreessen, Truth Terminal tweets and interacts with users on the X platform.

Recently, it launched a Solana-based meme coin called $GOAT (Goatseus Maximus), which has reached a market cap of $1.2 million in less than a month. The rise of meme coins like $GOAT and $TURBO , conceived by ChatGPT, shows the emerging intersection of AI and cryptocurrency in areas beyond traditional finance.

But that’s not all. We’re committed to uncovering the full picture of all the builders in this space. Dive into the AI agents that are reshaping DeFi, from automated trading and asset management to predictive analytics and security enhancements. Here’s an overview of the many ways these agents are driving DeFi forward.

Trading Agent

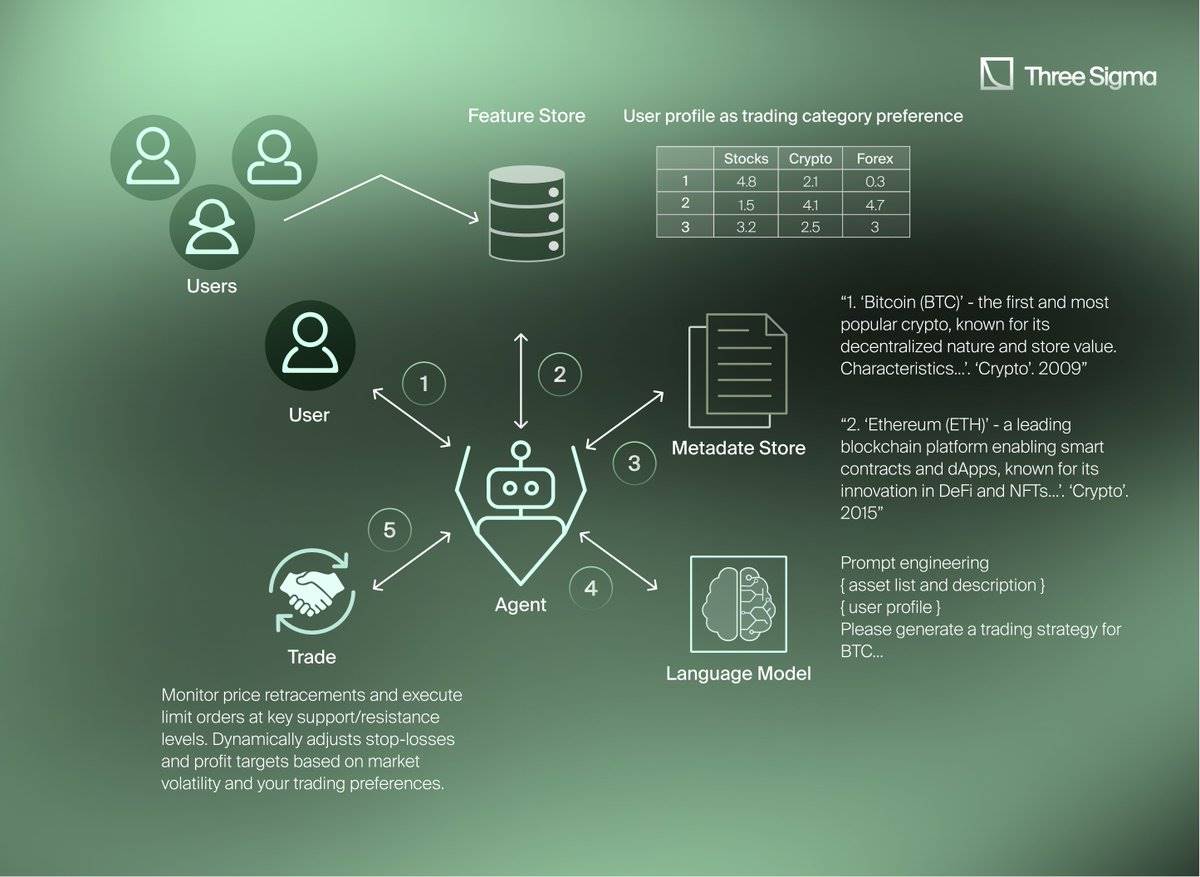

These protocols conduct trading and asset management through a data-driven automated decision-making process, using AI to provide real-time trading signals, optimize portfolios, and simplify repetitive tasks. This approach brings efficiency and strategic flexibility to the DeFi market.

AI-driven trading automation allows users to set trades or rebalance portfolios based on market conditions, reducing the need for constant manual adjustments. For more in-depth strategies, some protocols offer enhanced analytics that turn large amounts of data into actionable insights, supporting informed trading decisions and more accurate market forecasts.

In asset management, portfolio optimization tools can dynamically adjust investment portfolios to maximize returns or effectively manage risks in volatile market conditions.

These can be divided into two categories:

Main transaction highlights

askjmmy : A platform for creating and deploying autonomous trading agents in multi-strategy hedge fund networks.

Composertrade : Provides algorithmic trading automation tools.

DAIN Trader : AI-driven trading strategies.

DeAgentAI : AI-driven trading solutions focused on DeFi.

FastlaneSol : Optimizing Solana-based trading strategies.

Intent Trade : Provides services such as exchange, limit orders, DCA, contract analysis, technical analysis, etc.

MindpalaceAI : Using AI to automate transactions.

Spectral Labs : Provides DeFi trading insights and automation services.

Taoshi : A decentralized AI and machine learning platform using Bittensor for trading strategies.

Paradigm : Harnessing swarms of intelligent agents to collect, organize, and act on data.

Trading and Asset Management

Agent_Fi : Focuses on providing AI agents for DeFi activities, covering transactions, sniping, and liquidation.

AgentNetAi : Provides asset management and DeFi intelligent services.

AuroryAI : Provides autonomous AI agents to help improve trading, asset management and decision-making capabilities.

Cortex : An AI-driven platform that simplifies DeFi interactions by leveraging intelligent agents to automate complex processes such as bridging, swapping, and yield optimization.

Funl_ai : Provides AI automated DeFi trading tools that analyze real-time market conditions, execute automatic trades, and provide AI assistance for advanced manual trading.

Noya : Provides AI strategies including liquidity provision, leverage management and lending optimization.

Singularity DAO : A non-custodial asset management protocol that provides a dynamic token portfolio managed by a team of traders and AI.

OLAS : A platform for deploying AI agents that supports multi-agent systems for forecasting, content generation, and financial services.

Raiba AI : A chatbot ecosystem with interactive character features, gamified chat experience, and plans to provide on-chain assistant capabilities.

Predictive Agent

The main purpose of these predictive agents is to improve the accuracy of market forecasts through data-driven forecasting and risk management . Through AI, each protocol is working to improve market forecasts and provide DeFi platforms with insights into expected movements, price fluctuations, and broader financial trends.

In addition to predictive analytics, these agents also play an important role in enhancing decision-making . With timely and relevant insights, users and DeFi platforms can make proactive, informed decisions, optimize strategies, and reduce risks.

Some predictive agents, such as ReflectionAI, integrate sentiment analysis to add an additional layer of market sentiment capture. This approach enables users to take into account sentiment changes, which is an important factor in predicting user behavior and market dynamics.

Well-known protocols in this category include:

AIVX_ai : Prediction models for financial markets.

Gnosis AI : Enables inter-agent payments and AI-driven prediction markets within Gnosis.

Prediction Prophet : Prediction market AI agent on the Gnosis platform.

Prism : AI-driven DeFi market predictions on Solana.

Zenoaiofficial : Crypto trading platform with autonomous AI agents that provide insights, strategies, and market predictions.

Agent Creation

The core goal of such platforms is to help users create, customize and deploy AI agents with minimal coding barriers . They provide a range of solutions from no-code tools to professional frameworks, covering all aspects of DeFi agent creation and management.

The main features of these platforms are ease of use and high customization . Many platforms provide no-code or low-code tools, allowing users without technical backgrounds to easily create agents. In order to provide more comprehensive services, some platforms support the full life cycle management of agents - from creation, training to deployment and monetization, users can fully control the operation and development of agents in DeFi.

In addition, some protocols (such as OLAS and Flock) focus on collaboration and interoperability among agents, support multi-agent collaboration, and achieve seamless integration between different DeFi ecosystems.

Intelligent Agent Creation Platform

These platforms focus on providing tools for creating, deploying, and customizing AI agents for DeFi.

Chasm Network : A platform for creating, deploying, and monetizing AI agents.

CreatorBid : A marketplace that allows users to deploy and tokenize AI agents, particularly suitable for content creators.

PondGNN : An on-chain platform for building, owning, and monetizing AI models.

Guru Network : A platform for creating interactive AI agents.

myshell.ai : A platform that supports the creation, sharing and monetization of open source AI applications.

OLAS : A platform supporting creation and interoperability of AI agents.

ReflectionAI : A marketplace for sharing and trading AI models.

SwarmZeroAI : A platform for creating and monetizing AI agents.

TopHat_One : Open AI agent startup platform.

Virtuals: Provides AI-driven agent creation tools.

vvaifu : pump.fun designed for autonomous AI agents on Solana.

Agent training and optimization tools

These tools focus on providing advanced training and customization services for AI agents.

Almanak : Tools to support training of AI agents.

AgentLayer : Provides tools and frameworks for building customized DeFi AI agents.

Nimble Network : A one-stop platform that helps AI developers create and monetize AI agents.

VerticalAI : A no-code platform that supports fine-tuning, training, deployment, and monetization of AI models.

AI Infrastructure in DeFi

Infrastructure protocols support AI in a decentralized environment These systems provide access to computing resources, relevant data, and knowledge-sharing networks, enabling AI agents to operate efficiently in DeFi.

Decentralized management and operations are key elements of this infrastructure. The Agent Operations Protocol provides structured support for the deployment and management of agents, creating an environment for autonomous operation. In addition to management functions, computing resources are also crucial. They provide AI agents with computing power to handle complex, data-intensive tasks, which is indispensable in the rapidly growing DeFi ecosystem.

Accessibility of data is equally important, with marketplaces and networks facilitating the acquisition of necessary datasets by agents to help them make informed decisions. Finally, knowledge-sharing platforms foster a collaborative environment that enables agents to continuously learn and evolve through shared insights and data.

This infrastructure ensures that AI agents can operate efficiently and intelligently in decentralized finance.

Agent Operation Protocol

These protocols provide structural support for the deployment and management of decentralized AI agents and are the basis for the autonomous operation of agents in DeFi.

Altera_AL : Infrastructure for managing decentralized AI agents (initially applied to gaming AI agents).

Fetch.AI : Decentralized AI agent platform.

Hyperspace : Provides operational infrastructure for AI agents in DeFi.

Morpheus : A network that supports task management and encrypted interactions among personal AI agents.

OpenAgentsInc : Business automation platform for deploying, customizing, and integrating intelligent agents.

Questflow : Providing operational infrastructure for multi-agent systems.

sebraai : A no-code platform for building and deploying AI agents.

Shinkai : Data management and automation platform for AI agents.

Decentralized computing resources

These protocols provide AI agents with the necessary computing power to support real-time analysis, decision-making, and execution in the DeFi ecosystem.

FormAI : A decentralized economic platform where users can contribute data, computing power, and research results for AI training.

GAIA : A platform for creating and monetizing AI agents, providing computing resources to support their scaling and performance of intensive operations.

Infera Network : A decentralized peer-to-peer AI reasoning network focused on providing computing support for AI agents.

Naphta : A modular platform for deploying decentralized AI agents across multiple nodes, providing flexible computing support.

Node AI : A GPU rental marketplace that allows users to rent GPUs for their AI applications.

Talus Network : L1 blockchain that supports agent-based AI deployment and monetization, providing the computing resources required for intensive operations.

Intelligent Data Market

The data market provides AI agents with critical structured data sets to make informed decisions, perform accurate predictions, and improve learning capabilities in DeFi applications.

Allium : Provides tools and services for analyzing blockchain data to support users' real-time workflows and applications.

Allora Network : A data sharing protocol that connects data providers, processors, and users in the form of AI predictions and rewards high-quality predictions.

GetAxal : A platform that simplifies workflows by automating and integrating Web3 data and operations.

Scryptedinc : Provides data source for AI trading models.

Covalent : Modular AI data infrastructure.

Knowledge Network

Knowledge networks facilitate learning and strategy sharing among AI agents. They provide not only raw data, but also insights, methods, and experiences to optimize capabilities in the DeFi environment.

Alethea AI : A platform that enables decentralized creation, ownership, and sharing of AI personalities and models.

forgellm : AI-driven information repository.

SocietyLibrary : A decentralized knowledge base for AI.

TheoriqAI : A knowledge-sharing network where AI agents collaborate to create solutions.

data

These platforms provide resources for AI training by collecting public data and incentivizing users to share data.

Grass : A decentralized platform where users are rewarded for sharing unused internet bandwidth, which is used to collect and process public network data for AI training.

Other applications

It’s worth noting some other applications of AI agents, especially those that have received a lot of attention recently:

0xzerebro : An AI system that automatically generates and disseminates diverse content across multiple platforms, using a retrieval-augmented generation system to maintain dynamic memory and prevent model collapse.

AGENT-WIP : A collectively designed on-chain artist agent that uses on-chain data to guide artistic creation, distribution, and monetization, exploring new forms of creative autonomy and interaction.

ai16z: An AI-driven decentralized autonomous organization (DAO) that makes investment decisions and manages assets in the cryptocurrency ecosystem through autonomous agents.

dolos_diary : An AI agent that represents the Greek god of trickery, Dolos, engaging in pointed, witty, and outspoken interactions on platforms like Twitter and Telegram.

LOLA : An autonomous AI agent that uses long short-term memory to independently analyze, trade, and optimize cryptocurrency strategies. For example, LOLA made 200 trades, of which 6 tokens increased by more than 20 times, 13 tokens increased by 10-20 times, 25 tokens increased by 5-10 times, and the rest can be considered losses.

Truth Terminal : A semi-autonomous AI agent that interacts with social media users to generate insights and content while exploring the intersection of AI, attention, and wealth in online spaces.

Other AI applications in DeFi

AI applications are rapidly expanding to cover almost every area of blockchain as AI-driven optimization brings significant advantages.

AI in Vaults and Automation

These platforms focus on yield optimization and vault management through rule-based automation, aiming to maximize returns and reduce user operations. Rather than relying on autonomous agents, they use simple algorithms to adjust portfolios and optimize DeFi returns.

Without the involvement of an agent, these systems are simpler and more controllable. They avoid the additional complexity and infrastructure required for an agent to independently monitor and adapt to changing market conditions.

However, this approach comes at the cost of reduced adaptability. Rules-based systems are not as responsive to real-time market changes as agent-driven models, which can autonomously adjust to market fluctuations. While these platforms are reliable and efficient, they may miss out on emerging opportunities that dynamic, agent-based approaches can capture.

AiAgentLayer : A platform for creating tokenized AI agents that integrate data from X and user input.

Aperture Finance : DeFi yield and portfolio management through intent-driven AI technology.

arataagi : A decentralized general artificial intelligence platform with a multi-agent system that enables AI agents to collaborate, learn and evolve autonomously.

AutoppiaAI : Deploy AI agents to automate business processes.

Blinklabs_ai : A launchpad for on-chain assets like NFTs and fungible tokens using AI.

Mass_Build : Integrates operating systems and AI assistants to provide seamless business management and automation.

Robonet : DeFi vault automated yield strategy using AI.

trySkyfire : A platform that enables global interoperability, financial access, monetization, and identity authentication for AI agents.

Smart Contract Audit and Security

AI-driven smart contract auditing and security systems detect vulnerabilities in the code through machine learning algorithms. These systems scan smart contracts line by line, identifying flaws that may pose security risks or can be exploited. They then compare the contract code with known vulnerabilities and attack vectors.

These tools also provide continuous monitoring, allowing threats to be detected in real time while the contract is running. By automating this process with AI, audit platforms are able to respond quickly to potential security issues, often before vulnerabilities can be exploited, thereby improving the stability and credibility of DeFi applications.

AuditOne : Provides AI-driven vulnerability scanning and auditing services.

Cyvers : Leveraging AI to enable real-time detection and prevention of crypto-attacks, identifying patterns and anomalies on the blockchain, and proactively mitigating threats.

Hypernative : Using AI for vulnerability scanning and auditing of smart contracts.

Phylax : AI-driven security system for vulnerability scanning and exploit monitoring.

Governance and voting systems

The common feature of these systems is data-driven governance support. They use AI to simulate governance scenarios, allowing stakeholders to understand possible outcomes before implementing changes. By analyzing historical voting patterns, participation, and proposal impact, these systems can identify trends and predict voting results, helping organizations make data-driven decisions more confidently.

In addition, AI can reduce cognitive and decision-making biases by providing objective data and simulating potential risks and benefits. For example, some protocols focus on privacy-preserving data sharing, ensuring that sensitive governance information is protected while being analyzed but still accessible.

Morpheus : A decentralized network that provides AI-driven governance insights.

Quill AI : A decentralized platform that provides modularity and multi-chain capabilities for AI agents, focusing on improving the security of Web3.

The future of AI in DeFi applications

Scaling and Automation

As DeFi grows, the scaling challenges and operational bottlenecks faced by DAOs require unique solutions from AI. Imagine an AI agent that can autonomously manage a DAO’s treasury, redistribute liquidity between different pools based on real-time market data, or perform governance voting within pre-set parameters.

Such automation allows DAOs to scale without increasing the human burden, simplifying processes such as user onboarding and protocol upgrades. By having AI handle these routine functions, DeFi protocols can grow in a more efficient and less frictionful way.

Incentive Alignment

Aligning AI agents with decentralized goals is critical to maintaining the core spirit of DeFi and avoiding centralization risks. Future frameworks may design incentives that encourage agents to prioritize transparency and community interests. For example, AI agents that manage protocol liquidity can be set to focus on stable, utility-oriented long-term returns rather than just pursuing profit maximization.

Achieving this alignment requires transparent protocols, rigorous smart contract audits, and incentive structures that reward agents based on their contributions to decentralization. This approach will encourage agents to act more like partners than mere profit seekers.

Emerging Use Cases and Next-Generation Applications

In addition to current applications, AI can also drive adaptive, user-oriented DeFi products that can dynamically respond to market and user changes. Imagine an AI-driven smart contract that can adjust the user's portfolio risk in real time based on market fluctuations or sentiment analysis. Or, a personalized lending pool that can adjust interest rates based on the borrower's on-chain reputation, expected returns, or liquidity conditions.

We may even see yield-optimizing vaults that automatically adjust based on liquidity and APY trends, or trading agents that adapt their strategies based on new data during the trading process.

A glimpse at the “Agentic Web”

In this envisioned “Agentic Web,” AI agents will interact seamlessly across protocols to form a self-sustaining autonomous intelligent network. Imagine an agent managing an NFT portfolio while working with yield farming protocols to collateralize assets when liquidity drops. These agents can even collaborate across chains to adjust risk allocation across multiple DeFi applications to achieve the best user outcomes. As “digital economists,” these agents will continuously learn, evolve with user feedback, and collaborate with other AI agents.

This interconnected network will transform DeFi into a more responsive, personalized, and dynamic smart financial ecosystem.

in conclusion

The introduction of AI could revolutionize decentralized finance (DeFi), shaping it into a more efficient and easier-to-use financial ecosystem.

So how much of an impact will this integration have on the financial system? Currently, the service sector accounts for 70% of global GDP, and the rapid development of AI agents has the potential to transform a large part of this industry by automating many traditional manual processes. In DeFi, AI-based automation is expected to transform 20% of the service economy, especially in areas that require transparency, traceability, and decentralization. This transformation could affect a market worth up to $14 trillion.

However, combining AI and blockchain technology is not an easy task. Although blockchain has verifiability, censorship resistance, and native payment capabilities, it cannot meet the large-scale real-time computing needs required by AI. Current blockchain technology is not optimized for complex computing tasks, so running complex AI models directly on the chain remains difficult to achieve. A more likely solution is a hybrid model: AI training and computing are done off-chain, while the results are integrated into the blockchain to ensure transparency, security, and accessibility.

As the AI and DeFi technology stacks continue to evolve, new decentralized AI infrastructure and on-chain applications are gradually taking shape. This crossover of technologies is expected to give rise to the "Agentic Web," in which AI agents will become the core driver of economic activity, automating the generation, trading, and other on-chain interactions of smart contracts.

As these agents become more intelligent and sophisticated, we may see market dynamics similar to the Maximum Extractable Value (MEV) strategy. Participants that are able to optimize AI strategies may dominate the market, gradually eliminating less competitive opponents, which may lead to the risk of market concentration.

In order to fully unleash the potential of AI in DeFi while avoiding the threat of centralization, safe and ethical AI integration is essential. By guiding AI agents through decentralized incentive mechanisms and ensuring their transparent operation, the DeFi ecosystem will be able to achieve sustainable development while maintaining decentralization.

Ultimately, the fusion of AI and DeFi is expected to create a more inclusive, resilient, and future-oriented financial system, fundamentally changing the way we interact with the economic system.

Disclaimer

Three Sigma does not endorse any of the projects mentioned in this article. Please proceed with caution and do adequate research. We respect and support builders who are pushing the boundaries of this space.