A quick overview of important events this week (11/17-11/23)

- Bitcoin News : The price of Bitcoin is close to US$100,000 , and its market value " surpasses the New Taiwan Dollar ", becoming the 12th largest currency in the world.

- The progress of the Federal Reserve's interest rate cut : Nomura Securities predicts that the Fed will suspend interest rate cuts in December, and interest rates will drop to 3.75% in 2025; Morgan Stanley predicts: In mid-2025, the U.S. 10-year Treasury bond yield will drop to 3.75%, and in the first half of 2025 Cut interest rates by 75 basis points.

- BTC strategic reserve: U.S. think tanks and Chinese official media criticized the inability to solve the U.S. debt problem; the Polish presidential candidate promised to establish a Bitcoin strategic reserve after being elected; U.S. lawmakers proposed selling Federal Reserve gold in exchange for 1 million Bitcoin reserves.

- Micro-strategy: The value of BTC holdings reaches US$26 billion, and the asset size exceeds IBM and Nike . Big short Citron said the valuation deviated from fundamentals and short the micro strategy.

- Regulation and taxation: The chairman of the SEC will resign in January next year; the U.S. Financial Supervisory Authority has added a special area for crypto assets ; Japan will reduce the cryptocurrency profits tax to 20% , and Taiwan plans to introduce tax audit measures .

- Trump: Nominated Bitcoin fan Howard Lutnick as Secretary of Commerce; nominated Kennedy Jr., who openly supports Bitcoin, as Secretary of Health; plans to establish a cryptocurrency advisory committee to help BTC become a strategic reserve.

- Market popularity : Solana usage surpassed Ethereum for the first time; Chris Burniske, who called SOL, " began to be bullish " on ETH.

Changes in trading market data this week

Sentiments and Sectors

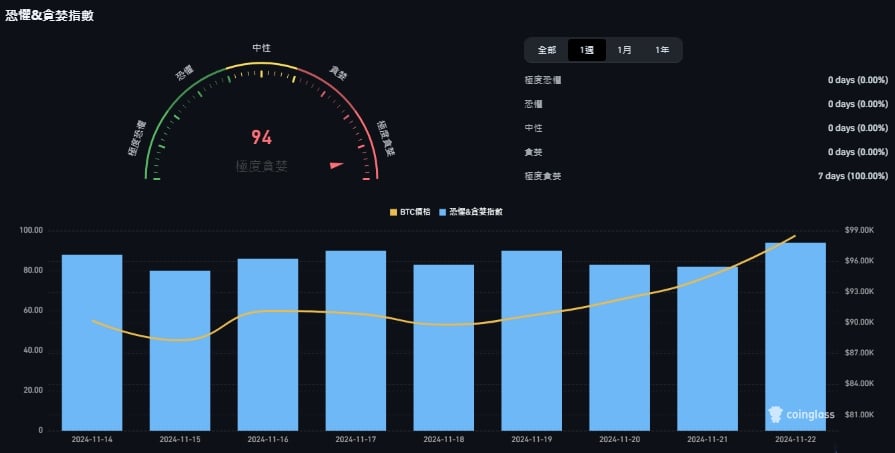

1. Fear and Greed Index

This week's market sentiment indicator rose from 90 (extreme greed) to 94 (extreme greed), staying in the (extreme greed) range throughout the week.

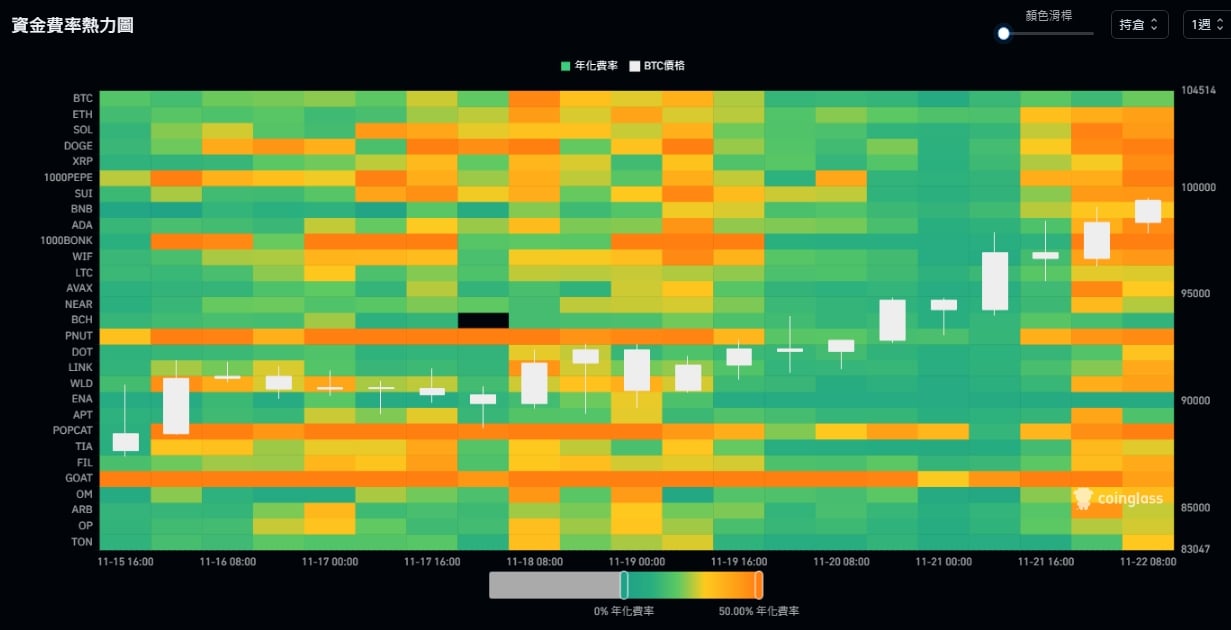

2. Funding rate heat map

This week, the Bitcoin funding rate reached a maximum of 47.97% and a minimum of 7.21% , indicating that the bullish sentiment continues to be strong.

The funding rate heat map shows the changing trend of funding rates for different cryptocurrencies. The color ranges from green with zero rate to yellow with 50% positive rate. Black represents negative rate; the white K-line chart shows the price fluctuation of Bitcoin. , in contrast to the funding rate.

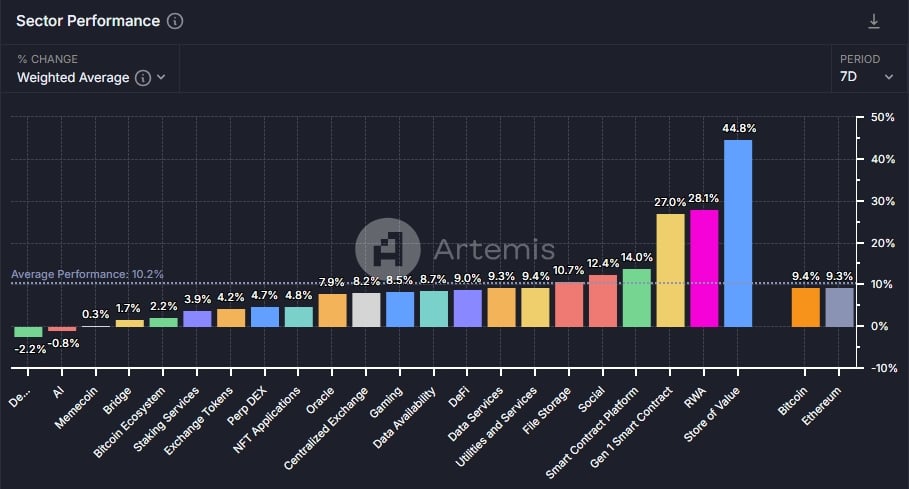

3. Sector performance

According to Artemis data, the average increase in the blockchain sector this week was (10.2 %) , with Store of Value, RWA, and Gen 1 smart contracts occupying the top three respectively (44.8%, 28.1%, and 27.0%) .

This week’s gains for Bitcoin and Ethereum were (9.4%, 9.3 %) .

The three worst performing areas are: DePIN (-2.2%), AI (-0.8%) and MemeCoin (0.3%) .

market liquidity

1. Total cryptocurrency market capitalization and stablecoin supply

Data on the total market value of cryptocurrency this week showed that it rose from US$3.08 trillion to US$3.34 trillion , an increase of US$260 billion, and the total market value increased by approximately 8.44%. BTC’s market share is 56.78%, and ETH’s market share is 11.11%.

The total stablecoin supply, an important indicator of market health and liquidity, increased from US$ 172.66 billion to US$176.10 billion this week, an increase of US$3.44 billion, an increase of approximately 1.99%.

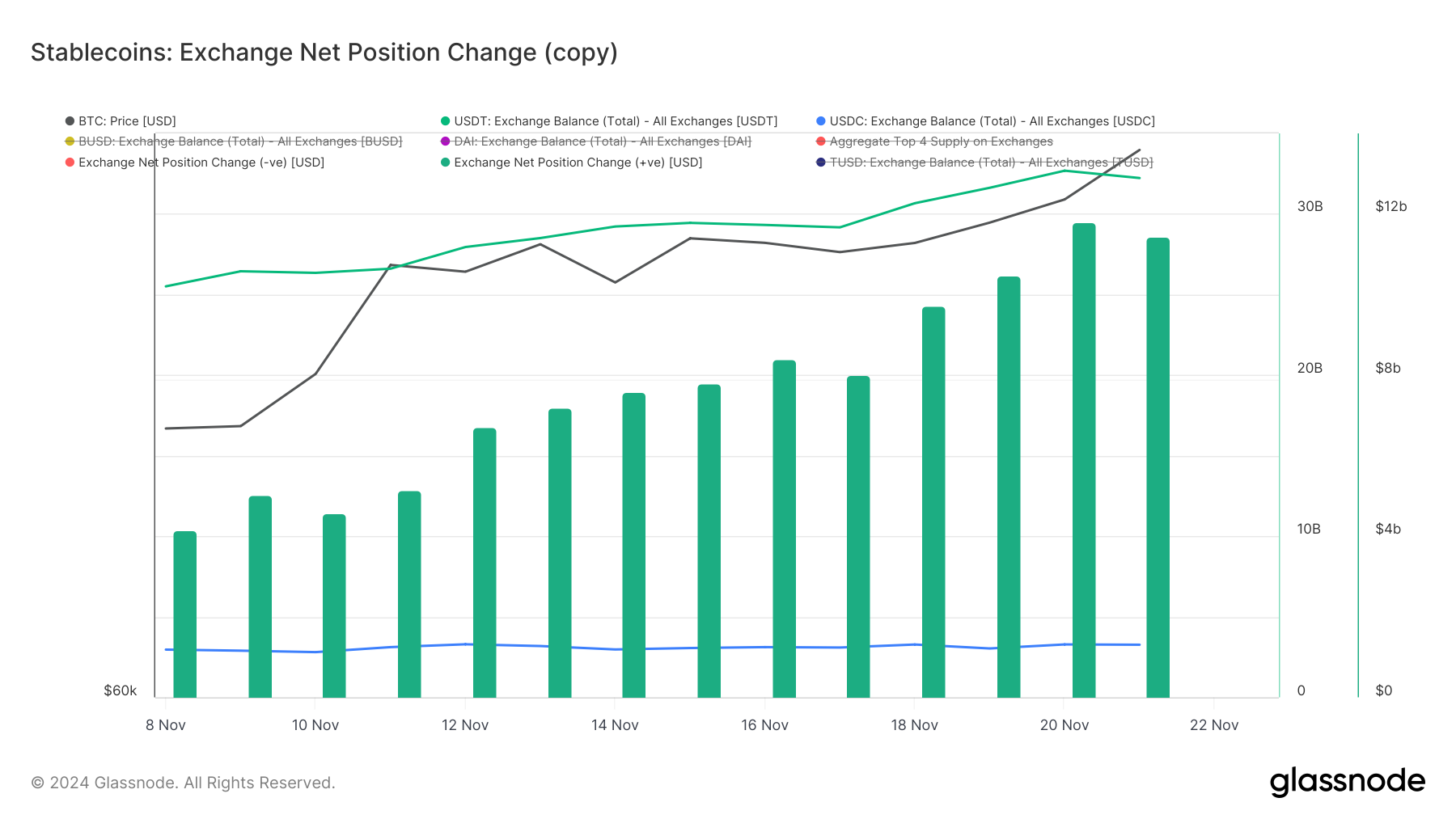

2. Potential purchasing power within the exchange

Data shows that exchange assets showed a net inflow trend this week, especially the large inflow of USDT after the US election. This phenomenon may be investors preparing for upcoming market fluctuations, and the inflow of funds into exchanges may mean increased buying demand in the short term.

In addition, the highest single-day net inflow of funds on November 20 reached US$11.8 billion , surpassing the highest single-day net inflow of US$6.7 billion in the previous bull market, indicating ample market liquidity.

3. Encrypt dynamics

The overall sentiment in the crypto market was bullish this week, with CLV, OM, and CTXC leading the way with gains of 190%, 147%, and 118% respectively. Mainstream currencies such as XRP and ADA also showed impressive gains. According to Blockchaincenter data, the current Altcoin seasonal index is 33 (+6) , indicating that the market is still dominated by Bitcoin. Although the popularity of Altcoin is relatively low, it is showing signs of recovery.

Bitcoin Technical Indicators

1. Bitcoin spot ETF funds

Bitcoin ETF inflows this week were $2.6036 billion.

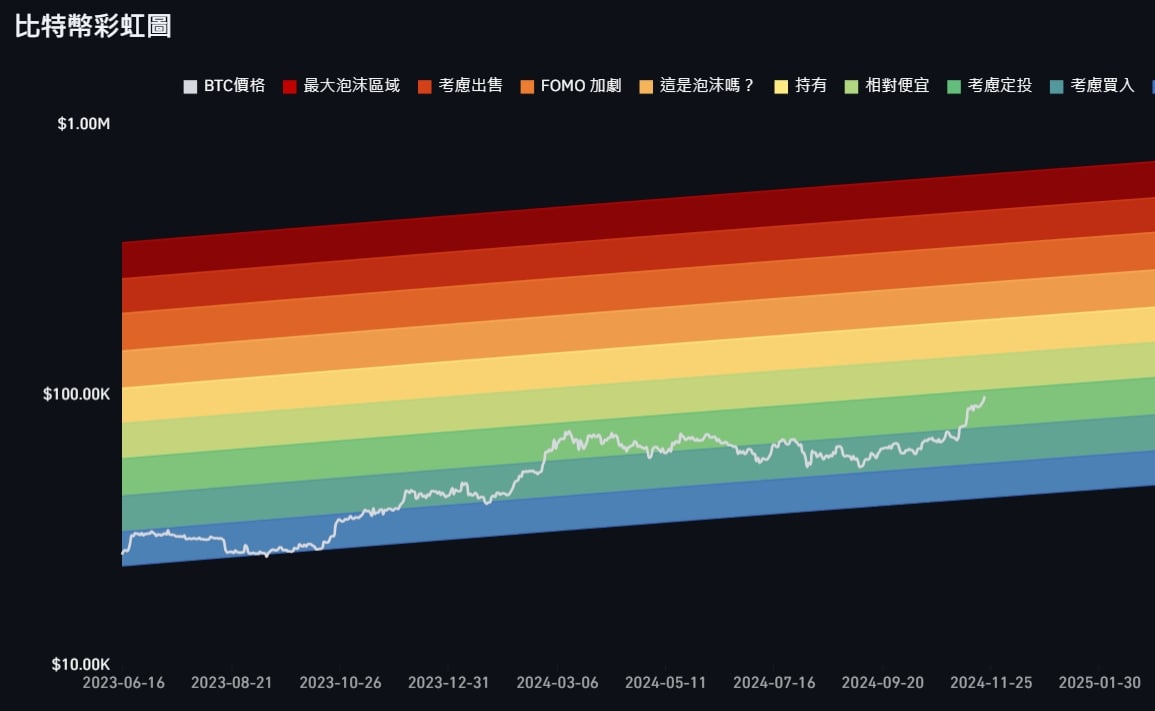

2. Bitcoin Rainbow Chart

The Bitcoin rainbow chart shows that the current price of Bitcoin ( $99,000 ) is in the " consider fixed investment " range.

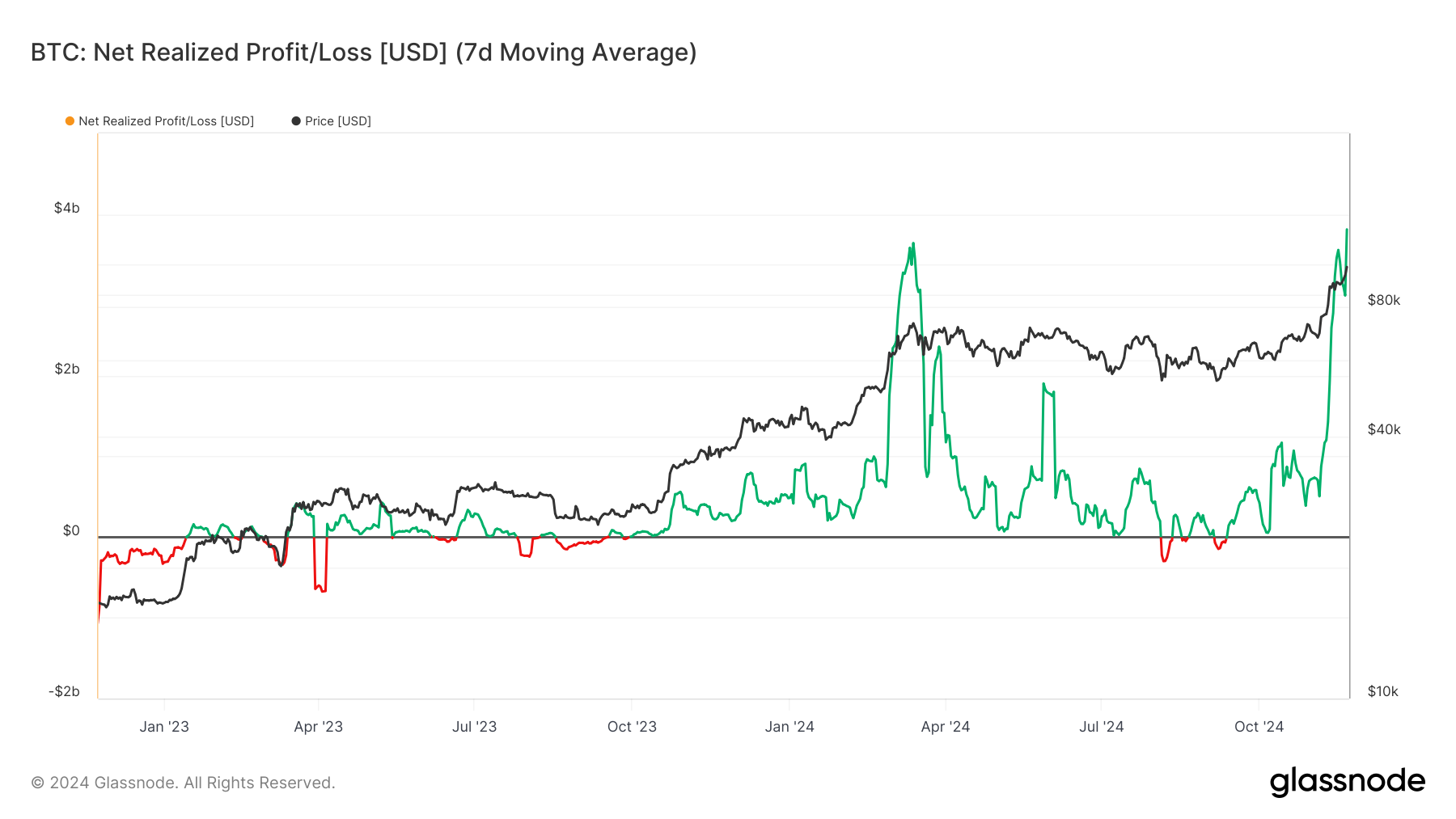

3. Bitcoin net profit and loss performance

Bitcoin's realized net profit and loss indicator shows that the current market situation is recovering, and the structure is similar to the situation in March this year , when the Bitcoin price reached a high in mid-March. Be wary of potential correction risks, especially profit-taking that may occur in the market after a rapid rise.

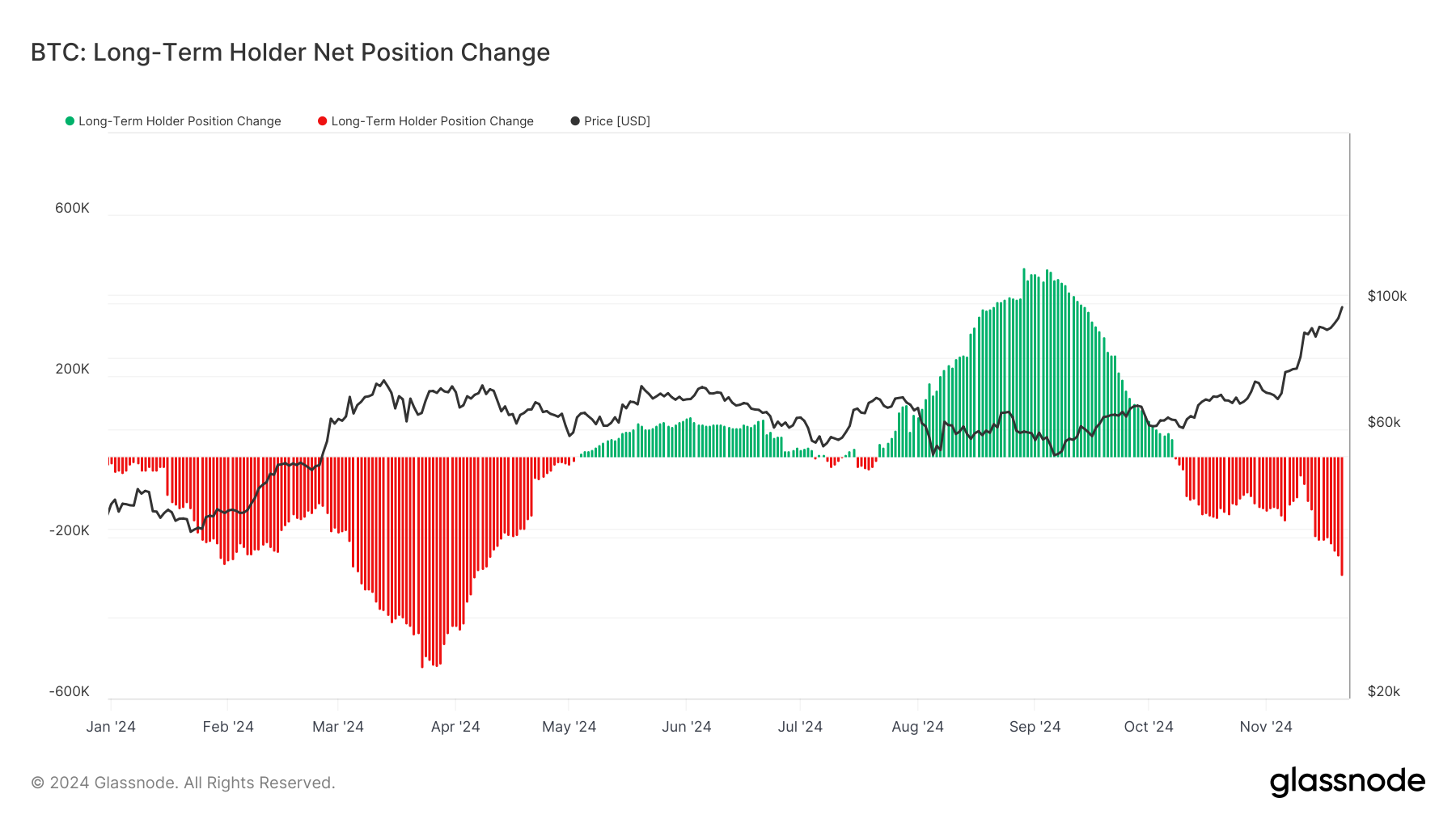

4. Long-term Bitcoin holders

According to on-chain data , long-term Bitcoin holders have seen a significant decline in their net positions, with the red bar chart showing a gradual increase in selling pressure. Since mid-October, the net position changes of long-term holders have turned from positive to negative, showing that some long-term investors have begun to gradually take profits. This phenomenon is especially obvious when the price of Bitcoin rises to near new highs, indicating that some capital in the market chooses to make profits at high levels, but the selling pressure has not yet reached the peak in March this year.

Although market sentiment is optimistic, the reduction of LTH positions may increase short-term selling pressure. It is necessary to pay attention to the behavior of short-term holders (STH) and whether market demand can absorb the new supply.

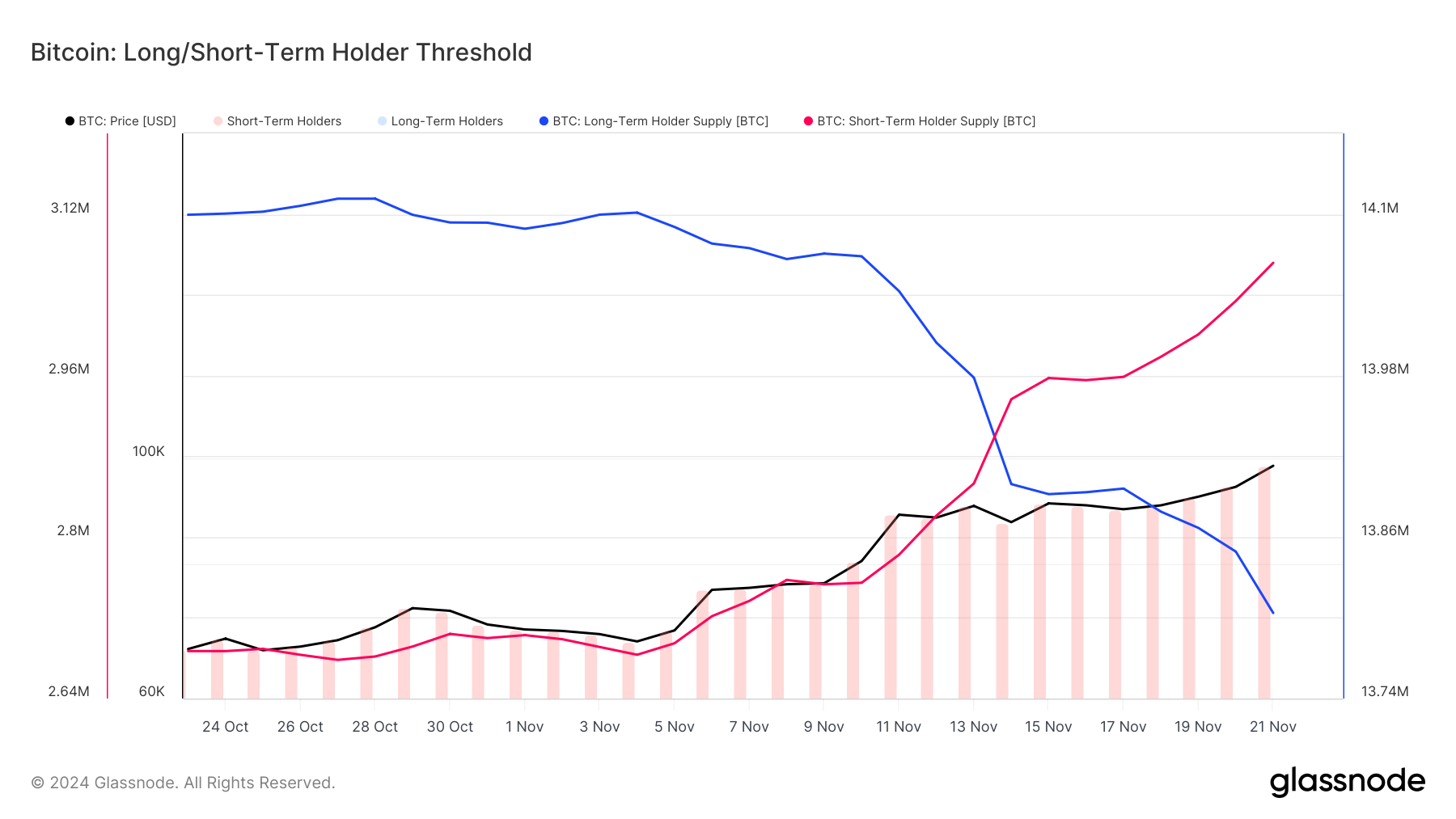

5. Purchasing power on the Bitcoin chain

According to on-chain data , this week’s data on Bitcoin’s long- and short-term holders shows that as the price rises, the positions of short-term holders (red line) increase significantly, while the positions of long-term holders (blue line) decrease.

Reflects the flow of funds from long-term investors to short-term speculators. As the proportion of short-term holders increases, market risk appetite heats up, but volatility risks also increase simultaneously. The reduction in positions by long-term holders indicates an increase in profit-taking at high levels, and attention needs to be paid to whether short-term funds can stably support market prices.

6. Bitcoin contract holdings

According to data , Bitcoin contract positions on exchanges rose rapidly this week, climbing from US$54.45 billion to US$64.17 billion . Not only did it set a record high for contract positions, but at the same time, the price of Bitcoin also hit a new high.

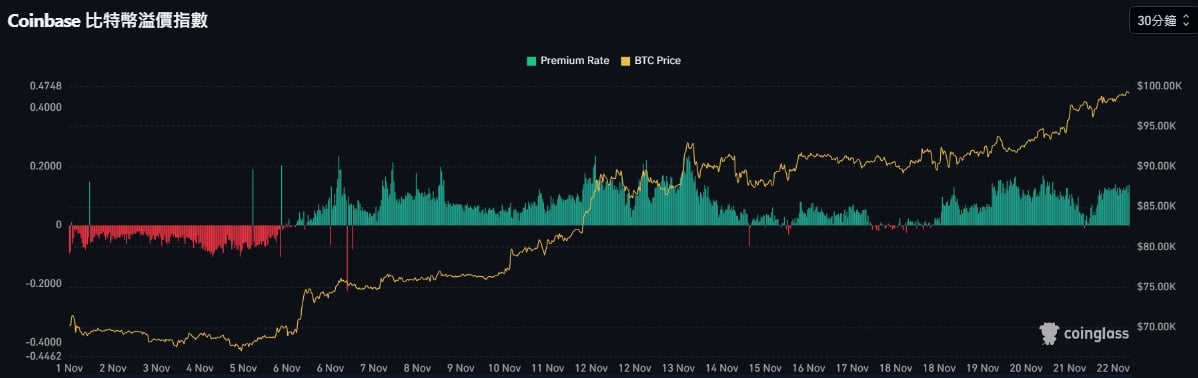

7. Coinbase Bitcoin Premium Index

This week, the Coinbase Bitcoin Premium Index turned positive from negative at the beginning of the month, indicating that the demand for Bitcoin in the US market has increased, driving the premium upward.

The positive premium differential may suggest that U.S. investors have greater purchasing power in the market than global investors.

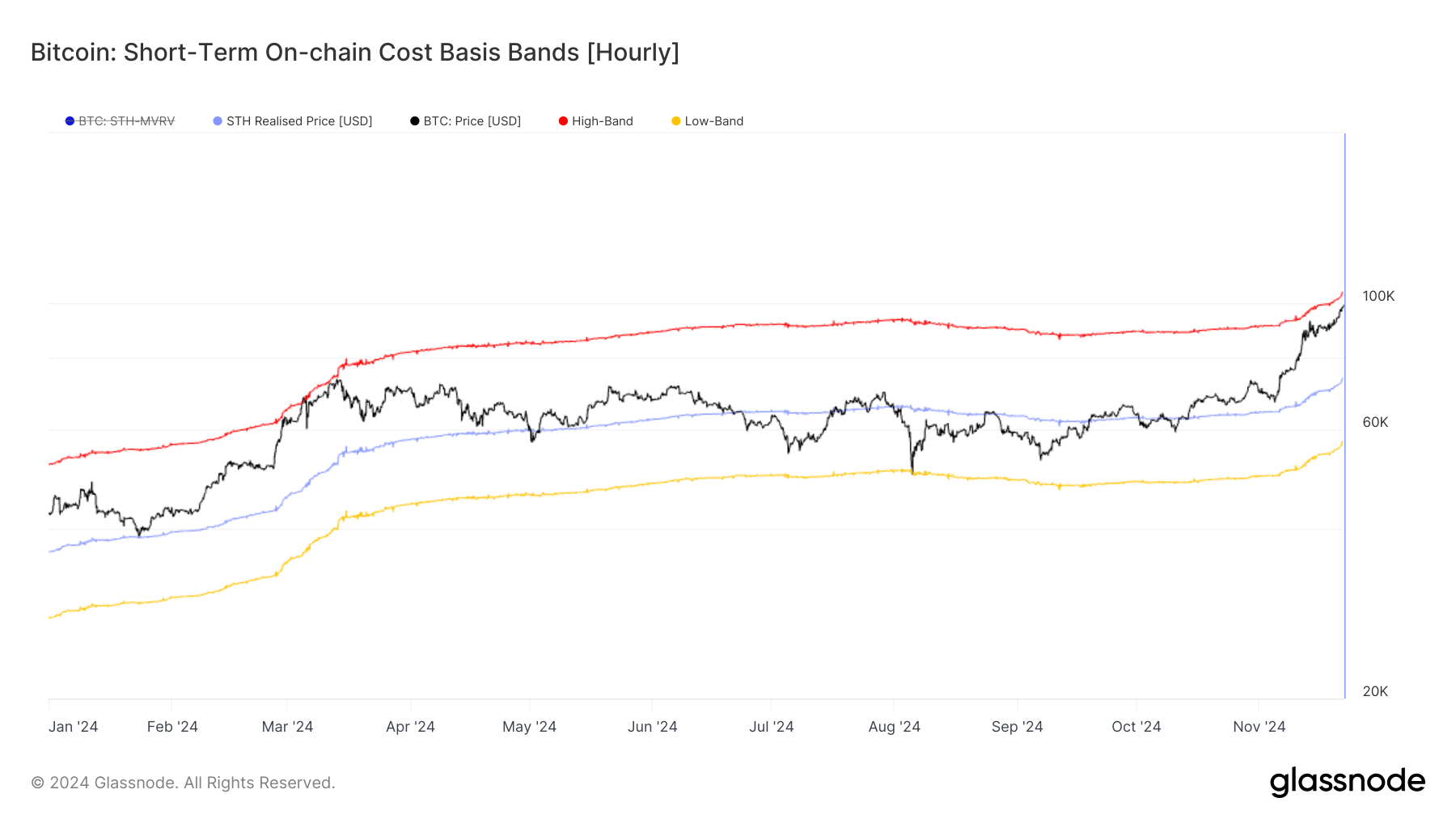

8. Short-term on-chain cost benchmark belt

This week, Bitcoin's short-term on-chain cost benchmark band shows that the price is close to the upper track (red line) of $103,200 , reflecting rising market sentiment and the increased willingness of short-term investors to make profits. The realized price for long-term holders (blue line) is $72,700 .

In the short term, the price may face resistance at the upper track, and the risk of a correction increases. It needs to be observed whether it can stabilize at a high level to support further upward movement.

9. Bitcoin historical monthly return

According to historical data , Bitcoin performed strongly in November, with an increase of 40.67% , close to the historical average of 46.30% ; the average increase in December was 5.45% , with mostly positive returns in history. Pay attention to the risk of profit taking.

Important technical indicators of Ethereum

1. Ethereum spot ETF

The net outflow of Ethereum ETF funds this week was approximately US$219.5 million .

2. Bitcoin Relevance

This week's data shows that the correlation between BTC and ETH and SOL is 0.80 and 0.82 respectively. Compared with last week's 0.24 and 0.72, the correlation between BTC and major tokens has increased, indicating that market funds are refocused on mainstream currencies. Additionally, the correlation coefficients of most major coins are higher than last week’s average, indicating a pickup in market risk appetite.

TON's correlation with other mainstream cryptocurrencies is still low. For example, the correlation with BTC and ETH is -0.01 and 0.48 respectively, showing that its market performance is still independent of the mainstream trend. This week, the correlation between TON, SOL and DOGE also fell into the negative range, indicating that the token has not been driven by the popularity of mainstream funds.

This week’s data shows that although the overall market linkage has increased slightly, there is still significant differentiation, and some assets perform independently.

3.DeFi market total locked position (TVL)

Data this week shows that the total locked-up volume in the DeFi market increased from US$117.286 billion to US$104.917 billion last week.

Market analysis news this week

1. Bitcoin hits $99,000! Analyst: There is still room for doubling this round, Ethereum comes back to drive Layer 2 to skyrocket

Bitcoin continues to hit new all-time highs, just one step away from the $100,000 mark. A recent report from BCA Research showed that Bitcoin still has room to double again in this bull market. ( continue reading )

2. How does a micro strategy succeed? Bloomberg: Bitcoin holdings exceed the asset reserves of IBM, Nike and other assets, and the stock price has doubled in five years

According to Bloomberg, the total value of MicroStrategy’s current Bitcoin reserves has reached approximately US$26 billion, surpassing the cash reserves and cash reserves of world-renowned companies such as International Business Machines Corporation (IBM) and sports brand Nike. Among the securities assets held, only a dozen companies including Apple and Alphabet are ahead of MicroStrategy in terms of asset reserves. ( continue reading )

3. Micro-strategy surged 10% to become the top US stock trading volume champion! Announced another $2.6 billion bond issuance to increase Bitcoin position

MicroStrategy announced yesterday that it plans to issue another convertible bond with a total value of US$2.6 billion and use the proceeds to continue to increase its position in Bitcoin. ( continue reading )

4. Chris Burniske, who yelled at SOL at the bottom of $8, "started to be bullish" on ETH.

Time came to November 2024, and Ethereum gradually fell into a low ebb due to narrative bottlenecks and other reasons. However, Placeholder partner Chris Burniske once again published a similar "calling article" on November 17 to publicly support Ethereum. Fong predicts that the chain will achieve a renaissance in the next few years. ( continue reading )

5. Kennedy Jr.: I have invested most of my wealth in Bitcoin and am optimistic about BTC’s ability to resist inflation and stabilize the US dollar.

Robert Kennedy Jr. has been in the spotlight again recently, not only because of Trump’s announcement to nominate him as Secretary of Health and Human Services, but also because of his public support for Bitcoin. He revealed that he has invested most of his wealth in Bitcoin and emphasized that it is a free currency that can fight inflation and stabilize the global status of the US dollar. ( continue reading )

6. BlackRock: The global race for strategic Bitcoin reserves has begun, and no country can ignore BTC anymore

BlackRock said that Trump's victory has brought "new optimism" and has intensified the discussion of Bitcoin as a strategic reserve. Investment institutions are also exploring how to promote Bitcoin's role in national economic strategies through policies and legislation. ( continue reading )

7. Bitcoin’s market capitalization “surpasses the New Taiwan Dollar” to become the 12th largest currency in the world at US$1.95 trillion!

According to "Bitcoin Magazine", if priced in BTC, Bitcoin has currently surpassed the total currency count (M2) of Taiwan Dollar (M2) of 19,760,251 BTC, with a total price of 19,785,378 BTC, becoming the twelfth largest currency in the world. ( continue reading )

8. Trump’s Cryptocurrency Advisory Committee will help establish a U.S. Bitcoin reserve

U.S. President-elect Trump has announced plans to establish a cryptocurrency advisory committee, which will provide advice on digital asset policies, work with Congress to formulate cryptocurrency-related bills, and assist in establishing the Bitcoin reserve promised by Trump. ( continue reading )

Cryptocurrency regulatory status in various countries

1. The Polish presidential candidate shouted: If elected, establish a strategic Bitcoin reserve! Global BTC bidding heats up

According to Bitcoin Magazine, Polish presidential candidate Sławomir Mentzen has promised to adopt a strategic Bitcoin reserve if elected. ( continue reading )

2. Ministry of Finance: Profits from buying and selling Bitcoin will be taxed! Develop measures to “strengthen tax inspections” within 3 months

Legislators today are concerned about the taxation of cryptocurrency in Taiwan. The Ministry of Finance stated that income tax will be levied on profits from related transactions. Currently, the Internal Revenue Service has audit tools available to review digital commodity transactions and has promised to study cryptocurrency transactions in three months. Measures related to income tax assessment. ( continue reading )

3. Heavy! SEC Chairman Gary Gensler announced his resignation on January 20 next year. Is the era of high-pressure supervision of cryptocurrency the end?

Gary Gensler, the current chairman of the US Securities and Exchange Commission (SEC), announced on his X account at 2 o'clock this morning (22) that he will resign on January 20. ( continue reading )

Before the election, U.S. President-elect Trump clamored to include Bitcoin in the national strategic reserve. Republican Senator Cynthia Lummis, who is considered a Trump ally, plans to push a bill to allow the United States to establish 1 million Bitcoins after the new Congress takes office next year. She recently suggested that this could be accomplished by selling off part of the Fed's gold reserves. ( continue reading )

The government of Japanese Prime Minister Shigeru Ishiba has reached an agreement with the main opposition party and plans to promote a major economic stimulus plan. The plan includes major reforms to the current tax rules for cryptocurrency, and may implement a 20% flat tax rate on cryptocurrency income. ( continue reading )

Paju City, South Korea, issued a warning to 17 tax defaulters that if they do not pay 124 million won in taxes by the end of November, they will sell approximately 50 million won worth of crypto assets held on exchanges. This is the first time a local government in South Korea has taken steps to directly liquidate crypto assets to recover taxes. ( continue reading )

Market focus next week

11/26 (Tue)

- United States: Conference Board consumer confidence in November, previous value 108.7

- US: New Home Sales in October, previous value 738K

11/27 (Wednesday)

- New Zealand: Interest rate decision, last value 4.75%

- United States: Gross domestic product GDP in the third quarter (quarter-on-quarter), the previous value was 2.8%

- United States: October core PCE price index (month-on-month), previous value 0.3%

- United States: October core PCE price index (year-on-year), previous value 2.7%

- United States: Crude oil inventories, previous value 0.545M

11/28 (Thursday)

- Germany: Consumer Price Index CPI in November (month-on-month), the previous value was 0.4%

11/29 (Friday)

- Eurozone: Consumer Price Index (CPI) in November (year-on-year), previous value 2.0%

11/30 (Saturday)

- China: Manufacturing PMI in November, previous value 50.1

"Influential Person of the Year" in Taiwan's Blockchain Industry

Time : From now on to December 10th

Nomination form link: https://forms.gle/8bwthcJEo6tHquBy9

Recommended activities

1. Blockchain gathering #Bitcoin Series 1 Learn the key to Bitcoin’s rise from the man behind the start of the Bitcoin bull market! MicroStrategy’s Mass Buying of Bitcoin & What’s the Impact of Bitcoin’s Good Performance on the Overall Crypto Market? ( Registration link )

Recently, the price of Bitcoin has repeatedly hit new highs and started a bull market. The key to the rise is not only the election of Trump as the new president of the United States, but also the improvement of Bitcoin application technology. In addition, the Micro Strategy (Micro Strategy), which has surged in U.S. stock prices, continues As soon as news such as buying Bitcoin comes out, Bitcoin can continue to challenge all-time highs.

When: Tuesday, November 26