The cryptocurrency market is showing signs of an altcoin season, where the prices of other assets are rising rapidly compared to Bitcoin. Market participants often focus on altcoins and shift their capital during this period.

Several key indicators have started to point to a gradual shift in market dynamics. This analysis explores some of these factors.

Is the Altcoin Season Starting?

One of them is the increasing trend of TOTAL3. This is a metric that tracks the total market capitalization of all cryptocurrencies excluding Bitcoin and Ethereum. At the current point, it stands at $933 billion, up 35% since the beginning of the month. For reference, this asset group's market capitalization has added $212 billion over the past 22 days.

As TOTAL3 approaches its all-time high of $1.13 trillion, it suggests that investors are allocating more capital to altcoins. Notably, the rise in TOTAL3 has occurred during a period of adjustment in Bitcoin's dominance (BTC.D).

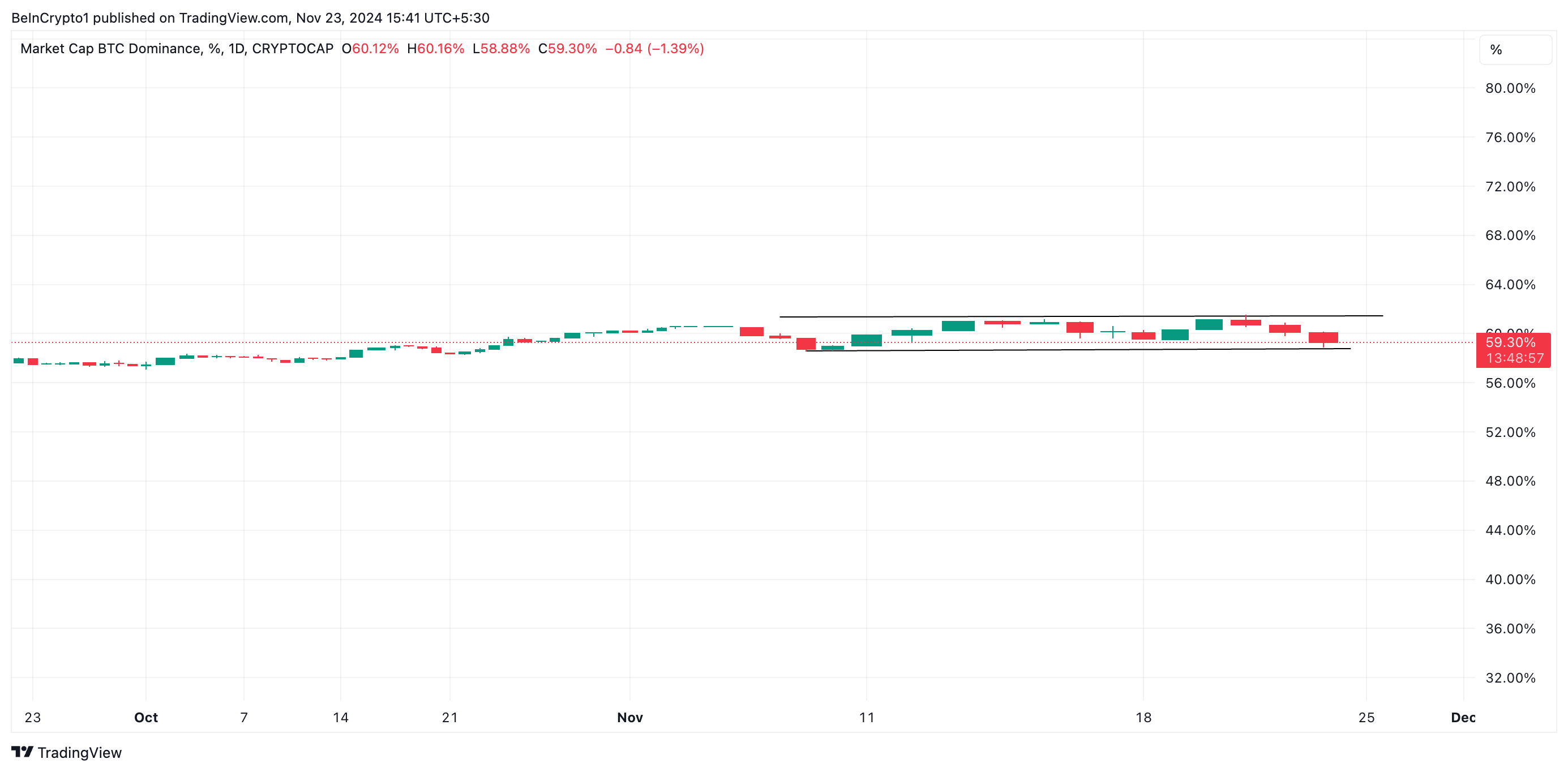

According to the daily chart readings, BTC.D has fluctuated between 61% and 58% since November 8th. Currently, BTC.D stands at 59.30%.

When TOTAL3 surges and BTC.D enters a correction, this is a significant indicator of a potential altcoin season. It means that investors are shifting their focus from Bitcoin to other cryptocurrencies, which can lead to increased demand for altcoins and potentially higher prices.

Moreover, in a new report, on-chain data provider CryptoQuant mentioned that the values of several Layer 1 altcoins, such as XRP, TRX, TON, ADA, and SOL, have risen since the U.S. presidential election, confirming that a potential altcoin season may be underway.

"Cryptocurrencies like XRP, TRX, TON, ADA, and SOL have seen their prices surge, driven by expectations that the new U.S. administration will be more crypto-friendly." – CryptoQuant

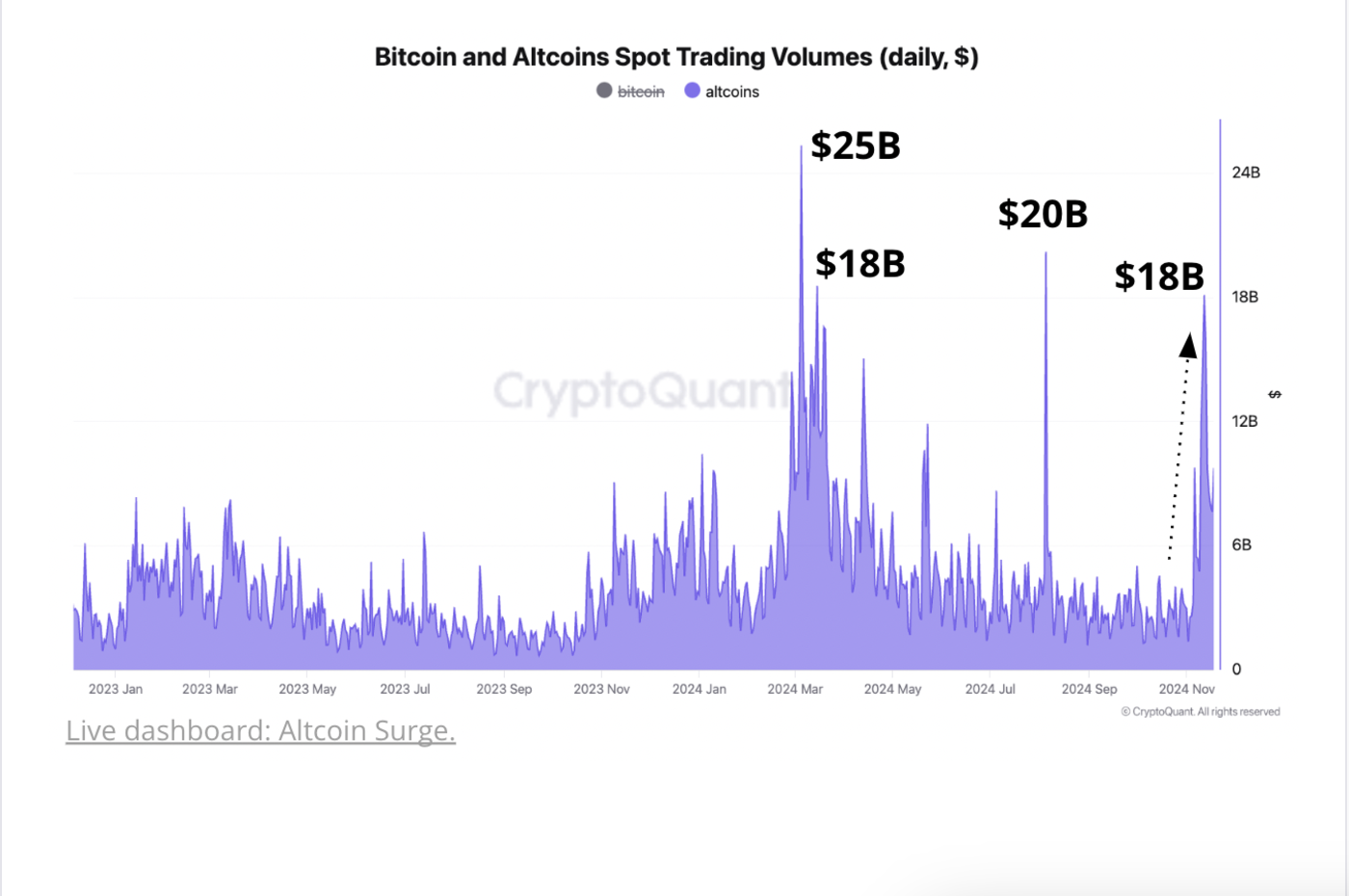

CryptoQuant also explained that this price surge has been accompanied by a sharp increase in spot trading volume.

"The daily spot trading volume of altcoins has increased since the U.S. presidential election, spiking to $18 billion on November 11th, the highest level since early August. Prior to this, the altcoin spot trading volume had been quiet since May."

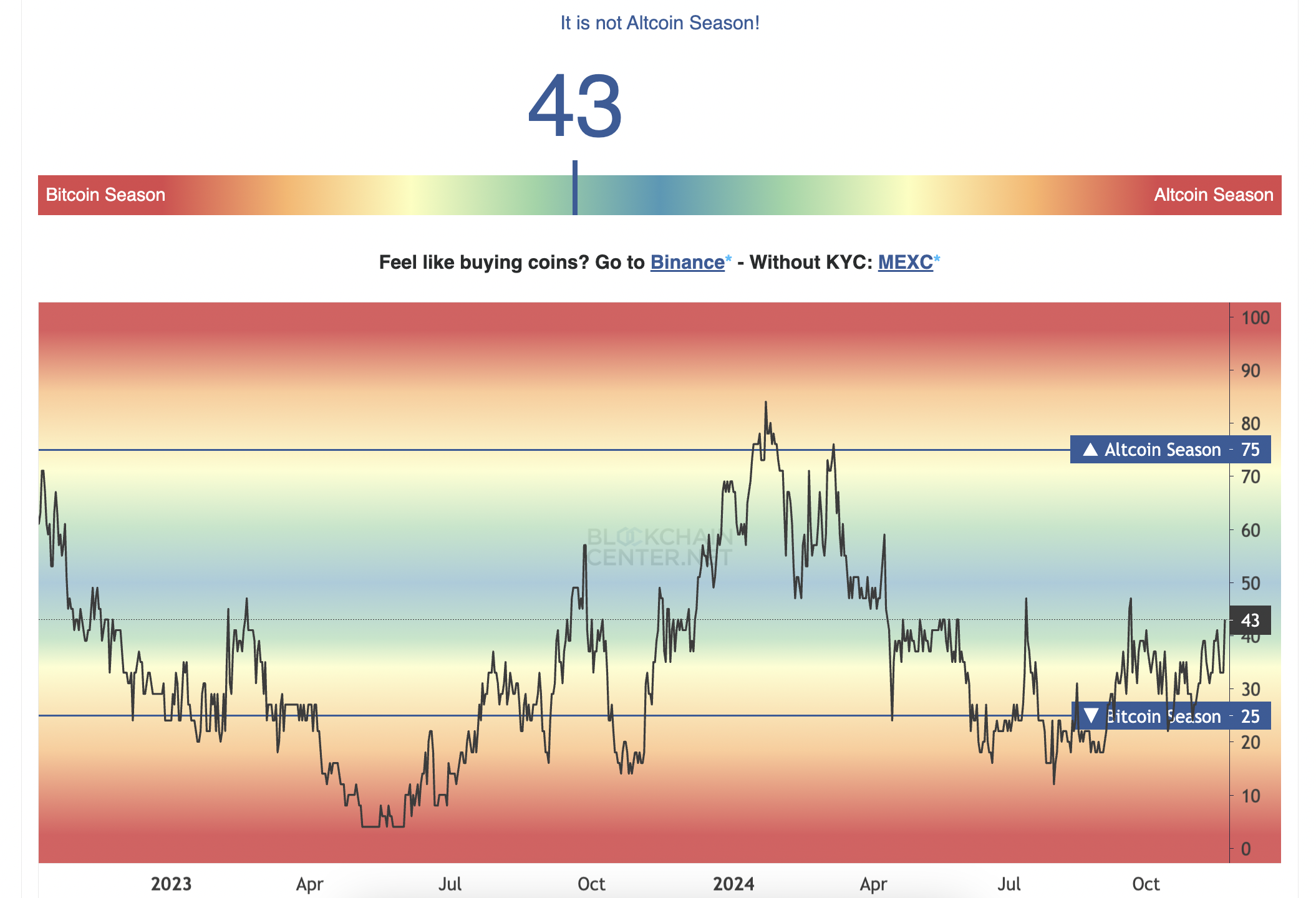

Altcoin Season Index Still at '43'...More Time Needed

While the readings of the indicators mentioned above suggest the possibility of a short-term altcoin season, this is confirmed when at least 75% of the top 50 altcoins outperform Bitcoin for a period of 3 months.

However, according to data from Blockchain Center, only 43% of the top altcoins have outperformed Bitcoin over the past 90 days, which falls short of the 75% threshold required to officially declare an altcoin season.