Author: Andrew Van Aken & Jon Ma

Compiled by: TechFlow

Abstract

Stripe acquired Bridge.XYZ for $110 million, while the company had just raised $50 million from Sequoia, Ribbit Capital and Haun Ventures less than a year ago. This means that the Series A investors have achieved nearly 10x returns in less than a year.

Yellow Card has completed a $33 million Series C financing, plans to transform into a B2B payments business for stablecoins, and announced that it has served over 30,000 businesses and reached eight-figure revenues.

Meanwhile, on-chain data for stablecoins is breaking or approaching historic highs. In a report co-authored with Castle Island Ventures and Visa, we provide quantitative and qualitative analysis of this data.

Historically, investors have generally believed that stablecoin issuers are the biggest beneficiaries of stablecoin adoption.

However, 2024 has brought a new change: as stablecoins become more mainstream, fintech applications, payment networks, infrastructure builders, on/off ramps, and data analytics tools are gradually becoming the main drivers of value accumulation.

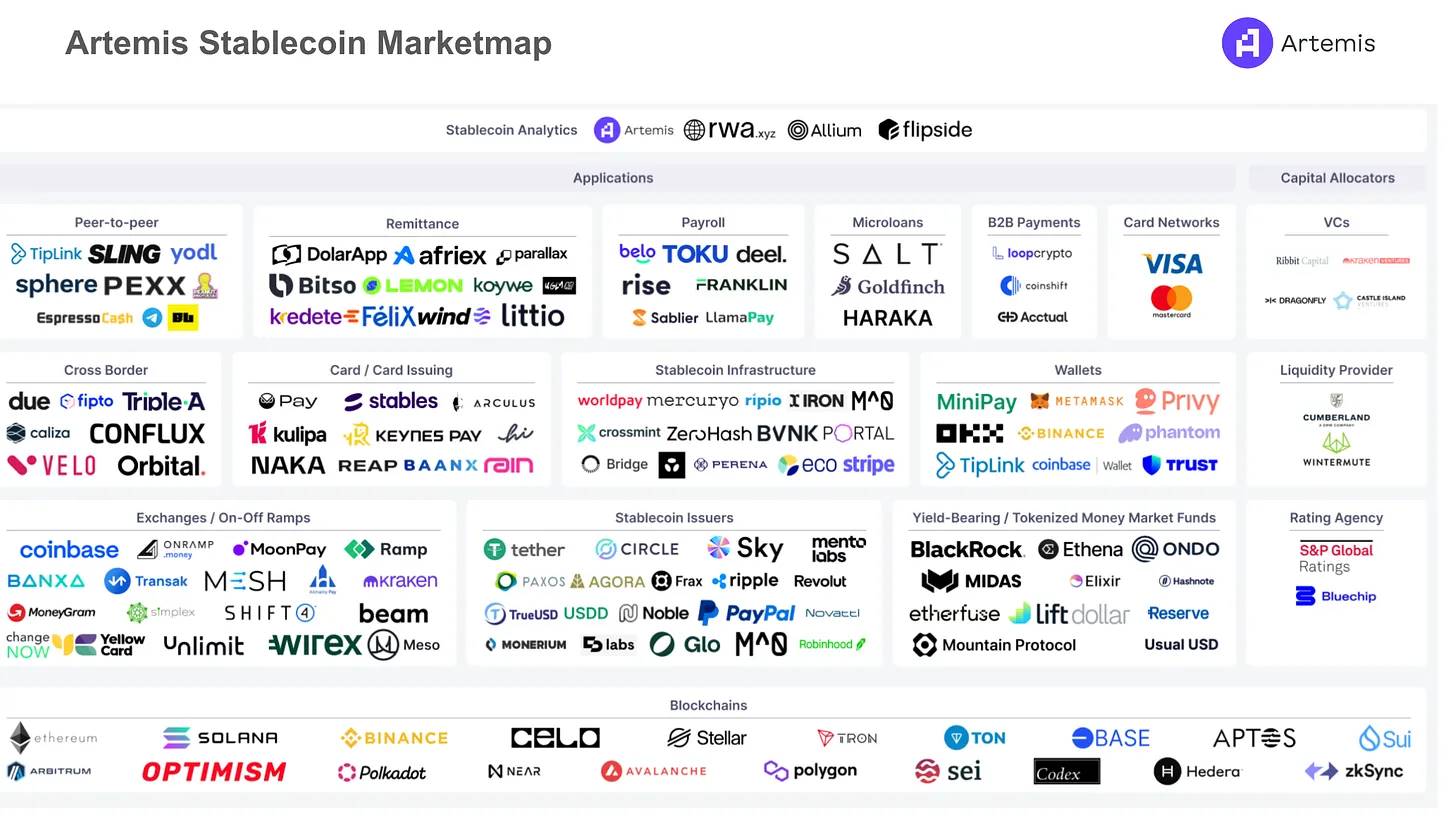

We have identified many companies that will benefit from the proliferation of stablecoins. Today, we are sharing these research findings with the broader community.

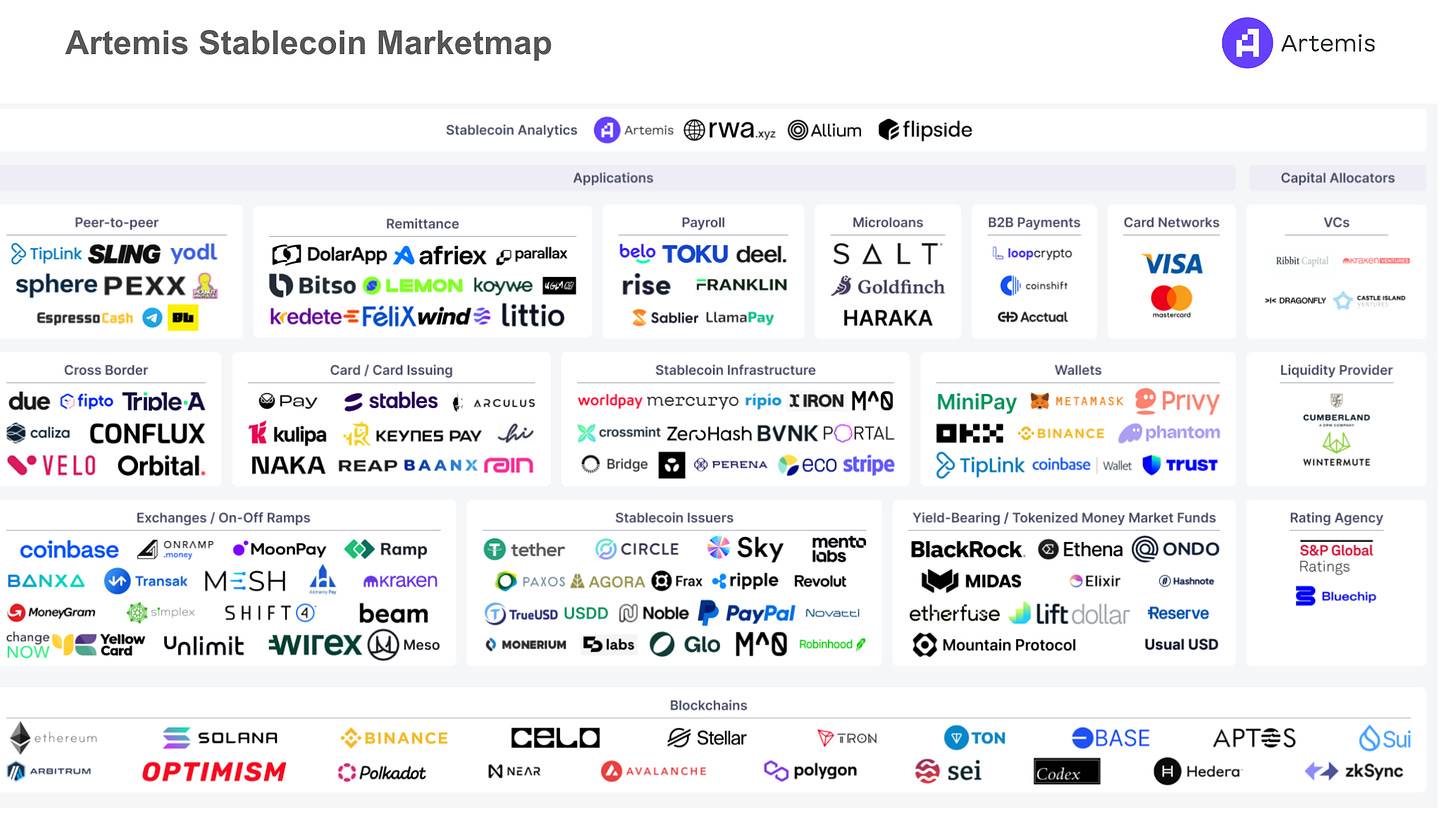

Here is a real-time, open-source market map: if you would like to recommend companies, please contact Crystal Tai.

Introduction

"Even if we only get stablecoins, that would be a very meaningful achievement." —— Nic Carter

Satoshi Nakamoto proposed a fully decentralized peer-to-peer electronic cash system in his white paper, without relying on central servers or trusted third parties. We believe that 2024 will bring us closer to this vision, and stablecoins are the killer application of blockchain networks.

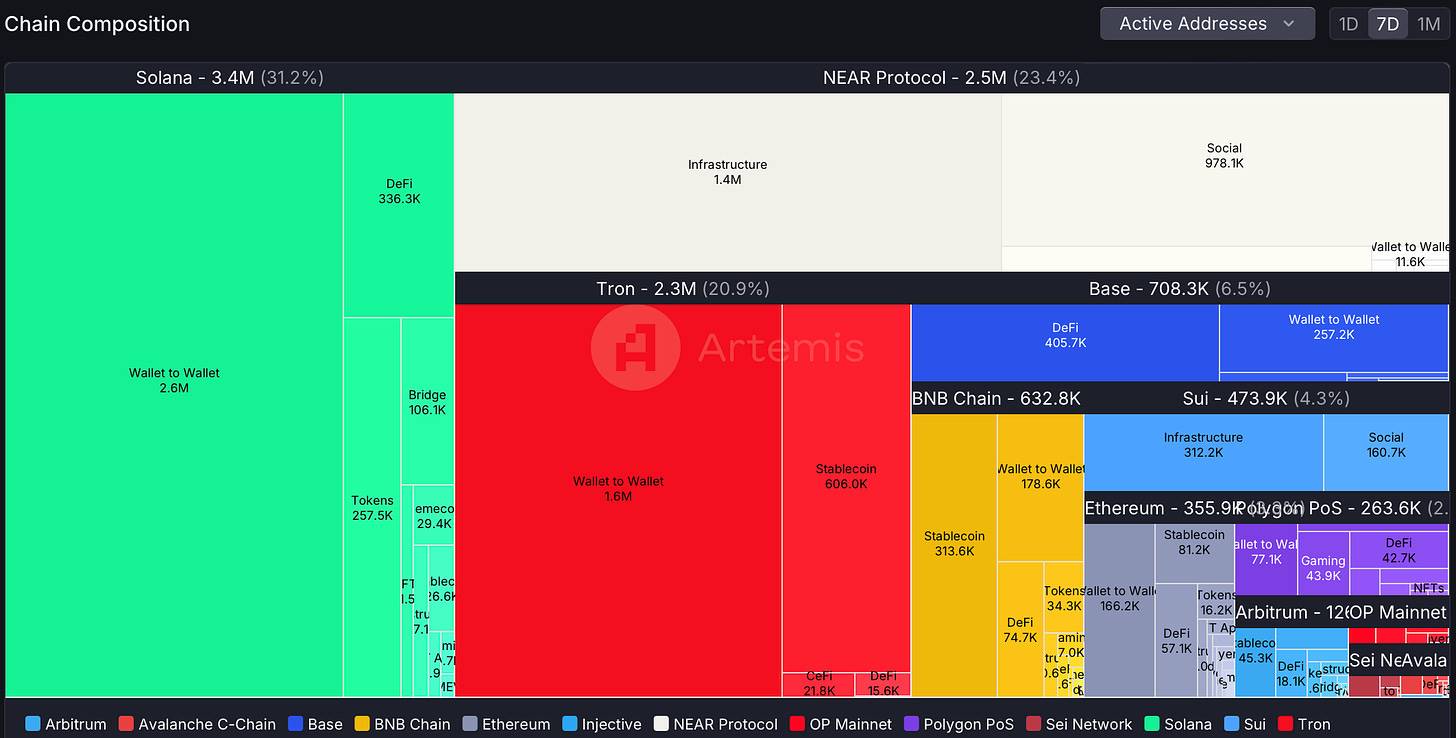

The emergence of stablecoins has enabled global users to easily transfer funds, make payments, and effectively address the challenge of high inflation. On-chain data shows that the supply, transaction volume, and active addresses of stablecoins are all growing significantly. To verify these trends, we interviewed users in Lebanon, India, and the US, and their feedback further confirms the authenticity of this data. Castle Island Ventures recently published a report titled "Stablecoins: The Emerging Market Story", using Artemis' on-chain data to showcase the real-world use cases and rapid growth of stablecoins in emerging markets.

Stablecoins are gradually entering the mainstream.

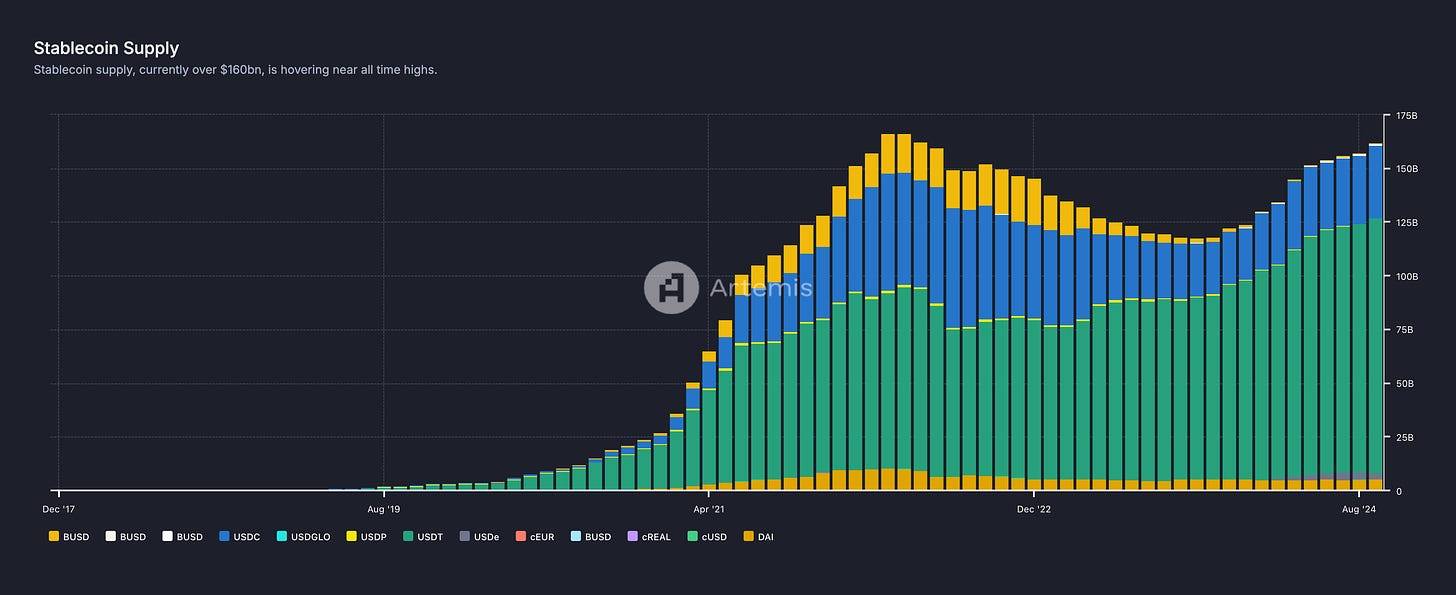

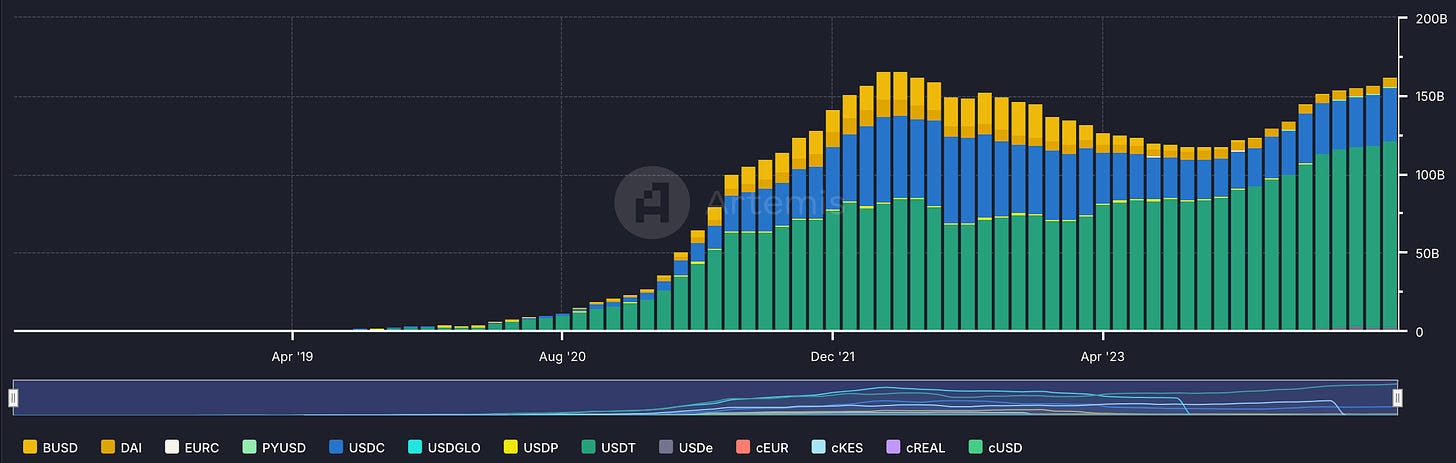

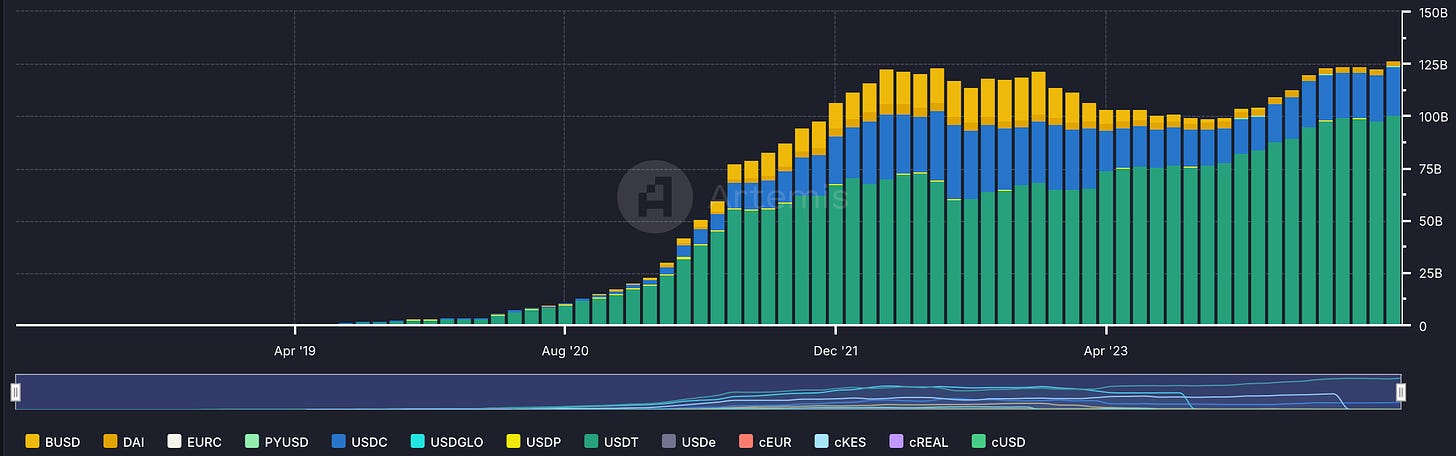

While the cryptocurrency market has experienced cycles of bull and bear markets, several key indicators for stablecoins have continued to break or approach historic highs:

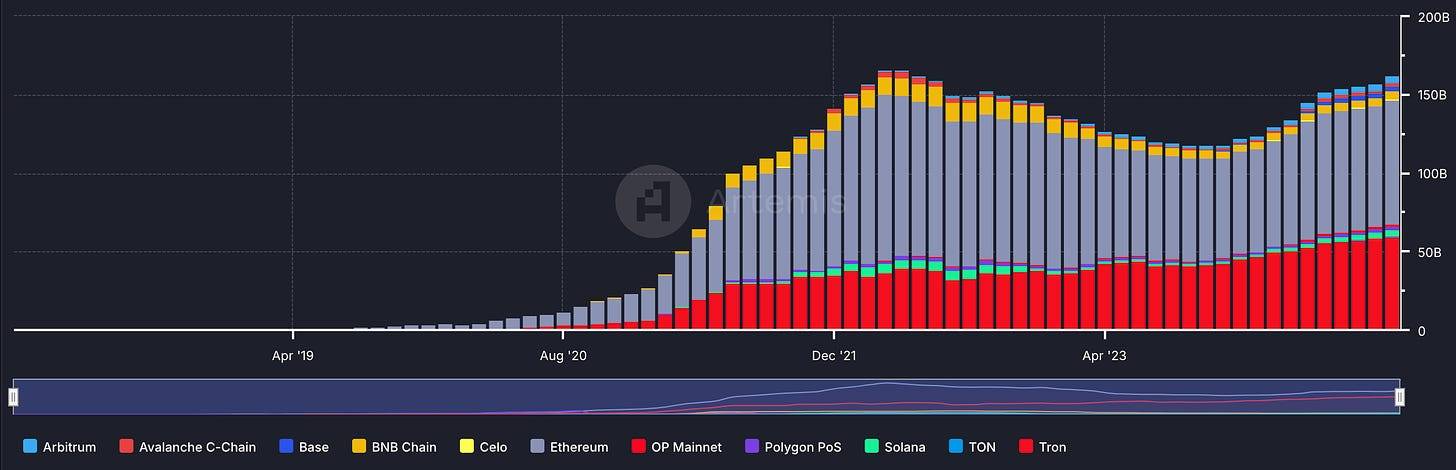

The total supply of stablecoins has exceeded $160 billion, approaching the historical peak.

Stablecoin Supply - Real-time Dashboard

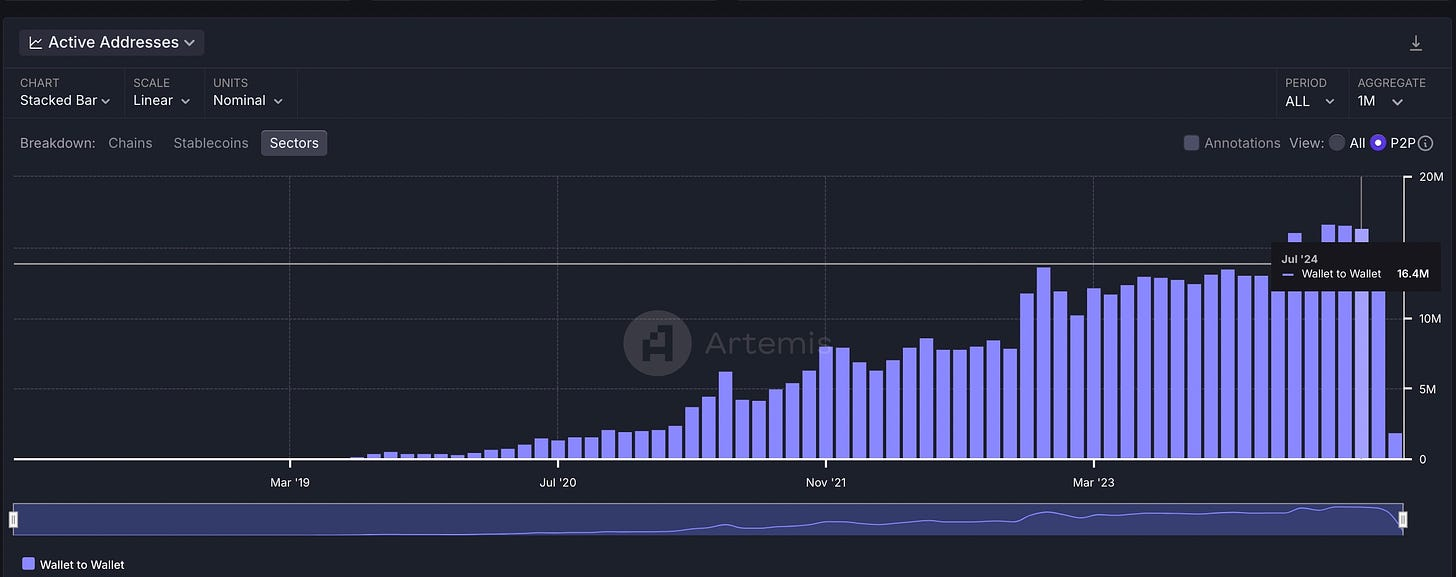

From May to July 2024, there were 16 million active addresses per month, exhibiting peer-to-peer payment behavior through wallet-to-wallet transfers of stablecoins, setting a new historical high.

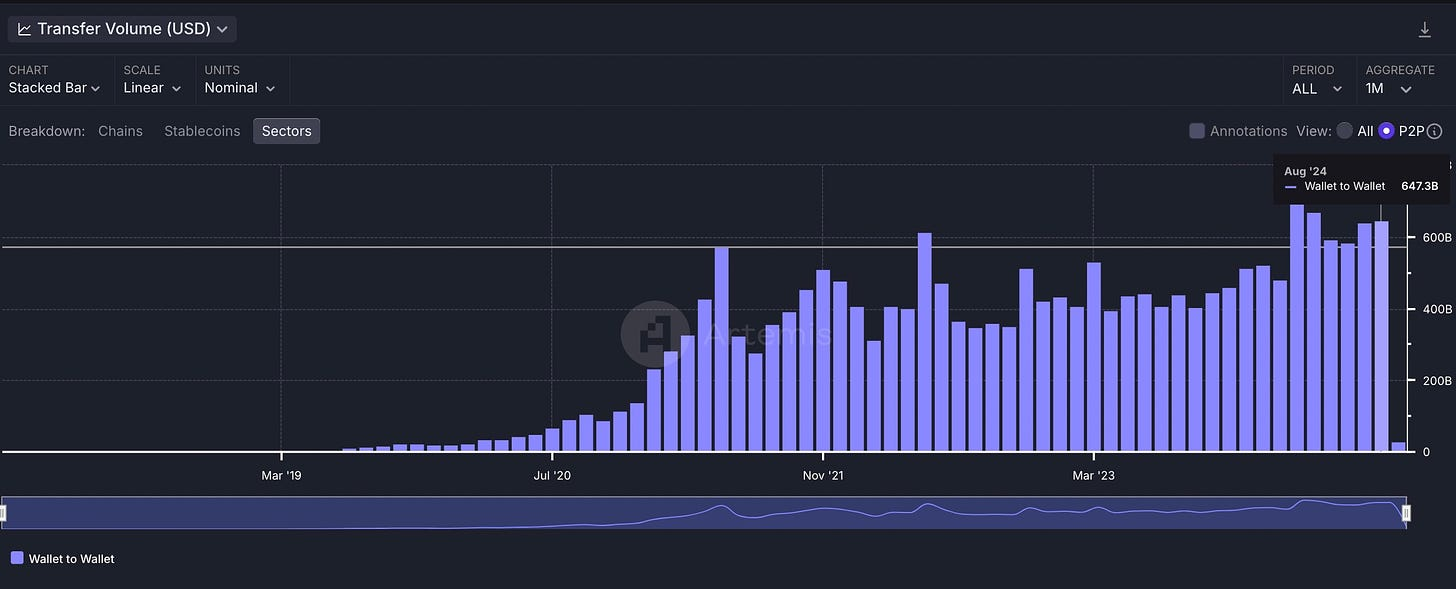

The peer-to-peer transaction Volume of stablecoins surpassed $700 billion in March 2024, once again setting a new record.

Investors are Paying Attention

The conventional view has been that investing in stablecoins is somewhat challenging, as the value of stablecoins is fundamentally pegged to fiat currencies. In most conversations with investors, the focus has tended to be on how stablecoin issuers (such as Circle and Tether) can benefit from this.

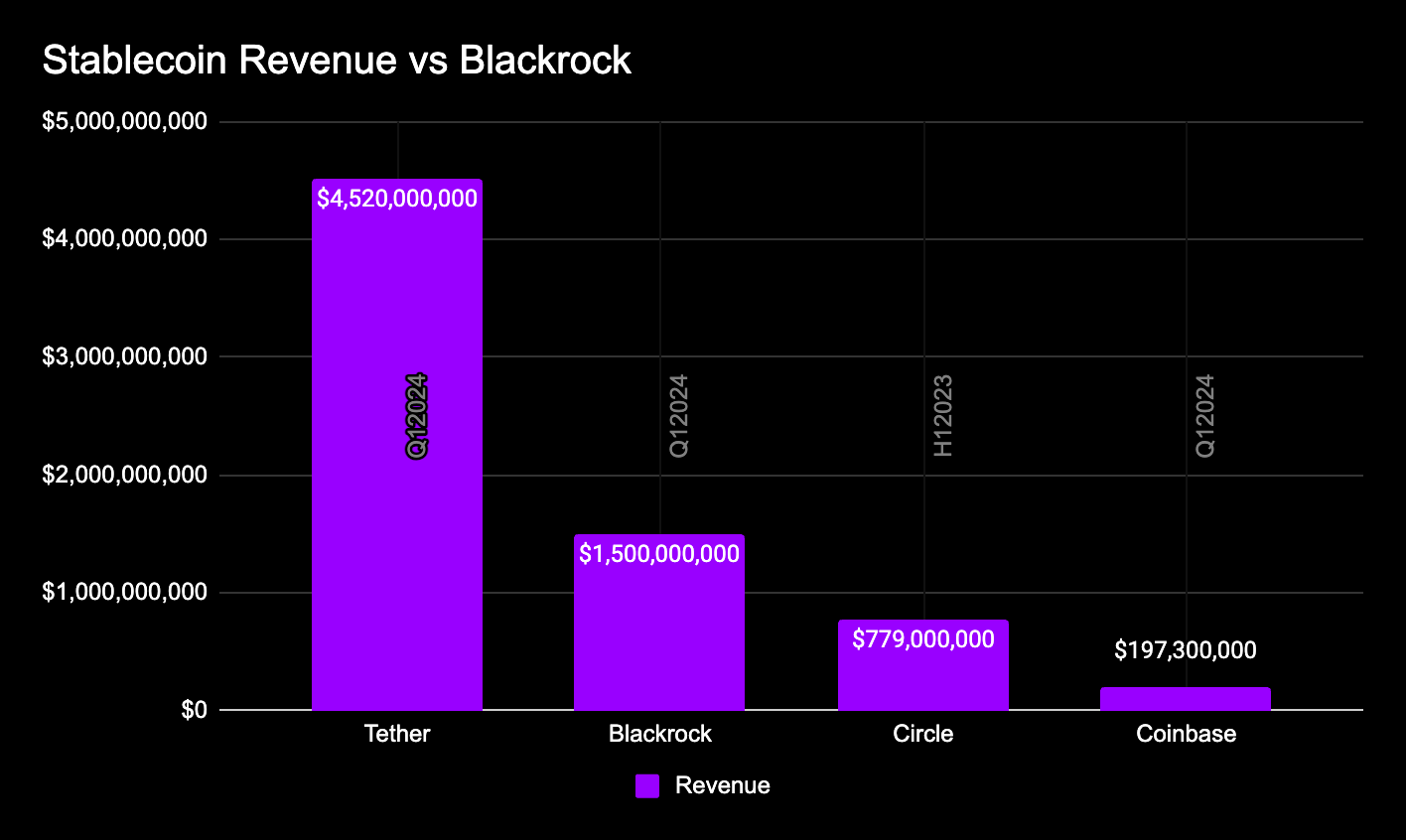

For example, Circle disclosed that it achieved $779 million in revenue in the first half of 2023, while Tether reported a net profit of $4.52 billion in the first quarter of 2024 - a figure that is three times the net profit of Blackrock ($1.5 billion) in the same period.

However, this landscape is changing. In August 2024, several crypto-related payment companies announced over $100 million in funding. For example, Bridge.xyz stated that its clients include SpaceX and Bitso, indicating a growing market demand for stablecoin-related products.

Through our research, we have identified many companies that are accumulating value in the stablecoin space. Today, we are sharing these research findings with the broader community.

In our market map, we hope to show investors and the community that supporting the global adoption of stablecoins is not limited to a single approach. In addition to investing in private companies, there are also opportunities to focus on public blockchains or related Tokens.

The Stablecoin Value Accrual Chain

Blockchains

The operation of stablecoins is inseparable from the blockchain.

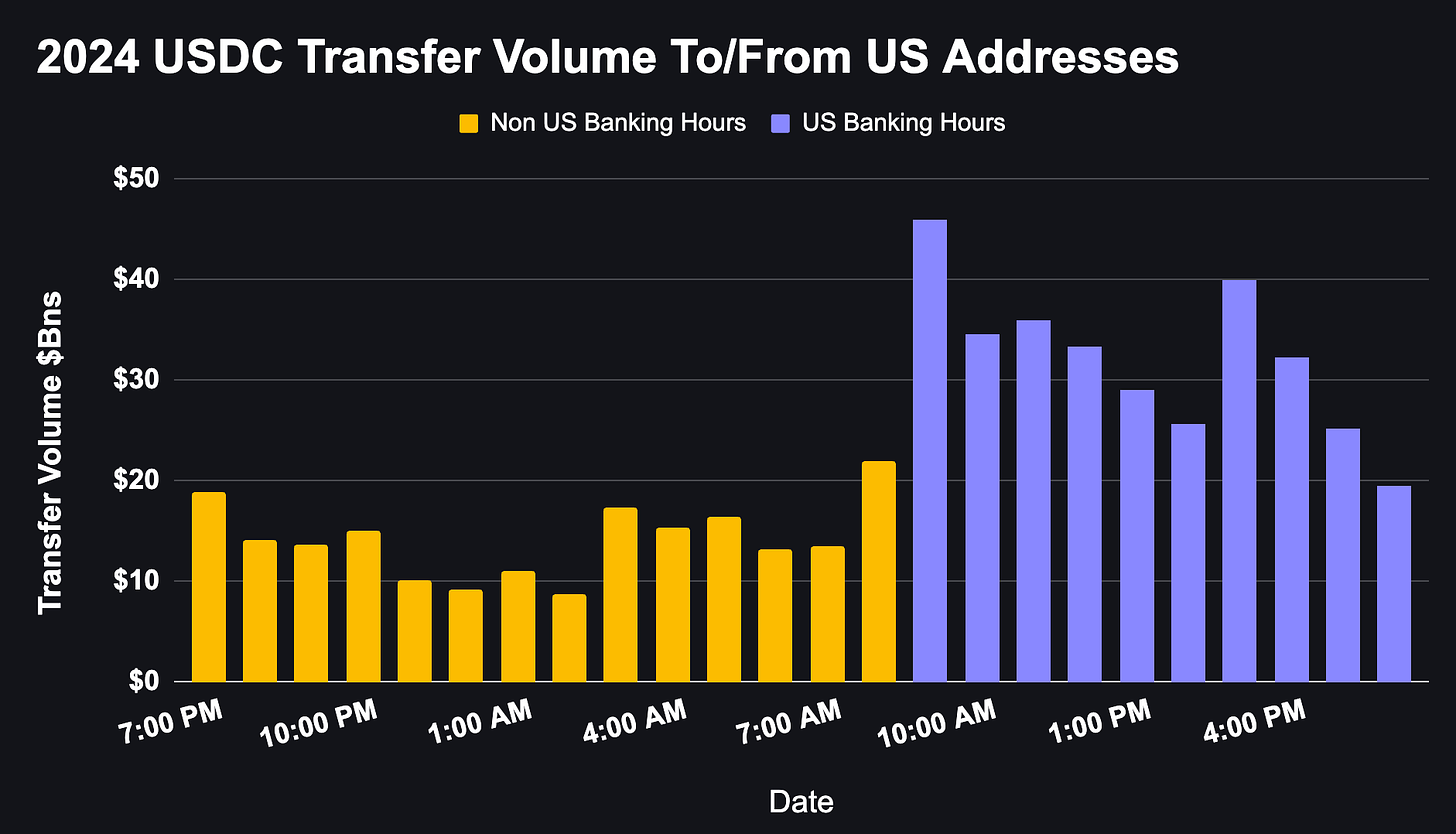

Blockchains play a crucial role in the transactions of stablecoins. As a transparent public ledger, blockchains not only support the final settlement of stablecoin transactions, but also allow anyone to verify the transaction information. Blockchains operate 24/7 without interruption. For example, when looking at the transaction activity of USDC in the US, we observe that it peaks during US bank business hours, but maintains a high level of activity even when banks are closed.

Source: Internal Artemis Data

While Ethereum remains the primary platform for stablecoin transactions currently, some newer blockchains with faster block times and lower fees are driving further growth in stablecoins. These blockchains include Solana, TRON, TON, Base, Celo, Stellar, and BNB Chain. Additionally, new blockchains are continuously emerging, such as Sui, which recently announced a partnership with Circle.

Stablecoin Supply by Chain

Another question worth exploring is: how do blockchains accrue value? When the stablecoin supply on a network grows, does the value of that network also increase accordingly? Using TRON as an example, its price and circulating supply have shown a high correlation as the stablecoin supply has grown, suggesting a potential positive relationship between the two.

Stablecoin Issuers

Stablecoin issuers are the institutions responsible for creating, distributing, and managing stablecoins. To ensure the stability of the stablecoin's value, issuers typically back each stablecoin with reserve assets (such as cash or equivalents). Their main responsibilities include issuing and redeeming stablecoins, managing the reserve assets, ensuring transparency, and complying with relevant regulations.

Currently, Tether is one of the major stablecoin issuers, and it is reported that its net profit in the first half of 2024 has exceeded $5 billion. Meanwhile, Circle is also considering an IPO with a valuation of around $5 billion.

Additionally, there are some stablecoin issuers that provide yield, such as Mountain Protocol (with a circulating supply of around $48 million). These issuers generate profits from the spread between the assets they hold and the interest paid to holders, while also providing additional yield for users.

Stablecoin Supply by Issuer

Stablecoin Infrastructure

To help stablecoin issuers quickly and compliantly issue stablecoins, and to allow applications that want to utilize stablecoins to easily convert between fiat and cryptocurrencies, the stablecoin ecosystem requires robust infrastructure support. These companies form the infrastructure layer of the stablecoin ecosystem.

On the fiat side, companies like Bridge.xyz and Brale.xyz provide APIs and infrastructure tools for developers and enterprise teams, enabling smooth flow of funds between fiat and stablecoins. These fiat-stablecoin infrastructure companies help businesses achieve cross-border payments, issue their own stablecoins, and provide convenient fund management tools. They also take on the complex regulatory, compliance, and technical work, which can be costly and time-consuming.

Time-saving: For example, Glo Dollar (a stablecoin focused on funding charitable projects) was able to successfully issue Glo Dollar in a matter of weeks through these infrastructure providers, compared to a traditional process that could take up to 6 months.

24/7 Service: Users can now make stablecoin transfers at any time, with companies like Bridge.xyz serving as the backend infrastructure to ensure 24/7 availability.

On the on-chain side, companies like Perena and M^0 use decentralized protocols to help stablecoin issuers achieve scalable expansion while avoiding liquidity fragmentation issues. These protocols position themselves as "capital middleware" for stablecoin issuers, providing efficient on-chain support.

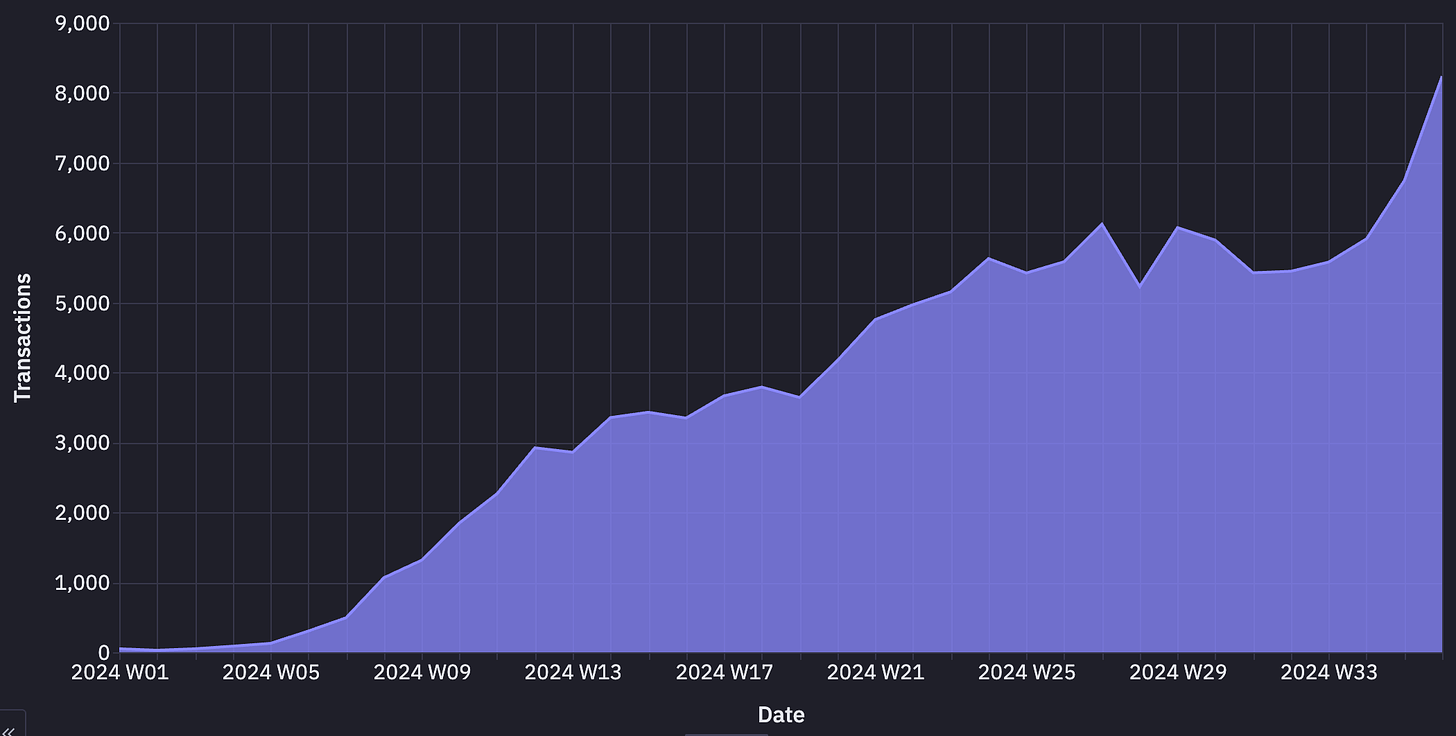

On-Ramps

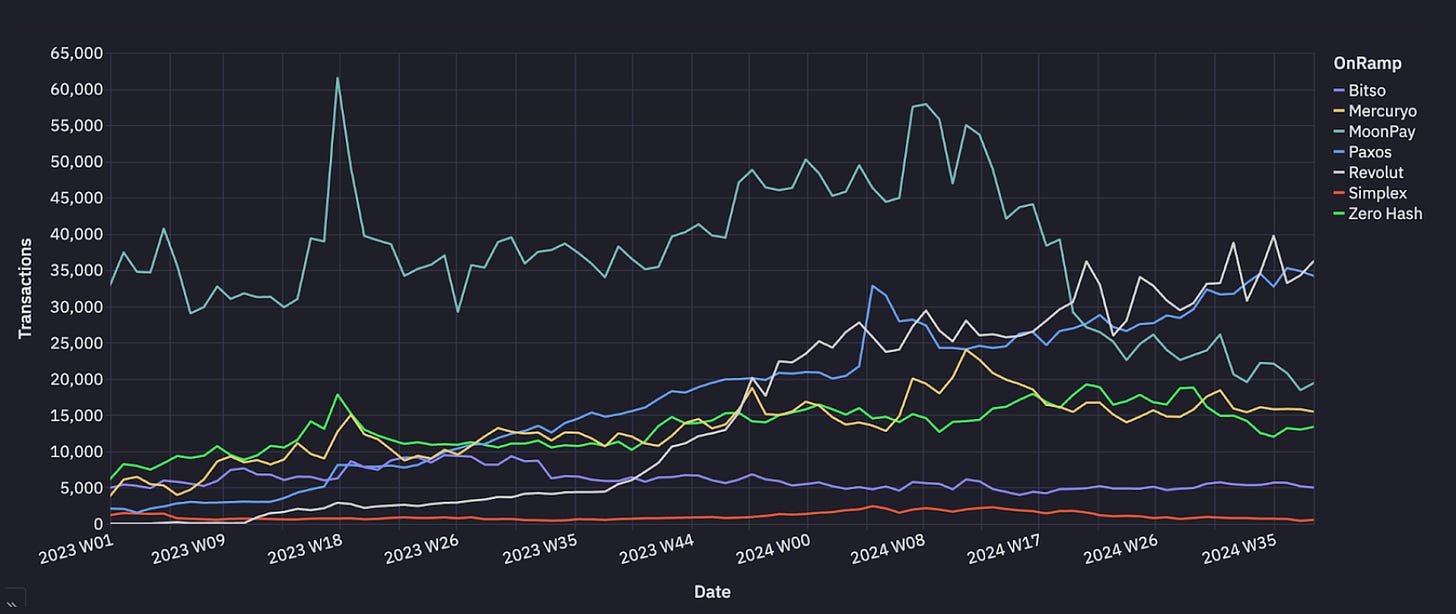

Crypto-to-fiat on-ramp services (such as MoonPay and Transak) allow users to directly purchase cryptocurrencies using traditional payment methods (like credit cards, bank transfers, or mobile payments). These services typically deposit the user's cryptocurrencies directly into digital wallets like MetaMask and Coinbase Wallet, without the need to go through traditional cryptocurrency exchanges. These companies usually charge a small fee to cover the costs of infrastructure operation, KYC (Know Your Customer) processes, and other services. As shown in the chart below, the activity of crypto-to-fiat on-ramps on Ethereum has been steadily increasing since 2023.

Crypto-to-Fiat On-Ramp Activity on Ethereum

Source: Internal Artemis Data

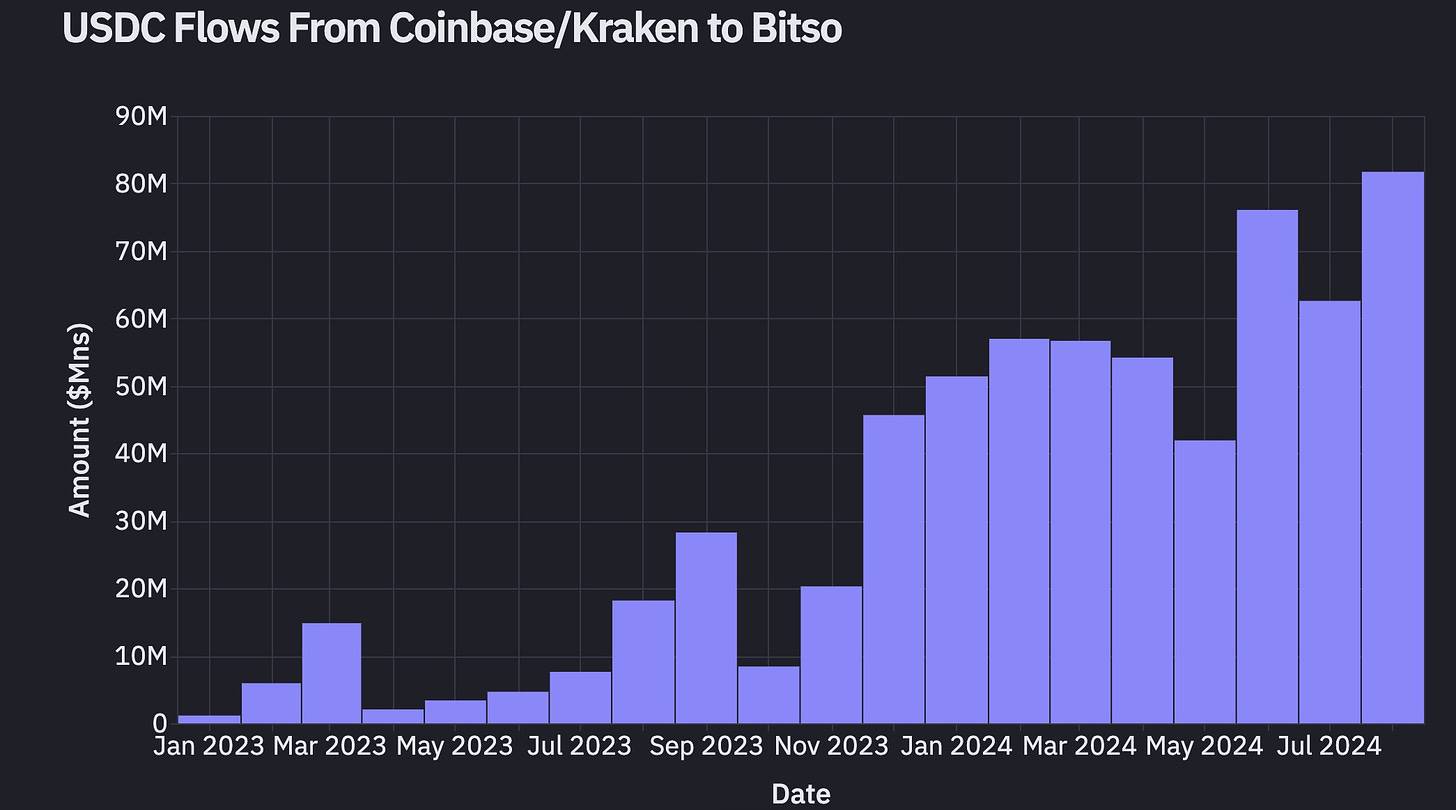

Cross-Border Payments/Remittances/P2P

Many companies are using stablecoin technology to simplify cross-border payments and remittance processes. These applications are often designed to be very intuitive, hiding the underlying cryptocurrency technology and allowing users to complete transactions without needing to understand the technical details. These companies typically charge fees that are much lower than traditional remittance companies, while also providing more competitive exchange rates. For example, the volume of stablecoin transactions from Coinbase or Kraken to Bitso (an exchange in Mexico City) is gradually increasing, indicating the growing application of stablecoins in cross-border remittances.

Source: Internal Artemis Data

Peer-to-peer (P2P) crypto transactions, often referred to as the "global Venmo", provide users with a convenient way to transfer funds globally. Companies like TipLink and Sling offer extremely simple user interfaces, allowing anyone to easily receive payments through the cryptocurrency network. More importantly, the users of these products typically do not even know they are using cryptocurrencies, achieving a truly seamless user experience.

Monthly P2P Stablecoin Transfer Volume by Stablecoin

Wallets

Cryptocurrency wallets provide users with a self-custodial way to fully control their digital assets. These wallets typically support multiple blockchain networks, allowing users to store and manage various types of crypto assets. Additionally, many wallets have built-in fiat-to-crypto on-ramp services, making it more convenient for users to purchase cryptocurrencies. According to Artemis data, wallet-to-wallet transfers are one of the largest application scenarios on the blockchain currently.

Source: Artemis

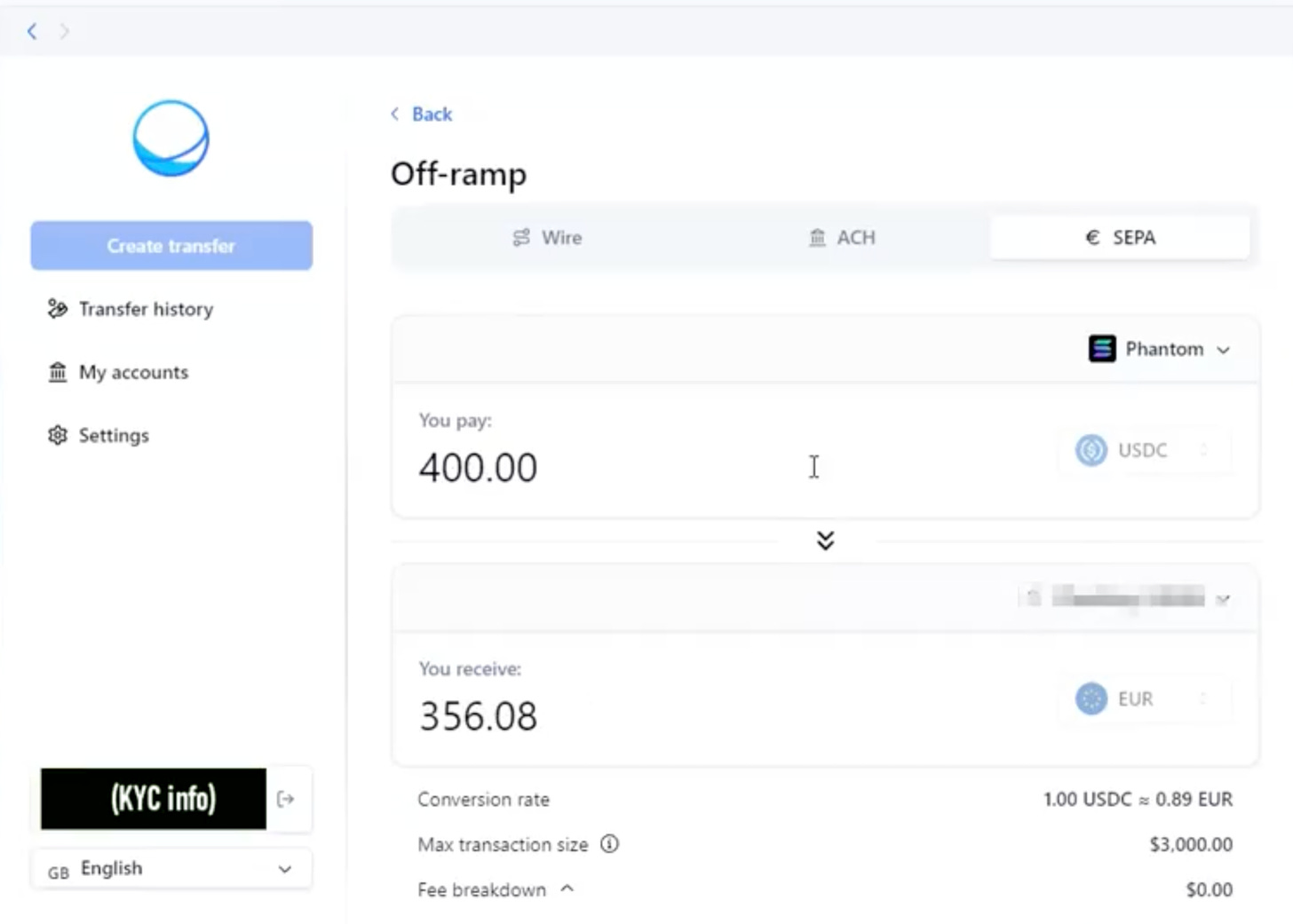

Here is an example of a seamless transfer using Sphere. Users can select the transaction type (e.g., fiat-to-crypto or crypto-to-crypto exchange) and payment method (such as wire transfer, ACH, or SEPA), with the entire transaction settled in just a few minutes, fast and efficient.

Cards and Card Processors

Cryptocurrency credit cards and payment processors are collaborating to provide users with the convenience of spending cryptocurrencies directly. The significance of this service is that users can complete payments within the cryptocurrency ecosystem without the need to convert their cryptocurrencies back to fiat. For example, Visa allows for the settlement of transactions between consumers and merchant acquirers using stablecoins.

Last year, Gnosis Pay launched a Visa card that allows European users to conduct credit card transactions directly through the Gnosis Safe wallet. Although the user base is still small, Gnosis Pay's various metrics show a continuous growth trend.

Gnosis Pay Weekly Transaction Volume

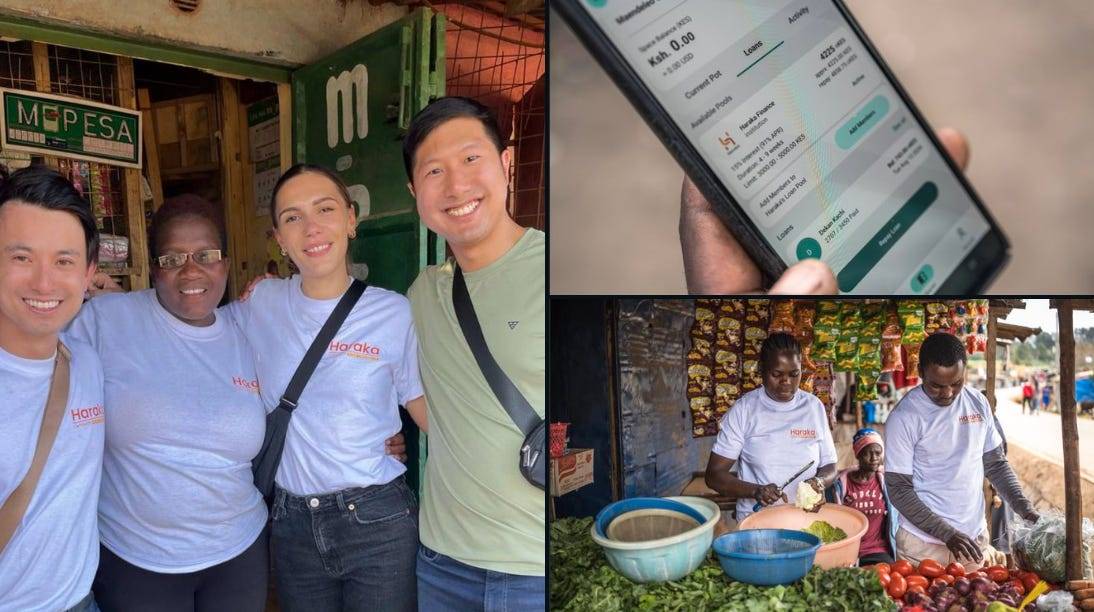

Microlending

These companies provide loans to small businesses or individuals using blockchain technology. Enterprises like Haraka and Goldfinch focus on offering lower-interest loan services to businesses in emerging markets. Due to the characteristics of blockchain technology, funds can be disbursed almost instantly, and transaction costs are significantly reduced, providing a new solution for markets that traditional banks cannot effectively serve.

Payroll

More and more companies are starting to support employees receiving their salaries in cryptocurrencies. As the global economy expands and remote work becomes more prevalent, establishing a globalized financial system that can quickly and efficiently pay salaries has become increasingly important. Some systems are experimenting with real-time payment capabilities, allowing employees to receive their salaries on a weekly, daily, or even second-by-second basis.

Ravi Kiran (Growth Manager) shared a story of a freelancer choosing to be paid in stablecoins:

"I once worked with a freelancer from an emerging country who recently received a payment in USDC. She kept saying this payment method was much better than using the local currency (saving on taxes, stable in value, and worth more than the local currency). It was only then that I realized there is a story behind every payment. Two months later, she had completely switched to stablecoin payments. I believe that as business payments become more widespread, the influence of Circle and Tether will continue to grow."

Stablecoin Analytics

Artemis, in collaboration with partners like Allium, RWA.xyz, and Flipside, provides in-depth analytical services on the stablecoin market. Allium has partnered with Visa to launch the Visa On-Chain Analytics Dashboard, while the RWA platform provides many key data metrics on stablecoins and their issuers.

We believe that as the stablecoin market continues to expand, the demand for understanding the drivers behind stablecoin usage will also grow.

What's Next for Stablecoins?

With inflation rates continuing to rise through 2024, the applications of stablecoins are also rapidly expanding. According to the CIV / Visa / BHD Stablecoin Report, stablecoins have become the second-largest use case after cryptocurrency trading. We predict that the adoption of stablecoins will continue to rise in the future.

This growth may create network effects: as friends, family, or businesses in a particular region start widely using stablecoins, it will attract more local users, like a "global Venmo". This scaling of user base will further increase the liquidity of the entire network. Additionally, we expect the US to introduce regulations to support the global demand for the US dollar through stablecoins.

While the current stablecoin supply in the market is primarily denominated in US dollars, we also see the adoption of non-US dollar stablecoins gradually increasing. For example, euro-based stablecoins are gradually increasing their circulation, and Bitso recently launched a Mexican peso-based stablecoin MXNB, signaling the potential of regional stablecoins.

At the same time, yield-bearing stablecoins are receiving increasing attention. These stablecoins not only provide users with the opportunity to grow their assets, but also become an important source of funding for US Treasury bond holders. For instance, Ethena has launched an innovative "Delta-neutral yield generation mechanism" that maximizes yields through unique strategies, making it one of the fastest-growing stablecoins.

How Artemis Can Help

Artemis is dedicated to providing in-depth analysis on the stablecoin space, helping users and businesses better understand stablecoin usage trends and market dynamics. We have collaborated with Nic Carter and his Castle Island Venture team to produce the most comprehensive stablecoin analysis report to date, leveraging on-chain data support.

If you are interested in the stablecoin market or need help analyzing stablecoin adoption, feel free to reach out to us anytime! You can find us on X.com or contact us via email at team@artemis.xyz.

Special thanks to Anna from Perena, Isaiah Washington, Peter Schroeder from the Castle Island Ventures team, EffortCapital, and all the users who provided suggestions on Twitter here.