Background and Vision

THENA was founded by a group of experienced DeFi developers, committed to breaking through the current barriers in the DeFi market and building a more inclusive, user-friendly, and efficient decentralized finance platform. The team's vision is to make THENA the "SuperApp" of the DeFi field, meeting the needs of various assets through modular liquidity solutions, including Stablecoins, Liquidity Staking Tokens (LSTs), Real-World Asset Tokenization (RWAs), Memecoins, and AI tokens. At the same time, THENA is committed to making on-chain transactions simpler, so that both novice and experienced users can enjoy a CEX-level user experience.

What is THENA?

THENA is a trading hub and liquidity layer built on the BNB Chain and opBNB, dedicated to providing DeFi users with a convenient experience similar to a centralized exchange (CEX), while maintaining the advantages of high decentralization. As a modular "SuperApp" ecosystem, THENA offers a full suite of products and services covering spot trading, perpetual contract trading, social trading, and an upcoming project launchpad.

The THENA ecosystem includes:

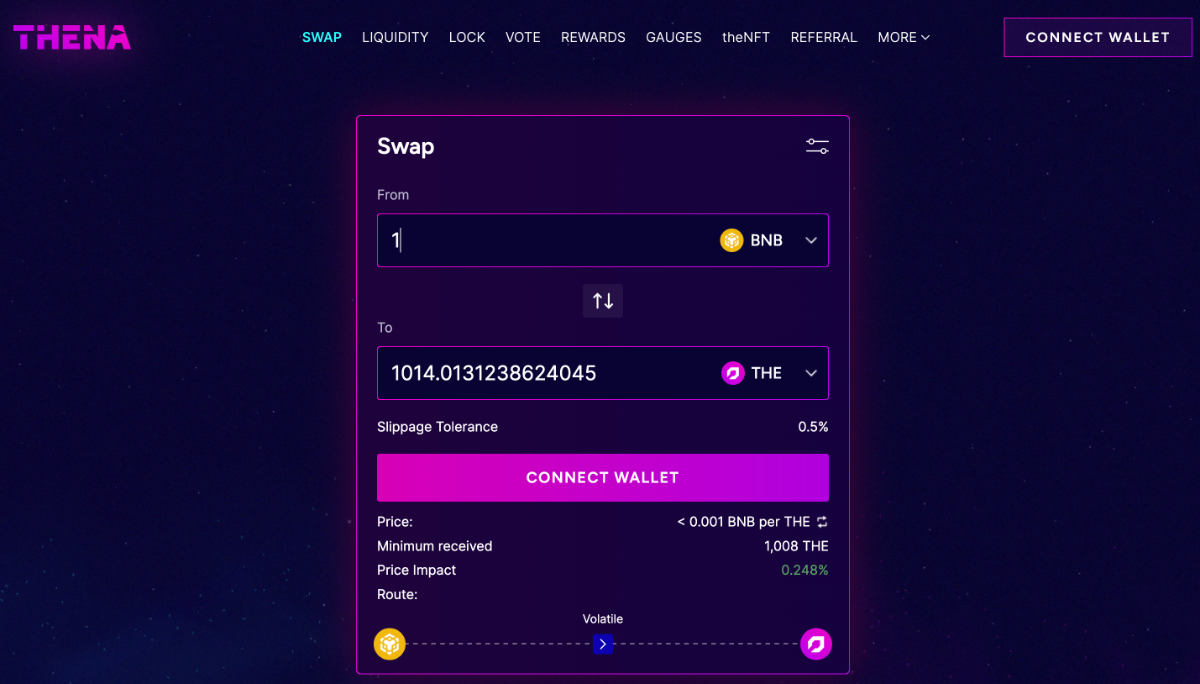

- THENA: A decentralized spot exchange (Spot DEX) where users can swap tokens, acquire assets, and earn passive income.

- ALPHA: A decentralized perpetual contract exchange (Perpetuals DEX) that supports leveraged trading of over 270 crypto asset pairs, with a maximum leverage of 60x.

- ARENA: A social trading platform that provides gamified experiences for users through a competition mechanism, while also offering growth tools for partners.

- WARP: An upcoming project launchpad.

Core Features

- Wallet abstraction and fiat on/off-ramps: Simplifying the user onboarding process and supporting seamless integration between traditional finance and DeFi.

- Cross-chain bridging: Enabling the transfer of assets across blockchains, enhancing user flexibility.

- Asset acquisition and yield services: Users can earn yields through single-asset staking (e.g., BTC, ETH, BNB, USDT) or use the spot market for instant trading.

- Trading and derivatives services: Supporting crypto derivative trading with high leverage options.

- Liquidity management and incentives: Utilizing the ve(3,3) incentive model and a modular AMM system to provide liquidity solutions for partners, catering to specific needs.

With its robust technical foundation and user-friendly design, THENA is not only a DeFi platform but also a bridge connecting decentralized finance and traditional finance, providing innovative and convenient services for the future user base.

Innovative Technologies and Solutions

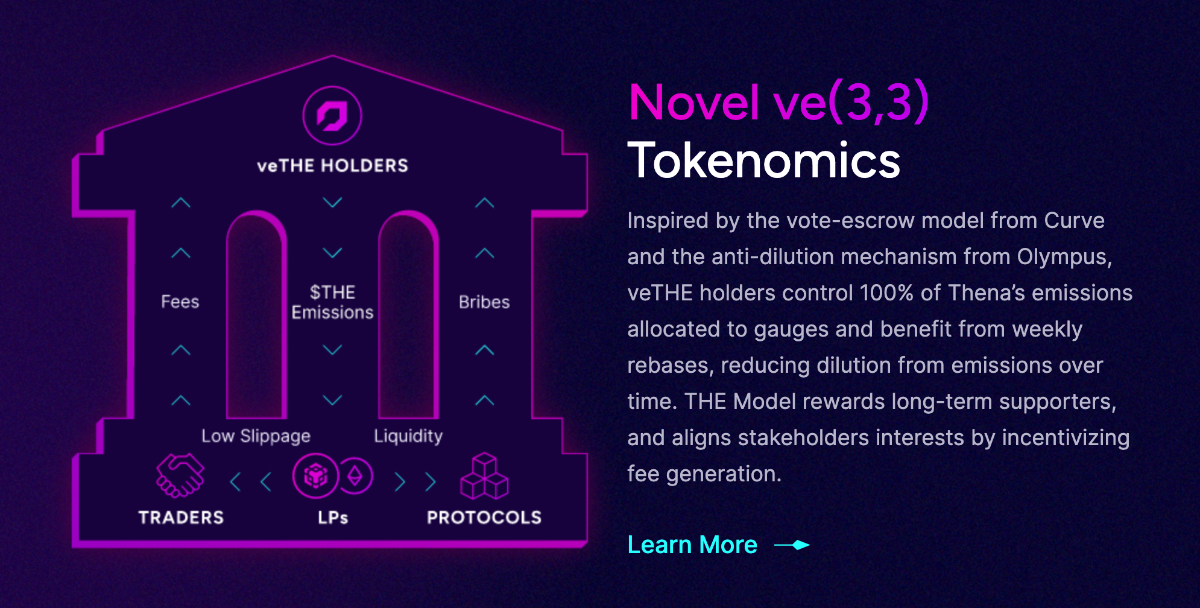

Improved ve(3,3) Model

THENA's core innovation lies in the introduction of the ve(3,3) model. This mechanism is based on the design of Solidly, with important optimizations:

- Locking and Governance Participation: Users can lock their $THE tokens into veTHE, and the longer the lock-up period, the more voting power they have. veTHE holders not only receive a share of the trading fees but can also influence the allocation of liquidity pool incentives through governance voting.

- Bribery Mechanism: Other protocols or stakeholders can pay bribes to veTHE holders to gain their voting support, allowing veTHE holders to earn additional rewards through governance.

This design creates a positive feedback loop between users and the platform: users who lock their veTHE receive ongoing rewards, further enhancing the platform's liquidity and governance vitality.

Dual AMM Model

THENA adopts a combination of vAMM and sAMM to address the liquidity needs of different asset types:

- vAMM (Virtual Automated Market Maker): Suitable for general crypto asset trading, optimizing capital efficiency and pricing mechanisms.

- sAMM (Stable Automated Market Maker): Designed for trading similar assets (such as stablecoins), providing an extremely low slippage experience.

This combination improves user trading efficiency and reduces the threshold for liquidity provision.

Deep Integration with BNB Chain

THENA's deep deployment on the BNB Chain has led to a significant improvement in transaction speed and effective reduction in slippage. Leveraging the ecosystem advantages of the BNB Chain, THENA can attract more new users and drive the DeFi ecosystem towards higher capital efficiency.

Token Economics and Incentive Mechanism

THENA's economic system is designed around three core tokens: $THE, veTHE, and theNFT. These three tokens have different uses and are interconnected, collectively building a robust DeFi ecosystem.

1. $THE: Platform Native Token

$THE is the base token of the THENA platform, like a "ticket" to enter the THENA world. It can be used to:

- Incentivize Liquidity Providers: By rewarding users who provide liquidity, it attracts more participants and creates a better trading environment.

- Participate in Governance: Users can lock their $THE into veTHE to gain platform governance rights and a share of the trading fees.

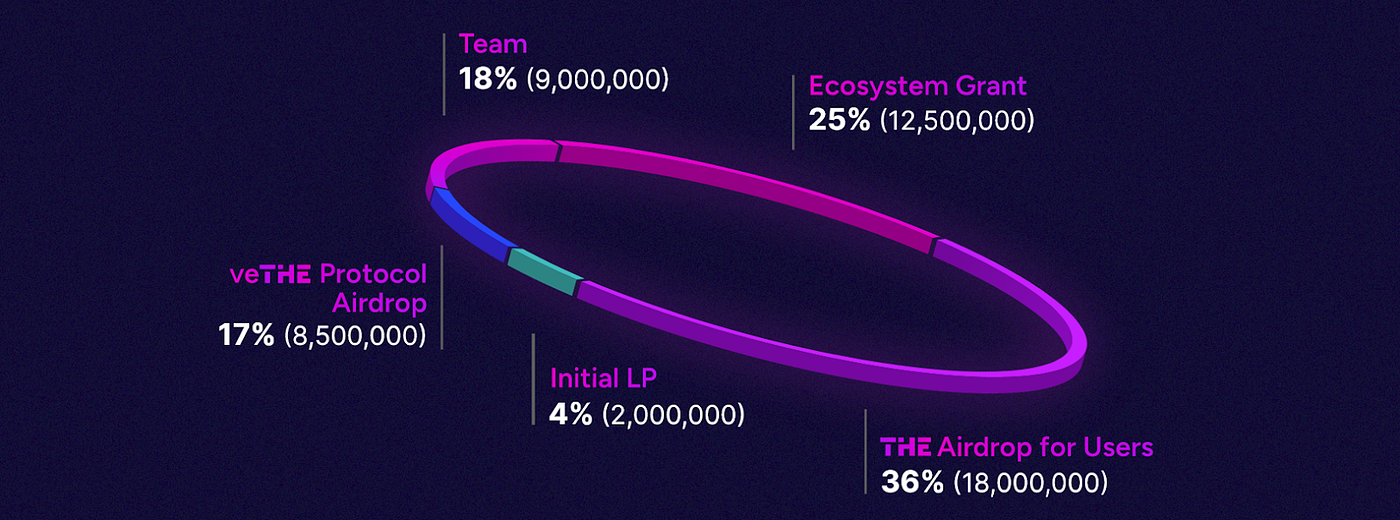

$THE Distribution Plan:

- theNFT Minter Airdrop: 9% of the initial supply is allocated to theNFT minters, who can claim it immediately upon the THENA platform launch. 40% of this allocation will be distributed as locked veTHE with a 2-year lock-up, and 60% will be distributed as $THE.

- Ecosystem Grants Fund: 25% of the initial supply is dedicated to supporting various projects aimed at accelerating THENA's development. Selected projects will receive support from the core team in areas such as smart contract development, marketing, and business expansion.

- Team Allocation: 18% of the initial supply is allocated to the team members, to incentivize their long-term commitment to THENA's success. 60% of this allocation will be distributed as locked veTHE with a 2-year lock-up, and 40% will be distributed as $THE, with a 2-year vesting period and a 1-year cliff.

- Initial Liquidity Providers: 4% of the initial supply is paired with $BUSD and/or $BNB to provide sufficient liquidity for the platform's launch.

- Emission Mechanism: The initial weekly emission is 2,600,000 $THE, decreasing by 1% per week. 67.5% of this emission is allocated to liquidity providers, 2.5% to the developer wallet (reduced from the original 4%), and up to 30% for the weekly veTHE base reward (Rebase). Under this emission plan, the theoretical maximum supply of $THE is 310 million.

Through the above distribution plan, THENA aims to incentivize early supporters, ecosystem partners, and team members to participate in the long-term development of the platform, ensuring its sustainable growth.

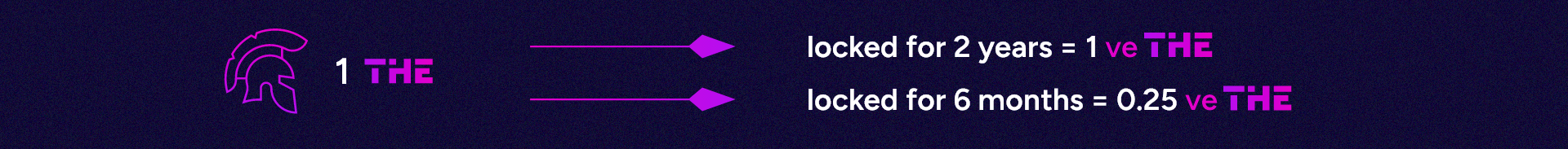

2. veTHE: Governance and Long-term Yield Token

veTHE is the "advanced version" of $THE, obtained by locking $THE (up to 2 years). Its functions include:

- Governance Voting Rights: veTHE holders can vote to determine which liquidity pools receive more incentives, influencing the platform's resource allocation.

- Fee Sharing: veTHE holders can receive a portion of the platform's trading fees, directly sharing in the growth of the platform.

- Bribery Income: Protocol projects can pay "bribes" to attract veTHE holders to support their liquidity pools, allowing veTHE holders to earn additional rewards.

veTHE is the locked version of $THE, with the key difference being that $THE is more flexible and can be traded or used at any time, while veTHE is more suitable for long-term investors as it locks up $THE but provides additional rewards.

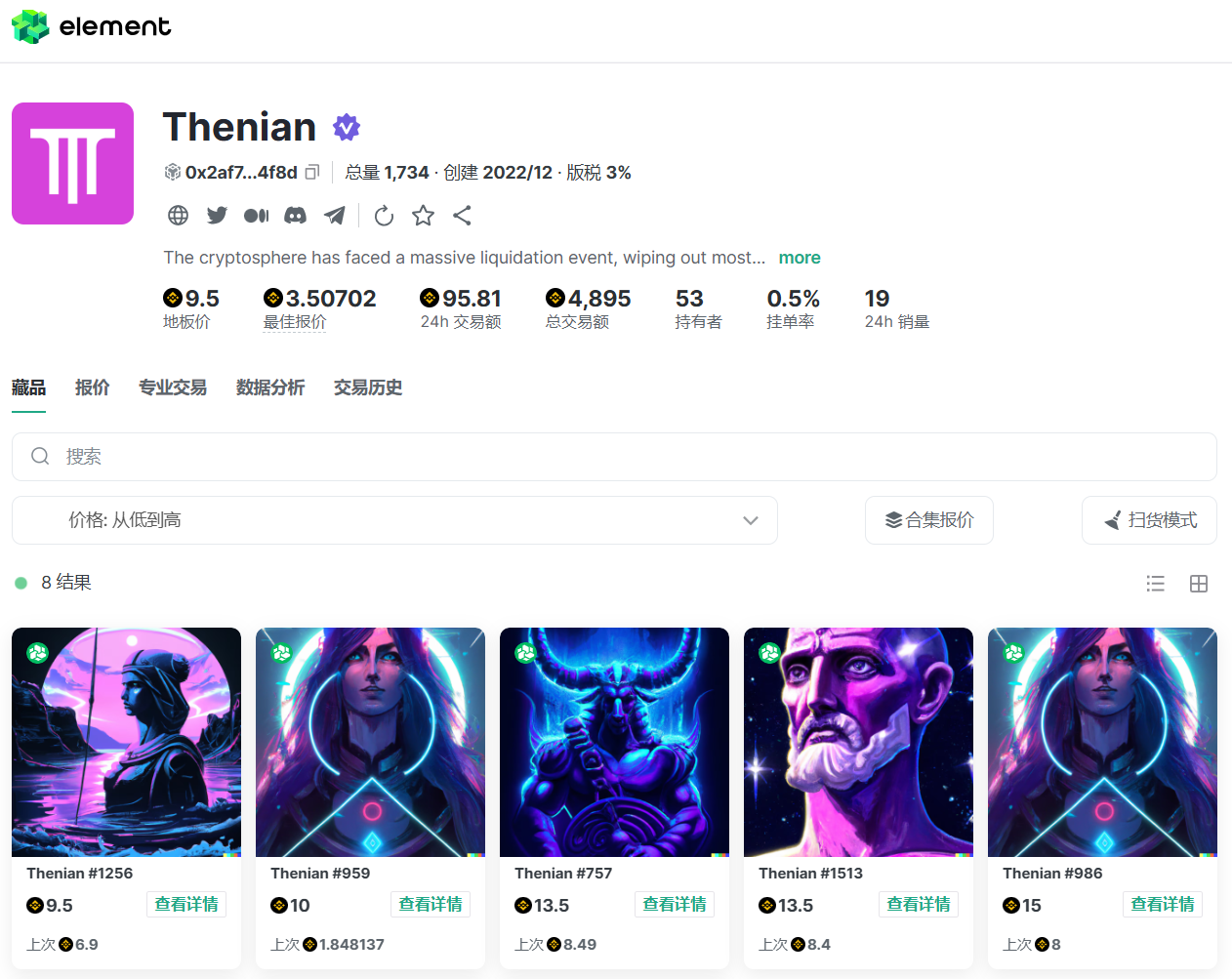

3. theNFT: Founder's Token

theNFT is a unique asset of THENA, primarily targeting early supporters. Its functions include:

- Revenue Rights: Holders can obtain a share of the platform's transaction fees by pledging the Non-Fungible Token.

- Asset Scarcity: The number of Non-Fungible Tokens is limited, and each Non-Fungible Token represents a portion of "ownership" of the THENA platform.

The Non-Fungible Tokens do not directly participate in governance, but they provide another way to earn passive income through the THENA platform, attracting long-term supporters and investors to the platform.

Summary

Relying on the ve(3,3) model, dual AMM design, and deep integration with the BNB Chain, THENA has successfully solved the problems of insufficient liquidity and low efficiency of incentives in the DeFi ecosystem. Through a fair and transparent fee distribution and multi-dimensional revenue model, THENA not only provides users with strong economic returns, but also builds a stable long-term relationship between users and the platform.

Looking to the future, THENA has the potential to become a benchmark for DeFi liquidity ecology, leading decentralized exchanges to a more efficient and fairer new stage. We look forward to THENA's continuous innovation, bringing new possibilities to the entire industry.