Author:adam

Compiled by: TechFlow

Before getting to the main topic, please remember that trading is a complex and high-risk activity.

There is no method that can quickly grow your account without any losses.

In fact, those who can quickly grow their accounts often do so by taking on enormous risks, even bordering on desperation.

The focus of this article is not to tell you to patiently wait for ideal market conditions, nor to teach you how to deeply analyze the market.

Instead, I will share some methods to help you achieve rapid account growth while maintaining reasonable risk control.

If you are not familiar with the basic concepts of "risk management", I strongly recommend that you read this article on risk management first.

If you find this article helpful, you can also check out the other content on the blog, or join the Tradingriot Bootcamp to access the complete video course, join the private Discord group, and receive regular updates on trading strategies.

Why choose to trade in niche markets?

If you primarily trade BTC, ES (S&P 500 futures), major forex pairs, or gold,

you will directly face retail traders like yourself, as well as compete with large institutional players and quantitative firms.

This is mainly because these markets have extremely high liquidity, allowing large capital players to easily participate in the competition.

Although trading these markets is not impossible, if you don't have enough capital, you will actually have more advantages in markets with lower liquidity.

For example, many Altcoin derivatives, Non-Fungible Tokens (NFTs), or on-chain tokens are not very attractive to large players because the liquidity in these markets is insufficient to meet their trading volume requirements.

When I started to delve deeper into the Altcoin market, I often found the clearest trading signals in markets with lower liquidity.

Initially, I was very confident in these "low-threshold" markets, but when I tried to execute large positions, I realized that my orders were highly visible in the order book, making me aware of the disadvantages of low liquidity.

However, for small account traders, this is not a major concern, as the liquidity problem will only truly affect you when your order size reaches the high five-digit or six-digit range.

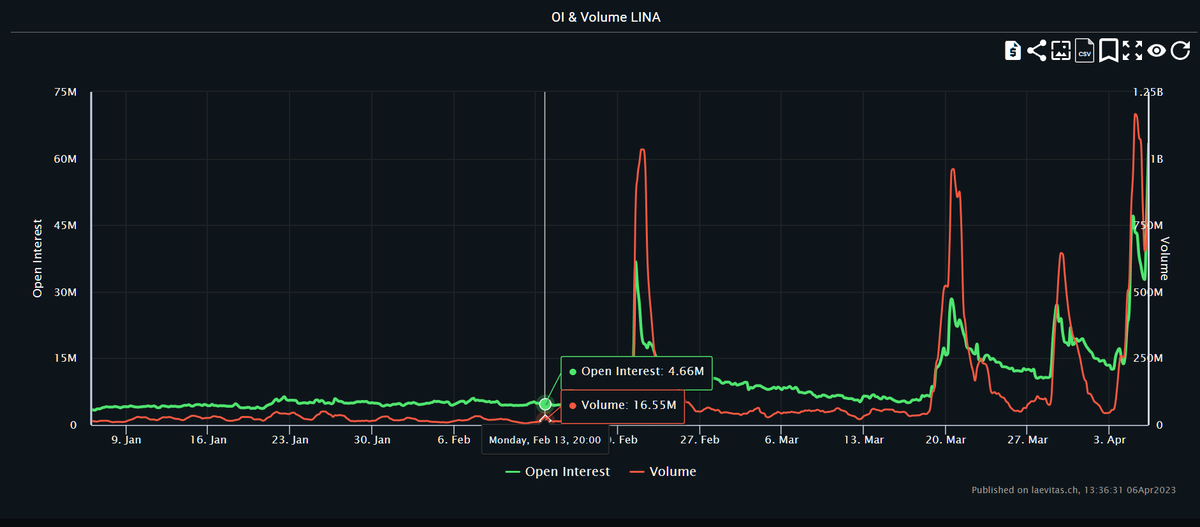

Taking Velo on Lina as an example, the chart shows that potential breakout signals for Lina can be observed a few days before the actual breakout occurs.

Such opportunities can potentially generate significant profits, but we also need to consider the potential risks.

By checking the trading volume and open interest data for Lina on the Laevitas platform, we can see that before the breakout, Lina's daily trading volume was 16 million, and the open interest was 4.5 million.

If the trade fails and you hold a large position, your stop-loss may be triggered with significant slippage, resulting in actual losses far exceeding your expectations. However, for small account traders, their position sizes are smaller, and their stop-losses can often be triggered near the ineffective point, so they won't face this problem.

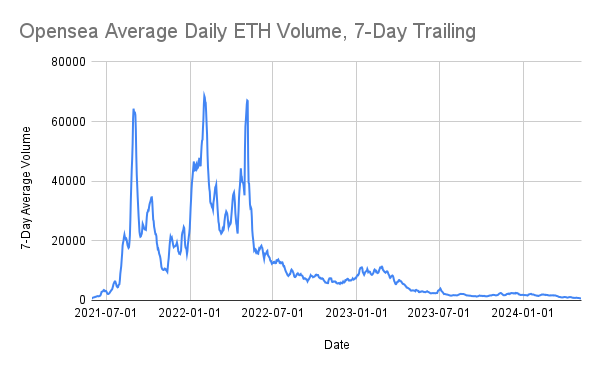

Low-market-cap Altcoins are not the only things you can participate in. On-chain tokens or Non-Fungible Tokens (NFTs) are also options.

When trading, the most important thing is to be aware of where the "meta" is currently.

For example, NFTs were very popular a few years ago, but have now faded.

You need to understand the speed of information dissemination in this field, so that you can avoid taking unnecessary risks and not miss out on significant gains by selling too early.

On-chain trading is very challenging. Although you may see many success stories on platform X, the likelihood of turning "1 SOL" into "1000" is actually very low.

In on-chain trading, there are some unique strategies you can use, such as tracking different wallets, analyzing the distribution of holdings, or simply using common sense to avoid tokens that are heavily promoted by Key Opinion Leaders (KOLs).

Apart from that, you'll find that using simple support, resistance, or trading indicators is usually sufficient to handle trading, especially for larger-cap and lower-risk tokens.

Day Trading

Prices have fractal characteristics. This means that if I show you a chart, you may have difficulty determining whether it is a daily, monthly, or 5-minute chart.

Furthermore, for highly liquid markets, if you are not familiar enough with them, it can also be difficult to discern which specific market it is.

For example, the chart shown above is a 5-minute chart of XRP.

If you choose to trade swings, the trading frequency will be relatively low. Even if you are profitable, most of the time, you will just patiently wait for opportunities, and these opportunities usually only occur 1-2 times per week per market.

I will discuss swing trading in more detail later, but day trading is different, as it can provide immediate feedback, with a large number of small fluctuations to trade each day.

Therefore, if you engage in day trading and execute small trades in each trading session, theoretically, your account balance will grow faster.

However, day trading is one of the most challenging areas of trading. A moment of distraction or a small mistake can cause you to lose all your gains in just a few minutes, as quickly as you made the money.

I recommend that every beginner trader try day trading, as it can provide quick market feedback and accelerate the learning process.

A major advantage of day trading is that you can focus on highly liquid markets, which makes trading scalable. If you focus on BTC, ETH, ES, NQ, gold, or major forex currency pairs, you won't encounter position size limitations.

Nevertheless, day trading is very difficult and not suitable for everyone. It requires high focus, quick decision-making, and decisive stop-loss, among other abilities.

Therefore, it is crucial to develop detailed trading plans and strategies for each step. Once you enter a trade, your emotions may affect your judgment, and the pre-prepared plan will come in handy.

There are many day trading methods, such as trading based on price action, order flow, news, technical indicators, etc. Each method has its own applicable scenarios, and there is no absolute superiority or inferiority.

If you are interested in my day trading and swing trading methods, you can check out the Tradingriot Bootcamp, which is a training course specifically designed for traders.

Trading with Other People's Assets

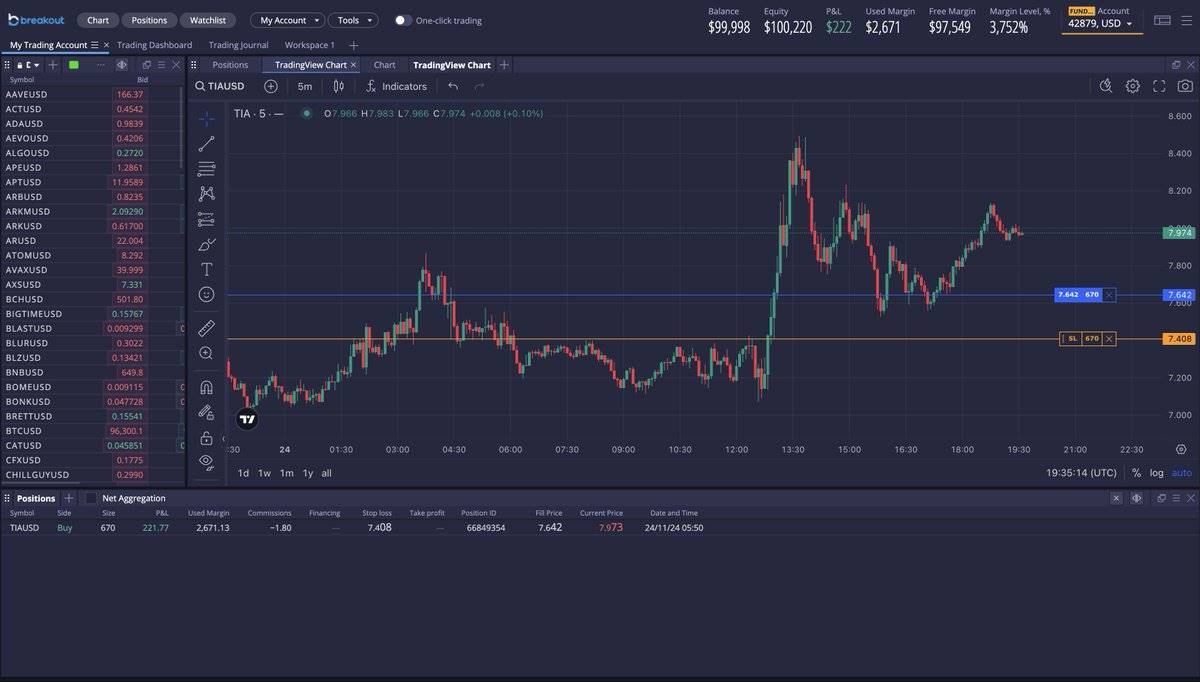

In recent years, the online proprietary trading firm (prop firm) industry has been developing rapidly.

If you are new to these companies, you need to pay an evaluation fee and follow the trading rules in a demo account before you can gain access to a funded trading account.

This model allows you to trade with larger capital, and the only cost is the evaluation fee.

However, if you are not familiar with trading, you may end up wasting money by frequently paying the evaluation fee, without ever being able to obtain a funded trading account.

Although prop firms are often controversial, I believe they present a great opportunity for those who have trading skills but lack capital.

As this field expands rapidly, it has become increasingly important to choose a reputable and stable company. In recent years, we have seen some companies refuse to pay profits, set almost insurmountable rules, and even go bankrupt directly.

I may be somewhat biased here, as I am directly involved with the Breakout capital provider company. But if you focus on cryptocurrency trading, Breakout is a very good choice. It provides daily payment services, has never had a record of refusing payments, and its evaluation rules are also very reasonable.

High Time Frame Analysis and Low Time Frame Execution

If you find that day trading is not suitable for you, do not be discouraged. This approach can also help you quickly grow your account balance, while being easier to operate.

In fact, this approach is not limited to small accounts; I have already completely switched to this trading style, as I no longer want to spend a lot of time watching the charts.

Nevertheless, I still have to emphasize that the experience of engaging in day trading, researching different futures markets, and understanding the microstructure of the market over the past few years has been very important to me, and I am also grateful that I have experienced these.

Although we mentioned that prices have fractal characteristics, the key points on the daily, weekly or monthly time frames in the market often bring greater market reactions than the points on the 1-minute chart. This is because more traders and algorithms focus on these key points on the higher time frames and take action accordingly.

For example, in late February 2023, Solana rebounded to the daily resistance level and then fell back to the next daily support level. If a short position was established at the daily close and a stop loss based on the 1-day ATR was set, a 2.5x risk-reward ratio could be achieved in 18 days.

Of course, achieving a 2.5x return in 18 days is very good. But if your account is small, for example, the risk per trade is $100, then making a $250 return may not be exciting; in contrast, if the risk per trade is $10,000, making a $25,000 profit would be quite substantial.

If you want to quickly grow your account balance, you can switch to a lower time frame while following the trading logic of the higher time frame (HTF). This means that your target remains the same, but by executing trades on the lower time frame (LTF), you can reduce the stop loss range and thus increase the position size.

You don't need to switch to a 1-minute or 5-minute chart, the H1 or H4 time frame is sufficient. Focusing too much on the lower time frame may increase the risk-reward ratio, but it also significantly increases the risk of being stopped out before the market moves.

If you choose the H1/H4 time frame, you may still be unable to get the ideal entry point, or be stopped out before the market moves. But based on my experience, giving 1-3 attempts at lower time frame execution to the high time frame trading logic usually brings better results than relying solely on the daily chart.

Conclusion

Trading is not easy, it requires time and patience. But as long as you can control the risk, even a small amount of capital has the opportunity to gradually grow into a large amount.

In trading, always try to break out of the existing mindset, maintain patience in execution, and develop a comprehensive trading plan.