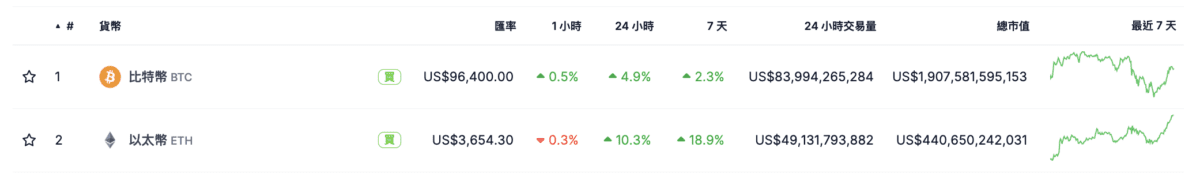

According to market data, after two days of correction, the market has rebounded, with closing up nearly 5% yesterday, and even recording a gain of nearly 10%. The open interest also broke through $24 billion, setting a new historical high, with a 24-hour increase of 16.14%.

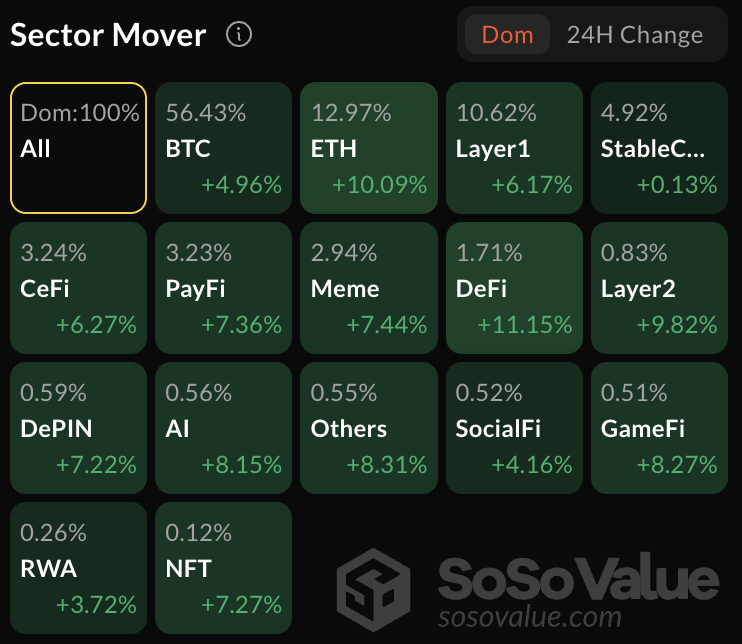

It is worth mentioning that while has performed relatively strongly, it has also triggered a surge in , with the decentralized finance (DeFi) concept sector being the most eye-catching.

Regarding the current market situation, Adam, a researcher at Greeks.live, posted on social media stating that market attention has gradually shifted from to . From the options data, the implied volatility (IV) of short-term options has risen sharply and then fallen back, while has remained above 80%, and there are signs of a breakout trend. The IV difference between the two has exceeded 20%.

"We observe that the bullish sentiment on is significantly higher than the bearish sentiment. Considering the above, the options market currently believes that has a higher upside potential and is worth buying calls."