To fully unlock Bitcoin DeFi and make Bitcoin a programmable, productive asset, you need to wrap Bitcoin (sometimes referred to as tokenized Bitcoin or synthetic Bitcoin). In this article, we will compare WBTC (the most popular wrapped Bitcoin version in Ethereum) with sBTC, a decentralized, 1:1 Bitcoin-backed asset supported by Stacks, which is set to launch in December.

In the world of cryptocurrencies, Bitcoin is the king. It has over 50% of the industry's market capitalization and is widely regarded as the most powerful and decentralized blockchain.

In the world of cryptocurrencies, Bitcoin is the king.

However, despite Bitcoin's dominance, Bitcoin holders have limited choices in utilizing Bitcoin's liquidity in applications. The most common way to participate in Bitcoin DeFi today is to tokenize BTC and bridge the synthetic asset to another chain.

Wrapped Bitcoin (WBTC) is the most popular tokenized Bitcoin. Today, 0.7% of Bitcoin is locked in DeFi through WBTC. While WBTC has a promising product-market fit, it requires trade-offs in terms of speed, cost, and centralization, making it an imperfect solution. sBTC is a new design for a programmable, 1:1 Bitcoin-backed asset supported by Stacks, expected to launch in December 2024.

Non-custodial wrapped Bitcoin has a huge opportunity to unlock over $1.5T in potential capital - even tapping into just 1% of it is a multi-billion dollar opportunity. This is the opportunity that sBTC is focused on.

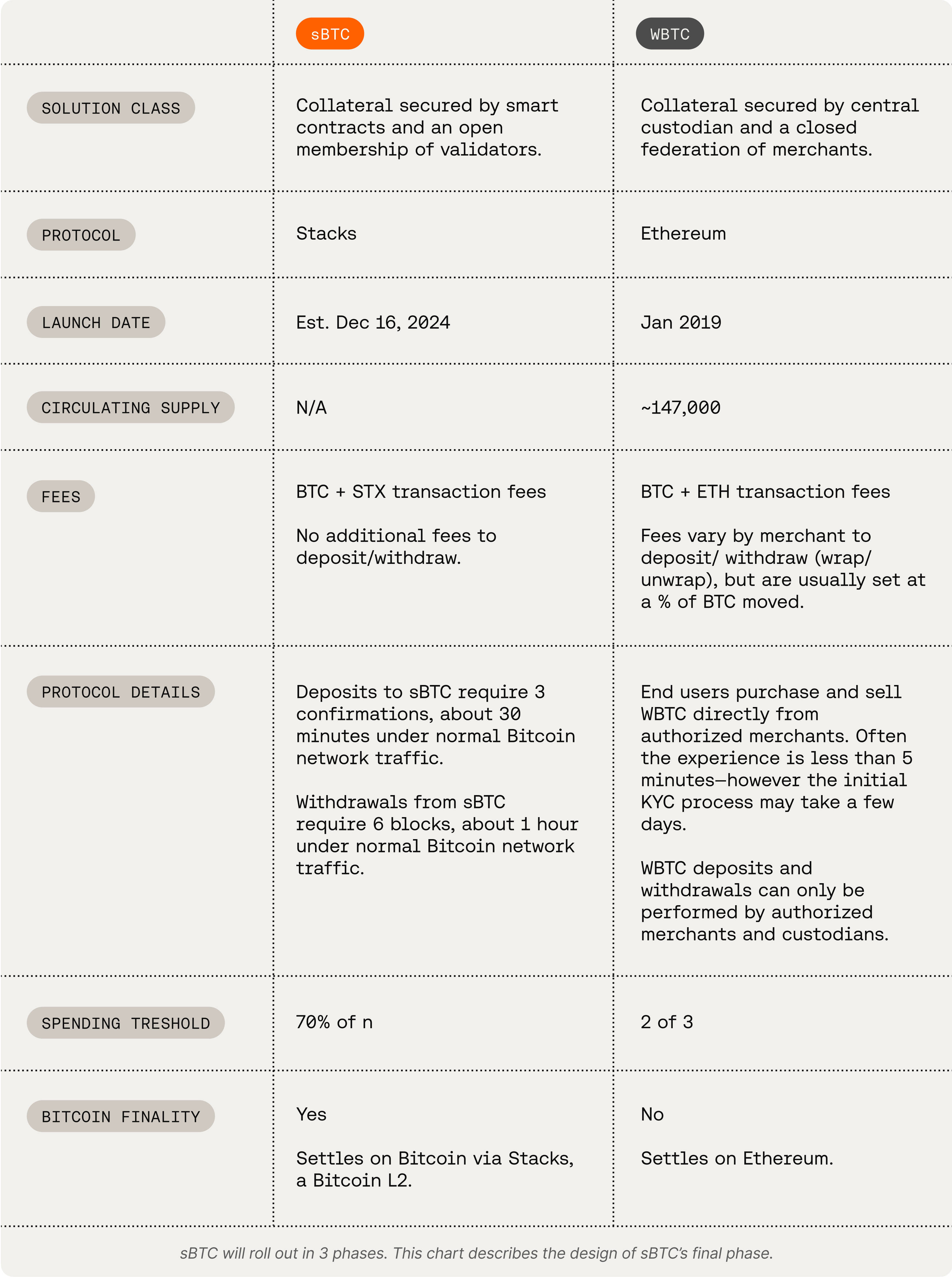

So how does sBTC compare to WBTC?

Note: sBTC will be rolled out in phases. The first phase of sBTC (launching on December 16th) will be maintained by 15 elected signers and will allow deposits. Withdrawals will be enabled in the later stages in February 2025, after which a more decentralized sBTC design with an open, rotating set of signers will be adopted. This blog primarily describes the final stage of sBTC, but we will discuss the gradual decentralization in more detail below. You can find more details on the sBTC rollout stages here.

sBTC vs. WBTC Overview

What is WBTC?

WBTC is a digital token that represents Bitcoin on Ethereum and other EVM-compatible blockchains. It is the oldest and most popular tokenized Bitcoin used in DeFi.

WBTC is the oldest and most popular tokenized Bitcoin in DeFi.

In terms of how it works, WBTC is an ERC-20 token pegged 1:1 to Bitcoin, where for every WBTC in circulation, BitGo and BiT Global (the centralized custodians of wrapped Bitcoin) hold 1 BTC. To buy/sell WBTC, users need to go through an authorized merchant network.

WBTC brings greater liquidity to decentralized exchanges (DEXs) and financial applications in the Ethereum ecosystem, allowing users to interact with DeFi using Bitcoin as collateral. Currently, the circulating supply of WBTC is around 147,000, representing 0.7% of the total Bitcoin supply.

What is sBTC?

sBTC is an upcoming asset that represents Bitcoin on the Stacks network. The sBTC whitepaper details the design of this trust-minimized, 1:1 Bitcoin-backed asset, but at a high level, sBTC enables anyone to move BTC in and out of the Bitcoin layer (and other Web3 ecosystems) in a secure and decentralized way.

sBTC is a new design for a decentralized, 1:1 Bitcoin-backed asset.

sBTC differs from WBTC in several ways.

— sBTC has no centralized custodian. Instead, sBTC is maintained by a smart contract and an open, decentralized network of validators (called signers).

— All sBTC transactions are settled in Bitcoin, with 100% Bitcoin finality, meaning sBTC benefits from the full security budget of Bitcoin itself.

— sBTC is more cost-effective than WBTC, as there are no custodial fees associated with wrapping and unwrapping, and users pay lower transaction fees when depositing and withdrawing BTC.

sBTC is planned to launch on the mainnet in December 2024.

Protocol Design

Bitcoin lacks a stateful smart contract system, requiring a separate smart contract-driven blockchain and a method to deposit/withdraw BTC from the second blockchain in order to use Bitcoin in DeFi and other applications. The deposit/withdrawal mechanism is often referred to as a "peg" or "bridge", and it must fulfill two basic functions:

— Deposit: BTC holders deposit BTC into the Bitcoin chain in exchange for an equivalent tokenized Bitcoin asset on the smart contract chain. This process is sometimes called "pegging" or "minting".

— Withdrawal: Holders of the tokenized Bitcoin asset burn their synthetic asset on the smart contract chain and receive the corresponding amount of BTC on the Bitcoin chain. This is sometimes referred to as "unpegging" or "burning".

WBTC and sBTC adopt two different design approaches to handle these operations.

WBTC: Custodial Bitcoin Peg

The WBTC peg is maintained by the WBTC DAO and an approved merchant network. These merchants are the only entities that can request minting/burning of WBTC. Users purchase WBTC directly from the merchants in this network. The merchants verify the user's identity, and once approved, the individual sends BTC to the merchants. The merchants then send the corresponding amount of WBTC to the user.

All circulating WBTC is 1:1 backed by BTC, and the BTC is custodied by WBTC's primary custodians, BitGo and BiT Global. These custodians are the only entities that can mint new WBTC, storing the deposited BTC assets in cold, multi-signature storage.

Proof of the reserves corresponding to the deposited BTC is on-chain, so anyone can verify the 1:1 supply of minted WBTC tokens with the BTC held by BitGo and BiT Global. When individuals want to "peg" or withdraw their BTC, they must send the WBTC to an approved merchant, who will then "burn" (or destroy) the WBTC tokens and send back the equivalent amount of BTC. The burned amount is deducted from the merchant's WBTC on-chain balance, and the overall WBTC supply decreases, maintaining the 1:1 peg to BTC.

Importantly, WBTC is a custodial asset being deployed into non-custodial products. This means that third parties hold the underlying BTC supporting WBTC, and users do not control the base asset. This introduces counterparty risk - the adage "not your keys, not your coins" exists for a reason.

It's also worth noting that the recent addition of BiT Global as a custodian alongside BitGo has been controversial, as BiT Global has ties to Justin Sun, who is a controversial figure in the industry.

sBTC: Decentralized Bitcoin Peg

Similar to WBTC, sBTC has a 1:1 backing ratio with Bitcoin. However, the design diverges from there. In sBTC, users deposit BTC into a threshold signature wallet controlled by an open, decentralized network of validators (also called signers).

This open signer membership is achieved through Proof of Transfer (PoX), Stacks' unique consensus mechanism. sBTC will be maintained by a public, open, permissionless network, rather than a set or static group of custodians.

To become a Stacks network signer, signers must lock a dynamic threshold of STX tokens in PoX and run software nodes that process sBTC deposits/withdrawals. In exchange for this work, the validators can earn BTC rewards generated by PoX, incentivizing them to participate in the network.

Note: In the initial launch phase of sBTC, sBTC will be maintained by 15 elected signers. You can find more information on signer standards and responsibilities here. The open, rotating set of signers will be introduced in later versions.

Whenever BTC is sent to the sBTC multi-signature wallet (the deposit operation), an equivalent amount of sBTC is sent to the address chosen by the sender. This process happens automatically through smart contracts, without a series of intermediaries (merchants, custodians). Signers handle withdrawal requests (converting sBTC back to BTC) by burning the requester's sBTC and transferring the BTC to the requester's Bitcoin address, maintaining the peg.

sBTC's Connection to Bitcoin

sBTC has a unique and close connection with Bitcoin, as Bitcoin brings its value proposition to the bridge. Specifically, due to the following two features, sBTC can have a higher fidelity to the state of Bitcoin:

— Clarity smart contracts have read access to Bitcoin.

— sBTC forks with Bitcoin.

For tokenized Bitcoin assets like WBTC based on Ethereum, oracles or intermediaries are required to maintain up-to-date status in the event of a Bitcoin fork, and forks or reorganizations may temporarily disrupt operations or create disparities between the prices of Bitcoin and WBTC. This is known as "decoupling".

sBTC will not experience this. Stacks has a native Bitcoin oracle built into its blockchain, and the sBTC bridge will always fork with the Bitcoin chain. The proximity of sBTC to Bitcoin also means that sBTC is guaranteed 100% Bitcoin finality.

Fees

WBTC

For WBTC, merchants typically charge a fixed fee to convert Bitcoin to WBTC and vice versa. This is called a "wrapping/unwrapping" fee. Merchants may also require a minimum withdrawal amount. These fees vary by merchant and withdrawal amount. Since WBTC is an Ethereum token, any transaction will also include Ethereum gas fees to process the transaction.

sBTC

For sBTC, converting Bitcoin to sBTC is free, and vice versa, making sBTC cheaper for users than WBTC. sBTC has no minimum deposit/withdrawal amount, but it's worth noting that the initial sBTC launch will have a 1,000 BTC cap (this cap will increase over time).

Since sBTC is a Stacks token, any transaction will include the typical STX transaction fees to process the transaction on-chain.

Security

Wrapped Bitcoin

The security of WBTC is dependent on its custodian BitGo and BiT Global, as well as the merchants and signers participating in the WBTC DAO. This introduces counterparty risk, which is inherent in any transaction relying on a centralized intermediary. This risk includes participants losing keys, intermediaries becoming inactive or engaging in malicious coordination, bankruptcy, and more.

You can see evidence of this risk in WBTC today. For example, there is an issue where several of the original multi-sig signers of the DAO have become inactive or lost control of their keys. With the addition of BiT Global, we've seen community resistance, risking Justin Sun's involvement in WBTC, and Coinbase just announced they will delist WBTC by December 2024. In fact, the bridged WBTC amount has decreased by 5% since the WBTC announcement.

Merchants can also introduce counterparty risk, as seen when the largest two merchants, Alameda Research and 3 Arrows Capital, filed for bankruptcy and were unable to handle new or existing wrapping requests, causing the WBTC peg to temporarily trade at a slight discount.

sBTC

sBTC represents a significant leap in the security of Bitcoin-pegged assets, as it achieves a decentralized design. For custodial pegs like WBTC, the aforementioned counterparty risks are present, primarily concentrated between the custodians BitGo and BiT Global and the authorized merchants.

sBTC's design has no central custodian. Instead, a rotating set of signers maintains the peg, incentivized by Bitcoin rewards to do so honestly.

Unlike other tokenized Bitcoin assets, sBTC does not rely on a fixed consortium or multi-sig hardware wallet consortium for its peg, which would introduce greater counterparty risk. Instead, it achieves economic security through an open network of signers, integrated with the Stacks consensus protocol.

It's worth noting again that in the initial sBTC release launching in December, sBTC will not have this permissionless, rotating set of signers. Instead, the sBTC peg will be maintained by a set of 15 elected, permissioned signers, similar to the current setup of other tokenized Bitcoin assets. As the sBTC protocol evolves, more advanced features, including the gradual decentralization of the signer set, will be introduced.

Finally, on the security front, sBTC also provides 100% Bitcoin finality, meaning all sBTC transactions are recorded on the Bitcoin mainchain. This makes attacking or "reorganizing" sBTC transactions very costly/difficult, which may not be the case for other tokenized Bitcoin assets, depending on the chains they use.

Traction and Use Cases

Wrapped Bitcoin

Today, WBTC is the most popular form of tokenized Bitcoin asset, with over 145,000 WBTC minted (equivalent to $13B). WBTC is held by over 104,000 addresses, in fact, over 50% of all tokenized Bitcoin is WBTC.

You can now access WBTC in many different ecosystems, and the network has an impressive array of partners, including the aforementioned BitGo and BiT Global, as well as Sky (Maker), Uniswap, Loopring, and dozens more.

The primary use cases for WBTC are lending and borrowing on DeFi platforms like Maker, Curve, and Aave. In addition to lending out WBTC or borrowing against WBTC, WBTC holders can also provide liquidity and yield farm with their WBTC to earn rewards and interest. So where is WBTC specifically being used? Here are the details on some of the most popular destinations as of November 27th:

— Aave: 27.8%

— Compound: 7.7%

— Arbitrum: 7.1%

— Sky: 3.2%

— Polygon: 2.6%

Interestingly, due to the lack of a native Bitcoin bridge, WBTC is also popular on the Bitcoin layer.

sBTC

sBTC has not yet launched, so we have fewer statistics on its traction. However, partner interest in sBTC has been strong, hinting at a successful launch. Figment, Luganodes, Kiln, and others have announced they will be community-reviewed signers for the sBTC launch. The Solana and Aptos ecosystems have both expressed interest in connecting sBTC to their networks.

sBTC holders can earn BTC rewards, rather than other tokens or points.

As for use cases, the primary use cases for sBTC are similar to WBTC. Here are some of the operations users can perform with sBTC:

— Trustless, BTC-collateralized stablecoin lending

— On-chain, under-collateralized BTC lending

— Trustless deployment of BTC to earn BTC yields

— BTC DAO treasuries

— sBTC staking pools

While the actual activities users can perform are similar (lending, borrowing, liquidity mining), the two main differences are the ability to do trustless BTC-denominated lending and borrowing, and the fact that holders can earn BTC rewards, rather than tokens or points on the DeFi platforms used (this is possible due to Stacks' unique consensus mechanism, Proof of Transfer).

Given Stacks' Bitcoin finality and sBTC's decentralized nature, we believe sBTC can effectively unlock Bitcoin's potential and attract users who want to put their BTC to productive use without compromising security.

Conclusion

Stacks' unique properties, from Proof of Transfer to the Clarity programming language, make Stacks an ideal Bitcoin layer for smart contracts. The STX token is crucial to this Bitcoin layer, as it provides the economic incentives to support the open network of miners and signers maintaining the sBTC peg.

All these features ensure Stacks remains aligned with Bitcoin's decentralized ethos, where anyone can participate and actively contribute. Ready to learn more about sBTC?