How to explore the frontiers of Web3? Web3Caff Research will carefully select the latest publicly disclosed Web3 financing projects for you, and provide interpretation and comments. Look at the essence through the phenomenon - immediately follow us to sniff the market trends.

Author: ShirleyLi, Web3Caff Research Researcher

Cover: Logo by this project, Typography by Web3Caff Research

Word Count: The full text is over 1600 words

According to the official disclosure, on November 25, the reStaking infrastructure Kernel on the BNB Chain announced that it has received investment from Binance Labs, and the investment amount has not been disclosed yet.

The trend of reStaking mode has spread from Ethereum to ecosystems such as Bitcoin, Solana and TRON, and now this trend has also blown towards the BNB Chain ecosystem. Among the projects announced to have received financing in this issue, Kernel is trying to introduce the reStaking mechanism into the BNB Chain ecosystem, hoping to promote the development of the entire ecosystem by maximizing the efficiency of BNB assets. However, the Kernel team has also stated that this staking protocol will be expanded in the future to become a staking infrastructure that supports multi-asset and multi-chain.

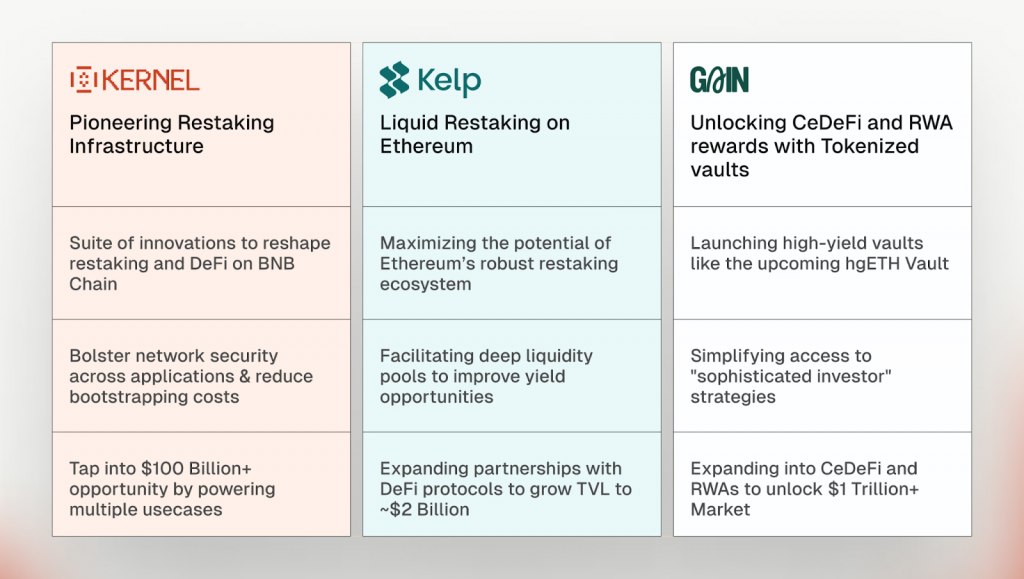

In terms of current development, the Kernel team has already launched three solutions: the reStaking platform Kernel on the BNB Chain, the liquid staking protocol Kelp on Ethereum, and the abstracted investment strategy product Gain, all of which rely on the same native Token asset KERNEL to sustain and drive.

Among them, the reStaking platform Kernel is the focus of Binance Labs, and its testnet has been launched recently. Through Kernel, users can directly submit their BNB or BNB staked through LST (Liquid Staking Token) to the Kernel platform to unlock new rewards. Like reStaking protocols such as EigenLayer, Kernel also hopes to maximize the efficiency of BNB staked through this staking mechanism and introduce the security of the BNB Chain to the applications in the ecosystem.

However, unlike ecosystems originating from public chains such as Ethereum and Solana, the BNB Chain originates from the Binance CEX platform, and the birth of BNB is also for the purpose of optimizing the platform's trading experience. This will cause a problem, that is, BNB holders trust more in the status of the Binance platform than the development of the BNB Chain, and in the Binance platform, the use cases of BNB are closely related to centralized activities such as trading and Launchpad, these factors will lead to a considerable part of the liquidity of BNB being restricted in the CEX environment. In addition, due to the impact of last year's Binance regulatory turmoil, the development of the BNB Chain ecosystem has also been in a state of turmoil for a certain period of time. Therefore, in order to further promote the liquidity of BNB, the BNB Chain ecosystem has also launched some projects. For example, in September this year, BNB Chain, together with Lista DAO, PancakeSwap and others, launched an integrated on-chain staking platform BNB.xyz, which integrates various on-chain DeFi and platform staking opportunities related to BNB to meet the needs and risk preferences of different users. Another example is the focus project of this issue, Kernel, which is an investment by Binance Labs. For the BNB Chain ecosystem, whether it is the launch of staking platforms or the introduction of reStaking protocols, they will undoubtedly play a certain driving role in the development of its ecosystem applications.

However, it is important to note that although EigenLayer has become a pillar product in the Ethereum ecosystem, it is essentially a "nested doll" model of liquid staking and restaking, which can be said to have both opportunities and risks. This is because EigenLayer, as the entry point and connector for the restaking product, maintains the security level of all applications and protocols built on it. Therefore, if there are security issues with the Kernel, all ecosystem applications and protocols built on it will be affected. At the same time, although the restaking mechanism has brought prosperity to the Ethereum ecosystem, there is a huge bubble hidden beneath this prosperity. This is because the same original asset can often be utilized multiple times through liquid staking protocols and restaking protocols, and this approach has implicitly increased the leverage level in the entire ecosystem. When the market fluctuates significantly and protocols are liquidated, a series of related staking protocols will also be affected. It can be seen that restaking is undoubtedly a double-edged sword for the BNB Chain ecosystem. As the underlying infrastructure for restaking, Kernel not only needs to focus on the security of its mechanism design and system operation, but also needs to consider the sustainability of the BNB revenue it brings, such as how to further optimize the incentive scheme of the KERNEL economic model, how to reasonably adjust the staking rate and locking mechanism, and so on. Only by achieving sustainable revenue growth and incentive system can the Kernel network hope to attract more users to participate, thereby further consolidating its system scale and consensus foundation. Otherwise, Kernel will face potential user loss, reduced staking scale, and compromised network security.