Author: Revc, Jinse Finance

XRP, the native token of Ripple, has once again attracted the attention of the global cryptocurrency market. Recently, the price of XRP has risen rapidly, reaching $2.42 per coin, with a market capitalization exceeding $137 billion, making it the third-largest cryptocurrency asset globally. This surge is not a coincidence, but the result of multiple forces at work, including favorable market policies, technological innovation, and the continued development of the global cryptocurrency landscape.

Three Main Drivers of the Price Surge

1. ETF Investment Plans and New Product Layouts

Ripple recently announced an investment in the renamed Bitwise Physical XRP ETP, an important step in its efforts to mainstream cryptocurrency assets. The launch of the ETF provides a safe and convenient investment channel for institutional investors, helping to attract more traditional capital into the cryptocurrency market.

Furthermore, Ripple announced the launch of the first tokenized money market fund on the XRP Ledger and plans to introduce a US dollar-pegged stablecoin, RLUSD. The addition of stablecoins will expand the real-world applications of XRP, further enhancing market trust in its technology and ecosystem.

2. A More Transparent Regulatory Environment

Ripple's long-running legal dispute with the U.S. Securities and Exchange Commission (SEC) may be nearing a breakthrough. SEC Chairman Gary Gensler's announcement of his planned departure in early 2025, coupled with the potential crypto-friendly policies of the new U.S. administration, have further boosted market confidence. Additionally, the imminent approval of Ripple's RLUSD stablecoin by the New York Department of Financial Services marks an important compliance milestone for the company.

3. Active Trading by Whale Accounts

Data shows a significant increase in the activity of large accounts holding between 1 million and 10 million XRP in recent transactions. The activity of these whale accounts has driven market momentum and suggests that institutional investors remain optimistic about the future potential of XRP. At the same time, the performance of mainstream cryptocurrencies like Bitcoin and Ethereum has also enhanced the overall market sentiment, further consolidating the upward trend of XRP.

Short-term Risk Signal: MVRV Ratio Warning

The market value to realized value (MVRV) ratio of XRP has recently surged to 217%, indicating a potential short-term risk of overvaluation in the market. MVRV is an important indicator of market overheating, and a ratio that is too high usually suggests the possibility of profit-taking and price corrections. However, this adjustment does not necessarily undermine the long-term value of XRP, but rather provides a more stable foundation for its subsequent price growth.

Ripple's Technology and Governance Analysis

1. Efficient Technical Architecture

Ripple's payment network, RippleNet, is built on the XRP Ledger, providing an efficient and low-cost solution for cross-border payments. Its technical features include:

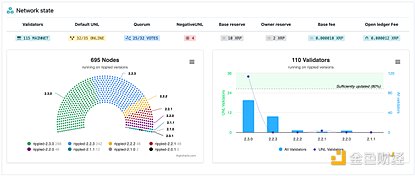

-Ripple Protocol Consensus Algorithm (RPCA): Avoids the high energy consumption of Proof-of-Work (PoW) and Proof-of-Stake (PoS), relying on the voting of validator nodes to reach consensus.

-High Throughput and Low Fees: The XRP Ledger can process 1,500 transactions per second, with each transaction costing only 0.00001 XRP, significantly lower than Bitcoin and Ethereum.

2. Centralized Governance Model

Although Ripple has demonstrated excellent technical performance, its governance model has long been criticized for its "centralization":

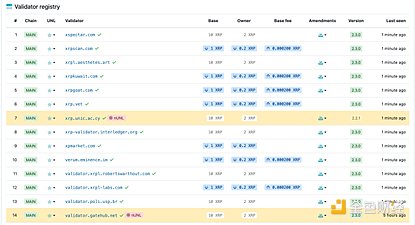

-Concentrated Node Distribution: Ripple Labs directly or indirectly controls approximately 20% of the validator nodes and has significant influence over the selection of the Unique Node List (UNL).

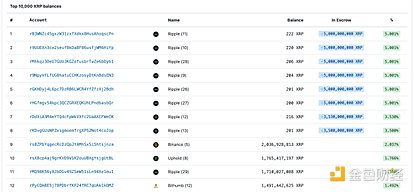

-Concentrated XRP Supply: Ripple Labs holds more than 50% of the XRP supply and periodically unlocks it through a custody mechanism, which enhances its control over market supply and demand but also undermines the credibility of decentralization.

Future Challenges

1. Globalization and Regulatory Compliance Challenges

While the regulatory environment in the U.S. market may improve, the complexity of policies in other regions remains an obstacle to Ripple's global expansion. Particularly in the context of the implementation of the EU's MiCA regulatory framework, Ripple will need to increase its compliance efforts to ensure the legality of its products worldwide.

2. Technological Innovation and Competitive Pressure

Ethereum's payment channels and DeFi applications are gradually expanding their market share, posing a challenge to XRP's competitive position. Ripple needs to continue to drive technological iterations to maintain its core advantages in efficient payments.

3. Market Volatility and Selling Pressure Risks

The upcoming unlocking of 1 billion XRP by Ripple may have a short-term impact on the market. Additionally, the large whale holdings could exacerbate price fluctuations when market sentiment is unstable.

Summary

Ripple and XRP are in a critical stage of rapid development. From ETF investments and the launch of stablecoins to the continuous expansion of the cross-border payment network, Ripple has demonstrated strong momentum in the mainstream adoption of cryptocurrency assets and technological applications. However, its centralized governance model and token distribution mechanism remain important factors limiting its ability to gain broader user acceptance. Compared to Ethereum and other community-driven networks, Ripple's governance appears more "corporate-like." Although its governance process includes feedback from community nodes, Ripple Labs' voice dominates. This "top-down" governance approach may conflict with the decentralization ideals of the community.

In the future, Ripple's success will depend on its ability to adapt flexibly to global regulatory trends and its efforts to further decentralize network governance and token holdings. The technical advantages of the XRP Ledger in the payments sector give it the opportunity to become a standard for enterprise-level payments, a "functionality-first" approach that may attract user groups not primarily focused on decentralization. If Ripple can balance the demands of decentralization and enterprise applications, its long-term potential will continue to be recognized by the market.

Additionally, investors can also pay attention to cryptocurrency projects and listed companies that are influenced by the policies of the new U.S. administration. As the regulatory environment is relaxed, institutional acceptance increases, and a new round of investment layouts unfolds, these companies and projects are expected to see good growth performance.