Coinbase has decided to withdraw from the cryptocurrency market in Turkey and is in the process of winding down its local operations. This follows the withdrawal of its application submitted to the Turkish financial regulatory authorities.

According to reports, this move comes just 3 months after the company submitted its preliminary application to operate in Turkey.

Coinbase Wants to Avoid Challenging Crypto Regulations in Turkey

According to local reports in Turkey, the Capital Markets Board has updated its liquidation list last week. This list includes Coinbase's withdrawal and liquidation application.

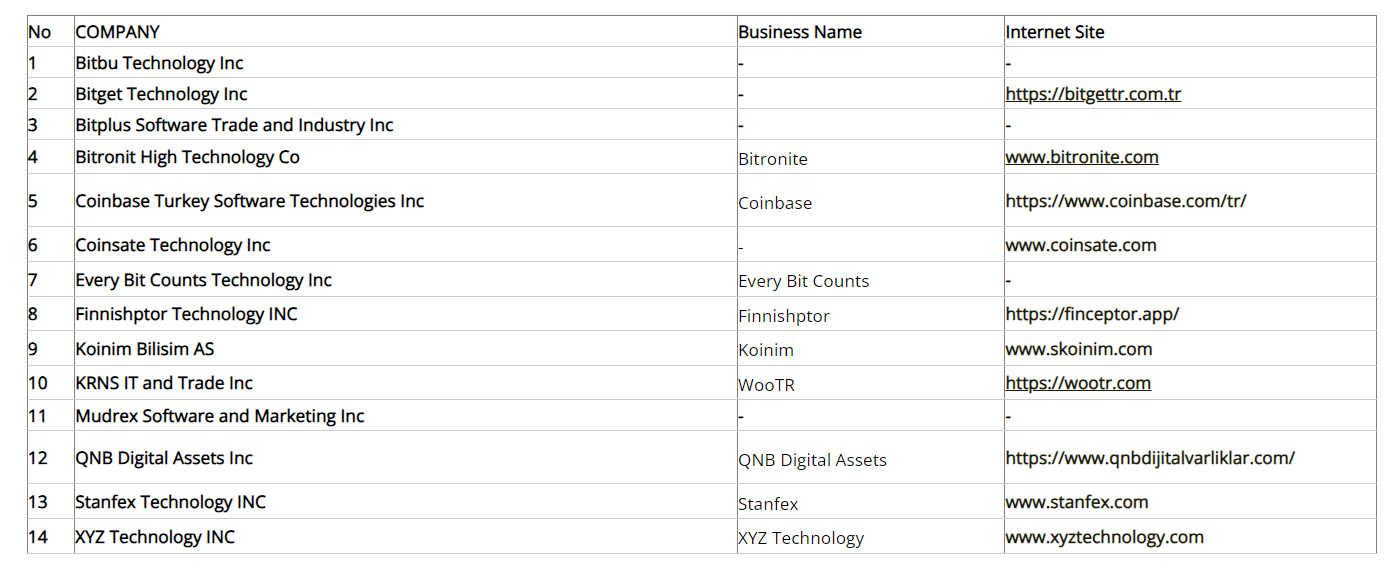

Along with Coinbase, 14 companies have applied for liquidation, while 77 companies are still in the application process. Crypto platforms like Binance, Kukoin, and OKX are among those with pending applications.

Binance and Kukoin had previously removed the Turkish language option from their platforms and suspended marketing to Turkish users in September. Binance stated that these measures were to comply with Turkish regulations on foreign cryptocurrency service providers.

"The custody application of Yapı Kredi Bank (YKB) has been added to the CMB's list of crypto asset custodians. But there is another interesting development: Coinbase, the giant company that custodies ETFs in the US, has abandoned its plans to enter the Turkish market." - Bloomberg analyst Sevcan Ersözlü posted on X (formerly Twitter).

In December, Coinbase had discontinued providing USDC yield to its European users. The exchange attributed this decision to the European Union's Crypto-Asset Markets (MiCA) stablecoin regulations.

Additionally, Coinbase has announced plans to discontinue trading of Wrapped Bitcoin (WBTC) by December 19, 2024, following an internal compliance review.

Coinbase's cbBTC token has achieved success in decentralized finance, with a market capitalization of $1.44 billion. However, the WBTC team has expressed disappointment over the delisting, and users have criticized the exchange's competitive strategy.

The US is Shifting from Uncertain to Clear Regulations

Despite the changes in the international market, Coinbase is actively working to influence cryptocurrency policy in the US. The exchange's CEO, Brian Armstrong, is reported to have discussed the potential appointment of a pro-crypto figure with former President Donald Trump.

He is pushing for a more pro-crypto leadership at the SEC by proposing SEC Commissioner Hester Peirce as a successor to Gary Gensler. Gensler announced his resignation in early November, and his term will end in January, before Trump's inauguration.

Meanwhile, Coinbase's global app ranking surged to 9th place in November, alongside the rise in Bitcoin prices. This increase in app downloads reflects growing retail interest in cryptocurrencies, which can drive higher trading volumes and support broader market adoption.