Hedera, Stellar, XRP, Algorand and Cardano have risen by 250% in 30 days. Is a price correction imminent?

Over the past 30 days, some altcoins have seen gains of over 250%, including Hedera (HBAR), Stellar (XLM), XRP, Algorand (ALGO), Cardano(ADA). Such rapid increases have traders questioning the sustainability of the rally and looking for potential signs of a pullback.

Some investors believe these tokens are still significantly discounted from their previous all-time highs, suggesting further upside potential. However, regardless of whether the recent surge is justified, the widespread use of leverage by buyers increases the risk of a sharp price correction.

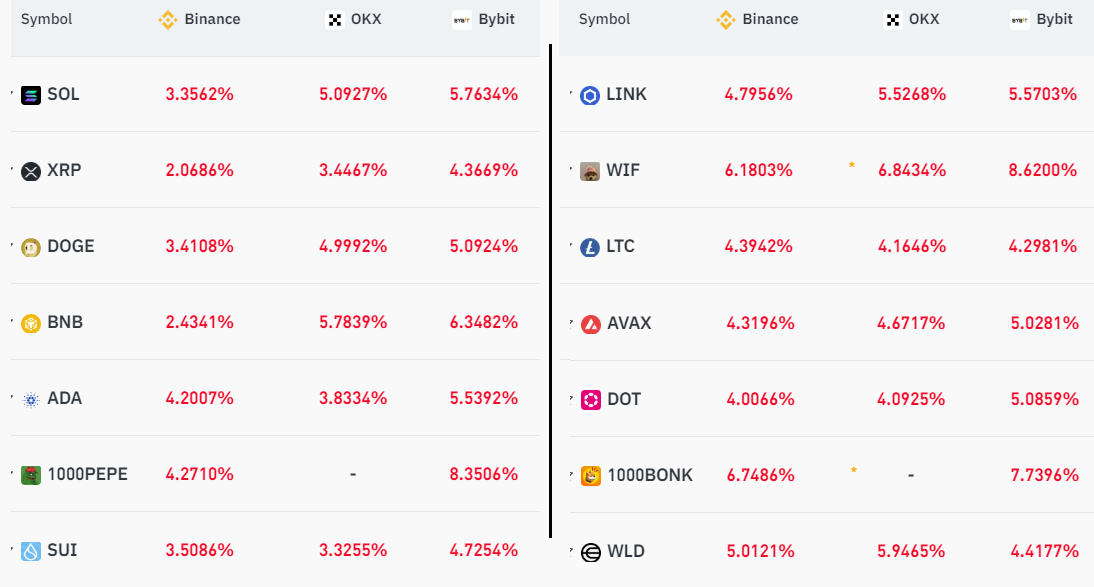

30-day funding rates for perpetual futures. Source: CoinGlass

Data from CoinGlass shows that 30-day funding rates for perpetual futures have spiked significantly, with longs paying 4% to 6% per month to maintain their leveraged positions. While these costs may be manageable in a strong uptrend, if prices stall or decline, they could quickly erode traders' profits. While experienced crypto traders may tolerate 5% monthly funding fees, such costs are ultimately limited.

Leverage is not at extreme levels compared to historical peaks

As context, during the altcoin rally in February, some tokens saw 30-day funding rates as high as 25%. These extreme levels are typically short-lived, as arbitrage desks step in, taking short positions in the perpetual contracts while buying the underlying assets to capture the funding fees without taking market risk.

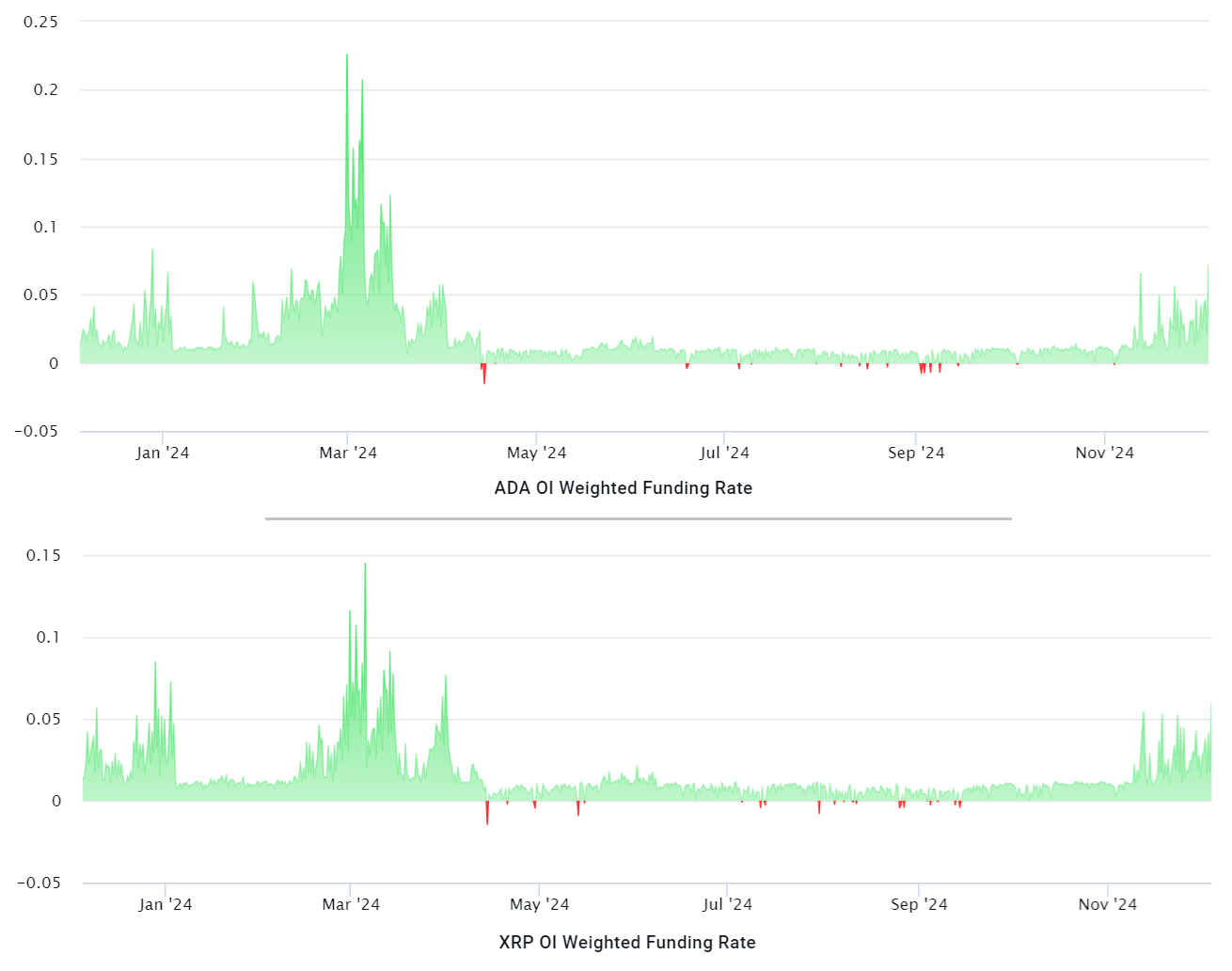

30-day funding rates for Cardano (ADA) and XRP. Source: CoinGlass

CoinGlass data shows that while the current funding rates for ADA and XRP are elevated compared to the past six months, they remain below the 12-month highs. Historically, this suggests that altcoins may still have room for further leverage-driven growth. However, funding rates alone are not enough to guarantee the continuation of the current bull market.

A similar situation occurred on January 11th, when the altcoin market cap had surged 80% over the previous three months. At that time, 30-day funding rates for most altcoins had climbed to around 8%. However, the rally stalled within two weeks, with prices retracing 15% by January 25th. This indicates that rising funding rates are often a result of a bull market, rather than the cause.

In the current altcoin season, the most striking contrast is between the performance and leverage of altcoins versus the major cryptocurrencies.

Bitcoin and Ethereum's 30-day funding rates are only around 2.5%, which is relatively modest considering their respective monthly price gains of 39% and 49%.

Part of the reason for this disparity is that investors can leverage BTC and ETH positions through monthly futures, options, orexchange-traded funds(ETFs). However, other factors have also fueled the altcoin frenzy, such as the meme coin craze and new token launches reaching all-time highs.

Tokens like Goatseus Maximus (GOAT), NEIRO, and Cat in a Dog's World (MEW) have at times exceeded $1 billion in market capitalization. This speculative fervor may be increasing the perceived value of altcoin projects with active development and strong community support. While these valuations may be overly optimistic, only time will tell if they are reasonable or merely temporary.

Despite the surge in funding rates, most altcoins have not yet faced the threat of large-scale liquidations. The current 30-day funding rates of 4% to 6% are still within manageable levels, but with volatility persisting, excessive leverage should be approached with caution.