※This article has been automatically translated. Please refer to the original text for accurate content.

As the cryptocurrency field has grown beyond Bitcoin and Ethereum over the years, a vibrant ecosystem has emerged consisting of numerous blockchains, each offering its own assets, functionalities, and communities. However, with this expansion comes an increasing demand to move data and value between different blockchains. This is a necessity, but also an extremely challenging demand. Unlike centralized systems, individual blockchains operate independently and cannot natively verify or interact with other networks. This lack of "cross-chain communication" creates fundamental problems. Without direct trust or interoperability, how can information be securely, or assets be moved from one blockchain to another?

This is where cross-chain bridges come into play. This innovative solution is designed to enable communication between blockchains, allowing users to seamlessly move assets, data, and other value across the entire ecosystem.

In this blog, we will cover the following topics:

- What are cross-chain bridges?

- How do cross-chain bridges work?

- Benefits and use cases of cross-chain bridges

- Challenges of cross-chain bridges

- Chainalysis simplifying cross-chain bridge investigations

What are cross-chain bridges?

Cross-chain bridges are connective entities that enable the secure sharing of data and assets between different blockchains. At their core is a messaging system that allows information to be exchanged in a verifiable way across blockchains. Rather than relying on a centralized intermediary, trustless bridges use automated software on each blockchain to independently handle the exchange and verification of messages. This approach allows data or assets to move seamlessly between networks, while maintaining the security and transparency that characterize blockchain technology.

How do cross-chain bridges work?

The mechanics of cross-chain bridges vary by the type of bridge, but the fundamental purpose remains the same: to securely transfer data or assets between blockchains that cannot natively communicate. To understand this process, let's look at a hypothetical example of transferring assets.

The locking and minting process:

- Initiate the transfer on the source chain: Let's say we want to transfer an asset from Ethereum to Solana. First, we send this Ethereum asset to the bridge contract, "locking" it.

- Register the deposit and notify the target chain: Once the asset is locked, the Ethereum bridge contract records the deposit and sends a secure message to the corresponding counterpart on the Solana blockchain.

- Create a wrapped asset on the target chain: Upon receiving the message, the Solana bridge contract creates a copy of the locked asset. This wrapped asset represents the original Ethereum asset and can be used as a native Solana asset on the Solana network.

The unlocking and burning process (reversing the transfer):

- Burn the wrapped asset on the target chain: By sending the wrapped asset on Solana to the bridge contract, the asset is effectively removed from circulation. This "burning" process ensures the wrapped asset no longer exists on Solana.

- Register the burn and notify the source chain: The Solana bridge contract records the burn and sends a message to the corresponding Ethereum contract, approving the removal of the wrapped asset.

- Unlock the original asset on the source chain: Upon receiving the message, the Ethereum bridge contract unlocks the original asset and returns it to the specified address.

Benefits and use cases of cross-chain bridges

Cross-chain bridges open up new possibilities within the blockchain ecosystem, providing benefits and use cases that expand the flexibility and applicability of decentralized technologies. Here are some of the key advantages and use cases:

- Improved interoperability: Cross-chain bridges enable communication and asset sharing between different blockchains, fostering a more interconnected network. This interoperability provides a foundation for combining the unique strengths of various networks.

- Expanded DeFi opportunities: By bridging assets across chains, users can access decentralized finance (DeFi) platforms on multiple networks, gaining access to a wider range of lending, borrowing, and staking options.

- Multi-chain decentralized applications (DApps): Bridges allow developers to build decentralized applications that operate across multiple blockchains. For example, yield farming platforms like Curve Finance and Aave can use bridges to enable users to move liquidity between Ethereum and networks like Polygon or Avalanche.

- Increased user choice and flexibility: Cross-chain bridges allow users to select the blockchain that best suits their needs, whether it's lower fees, faster transactions, or specific DApp functionalities. This flexibility ultimately expands access to blockchain technology.

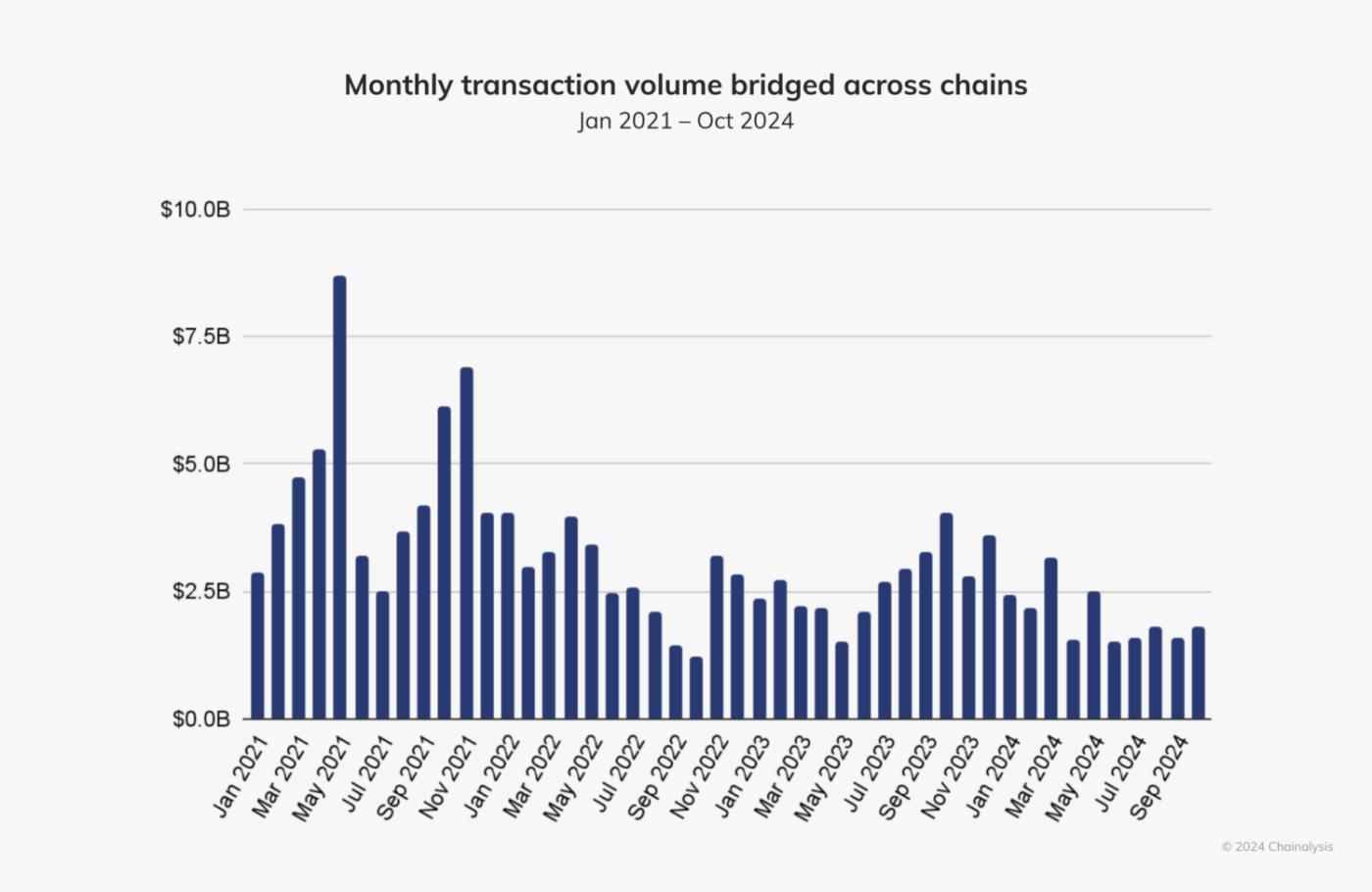

As shown in the figure below, the high levels of cross-chain monthly transaction volume indicate that users are actively leveraging these diverse use cases of cross-chain bridges. The monthly transaction volume is projected to range from $1.5 billion to $3.2 billion by 2024.

The Problem with Cross-Chain Bridges

Cross-chain bridges bring exciting opportunities, but also significant challenges. The main issues surrounding the bridges include the following:

- Fragmented Data Across Chains: Transactions span multiple Blockchain platforms that do not naturally share information, resulting in fragmented data that makes monitoring cross-chain activity complex. This makes it difficult to get a comprehensive view of the activity.

- Opaque Transaction Paths: Cross-chain bridges introduce complex transaction trails, often involving multiple smart contracts and intermediate steps. This complexity can make it difficult to detect illicit activity, money laundering, and other suspicious transactions.

- Increased Security Complexity: Cross-chain bridges function as interconnection points between Blockchains with different protocols and rules, making security a major concern. If any part of the bridge infrastructure is compromised, the bridge becomes vulnerable to attacks, and even minor vulnerabilities can lead to large-scale exploitation and asset loss.

Simplifying Cross-Chain Bridge Investigations with Chainalysis

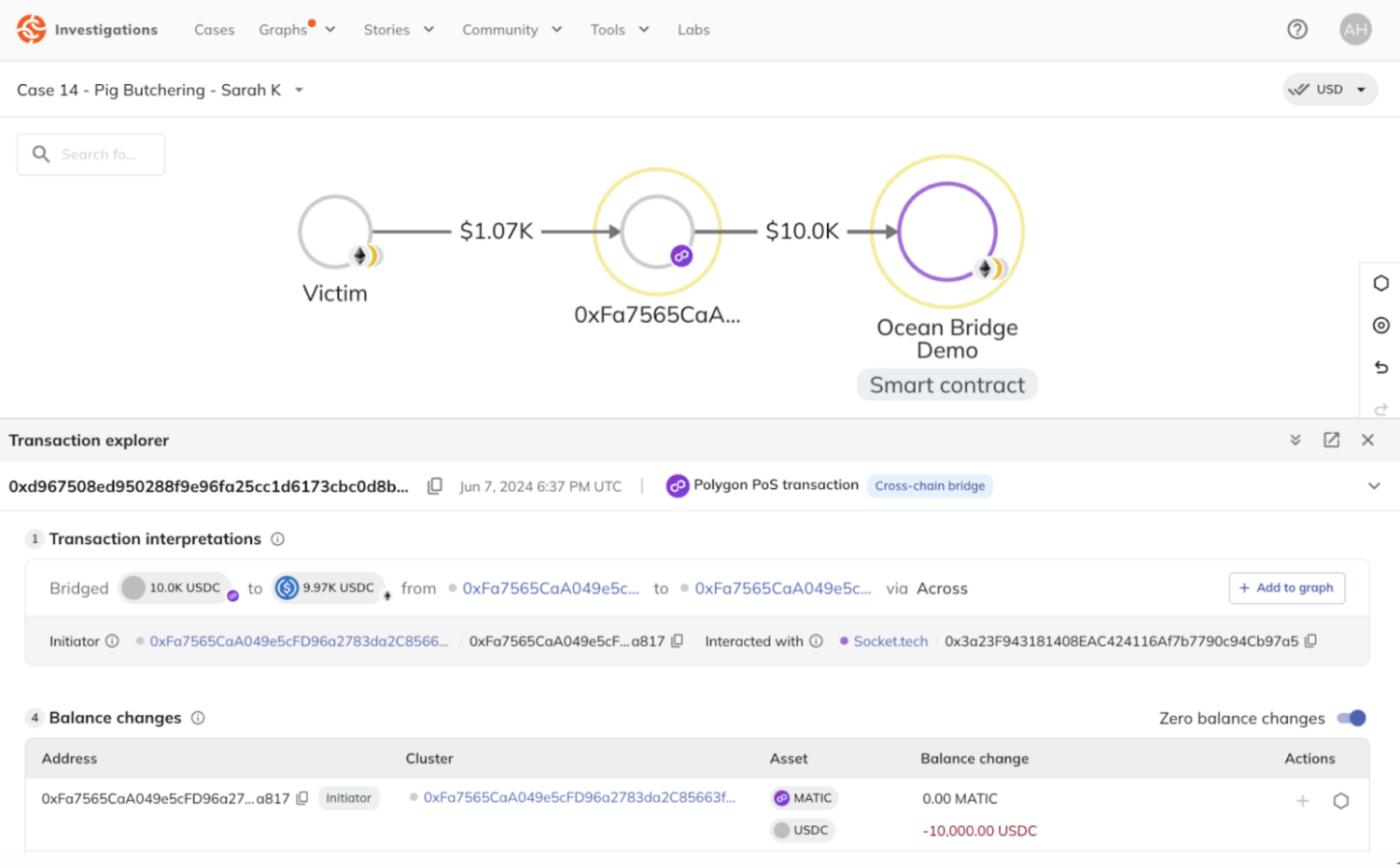

Tracing funds across Blockchains does not have to be complex. Using the Transaction Explorer in Chainalysis Reactor, investigators can seamlessly and accurately track funds spanning hundreds of bridge protocols and decentralized exchanges (DEXs) with just a few clicks.

Our clear, human-readable interpretations simplify smart contract activity, making it easy to understand transactions like Non-Fungible Token (NFT) sales, DEX swaps, approvals, and token transfers, even without deep technical expertise.

Chainalysis provides unparalleled data covering over 25 Blockchains, 17 million assets, and 220 million bridge transactions. Investigators can follow the most complex financial trails, revealing the sources, destinations, and all the connections in between.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively "Chainalysis"). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient's use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.

The post Introduction to Cross-Chain Bridges appeared first on Chainalysis.