BTC has surpassed $100,000, and many people still don't understand the top-level conspiracy that the US has inadvertently revealed. Faced with this, different groups have too many small thoughts, and there are even people who are petty and clever, which may ruin our competitive advantage in the great power game.

I. Is the US a tool to harvest China? Too narrow-minded!

When it comes to BTC, what is the first reaction of many people? This is the US's conspiracy, a tool specifically designed to harvest Chinese people.

This perception is too shallow, without understanding the market or the operation.

In the financial market, if you want to talk about harvesting, you must rely on strength, you have the qualifications to be the boss, you control the bullish and bearish forces of the market, and you can influence the price, then you have the qualifications to harvest.

If you want to harvest, you must rely on strength. For example, when Soros attacked Hong Kong and the Hong Kong dollar, he also wanted to harvest through strength, but he didn't expect that the mainland was backing Hong Kong, and in the end they didn't get what they wanted.

China and the US haven't competed in this market yet, and you've already belittled yourself, believing that others want to harvest you. Have you ever thought about harvesting others? To prevent others from harvesting you, you cut off both arms, ruin your future, and shut yourself in without playing with them?

Some people will also say that if China decides to enter the game, then the US will not play this game anymore. They believe that as long as the field where the Chinese are powerful, the US will definitely not play, and will start a new game.

This is really too binary in understanding the great power game. As long as it is related to the future situation, the US not only will not overturn the table and not play, but will also use all means to grab it back.

For example, manufacturing. China's manufacturing capabilities are top-notch globally, and the US used to not be able to beat us, but did they give up manufacturing and overturn the table and not play manufacturing? Of course not, they are trying their best to regain manufacturing, to make manufacturing great again in the US.

BTC is the same, people who understand know that it is absolutely an important strategic reserve for the future. Even if the Chinese start playing it first, if the US finds its importance, the US will definitely compete fiercely, rather than give up the game for fear of being harvested.

Speaking of harvesting, how do you understand our country's purchase of gold? According to the logic of self-belittlement, the US's gold reserves are absolutely dominant in the world, aren't we afraid of being harvested by the US when we buy gold?

Again, how much BTC do you have now? $190 million?

Is the US so painstakingly manipulating and controlling the market, through ups and downs in prices, to scrape a little bit of gold dust from your $190 million? Is it worth it?

If you really want to talk about harvesting, our gold reserves are worth nearly $190 billion, our total trade with the US is over $700 billion, isn't that a lot more than squeezing oil from BTC?

So, if you only think about the US harvesting China, it can only show that your thinking is too narrow, and you really don't understand what the US wants to do and what it is doing.

BTC exceeding $100,000 does have the US's conspiracy behind it, but this conspiracy is much more powerful than the so-called harvesting of China.

II. Price fluctuations

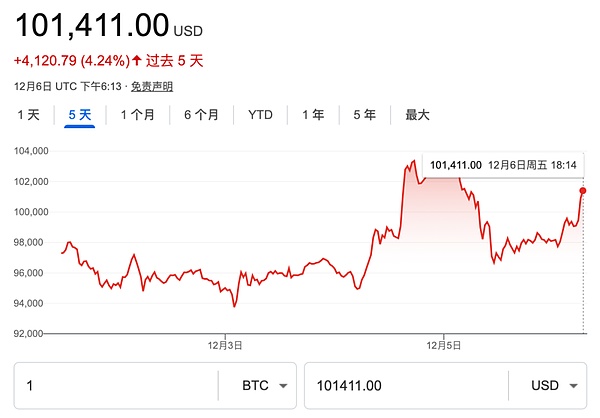

First, let's look at why the price was able to break through $100,000 on December 5th.

News 1: Trump will nominate Paul Atkins as SEC chairman, and Paul Atkins' biggest feature is that he supports cryptocurrencies and has repeatedly called for reduced regulation of cryptocurrencies.

News 2: Federal Reserve Chairman Jerome Powell said that Bitcoin is a speculative asset like gold, not something that can be compared to currency.

"It's like gold, just virtual, and people don't use it as a means of payment, and they don't use it as a store of value. It's very volatile. It's not a competitor to the dollar, it's a competitor to gold," Powell said.

News 3: Putin also lit a fire, saying that BTC is better than US dollar reserves, and no one can ban it.

Putin said, "Because they are new technologies. No matter what happens to the dollar, these tools will develop in one way or another, because everyone will strive to reduce costs and increase reliability."

Affected by this, the price of BTC broke through $100,000 at one stroke.

Then it remained above $100,000 for almost a full day. What does this mean?

In the long historical process, BTC has several key price levels, such as parity with the US dollar, which is $1/coin; parity with gold, which is $1,242/coin; and various whole number milestones, such as $10,000, $100,000, etc.

Among them, $100,000 is an important whole number milestone.

We know that whether it's stocks or exchange rates, etc., when breaking through important milestones, it is generally the case that they immediately pull back after touching the line, and then consolidate for a period of time before continuing to rise.

Because at the key positions, there are too many previous people who have taken profits, and these original longs have turned into shorts.

This sudden breakthrough of the key price can only mean one thing, the buying power is too strong, causing nearly 200,000 shorts to be liquidated.

They say that one person's new love is another person's old love. BTC has risen so much, because too many people want to make it their new love, and they recognize its value very much.

Then the price of BTC plummeted again, quickly falling below $93,000 from above $100,000, causing more than 210,000 longs to be liquidated.

Why did it crash again?

Former US Treasury Secretary Summers said a sentence, warning Trump, Musk, and the crypto currency tycoons behind them.

Summers said: "Some people say we should build some kind of national BTC reserve, and that idea is crazy! Doing so would serve no purpose other than to pander to generous special interest campaign donors."

But BTC's momentum was too strong, and after just one day of decline, the price was back above $100,000.

III. The game behind the price

How should we view the differences of opinion between Trump and Summers?

Xinhua News Agency discussed a key issue in this commentary article: this is a shadow cast on politics.

In 2019, Trump said, "I don't like Bitcoin or other cryptocurrencies. They are not money. The value of these things is illusory and extremely unstable. Unregulated cryptocurrencies enable the growth of illegal activities, such as drug trafficking or other criminal activities."

In 2024, Trump said, "I am developing a plan to ensure that the US becomes the global capital of cryptocurrencies and the world's Bitcoin superpower."

Why did Trump change his attitude? Because he is the first major party candidate in US history to accept Bitcoin and cryptocurrency donations.

Taking money and doing work, after he succeeded, he naturally wanted to repay those donors, so his attitude made a 180-degree turnaround.

This indirectly shows that institutions holding or engaged in Bitcoin and cryptocurrency trading are playing an important role in US politics, and they are starting to look for spokespeople.

Why did Summers oppose it?

Who is Summers? He is a professor and president of Harvard, his parents are famous economists, his uncle is the famous Nobel laureate Paul Samuelson, and his uncle is also a Nobel laureate in economics.

In short, Summers represents the traditional financial elite class in the US.

His opposition to Trump's cryptocurrency policy is determined by his class and the interest groups behind him, because the new rising group threatens the interests of his group.

In other words, the price fluctuations of BTC above $100,000 are indeed the game between different interest groups in the US.

IV. The Real Conspiracy of the United States!

Although there are different interest groups competing in the United States now, the trend has basically been determined, and as the competition intensifies, Americans will increasingly support the view of the "big pie" and its planning.

In the past, in the initial stage of the "big pie", all countries were very wary of it, like the various alarmist comments in the article above.

The United States was also nervous, fearing that it would threaten the hegemony of the US dollar.

Now the situation has completely changed.

We remove the noise from the remarks of the above figures and extract the keywords: Powell said that BTC is virtual gold; Summers said national BTC reserves; Trump, relaxed regulation (encouraged support).

What does this mean?

BTC is virtual gold, another form of gold, and it does not threaten the US dollar. The United States will relax its regulation and prepare to incorporate BTC into the national reserves.

This means: the BTC-US dollar is about to be born.

It will be another grand project to maintain the hegemony of the US dollar after the gold-US dollar and the oil-US dollar.

This is the real conspiracy behind the $100,000 BTC.

What's more regrettable is that we have handed this over to others, allowing the United States to win without any effort.

When the United States created the gold-US dollar, it relied on the fact that all the major countries in the world were battered during World War II, and the United States made a fortune from the war, once owning 60% of the world's gold.

Then in 1944, the United States convened 44 countries around the world and signed the "Bretton Woods Agreement". Under the Bretton Woods system, the currencies of various countries were pegged to the US dollar, and the US dollar was pegged to gold, known as the "dual peg".

The gold-US dollar was officially born, and the hegemony of the US dollar was established.

After the collapse of the Bretton Woods system and the decoupling of the US dollar from gold, the hegemony of the US dollar once faced a crisis, and the US dollar was once sold off by countries around the world.

In order to establish a new US dollar hegemony system, the US dollar was then anchored to oil, and the United States reached an agreement with Saudi Arabia, the world's largest oil producer at the time, to designate the US dollar as the currency for oil pricing, and promoted it to other OPEC oil-producing countries.

Thus, the United States has created the oil-US dollar to maintain the hegemony of the US dollar.

To create the oil-US dollar system, the United States did not hesitate to wage war. To maintain the oil-US dollar system, the United States also did not hesitate to wage war.

For oil-producing countries, if they do not use the US dollar for pricing, the United States will send troops to attack them, then support pro-US people, or impose economic sanctions, and so on.

But in recent years, the oil-US dollar has shown signs of collapse, and the United States also has the idea of actively abandoning it, because the oil-US dollar is really hard to sustain.

How does the oil-US dollar cycle work? The oil-producing countries in the Middle East produce oil, these oils are sold to the United States, and they receive US dollars. After the United States buys the oil, it is used for domestic production. The oil-producing countries in the Middle East, after receiving the US dollars, then buy weapons or US bonds from the United States.

In this way, the US dollar goes around in a big circle and returns to the United States. The United States gets the oil, and the Middle East gets the weapons or US bonds.

But in recent years, the United States' oil extraction technology has made rapid progress, and shale oil production has exceeded expectations. As a result, the United States is no longer a major oil importing country, on the contrary, the United States has become an oil exporting country, and has started to compete for food with the oil-producing countries in the Middle East.

In addition, the Middle Eastern countries also do not want to hold a pile of US bonds, they want to exchange them for various weapons or goods.

In this way, the oil-US dollar can no longer be sustained.

In this context, the United States has actually tried to change the anchor, such as anchoring the US dollar to carbon emissions and creating a global carbon-US dollar. However, it was found that the United States' carbon emissions are too large, and this project cannot be played either.

Now it's almost revealed, the US dollar will be "anchored" to BTC, creating a BTC-US dollar, and continuing the hegemony of the US dollar.

V. Can the BTC-US Dollar Succeed?

Let's first look at the process of the US regulatory policy.

After many rounds of competition, and even arrests, the United States found that it could not ban BTC, so it began to strictly regulate it.

FinCEN's authority comes from the US Bank Secrecy Act (BSA), which clearly stipulates that if virtual currency business involves the generation (acquisition), transfer, and trading of virtual currencies, it should be subject to BSA regulation.

In March 2014, the IRS defined virtual assets as "property" for tax purposes, which is different from the definitions of CFTC, SEC and FinCEN.

In 2015, the CFTC began to regulate BTC. In its enforcement action against Coinflip, Inc., the CFTC defined BTC as a "commodity" under the CEA. According to the provisions of the CEA, futures, options, swaps and other derivative contracts that reference the price of crypto assets that constitute commodities are subject to CFTC regulation.

In January 2024, the SEC stated that it had approved the listing and trading of spot BTC ETFs through an expedited process. The issuers of the approved spot BTC ETFs include: Grayscale, Bitwise, Hashdex, iShares, Valkyrie, Ark 21Shares, Invesco Galaxy, Vaneck, WisdomTre, Fidelity and Franklin.

From the experience of the US regulation of BTC, although it is very harsh, to a certain extent, it also acknowledges the status and value of BTC.

Currently, the strictest regulation is in the US SEC department, where CZ and other big shots have been dealt with by the US SEC. Now that Trump has nominated,

Now that Trump has nominated Paul Atkins, if he encourages the development of this industry, then the creation of the BTC-US dollar will clear the obstacles.

Now California, Canada's Vancouver, and other places are preparing to incorporate BTC into their finances.

In short, whether actively or passively, the world's regulation and acceptance of BTC has been constantly improving.

In addition, from the current distribution of BTC holders, the United States has actually already taken a dominant position, especially when including US private enterprises, the United States is even more dominant.

In fact, these are the results of us handing it over to others. In the past, we were the largest BTC holders in the world, with 80% of the global mining power here.

In short, from the layout, the United States has the opportunity to create the BTC-US dollar, and to maintain the hegemony of the US dollar.

We need to be clear that the BTC-US dollar is essentially the same as the gold-US dollar.

What does this mean? The US dollar cannot return to the gold standard, and a completely BTC-US dollar is also impossible to achieve.

However, if we have enough gold and virtual gold (BTC) reserves, then when the global order is reconstructed in the future, we will have enough chips and beliefs.

Just think about it, the price of gold is so high, why is our official reserve still continuously increasing gold for several consecutive months?

This is related to the future of the great power competition.

Seizing the high ground of the future competition is the real conspiracy behind the $100,000 BTC.