The U.S. Treasury Department has recognized Bitcoin as "digital gold" and emphasized its key role as a store of value.

At the same time, the Treasury Department stressed that the importance of stablecoins is growing, and this is driving demand for government bonds in the changing financial environment.

Treasury Department Recognizes Bitcoin, Stablecoins

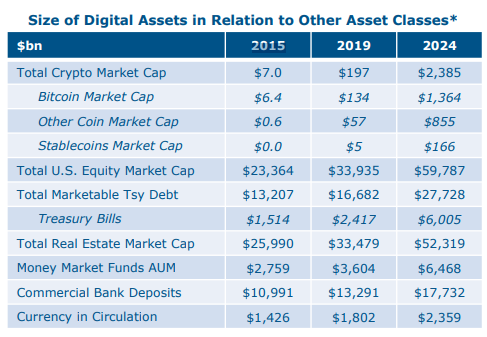

The Treasury Department's report emphasizes the rapid expansion of digital assets, including Bitcoin, Ethereum, and stablecoins, but notes that the market is still smaller compared to traditional financial products such as U.S. Treasuries.

"The primary use case for Bitcoin seems to be as a store of value, a 'digital gold,' in the decentralized finance (DeFi) world," the Treasury Department said.

The financial regulatory agency mentioned that Bitcoin has established itself as a store of value similar to gold. According to the report, the market value of Bitcoin has skyrocketed from $6.4 billion in 2015 to $134 billion in 2019, and is expected to reach around $1.3 trillion by 2024. This growth reflects the high interest in decentralized finance (DeFi) and digital tokens.

Indeed, the report comes amid increasing comparisons between Bitcoin and gold, and includes recent comments from Federal Reserve Chair Jerome Powell. This has reinforced the optimism within the cryptocurrency market that views Bitcoin as a key element of the financial future.

However, the U.S. Treasury Department noted that most people participate in cryptocurrencies as speculative investments expecting future value appreciation. Therefore, digital currencies still cannot replace traditional assets like Treasuries, which maintain high demand.

"As the market capitalization of the digital asset market increases, there may be a structural increase in demand for Treasuries, which could serve as a hedge against price volatility and as a 'safe on-chain' asset," the Treasury Department said.

For context, the Treasury Department report emphasized the rapid expansion of stablecoins and their growing role in the cryptocurrency ecosystem. More than 80% of all cryptocurrency transactions involve stablecoins, which act as a major intermediary in the digital market.

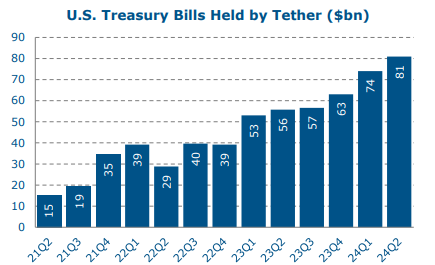

Fiat-backed stablecoin providers like Tether primarily use U.S. Treasuries and other government bond-based assets as collateral, accounting for around $120 billion in U.S. Treasuries. As the stablecoin market grows, demand for Treasuries is expected to increase, driven by their use as a hedge against price volatility and as a safe asset within blockchain networks.

Overall, the Treasury Department's recognition of Bitcoin and stablecoins indicates an increasing intersection between traditional finance and blockchain-based innovation. The department maintains a cautious stance, but its perception of digital assets suggests a willingness to explore their potential.