Cryptocurrency market participants should watch three key US economic data this week that could impact the psychology of Bitcoin (BTC) and induce volatility. This attention is due to the significant influence of US macroeconomic data on Bitcoin and the cryptocurrency market during 2023.

Meanwhile, the price of Bitcoin has approached $10,000 and remained in the range of $9,900 over the weekend.

3 US Economic Data that Could Impact Bitcoin Price This Week

This week is packed with many events, and the following US economic data are expected to induce volatility in the BTC and altcoin markets.

US Consumer Price Index (CPI)

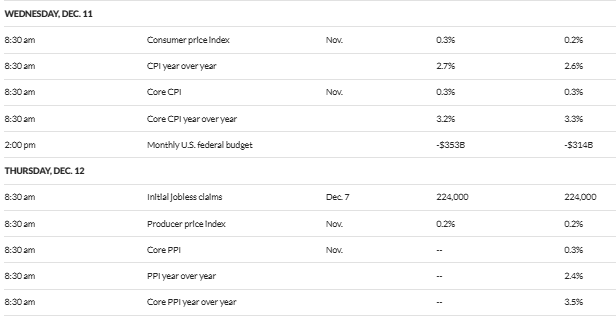

Among this week's US economic data, the US Consumer Price Index (CPI) is a key focus of observation. This indicator is scheduled to be released at 10:30 pm Korean time on the 11th (Wednesday). This macroeconomic data released by the US Bureau of Labor Statistics (BLS) measures the monthly change in prices paid by consumers, tracking inflation over time.

In the previous US CPI data release, the BLS reported that inflation rose to 2.6%. Specifically, inflation remained at 0.2%, matching the September figure. However, the 2.6% annual increase was the first rise in 8 months.

This increased the likelihood of the Federal Reserve's tightening. However, institutional interest in BTC has increased its appeal as a store of value, driving up demand.

According to economists' forecasts, there is a median forecast of 0.3%, meaning prices are expected to rise 0.3% on a monthly basis. This is higher than the 0.2% monthly increase in September. There is a consensus of 2.7% among Wall Street economists.

With the US inflation data on Wednesday attracting attention, all eyes will be on the Labor Department. In addition to the headline CPI, core CPI inflation is also a key focus this week. This provides a more stable reading of inflation by excluding food and energy prices from the calculation.

Core CPI inflation is a focus of attention because commodity prices tend to show large monthly fluctuations that are less related to consumer demand. In November, core CPI is expected to rise 3.3% year-over-year. If this happens, it will mark the fourth consecutive month of a 3.3% figure.

Meanwhile, the monthly core price increase is expected to be 0.3%, matching the October increase.

BTC is considered a hedge against inflation due to its decentralized nature and limited supply. On Wednesday, BTC could benefit from the upward trend in US CPI and core CPI.

For the general public, if investors perceive the rise in inflation as a threat to the purchasing power of traditional currencies like the US dollar, they may choose alternative assets like BTC as a store of value. This increased demand could drive up the price of BTC.

US Initial Jobless Claims

The US Initial Jobless Claims report is scheduled to be released on Thursday night. This data provides insight into the health of the labor market and the overall economic situation.

Generally, high levels of unemployment claims indicate economic distress and uncertainty, while low levels suggest a strong labor market and economic stability.

In the week ending November 30, initial unemployment insurance claims increased to 224,000, exceeding the initial estimate of 215,000. This was also higher than the previous week's 215,000, which was revised from 213,000.

However, BLS employment data shows that the US labor market recovered slightly in November. The unemployment rate rose to 4.2%.

Specifically, the US added 227,000 non-farm payroll (NFP) jobs in November, after the labor market stalled in October due to the Boeing strike and the aftermath of Hurricane Milton.

"The latest job data shows the labor market remains strong. After a weak October due to weather and striking workers, November saw a robust job gain and an upward revision. The economy has averaged 173,000 job gains over the past 3 months." - Elise Gould, Chief Economist at the Economic Policy Institute shared.

High levels of unemployment claims on Thursday could create negative market sentiment and uncertainty, leading investors to seek safe-haven assets like gold or BTC. This increased demand for BTC as a store of value could drive up its price.

Similarly, high unemployment claims could suggest weaker consumer spending and economic growth, which could prompt central banks to implement expansionary monetary policies. This could increase concerns about inflation and currency devaluation, prompting investors to shift to alternative assets like BTC to protect their wealth.

US Producer Price Index (PPI)

Additionally, on Thursday, the BLS will release the Producer Price Index (PPI), an indicator of wholesale inflation. This data measures the average change in the selling prices received by domestic producers.

This week's CPI and PPI price data will be key factors in the Fed's interest rate decision this month. The data will provide important milestones in the Fed's policy adjustment calculations. It is noteworthy that this week is the last inflation data week before the December Fed meeting.

"All eyes are on the CPI and PPI inflation data, and the market is hoping for another 25bp rate hike to be locked in for December." - Kobeissi Letter stated.

Meanwhile, according to BeInCrypto data, the market is currently declining today, and BTC is trading at $99,147. This is a 0.68% decrease.