Editor | Colin Wu

From perpetual contract trading to the eye-catching on-chain exchange, Hyperliquid has risen rapidly in the Crypto field. Recently, Hyperliquid conducted a large-scale HYPE token airdrop, which not only further increased the enthusiasm and user participation of the community, but also broke the undervalued state of the on-chain derivatives track, raising the ceiling of the track.

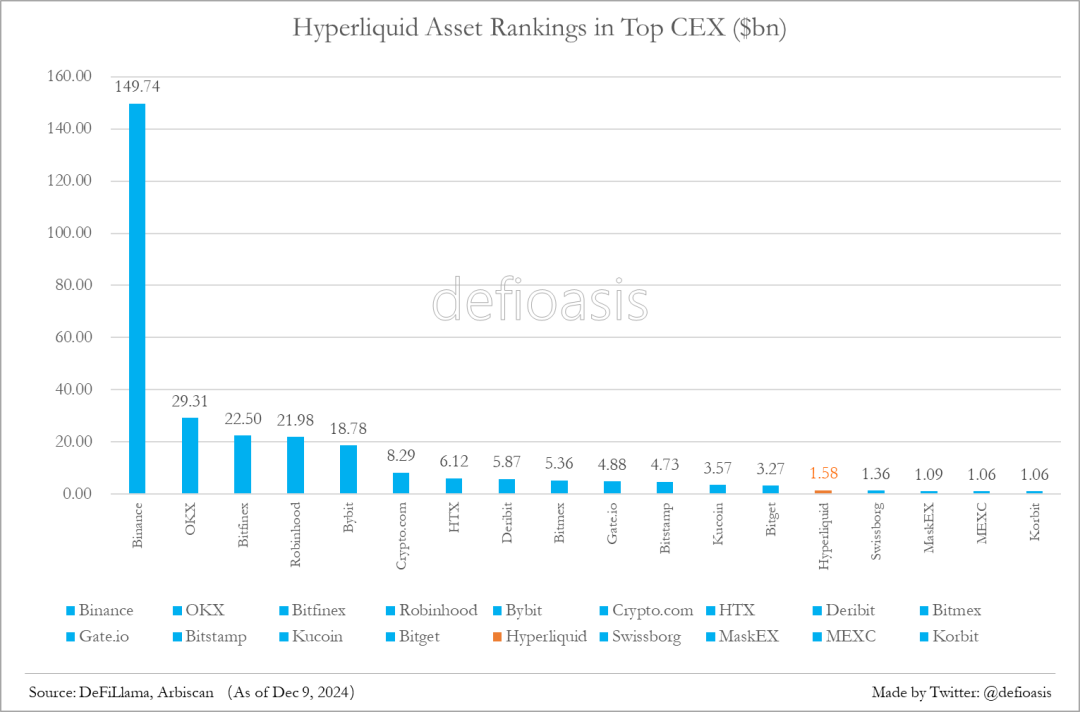

(1) Hyperliquid's assets exceed $1.5 billion USDC, comparable to the world's 14th largest crypto exchange

Hyperliquid is customized as a high-performance derivatives trading Layer1 exchange and is compatible with EVM. The assets deposited in Hyperliquid are mainly through the Arbitrum Bridge, currently supporting USDT, USDC.e and USDC assets on Arbitrum, but only USDC is accepted as collateral. As of December 9, the Hyperliquid Deposit Bridge contract: 0x2D...3dF7 held $1.58 billion USDC, and it is still in a growth trend. Comparing Hyperliquid's assets with the clean assets of CEXs, Hyperliquid can rank 14th among the world's largest exchanges, surpassing MEXC (about $1.09 billion), and its next target is Bitget (about $3.27 billion).

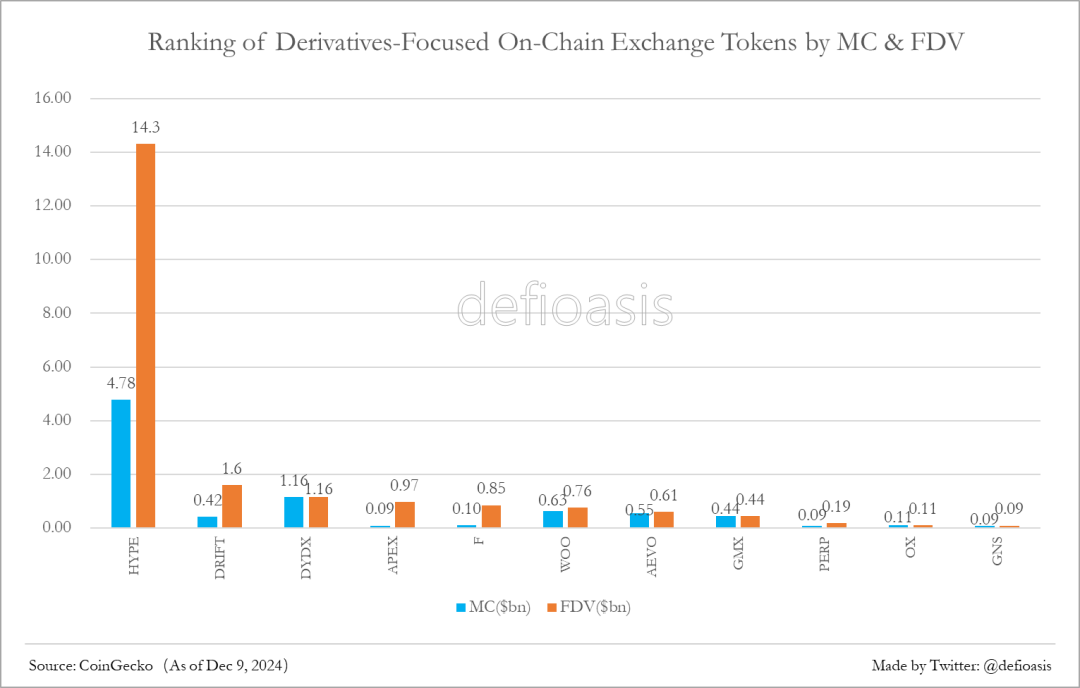

(2) Hyperliquid has single-handedly raised the valuation of on-chain exchanges focused on derivatives to over $10 billion

Prior to Hyperliquid's TGE, the token FDV of on-chain exchanges focused on derivatives did not exceed $1.5 billion, and the well-known DYDX and GMX had FDVs below $1 billion, which has long puzzled investors - the ceiling of the on-chain derivatives track, which is contested by more than a dozen protocols, is so low, but compared to centralized exchanges, the huge trading volume and fee revenue still shows huge potential.

With the Hyperliquid TGE and the distribution of up to 31% of the token supply to the community through airdrops, as a target that does not require VC investment and does not need to be listed on CEX, the price of HYPE has already tripled since its launch on the Hyperliquid exchange, and the HYPE market cap has been pushed up to $4.75 billion, with an FDV of $14.2 billion. Compared to the tokens of previous on-chain derivatives exchanges, Hyperliquid has single-handedly increased the valuation of this track by more than tenfold.

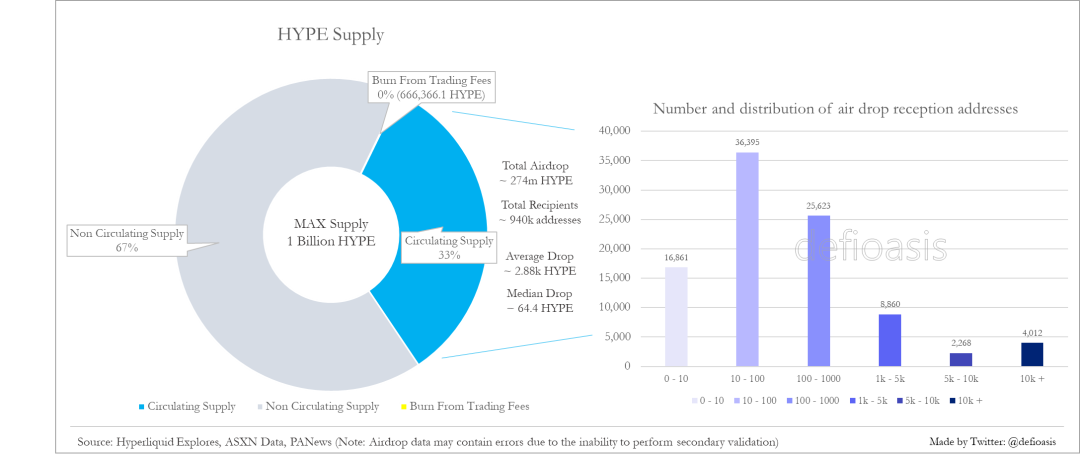

(3) The wealth effect of the HYPE airdrop is significant, but there may be a small number of large values that significantly raised the average

According to the Hyperliquid Explorer, the total supply of HYPE is 1 billion, of which about 33% is currently in circulation, and according to the HYPE TGE airdrop rules, theoretically 31% of the total supply is distributed to the airdrop, so the circulating supply should be mainly from the airdrop distribution to users.

According to data cited by PANews from ASXN Data, due to the fact that some users did not sign the Genesis Event terms and missed the opportunity to claim the airdrop, the actual number of Hyperliquid TGE airdrops was about 274 million, and it showed a situation where the average was tens of times higher than the median. This suggests that the airdrop has extreme values or outliers, with a small number of recipients receiving extremely high amounts, significantly raising the average.

Due to the difficulty in accessing Hyperliquid Airdrop data, it is currently not possible to re-verify this data. But from the intuitive perception of the airdrop distribution and the statistics of dozens of community airdrop samples, it is judged that there should be relatively few extreme values; the median airdrop data, which represents the middle value of the data, is less affected by extreme values and better represents the general ordinary users, and calculated at the current median, with HYPE tripling since the TGE, the single-airdrop value is over $900, making it one of the most wealth-effective airdrops of the year.

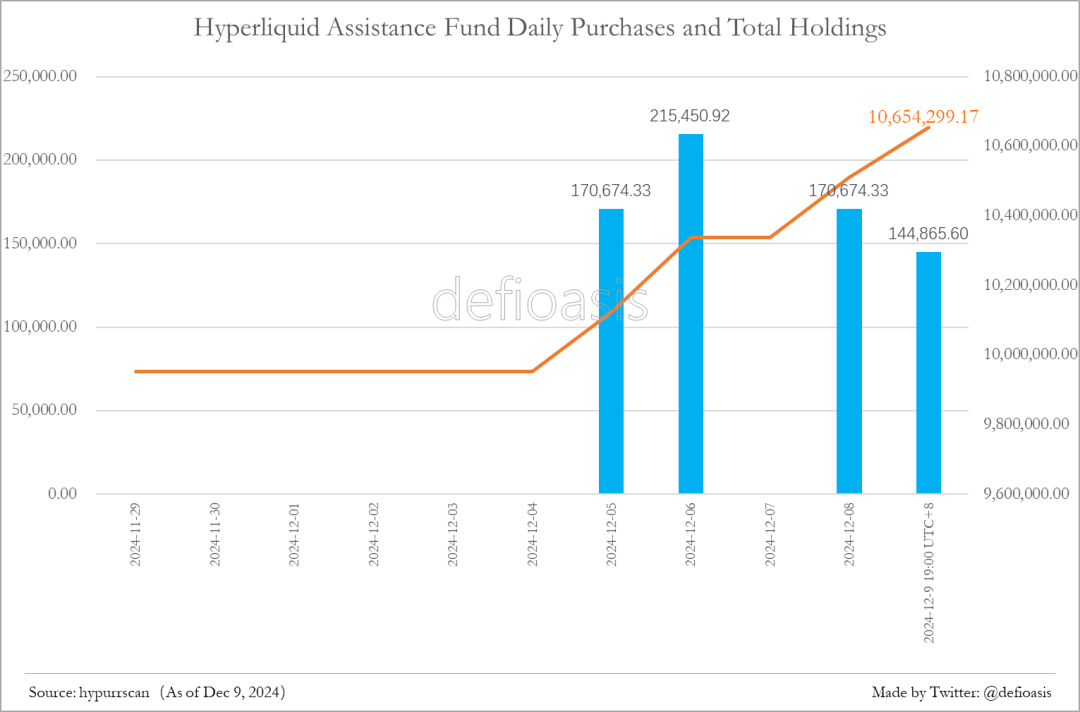

(4) The huge driver of the HYPE rise: the Hyperliquid Assistance Fund, which has made over $82 million in profits

The funds of the Hyperliquid Assistance Fund mainly come from the contract trading revenue of the Hyperliquid platform, i.e. a portion of the USDC fees will go into this fund to support various activities of the platform, mainly including the buyback of HYPE tokens. According to the hypurrscan browser, from December 5 to December 9 19:00 UTC+8, the Assistance Fund repurchased 567,083.22 HYPE from the secondary market, with a repurchase value of $7,364,369.45, at an average price of about $12.99.

In fact, HYPE can be seen as having a dual deflationary mechanism, on the one hand, the HYPE in the transaction fees will be burned to reduce the supply (currently 666,361.1 HYPE have been burned), and on the other hand, the Assistance Fund's buybacks will further reduce the tokens in the market.

The redistribution of platform revenue to enhance the value and liquidity of the platform token is also beneficial to the healthy development of the platform ecosystem. The Hyperliquid Assistance Fund currently holds about 10.654 million HYPE, accounting for over 1% of the total, making it the fourth largest holder of HYPE.

(Note: Or due to the inability of the hypurrscan browser to keep up with the synchronization, some of the buyback data since the TGE may be missing. The Hyperliquid Assistance Fund has received a total of $53.3 million USDC from a portion of the trading platform fees, but as of December 9, only 1,397.96 USDC remained, the vast majority of the USDC should have been used to repurchase HYPE, i.e. the calculated average price of the 10.654 million HYPE held by the Assistance Fund should be $5, and it has already made over $82 million in profits.)

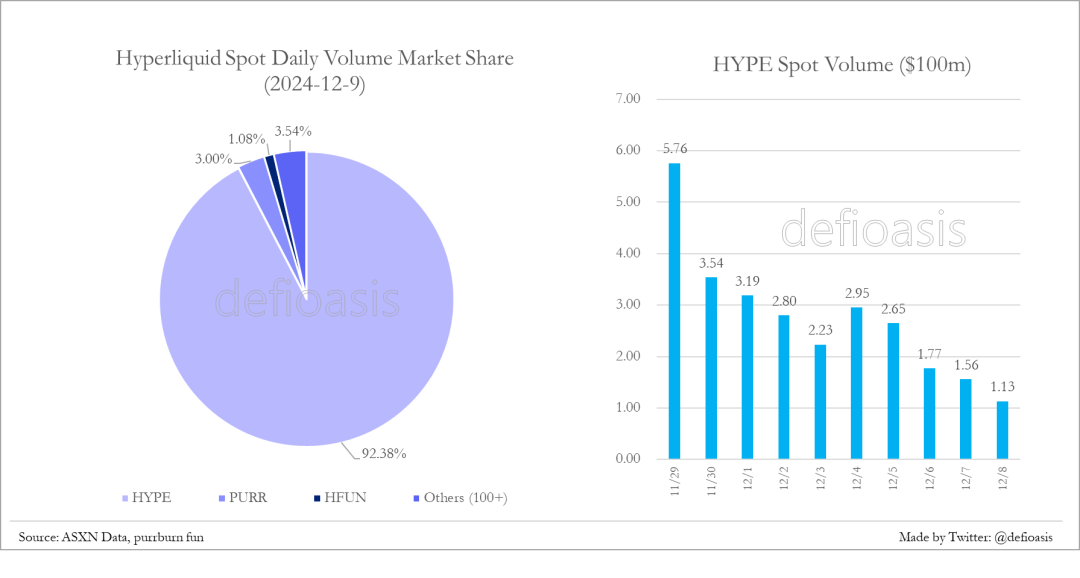

(5) Hyperliquid's spot market status: 92% of daily trading volume is concentrated in HYPE, with very few tradable targets

Hyperliquid already has over a hundred spot trading targets, but about 92% of the daily trading volume is concentrated on the platform token HYPE, 3% on PURR, Hyperliquid's largest native Memecoin, and the remaining hundreds of targets account for only about 5%. Hyperliquid's assets are not low, it is the largest USDC deposit application on Arbitrum, and it still needs more quality major project tokens to be listed on the platform for speculation.

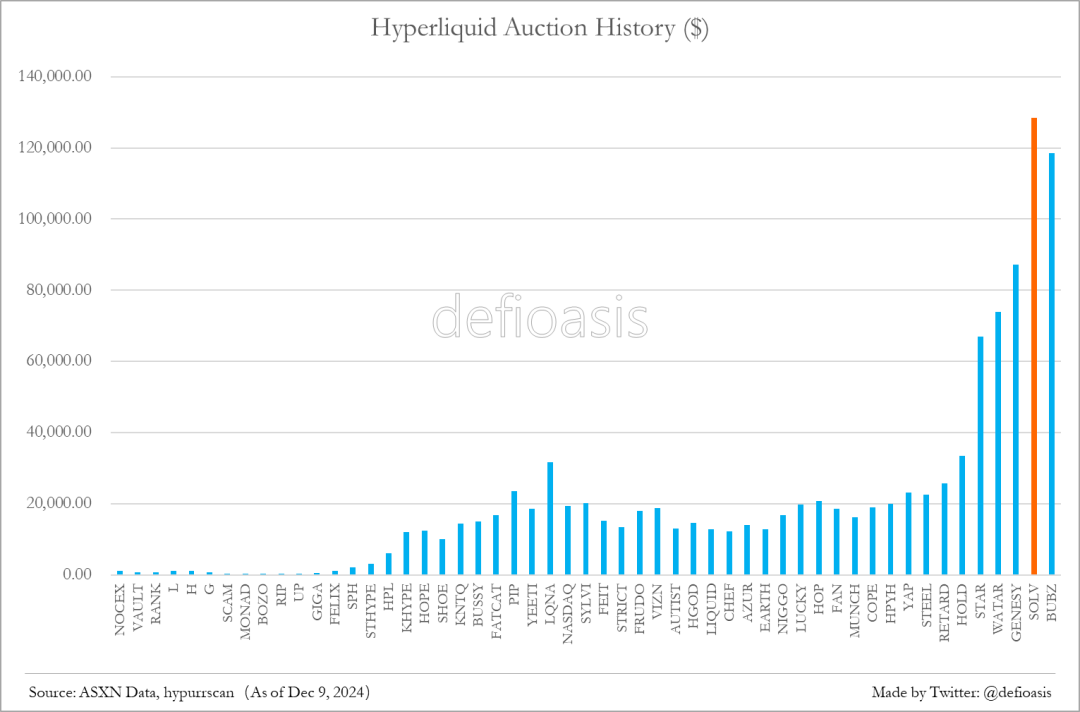

(6) Token Ticket auctions to acquire spot trading positions, Solv Protocol may be the first mover

Projects that want to list on Hyperliquid need to obtain the right to issue new tokens through a Dutch auction mechanism, which is usually held every 31 hours. For a long time, Hyperliquid has focused more on derivatives trading, and the participants in the Token Ticket Dutch auctions are mostly Memes, with the final auction prices rarely exceeding $20,000. However, with the wealth effect and enthusiasm brought by the HYPE TGE, as well as the opening of Hyperliquid EVM, it is expected that more types of projects will consider issuing tokens on Hyperliquid. In addition, some of the low-priced Tickets auctioned off in the past may be selected by a formal project of the same name in the future, becoming a shell for listing on Hyperliquid, and then bought back from the original project party at a high price.

In the recent few auctions, the final prices have soared, with the "SOLV" Token ticket being auctioned off on December 6 for a record-breaking $128,000 on Hyperliquid, and considering that Solv Protocol is about to TGE, this "SOLV" is very likely to be the same SOLV. If so, Solv Protocol will become the first major project to land on Hyperliquid.

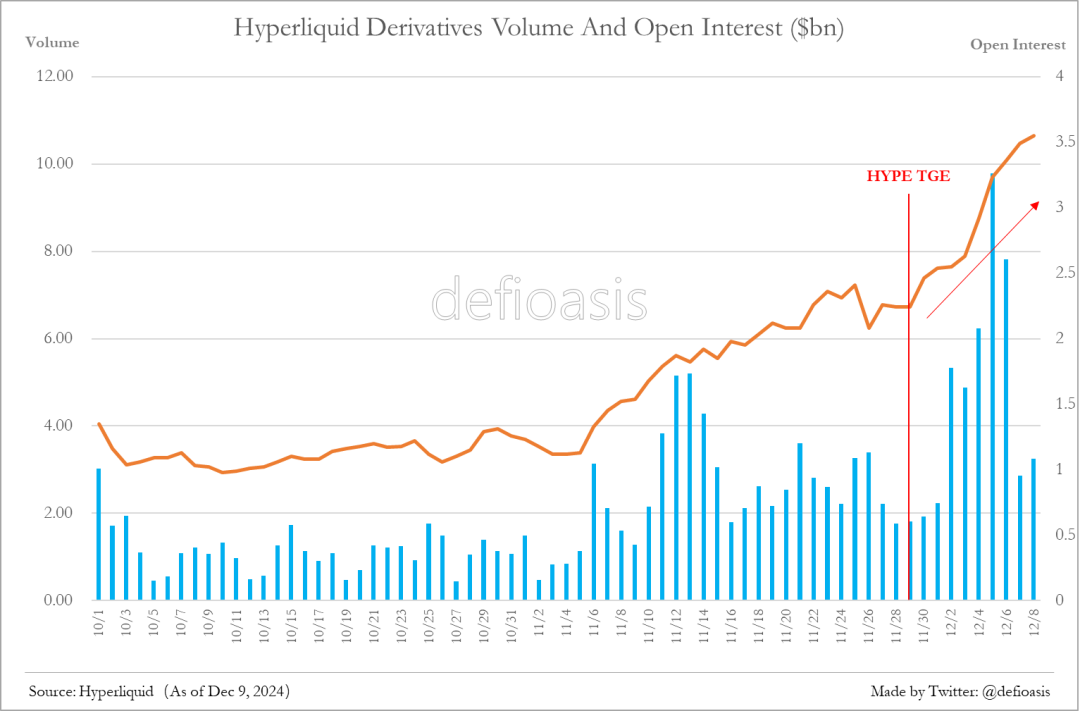

(7) No trading incentives or point programs, Hyperliquid's derivatives trading volume and contract holdings continue to grow

Since the TGE on November 29, Hyperliquid's contract holdings have grown from $2.24 billion to $3.55 billion, an increase of 58.5%. In addition, on December 5, during the high volatility of BTC's first breakthrough of the $10,000 mark, Hyperliquid's single-day derivatives trading volume hit a record high of $9.79 billion. In the absence of airdrops and without any trading or point incentives, Hyperliquid's derivatives trading volume and contract holdings continue to grow, thanks to Hyperliquid's fast execution and low-latency product performance, as well as the good user experience brought by liquidity and order depth comparable to centralized exchanges. With the brand awareness brought by the airdrop wealth effect, it is expected to drive more users to try using the Hyperliquid platform for trading.

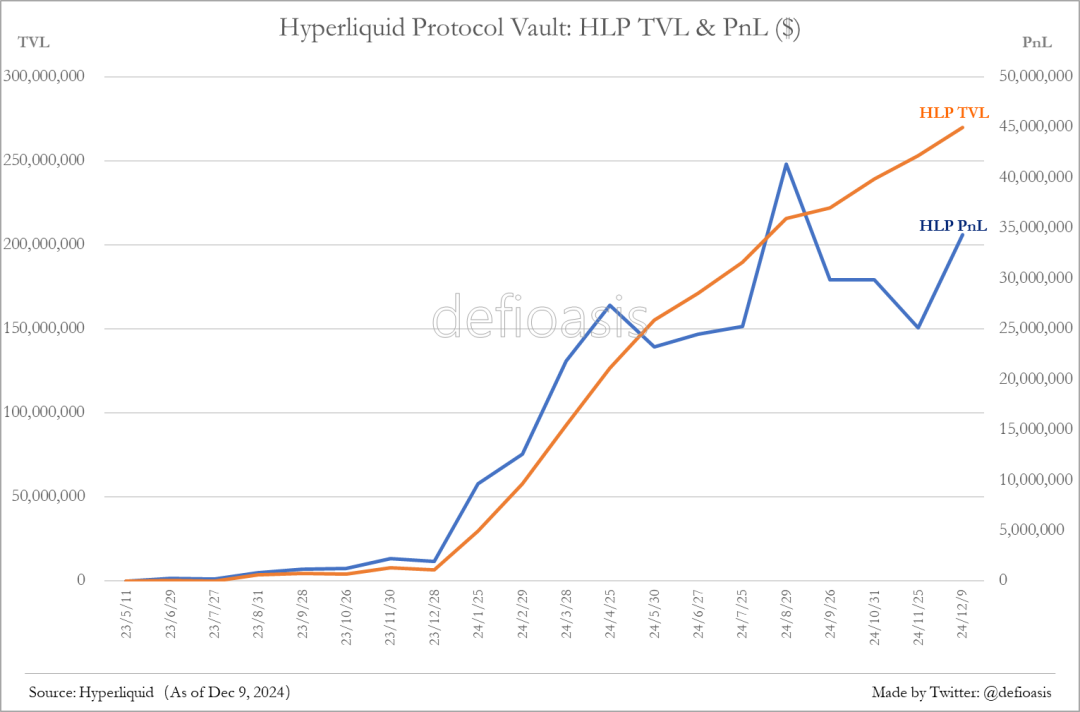

(VIII) Hyperliquidity Provider (HLP) has generated approximately $45 million in PnL gains

Hyperliquid Provider (HLP) is a Protocol Vault open to all users of Hyperliquid, primarily responsible for market making and clearing in the platform's derivatives market, and collecting a portion of the USDC trading fees. The market making strategy of HLP is rooted in the Hyperliquid core contributor team with extensive market making experience and background, and profits and losses are allocated proportionally to each depositor's share in the Vault. Currently, the HLP market making strategy is implemented in an off-chain manner, but users can review HLP's positions, order books, and transaction history on-chain. Furthermore, with the increased market awareness and community discussion of Hyperliquid after the TGE, it is expected that more external market makers will join, and Hyperliquid also allows any operating entity or individual to run User Vaults to execute strategies; for HLP, the risks previously borne by HLP will gradually shift to the various User Vaults, thereby improving the risk-return ratio of HLP itself. Currently, HLP's TVL has reached $206 million, with an accumulated PnL of nearly $45 million and a return of 34% APR over the past month.

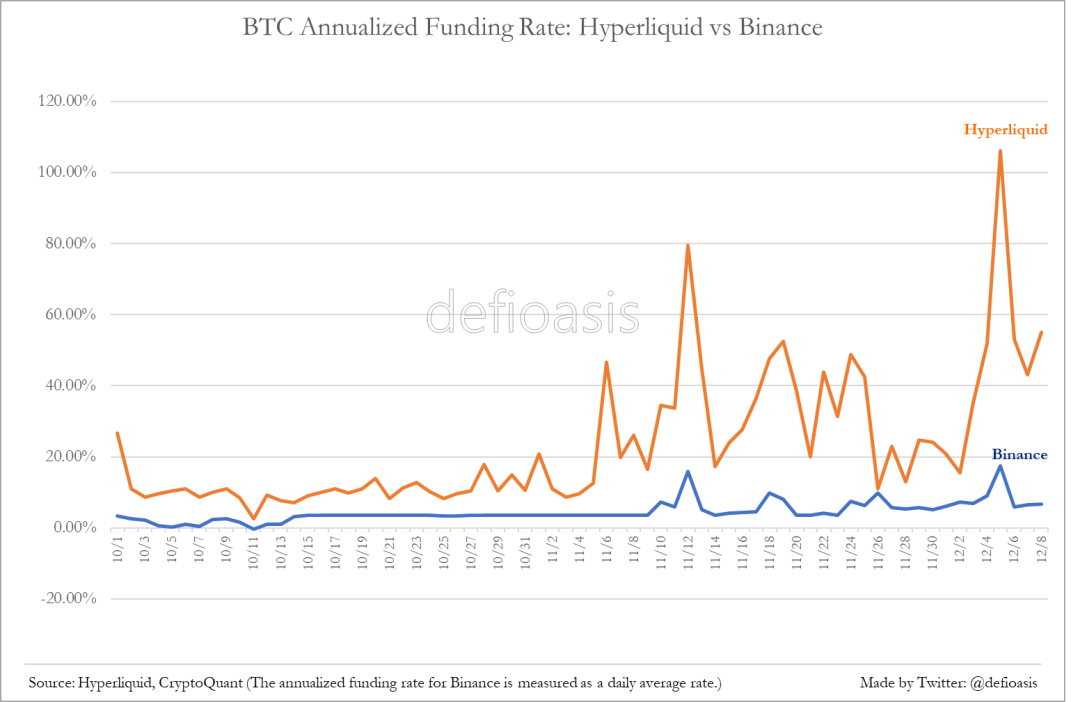

(IX) Hyperliquid has higher Funding Rates compared to mainstream CEXs

Since October 1st, the average annualized funding rate for BTC on Hyperliquid has been 23.23%, while on Binance it has only been 4.52%, with the BTC annualized funding rate on Hyperliquid soaring to 106.16% on December 5th when BTC broke the $100,000 mark. Compared to mainstream CEXs, Hyperliquid lacks more arbitrageurs and large market makers to control or dampen the funding rates, leading to a more aggressive market-based pricing of the rates. Such high funding rates may gradually attract more arbitrageurs to arbitrage or establish their own market making strategy Vaults.

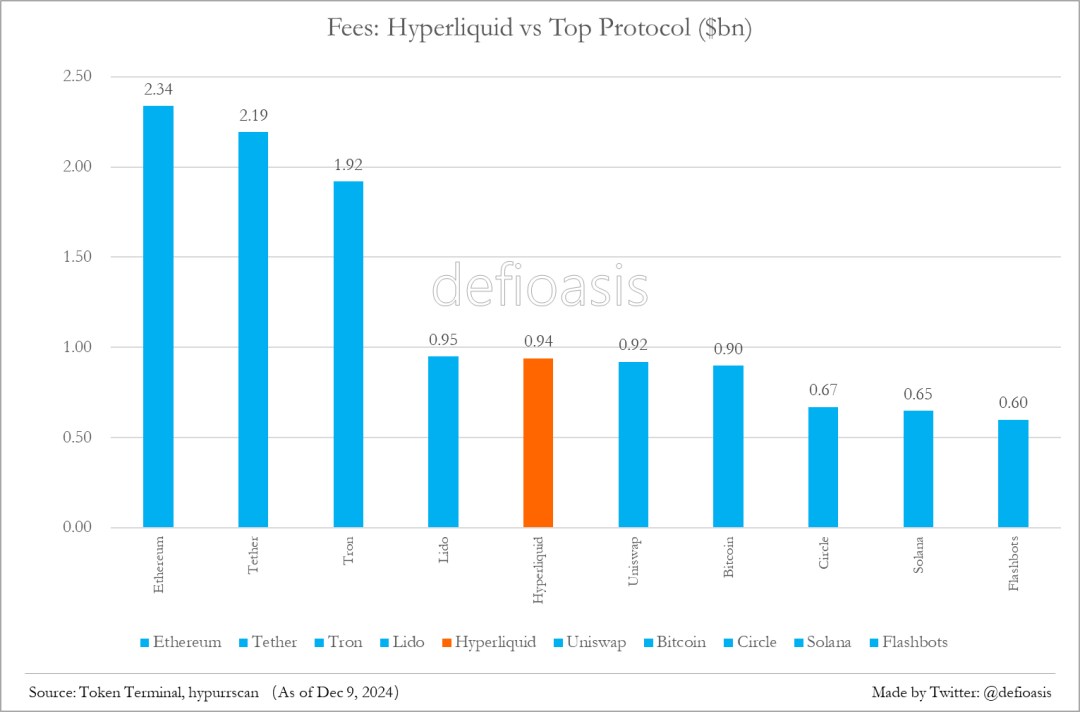

(X) From the beginning of the year to date, Hyperliquid's estimated fee revenue could reach as high as $94.41 million, making it one of the most profitable crypto protocols or applications this year, surpassing Uniswap and Bitcoin

Hyperliquid's revenue is divided into Token Ticket auction fees and USDC-denominated trading fees, with the USDC-denominated trading fees flowing into the HLP Vault (including liquidation fees) and the Hyperliquid Assistance Fund.

According to ASXN Data, from the first HFUN auction on May 16th to the BUBZ auction on December 8th, a total of 156 Token Ticket auctions were held, generating a total fee of $2.221 million.

As of December 9th, the HLP Vault's PnL gain is approximately $43.889 million (although it is uncertain what proportion of the USDC fees are included in the HLP Vault's revenue, this can be used to calculate the maximum value); since the HYPE TGE until December 9th, the Hyperliquid Assistance Fund has received $53.3 million in USDC, which is considered the USDC trading fees that have not flowed into the HLP Vault.

Therefore, as of December 9th, the total fee revenue of Hyperliquid from the beginning of the year is estimated to be as high as $94.41 million.

Reference links: