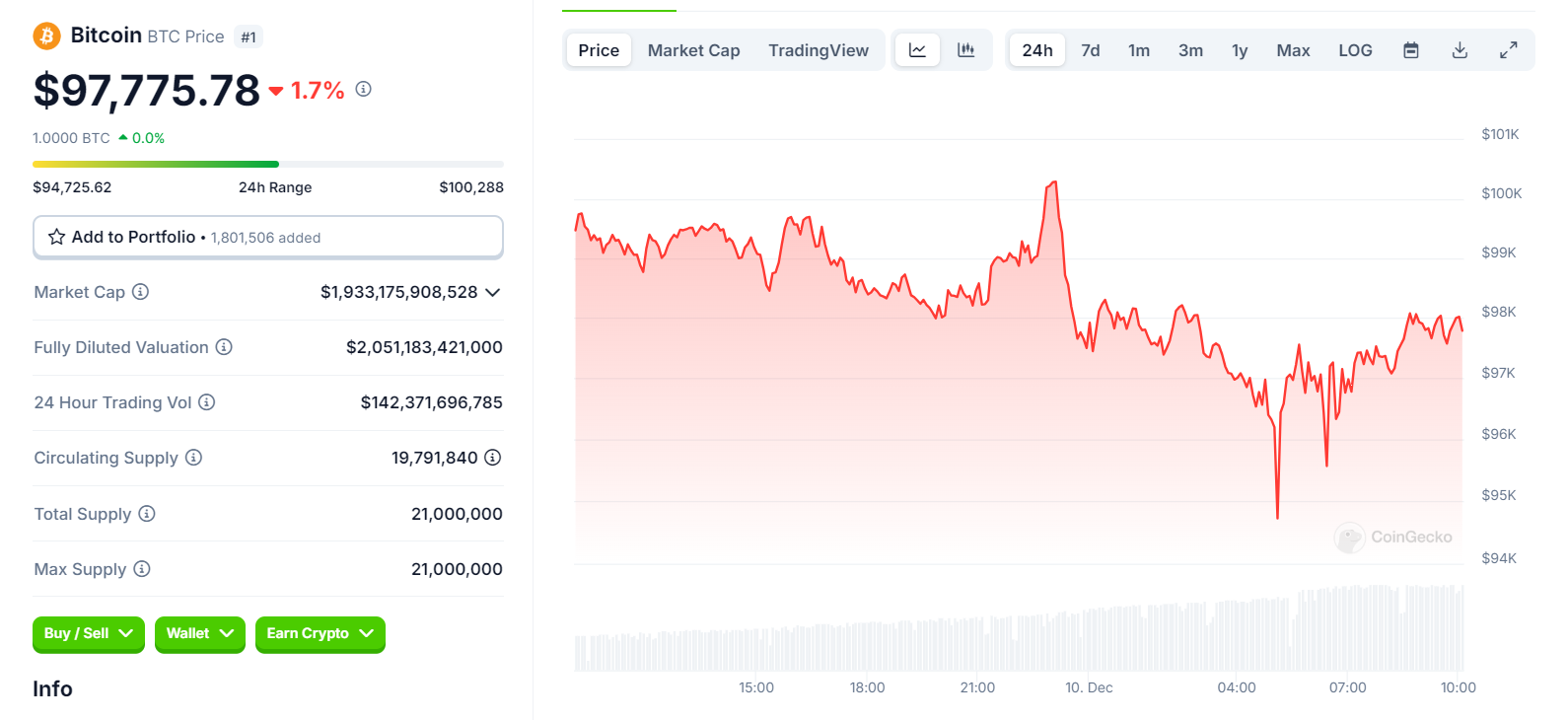

In the early hours of today, the Bitcoin price plummeted sharply to $94,000, triggering a violent fluctuation in the cryptocurrency market, with Altcoins performing even more disastrously, with most tokens falling by 20%-30%. As of the time of writing, Bitcoin has rebounded somewhat. This market turmoil has led to a total liquidation amount of as high as $1.716 billion, involving 570,876 traders. This event not only became the largest liquidation wave in nearly 2 years, but also reflects the structural risks and emotional volatility in the current crypto market.

This article will deeply analyze the background, data, market impact and future trends of this event.

Largest Liquidation Scale in a Year: Leveraged Trading Becomes a Risk Explosion Point

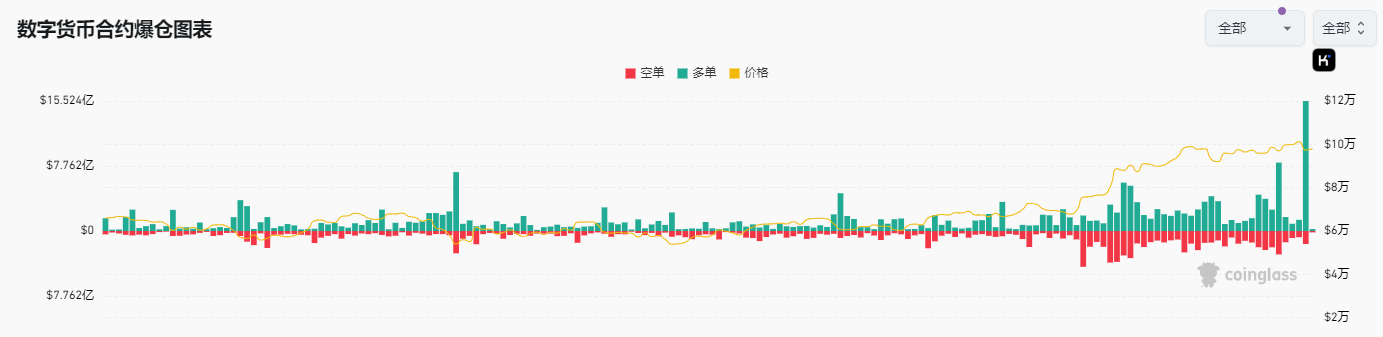

This liquidation event set a new record of $1.716 billion in liquidation amount so far this year, exceeding the scale of about $500 million in a single day last month. Among them, long positions suffered heavy losses, amounting to $1.53 billion, while short positions lost $155 million.Data shows that small Altcoins have become the "hardest hit area" of this liquidation, with a liquidation amount of $564 million, of which long positions accounted for more than 96%.

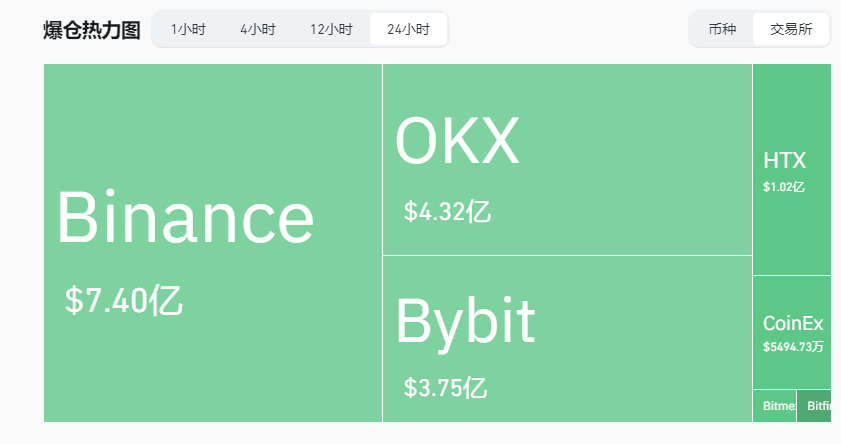

Hardest Hit Area of Liquidation: The Logic Behind Platform Data

Binance led the liquidation with a total liquidation amount of $740 million, accounting for 42% of the total network liquidation.

OKX and Bybit ranked second and third, with liquidation amounts of $422 million and $369 million respectively. The largest single liquidation transaction occurred in the ETH/USDT contract on Binance, amounting to $19.69 million.

Bitcoin and Ethereum, as the two core assets of the crypto market, were also not spared.

Bitcoin fell below the $100,000 psychological barrier in a short period of time, dropping more than $6,000 in a single day, recording $182 million in liquidation, of which long positions accounted for 77%.

Ethereum, unable to break through the key resistance of $4,050, saw its price retest the $3,500 support, recording $243 million in liquidation, of which long positions lost $219 million.

Historical Perspective: Why Was the Liquidation Scale So Huge This Time?

Large-scale liquidation events in the crypto market are not uncommon, but the scale of this liquidation wave is clearly abnormal.

From the trend, since 2022, with the expansion of the market scale and the increase of leverage, the total liquidation amount has continued to increase. More importantly, the concentrated risk exposure of leveraged traders has made the market more fragile when facing extreme volatility.

It is worth noting thatin the past year, the market has experienced multiple liquidation peaks, but the scale has mostly hovered between $500 million and $1 billion. However, this huge amount has surpassed the record high of crypto market liquidation since the 519 event in 2021, and may set a new record for this bull market, far exceeding the 312 event in 2020.

The main reasons for this liquidation wave include: the chain reaction of high-leverage positions, the liquidation chain triggered by the violent market fluctuations, and the dominant long position structure. Especially the sharp drop in Bitcoin triggered the leverage explosion, coupled with the high volatility of the Altcoin market, resulting in long positions accounting for more than 90% of the liquidation amount. Compared to the external shocks of the 312 event, this is more the result of internal leverage imbalance.

This once again warns investors: in a highly volatile market, rational control of leverage is the key to long-term participation.

Ethereum: From On-chain Activity to the Resilience of the Derivatives Market

On-chain Data and Network Activity

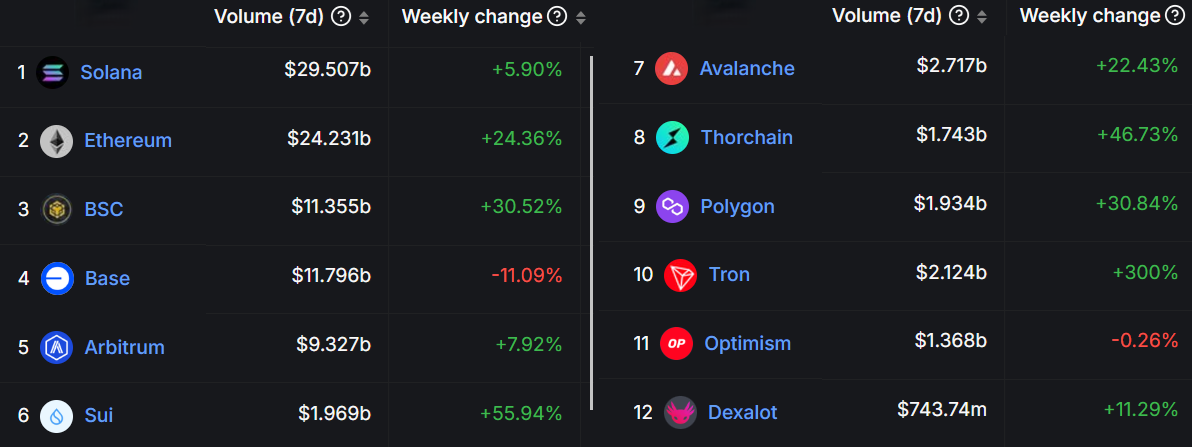

DApp Trading Volume Ranking in the Past 7 Days

As the second largest asset in the market, Ethereum has shown certain resilience in this liquidation wave. On-chain data shows that Ethereum network transaction volume surged 24% in the past week, reaching $24.2 billion, and the total transaction volume including Layer 2 solutions like Base, Arbitrum, and Polygon soared to $48.6 billion. This data is far ahead of Solana's $29.5 billion, indicating that Ethereum network activity remains high.

In addition, since November 29, the inflow of ETH ETF funds has reached a historical high of $1.17 billion, injecting liquidity into the market. However, the ETH price has still failed to break through the long-term resistance of $4,050, and this technical barrier has obviously limited the price trend.

Derivatives Market Signals: Optimistic Sentiment Has Not Completely Dissipated

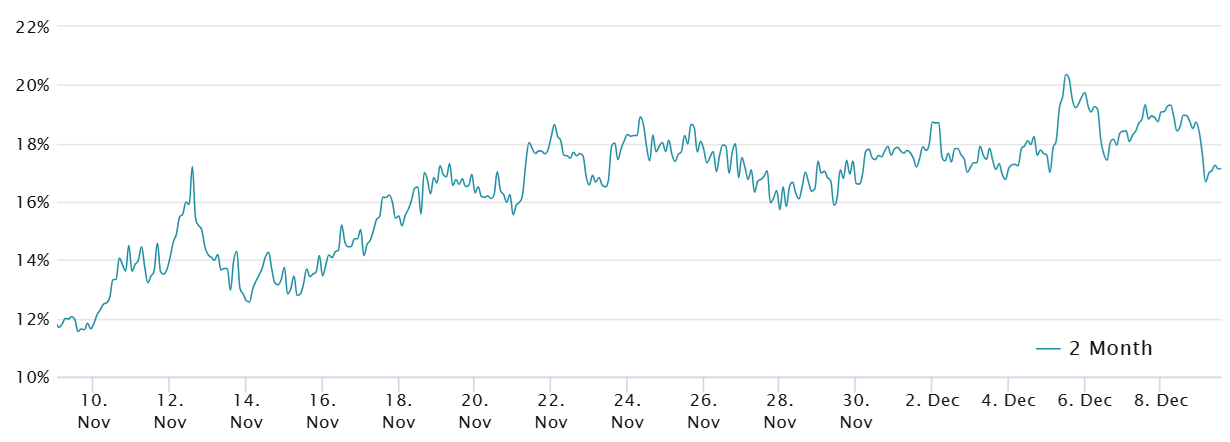

From the futures and options market, the ETH derivatives market has maintained relatively strong resilience.

The annualized premium of Ethereum futures remains at 17%, far higher than the neutral level of 10%, indicating a continued strong demand for ETH leverage.

At the same time, the skewness of Ethereum options has dropped from -7% to -2%, indicating that market sentiment has shifted from extreme optimism to neutrality, but there is no obvious bearish signal yet.

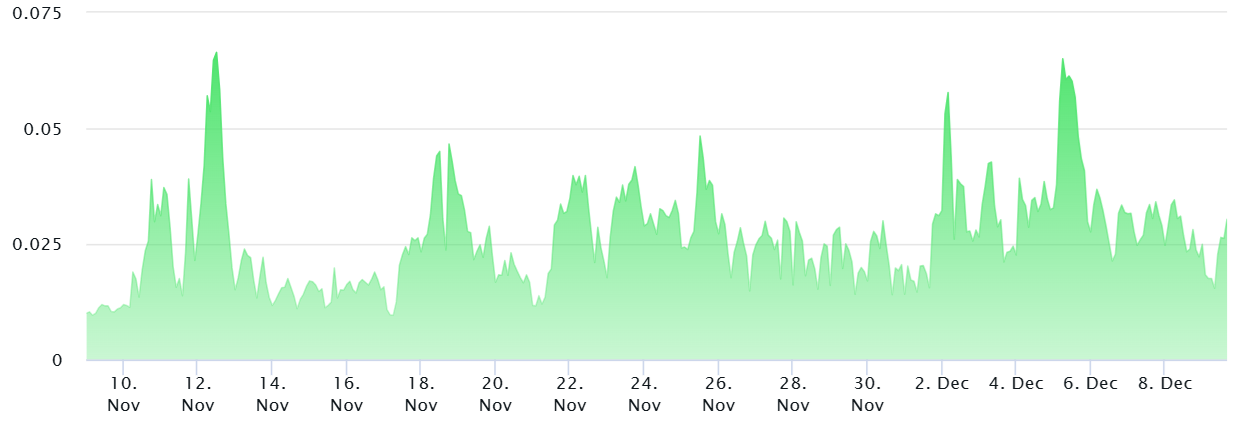

In addition, the perpetual contract funding rate is currently 2.7%, higher than the neutral threshold of 2.1%, indicating that the market's demand for short-term leverage is still strong. However, the funding rate has gradually declined from the peak of 5.4% on December 5, which may also reflect that some traders have become more cautious about market volatility.

Macro and Micro: Dual Factors Affecting Market Sentiment

Crypto market volatility often accompanies changes in macroeconomic variables. This plunge is no exception, with the macroeconomic environment clearly impacting investor confidence.

Recently, China's November inflation data fell 0.6% month-on-month, reflecting the risk of global economic growth weakening. The stock price decline of Nvidia due to monopoly investigation has also increased the downward pressure on the tech sector, indirectly affecting investors' preference for risky assets.

At the same time, the volatility and structural risks of the cryptocurrency market itself have exacerbated the panic sentiment. Although the on-chain activity and ETF fund inflows have provided some support to the market, they have not completely offset the negative impact of the external environment.

Future Outlook: Can Altcoins Catch a Breath?

Technical Levels and Key Supports

Bitcoin needs to stabilize above the $100,000 key psychological barrier to stabilize market sentiment; Ethereum needs to challenge the $4,050 resistance again to restore investor confidence. As for Altcoins, although the current liquidation ratio is high, the market may have a rebound opportunity after a deep correction, especially for those projects with strong fundamentals and community support.

Structural Opportunities and Risks

The actions of institutional investors in this liquidation event are worth watching. The inflow of ETF funds and the improvement of on-chain data may provide a basis for the future market recovery, but the high-leverage operations of retail traders are still the main source of market fragility. In the short term, as the market volatility gradually subsides, professional investors may re-position their positions, laying the foundation for the next round of market trends.

Conclusion: Market Recap and Warnings After the Liquidation Storm

This liquidation event once again highlights the high volatility and high-risk characteristics of the cryptocurrency market. The needle-like plunge of Bitcoin and Ethereum not only brought short-term panic, but also reminded investors to manage their leveraged positions prudently and avoid uncontrollable risks due to market fluctuations.

According to CoinGlass data, the probability of Bitcoin rising in December and January over the past 12 years is 50%. This historical data shows that the overall performance of the cryptocurrency market at the end and beginning of the year is relatively flat, with increased volatility but unclear trends. In the future, investors need to pay more attention to market data, macroeconomic environment, and the dynamic changes of leveraged positions, and manage risks well in their layout to support long-term investment strategies.