Table of Contents

ToggleAltcoins may continue to decline

In a X tweet on December 10, Felix Hartmann, founder of venture capital firm Hartmann Capital, said that most Altcoins may continue to decline until the end of January 2025.

"Some Altcoins may see a brief rally, but most are likely to enter a slow decline or consolidation phase within the next 2 to 6 weeks. At this point, chasing Altcoins (in my view) is unlikely to generate 'alpha' returns, as many coins have already seen 2-3x gains within a week, with the rally essentially topping out."

Returning to bullish bias

However, despite Felix Hartmann's relatively conservative outlook on Altcoin trends, this does not mean he is bearish on the current market sentiment. Felix Hartmann said that now may be an opportune time to take a moderately bullish stance.

"While I had expected some Altcoins to drop even lower, being overly perfectionistic is a big mistake, so now seems like a decent time to re-adopt a bullish position."

According to CoinGlass data, the Altcoin market experienced another round of declines in the past 24 hours, with around $480 million in long positions being liquidated. According to CoinMarketCap data, the top 100 cryptocurrencies with the biggest declines were Ethena (ENA) down 13.36%, Movement (MOVE) down 11.72%, and dYdX (DYDX) down 11.16%.

Bit declines but does not wane

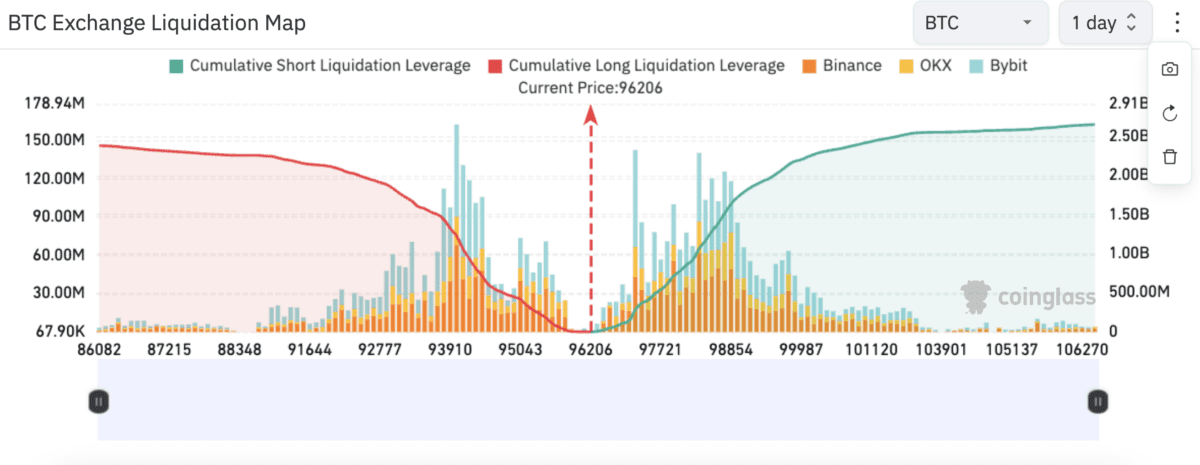

Bit (BTC) is currently priced at $96,123, down 1.8% over the past day. Bit has been trading below the psychological $100,000 level since December 9. However, Felix Hartmann said Bit has a "fairly good chance" of testing the $99,000 level again, with this rebound primarily driven by "short squeezes".

If Bit rises 2.41% to break above $99,000, around $1.53 billion in short positions could face liquidation risk.

In a X post on December 10, CryptoSea co-founder Daan de Rover stated:

"There is a lot of liquidity built up above Bit's current price, and we all know what's going to happen next."

Implying that there are large outstanding short contracts or sell orders above Bit's current price, and if the price breaks through the key resistance, it will trigger a short squeeze, driving further rebound.