Source: Liu Jiao Chain

Overnight, BTC sought support around the 96k level on the 5-week line. The vote by Microsoft shareholders on BTC reserves did not pass, as expected by the market. MicroStrategy has added to its position again. Michael Saylor posted:

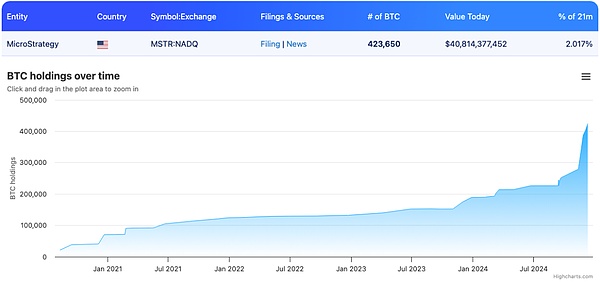

"MicroStrategy has purchased a total of 21,550 BTC for approximately $2.1 billion, at an average price of approximately $98,783 per BTC. The BTC-denominated return on investment for the quarter was 43.2%, and the year-to-date return was 68.7%. As of December 8, 2024, MicroStrategy holds 423,650 BTC, at an average purchase price of approximately $60,324 per BTC, for a total purchase price of approximately $25.6 billion."

Netizen Fred Krueger analyzed MicroStrategy's additional BTC purchase strategy:

In early November, MicroStrategy held 252,000 BTC. BTC price was $69k. MicroStrategy's stock price was 2.1 times its net asset value.

MicroStrategy formulated a plan to add 171,000 BTC, a 68% increase in position. A total of $16 billion was spent, with $3 billion raised through convertible bonds from the US stock market. Ultimately, MicroStrategy's stock price successfully increased to 2.4 times its net asset value.

Mathematical magic: Due to the high average net asset multiple (2.9x) and the use of convertible bonds, this 68% increase in BTC holdings only resulted in the issuance of 40 million new shares (a 17% increase). Verification: 1.68 / 1.17 = 43% fourth-quarter earnings growth (in line with the statement).

In summary: MicroStrategy spent $16 billion to increase its earnings per share by an astonishing 43%.

Note: In the number of new shares issued, Fred Krueger wrote 40k. The Chain Education suspects he made a typo, and it should be 40M, as MicroStrategy's total outstanding shares as of December 2024 are about 2.3 billion. Additionally, it is worth criticizing that when searching the internet for MicroStrategy's total shares, it is impossible to find a reliable figure, as the numbers given by various financial websites are quite different. Whenever delving into these details, one can't help but firmly believe that blockchain and digital assets will eventually replace these outdated financial systems. These outdated systems even make it impossible for retail investors to understand a simple number, and there is no publicly transparent and verifiable way to do so. It is almost suspicious that they are deliberately obfuscating, as the issue of quantity is the key to manipulating dilution.

Back to the topic. Then, Fred Krueger proposed a new BTC unit: 1 Nakamoto, equal to 1.1 million BTC - this is the suspected amount of BTC mined by Satoshi Nakamoto in the early years.

Previously, the smallest unit on the BTC main chain was 1/100 millionth of a BTC, called 1 satoshi. Now we can have a larger unit of BTC hoarding, 1 Nakamoto, equal to 1.1 million BTC.

We know that just a few days ago, the total holdings of the US spot BTC ETF had just exceeded 1 Nakamoto.

Fred Krueger calculated that if Michael Saylor tries to have MicroStrategy accumulate BTC to the level of 1 Nakamoto, it still needs 676,350 BTC. At the current price of $96k, it would require approximately $64.9 billion, which is four times the previous $16 billion.

Drawing on the concept of "gold content" for fiat currencies backed by gold, now with stocks backed by BTC, we can have a "Nakamoto content", that is, how many Nakamoto BTC each share is supported by.

Based on MicroStrategy's recent additional holdings of 423,650 BTC, and the total shares increasing to about 2.7 billion after the new share issuance, the Nakamoto content per share is:

423,650 / 2.7 = 0.157 Nakamoto/share

If MicroStrategy can still raise 4 times the amount of money with the same financing efficiency and increase its holdings to 1 Nakamoto, the total shares will expand to 4.3 billion, and the Nakamoto content per share will increase to:

1,100,000 / 4.3 = 0.256 Nakamoto/share

At this point, I wonder if the readers have noticed that with MicroStrategy's approach, although it has been continuously issuing new shares to dilute, since it has used the raised funds to buy BTC, the Nakamoto content per share has actually increased. If one is bullish on the long-term value growth of BTC, this means that the value of MicroStrategy's shares has also been greatly enhanced through this operation.

Of course, this calculation is too idealized. First, whether MicroStrategy can continue to raise funds at a high premium from the US stock market is questionable. Second, if MicroStrategy keeps buying, the price of BTC will not stay at $96k and wait for it to slowly accumulate. In other words, first, it may not be able to smoothly raise so much money, and second, even if it can raise the money, it may not be able to buy so much BTC at a low price.

Nevertheless, MicroStrategy has still managed to achieve its strategic goal of hoarding a large amount of BTC by leveraging the abundant US dollar liquidity in the US stock market, which is truly admirable.