AsDeFi investors prepare to welcome theHYPE token launch, what is it that has attracted so much attention toHyperliquid?

In just two years,Hyperliquid has quickly become a leading protocol in the crypto derivatives market, becoming one of the most active decentralized perpetual contract exchanges.

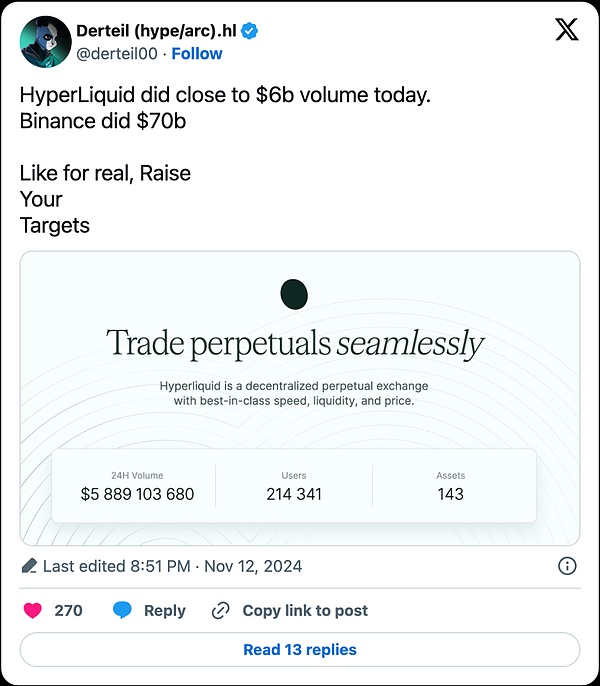

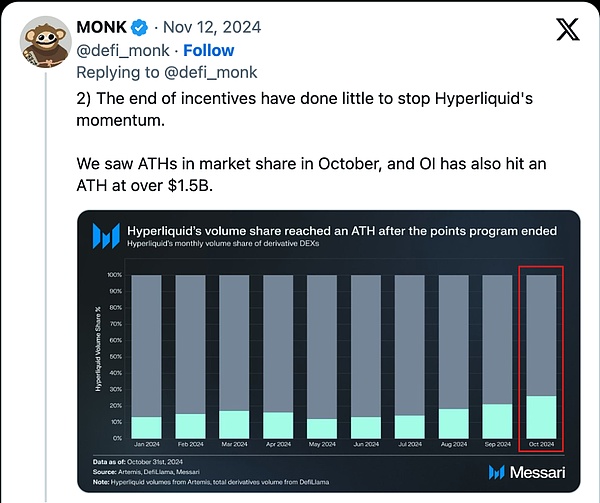

In the blockchain space,Hyperliquid has uniquely adopted a product-first strategy, achieving organic growth without large-scale incentives, and maintaining financial independence as a fully self-funded team. It has just processed $21 billion in trading volume this week, with its perpetual contract trading volume market share growing 3-fold this year, from around 11% in December 2023 to 33% this week.

At the same time,Hyperliquid has been running its own rewards program and is soon to welcome the highly anticipatedHYPE token initial offering (TGE), laying the foundation for its future decentralization, EVM compatibility, and community governance. (HYPE launched on November 29th morning with an opening price of $3.2, and a current circulating supply of 333 million. The trading volume in the first hour reached $157 million. As of the time of writing, the price has reached over $9.4, a gain of nearly 200%, with a market cap exceeding $3.2 billion.)

Let's explore what makesHyperliquid unique and the plans following the launch ofHYPE.

Hyperliquid's Unique Features

Hyperliquid's distinctive features go beyond traditional derivatives, providing carefully designed token creation tools, liquidity management, and smooth user experience and yield generation capabilities.

HIP-1: Native Spot Asset Standard

In addition to perpetual contracts,Hyperliquid also offers native token functionality through itsHIP-1 token standard. Projects can issue tokens through a simple five-step on-chain process, defining the token name, setting the supply cap and initial balances.

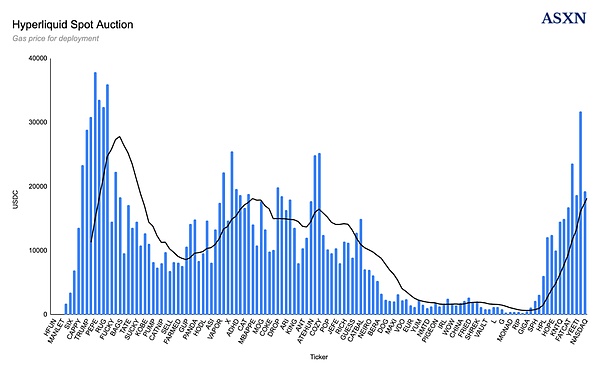

The most unique feature ofHIP-1 is its token ticker Dutch auction system. In this auction process, the token creators bid for the ticker, with the price starting high and gradually decreasing over 31 hours. This ensures a fair and transparent bidding and listing environment, maintaining reasonable costs and regulating the pace of new token listings.Hyperliquid only allows around 280 new tokens to be listed per year, prioritizing quality and preventing the market from being flooded with low-quality projects.

HIP-2: Hyper Liquidity

HIP-2 (also known as Hyper Liquidity) ensures that tokens have sufficient liquidity to maintain market stability. HIP-2 achieves this by providing a fully automated on-chain liquidity system forHIP-1 tokens, without the need for third-party market makers.

In practice,HIP-2 automatically places buy and sell orders onHyperliquid's order book for each token and frequently adjusts these orders to match the current market price. This feature creates a reliable and stable trading environment for token creators and traders.

Inspired by automated market makers (AMMs) likeUniswap,HIP-2 applies the AMM principle to the traditional order book model, which is the default mode for centralized exchanges and preferred by many traders for its precise buy and sell pricing.

Essentially,HIP-2 acts as an embedded market-making service, ensuring that all tokens issued on theHyperliquid platform enjoy a stable and convenient trading experience.

Excellent User Experience

Hyperliquid's user experience design is smooth and cost-effective, particularly suited for active traders, with two standout features:

-Zero-fee trading:Hyperliquid adopts a zero-fee trading model, where users do not pay any trading fees when placing orders - only a small fee is required for deposits and withdrawals.

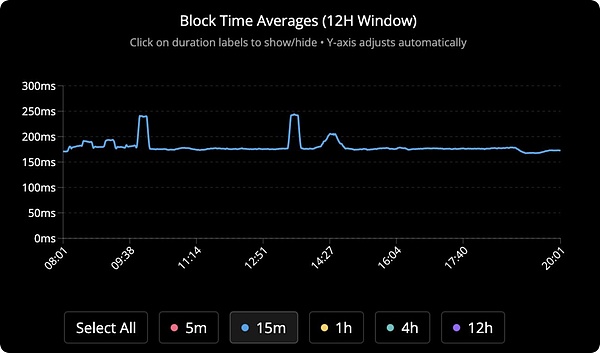

- HyperBFT: The platform uses a custom consensus mechanism calledHyperBFT to process large volumes of orders with extremely low latency. Most trades are completed within 0.2 seconds, and even during peak times, the system guarantees completion within 0.9 seconds. Furthermore, the system can handle up to 100,000 orders per second, with the potential for even higher throughput in future updates.

By combining free trading and fast, reliable processing capabilities,Hyperliquid provides a responsive and cost-effective trading experience suitable for both casual users and high-frequency traders.

Yield Opportunities from Pools and Copy Trading

Another unique aspect ofHyperliquid is its two types of liquidity pools, aimed at helping users earn yields by either copying experienced traders or participating in platform activities:

-User Pools: Allow users to automatically copy the trades of experienced traders. Users can deposit funds into the pools and share the profits and losses of the pool managers, earning potential returns without actively trading. This setup is ideal for those who want to participate in the market but lack advanced trading knowledge, although users must be cautious in selecting the pools.

-Protocol liquidity pools: Focused on low-risk yield generation. For example, super liquidity provider liquidity pools earn returns from market making, handling liquidations, and protocol fees. These liquidity pools provide more stable and predictable income streams through Hyperliquid's own operational activities, suitable for users interested in low-volatility yields.

Outlook after the release of HYPE

After the release of HYPE, there will be key developments, including the achievement of Ethereum compatibility and community-driven governance model through HyperEVM:

HyperEVM

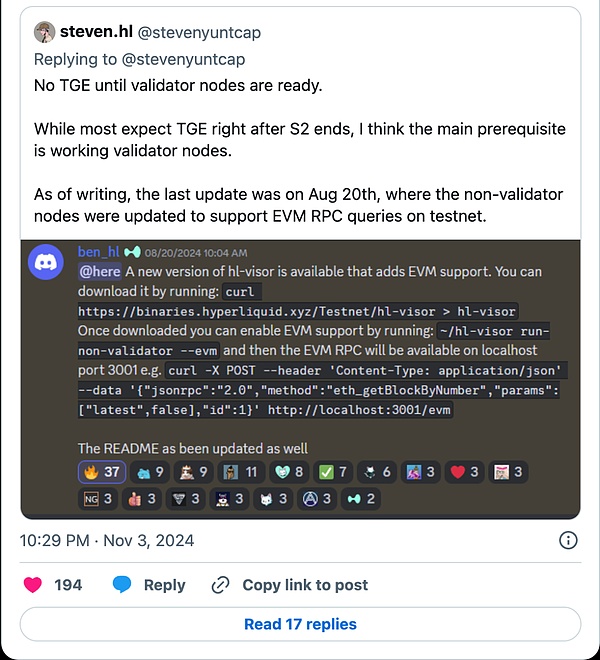

One of the most anticipated developments after the release of HYPE is HyperEVM, which will bring Ethereum compatibility to Hyperliquid. 35 teams are already preparing to deploy on HyperEVM. For example, Felix Protocol will launch the stablecoin feUSD, while HyperLend will bring a lending market to the layer-1 chain.

Network decentralization

After the issuance of HYPE, the decentralization journey of Hyperliquid will officially begin, with token holders playing a crucial role in platform governance and operational security. Through HYPE, token holders will gain voting rights on key decisions, including platform updates, fee structures, and broader policy changes, ensuring the community has a voice in determining the direction of Hyperliquid.

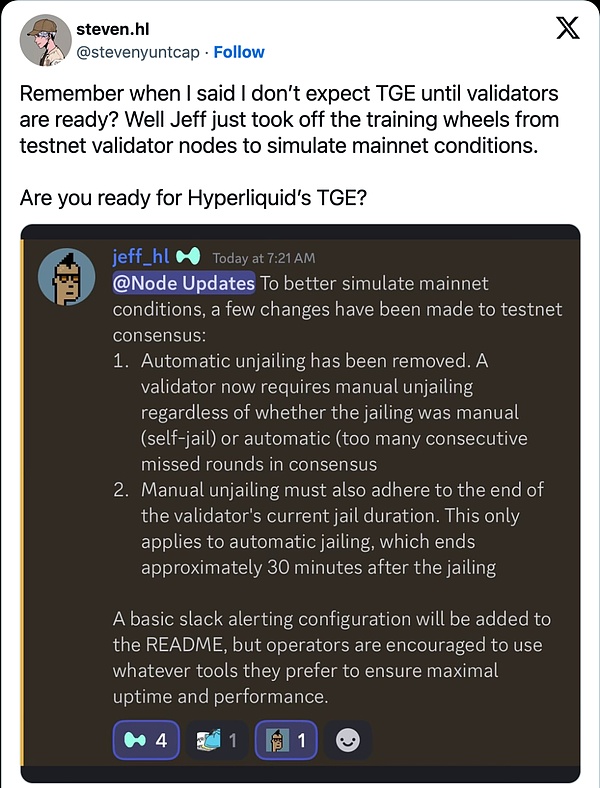

In addition to governance, HYPE will also play a role in establishing a distributed validator network to enhance network security. Currently, Hyperliquid is operated by four core validators run by the team members. After the initial token release, Hyperliquid plans to implement a validator network to decentralize transaction verification and reduce reliance on a single operator. This not only enhances network security and transparency but also lays the foundation for a fully decentralized ecosystem, allowing users to actively participate in governance and building operational resilience.

Summary

Hyperliquid has quickly become a powerhouse in the trading space, standing out in the market competition through a product-first, fast, and cost-efficient user experience, as well as a focus on organic growth.

After the initial token release of HYPE, the ecosystem will move towards decentralization, opening the door to community governance, rapid expansion through HyperEVM to achieve Ethereum compatibility, and a decentralized validator network to enhance security and resilience. The future of Hyperliquid looks very promising, and the release of HYPE is well-timed to drive its further expansion.