Introduction

Stablecoins, as an important form of cryptocurrency, are rapidly rising and profoundly impacting the global financial market. From traditional fiat collateral to innovative algorithmic mechanisms and over-collateralization designs, stablecoins are not only widely used in the decentralized finance (DeFi) field, but are also gradually penetrating the traditional financial system, triggering widespread discussion on their potential and risks. Although some experts believe that stablecoins can further consolidate the global dominance of the U.S. dollar, there are also views that they may pose a challenge to the stability of fiat currencies. As market demand grows and technological innovation continues to advance, how the diversified development of stablecoins will affect international payments, cross-border transactions, and the entire financial system has become a focus of attention in the financial and technological fields.

Stablecoin USDTLatest Price

Stablecoins: Consolidating Dollar Hegemony or Challenging Fiat Currency Status?

Stablecoins, as an important component of cryptocurrencies, are rapidly occupying the market and being widely used in decentralized finance (DeFi) and cross-border payment fields. A report released by Citi Wealth states that the rapid development of stablecoins will not undermine the dominance of the U.S. dollar, but rather help further consolidate the global financial hegemony of the U.S. dollar. The report emphasizes that although cryptocurrencies such as BTC were initially seen as competitors to central bank currencies, and some believe that BTC may end the dollar's hegemony, stablecoins pegged to the U.S. dollar are challenging this view.

The relationship between stablecoins and the U.S. dollar: Most stablecoins are pegged to the U.S. dollar, and their issuers usually purchase low-risk assets such as U.S. Treasuries to ensure the stability of the stablecoins' value. This not only provides a convenient way for the U.S. dollar to circulate globally, but also further consolidates the dominant position of the U.S. dollar through regulatory legitimization. With the growing global demand for stablecoins, traditional payment giants like Visa and PayPal are also actively launching their own stablecoins, trying to integrate into this trend and ensure their place in the new payment ecosystem.

However, the International Monetary Fund (IMF) holds a different view, warning that stablecoins could potentially replace sovereign currencies and even threaten the stability of fiat currencies in some cases. The IMF advocates that countries launch central bank digital currencies (CBDCs) to address the challenges posed by stablecoins to the existing monetary system.

Rapid Development and Innovation in the Stablecoin Market

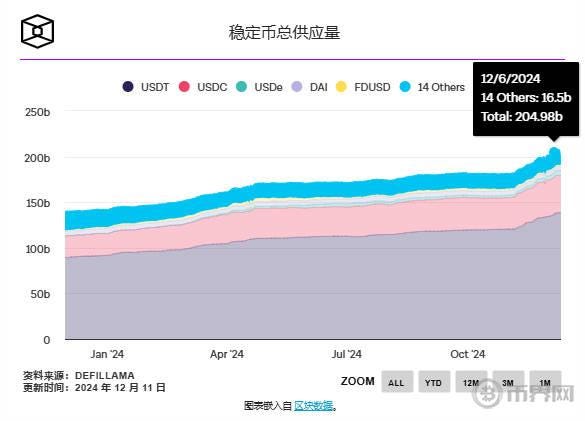

As the market demand for innovative stablecoins continues to grow, various emerging projects are constantly launching different stablecoin solutions. These innovations not only demonstrate the huge potential of the stablecoin market, but also reflect their diverse applications in the financial field. According to the latest data from Coin World, the total market capitalization of stablecoins has exceeded $200 billion, nearly doubling from last year, showing their strong growth momentum in the global market.

1. Ethena: Combining Low-Risk Wealth Management and Innovative Hedging Strategies

Ethena is one of the fastest-growing non-fiat-collateralized stablecoin projects since the Terra Luna collapse. Its native stablecoin USDe ensures the stability of its value through a Delta Hedging strategy using ETH and BTC as collateral. Ethena shorts these collateral assets to hedge against price fluctuations, providing users with a relatively high annualized yield (currently 27%). This innovative model that combines decentralized stablecoins and low-risk wealth management has helped Ethena stand out in the market.

Although Ethena's design can theoretically effectively hedge risks, it also faces potential risks such as bank runs. If users massively redeem USDe, it may lead to a decoupling of market prices, triggering the protocol to liquidate and repurchase the stablecoin. However, the project has not yet experienced systemic risks, and its innovative design continues to attract users.

2. Usual: RWA Stablecoin Based on U.S. Treasuries

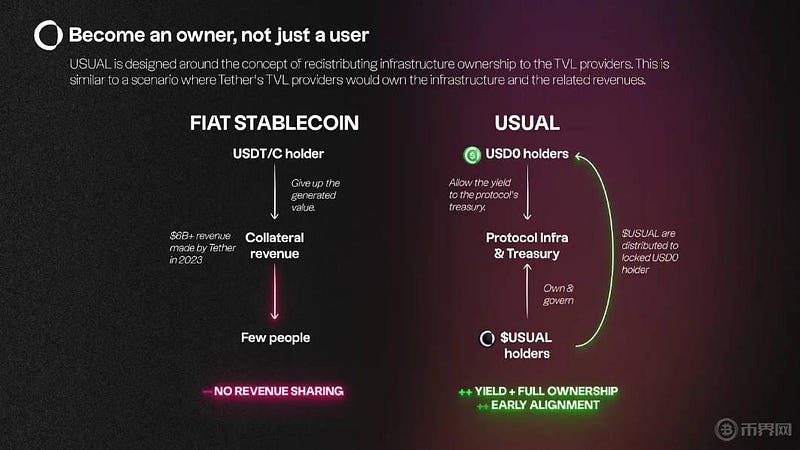

Usual is an emerging fiat-collateralized stablecoin project, whose native stablecoin USD0 adopts a 1:1 reserve ratio system, converting fiat currency into ultra-short-term U.S. Treasuries. Unlike traditional stablecoins, Usual provides users with a stable income stream by converting the capital behind the stablecoin into U.S. Treasuries. This revenue distribution mechanism breaks the control of traditional stablecoin issuers like Tether and Circle, and shares more profits with users. Usual's innovation lies in redistributing the ownership of financial products to TVL providers, allowing users to participate in protocol governance and revenue distribution.

Usual's advantage lies in its long-term lock-up design, which allows it to maintain capital efficiency while providing better underlying asset support. Compared to the higher short-term yields of Ethena, Usual has more long-term investment value, and its decentralized governance also makes it more risk-resistant, particularly suitable for non-trading users.

3. f(x) Protocol: Decentralized High-Leverage Stablecoin

f(x) Protocol is a decentralized stablecoin project, and its latest version (V2) further optimizes the stability of the protocol by introducing the high-leverage trading tool xPOSITION. f(x) Protocol supports the stability of its stablecoin fxUSD through multiple liquidity staking derivatives (LSDs). Unlike other stablecoin projects, f(x) Protocol V2 eliminates the liquidation risk and funding costs of traditional leveraged trading through a complex leverage mechanism and automated capital management system. Its goal is to create a fully decentralized stablecoin system, free from the control of centralized entities, while providing higher capital efficiency.

Although the project design is relatively complex, it represents the crypto community's ideal pursuit of decentralized stablecoins. As the market matures, f(x) Protocol may become an important innovation in the stablecoin field, providing users with a fully decentralized stablecoin solution backed by high-quality crypto assets.

Potential and Future Development of the Stablecoin Market

Stablecoins not only play an important role in the decentralized finance (DeFi) field, but are also entering the traditional financial field. As the legalization of stablecoins accelerates, market demand for their applications in retail payments, international remittances, and cross-border e-commerce will continue to grow. In emerging markets such as Asia, Africa, and Latin America, the application of stablecoins can effectively solve the problems of high inflation and currency instability, allowing residents to participate in global financial activities and obtain better financial services.

At the same time, the compliance and accelerated adoption of stablecoins will also drive their global proliferation. With the progress of AI technology, the demand for stablecoins will further expand, especially in areas such as computing power purchases and subscription services, and they are expected to become an important component of the next stage of the crypto economy.

Conclusion

Followin' as an important innovation in the cryptocurrency field, is leading the transformation of the global financial system. Whether it is the application of Tether to consolidate the hegemony of the US dollar, or the exploration of various emerging projects in terms of decentralization and innovative design, the Tether market is showing a trend of diversified development. With the continuous development of the market and technological progress, we have reason to believe that Tether will play a more important role in the future financial system and become a key force in promoting the efficiency improvement of global payment and financial services.