Author: Lorena Nessi

Translated by: Bai Hua Blockchain

2024 was a pivotal year for the crypto industry, filled with exciting trends and moments that continued to captivate the community.

From the headline-grabbing Memecoins to the tokenization of real-world assets, the year was full of stories that pushed blockchain into new frontiers.

Telegram games made cryptocurrencies more accessible to the average user, while prediction markets and liquid staking tokens provided new ways to interact with digital assets.

Add to that the race for rollups, modular blockchains, and solutions to the quantum threat, and 2024 was undoubtedly an extraordinary year.

These ten trends showcase the vitality and innovation driving the crypto world forward.

1. The Rise of Memecoins

Memecoins are an unprecedented social phenomenon. While some view them as simple, trivial, or even question their legitimacy as digital assets, considering them poor financial decisions or just fleeting trends and viral marketing, they have undeniably carved out a place in the crypto ecosystem, blending humor, community engagement, and innovative digital value creation with broader cultural movements.

1) Grassroots Movements and Celebrity Effects

These tokens respond to various social, political, and economic contexts, reflecting cultural sentiments. They leverage celebrity culture, driven by influential figures, often boosting their visibility.

Memecoins often harness grassroots movements, where communities rally around shared ideas and values, sparking collective action and viral trends. They also highlight the role of participatory culture, allowing users to collectively drive token adoption and shape narratives. They may sometimes just be trivial fads.

2) Memecoins in 2024: Milestones and Impact

In 2024, Memecoins solidified their status as a decisive force in the crypto realm. Tokens deeply influenced by Shiba Inu (SHIB), such as Neiro (NEIRO) and FLOKI Inu (FLOKI) - the latter launching a debit card - as well as PepeCoin (PEPE), which tapped into internet memes and nostalgic culture, demonstrated how humor and cultural relevance can drive significant financial activity.

A notable example of Memecoin influence in 2024 was the appointment of Elon Musk to lead the newly formed Department of Government Efficiency (DOGE) by the elected President Donald Trump. The agency's mission was to streamline federal operations and reduce inefficiency, with the acronym deliberately paying homage to Dogecoin (DOGE), Musk's well-known supported project.

3) Intersection of Technology, Culture, and Society

Memecoins reflect the intersection of technology, culture, social, and political dynamics, showcasing how seemingly outlandish ideas can challenge traditional notions of value and innovation. For many, they serve as a gateway into the crypto world, providing an accessible entry point to technology-driven digital assets.

2. The Growth of Prediction Markets

In 2024, decentralized platforms like Kalshi and Polymarket gained widespread attention for allowing users to predict events and earn rewards. These platforms covered a range of topics, including sports event outcomes, election results, and cryptocurrency prices, leveraging blockchain technology to ensure transparency and security.

During the 2024 US presidential election, Kalshi's betting volume exceeded $100 million, demonstrating the potential of prediction markets in gauging public sentiment. However, this growth also sparked criticism. Some analysts argued that low liquidity and susceptibility to manipulation undermine the reliability of prediction markets as forecasting tools.

Regulatory scrutiny also intensified. Kalshi prevailed in a legal battle with the Commodity Futures Trading Commission (CFTC), allowing it to offer political event contracts, but concerns about legality and market manipulation remained. Additionally, some expressed moral objections, questioning the ethics of gambling on elections.

One X user expressed her concerns about election betting, posting, "I think the CFTC is actually pushing for the right thing. Why gamble on elections? I personally don't like the idea."

Despite these challenges, the rise of prediction markets underscored the demand for decentralized solutions to real-world problems, solidifying their position as a significant trend in the crypto space in 2024.

3. Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs)

In 2024, Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs) gained more prominence, building on earlier innovations to achieve greater impact. While EigenLayer launched its mainnet in mid-2023, its influence became more pronounced in 2024 as the adoption of restaking gradually increased.

By mid-year, over 33.8 million ETH had been staked, indicating growing market confidence in the Ethereum Proof-of-Stake (PoS) model and the viability of liquid staking.

LSTs allow users to maintain liquidity while staking their assets, enabling decentralized finance (DeFi) activities such as lending and trading. LRTs further enhance this concept by allowing validators to restake their staked assets to other networks or support services like rollups, increasing their functionality and rewards. While adoption surged in 2024, achieving widespread adoption across all domains remains an ongoing process.

Key Platforms and Competition

EigenLayer made significant progress in restaking, with over 4.1 million ETH restaked on its platform by April 2024. Other platforms like Lido Finance, Rocket Pool, and Frax Finance also made important contributions, expanding the applications of LSTs and integrating them into the DeFi ecosystem. These projects played a crucial role in driving innovation and accessibility in the staking domain.

The advancements in 2024 have made LSTs and LRTs essential tools in the staking ecosystem, laying the foundation for the future integration of blockchain technology and DeFi.

4. The Quantum Computing Threat

In 2024, the discussion around the impact of quantum computing on blockchain security took center stage. While quantum computing technology holds immense potential for scientific breakthroughs and innovation, it also poses a significant threat to the core of cryptocurrencies - their security.

1) The Quantum Threat

Quantum computers, leveraging the power of quantum mechanics, may be able to break the encryption algorithms that protect blockchain networks. Algorithms like Shor's algorithm can theoretically decrypt public-private key pairs, jeopardizing the confidentiality and integrity of transactions. Imagine if malicious actors could steal private keys, enabling them to conduct double-spend attacks or launch 51% attacks to control the blockchain network.

This potential consequence has prompted industry leaders to proactively address this challenge. A speech by Professor Massimiliano Sala of the University of Trento, Italy, at a Ripple event served as a wake-up call, highlighting the impending "Q-Day" when quantum computing may render traditional cryptography obsolete.

2) Seeking Quantum-Resistant Solutions

Leading companies like IBM and Google are driving the progress of quantum technology while also advancing the development of quantum-resistant encryption technologies. This race has given rise to initiatives like the NIST post-quantum cryptography standardization process, aimed at creating encryption methods that can remain secure even in the face of quantum computing breakthroughs.

3) Blockchain's Quantum Defense

The blockchain community itself is also actively exploring "quantum-secure" solutions. Lattice-based cryptography and quantum key distribution (QKD) are emerging technologies aimed at protecting blockchain communications from quantum attacks.

While the industry is taking proactive steps, transitioning to quantum-resistant infrastructure remains a complex and resource-intensive challenge. Google's latest quantum chip, Willow, has made significant progress in error correction, laying the groundwork for larger-scale quantum computers. Although the power of this technology is undeniable, machines capable of breaking encryption are still far from widespread adoption.

Therefore, ensuring the long-term security of cryptocurrencies through the development and adoption of quantum-resistant solutions is crucial for the continued growth and stability of the crypto industry.

5. Decentralized Physical Infrastructure Networks (DePINs)

In 2024, Decentralized Physical Infrastructure Networks (DePINs) emerged as a major trend, connecting blockchain technology to real-world assets. These networks demonstrate the potential to reshape the energy, transportation, and logistics industries.

Examples include decentralized wireless networks like Helium, blockchain-driven shared mobility platforms, and supply chain tracking systems. DePINs bring greater transparency, enhanced security, improved accessibility, and a sense of community participation.

Despite these advantages, challenges such as interoperability, scalability, and regulatory uncertainty remain.

As DePINs evolve and regulatory frameworks catch up, they are poised to transform the way industries manage and access physical infrastructure, providing more equitable and efficient solutions for the future.

6. The Rise of Trading Bots and AI Agents

In 2024, the crypto market witnessed a surge in the popularity of automated trading bots and AI agents. These tools, designed to execute trades based on predefined algorithms or real-time market analysis, are revolutionizing the landscape of crypto trading.

Key Trends and Innovations

AI-Driven Trading Assistants/Agents: AI-powered trading assistants, such as Near's AI assistant, have become valuable tools for various types of traders. Additionally, Coinbase and Replit's Based AI Agent templates enable developers to create crypto bots for automated trading and asset management. As trading bots and AI agents become more widespread, concerns about market manipulation and unfair advantages have also emerged.

Leading Trading Bots: Truth Terminal, an AI chatbot, gained notoriety in the crypto space for promoting a meme religion ("Goatse Gospel"). Significant Bitcoin donations fueled the launch of the GOAT meme coin, highlighting the potential impact of AI on crypto trends. While Truth Terminal itself cannot execute trades, its influence has sparked debates about AI ethics, particularly in the volatile meme coin market.

The increasing adoption of trading bots and AI agents is undoubtedly reshaping the landscape of crypto trading. While these tools offer significant advantages, their use requires caution and a deep understanding of their limitations. As the technology continues to evolve, balancing automation and human oversight will be key to ensuring responsible and ethical trading practices.

7. The Application of Rollups in Layer2 Scaling

In 2024, rollups emerged as the cornerstone solution to Ethereum's scalability challenges. They address network congestion and high gas fees while maintaining Ethereum's security. As Layer-2 solutions, rollups move transaction processing off the main chain and batch them for submission to the main chain, enabling faster and cheaper operations.

Vitalik Buterin's Standards

In September 2024, Ethereum co-founder Vitalik Buterin emphasized that Layer-2 networks must reach "Stage 1" decentralization standards by 2025. These standards include anti-fraud mechanisms, governance by a security council, and upgrade delays to ensure trust and transparency.

Rollup solutions like Optimism and zkSync have achieved multi-billion-dollar total value locked (TVL) while supporting DeFi, Non-Fungible Tokens (NFTs), and decentralized applications (dApps).

Challenges such as interoperability and achieving full decentralization remain. However, rollup solutions continue to redefine Ethereum's scalability in 2024, cementing their critical role in the future growth and adoption of the Ethereum network.

8. Tokenization of Real-World Assets (RWAs)

In 2024, the tokenization of Real-World Assets (RWAs) is rapidly evolving, creating new opportunities for investors and businesses. Here's an overview of the current landscape:

1) Growth in the Secured Lending Market

The global secured lending market has reached $17 trillion and has expanded at a 17% compound annual growth rate (CAGR) over the past five years. However, only about $500 million in assets have been tokenized, indicating significant growth potential for tokenizing these assets.

2) Global Tokenization Potential

The global market for physical assets exceeds $867 trillion, and tokenizing these assets could significantly enhance the economic impact of the crypto industry. By 2027, tokenized assets could account for 10% of global GDP, potentially expanding the market to $240 trillion (World Economic Forum).

3) Industry Adoption and Initiatives

The DeFi platform Ethena has invested $46 million in an RWA tokenization fund, including products like BlackRock's BUIDL and Superstate's USTB. The Solana-based market platform AgriDex has partnered with Stripe's Bridge and Circle's USDC to reduce cross-border agricultural trade costs from 2-4% to around 0.5%. Latin American banks like Littio are adopting the Avalanche blockchain to manage RWA vaults, showcasing the global appeal of tokenization.

4) Institutional Initiatives

UBS Group, Switzerland's largest financial holding company, has launched its first tokenized fund, the "UBS US Dollar Money Market Fund Token," issued on the Ethereum blockchain, marking a significant shift in institutional adoption of tokenized assets. The Monetary Authority of Singapore is exploring tokenization through Project Guardian, developing standards for tokenized assets.

China is also driving its digital asset initiatives by issuing fully digitized structured products on the blockchain, reflecting the regional demand for tokenization.

Launched in November 2024, Hadron is an asset tokenization platform by Tether, aimed at simplifying the creation, management, and trading of tokenized assets. Hadron aspires to become an easy-to-use solution for tokenizing a wide range of assets, from real estate to financial securities. As the tokenization of RWAs continues to grow, Hadron is poised to redefine the global financial system, enhancing efficiency, transparency, and providing new investment opportunities across industries.

9. The Rise of Modular Blockchains

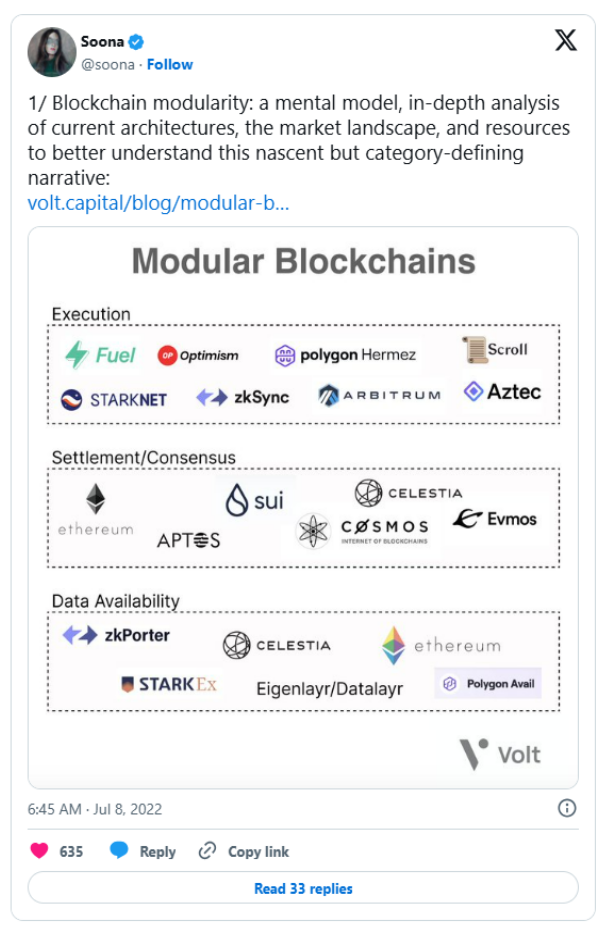

In 2024, the blockchain landscape is undergoing a transformation, with the emergence of modular blockchains driving this change. This innovative approach holds the promise of revolutionizing scalability, efficiency, and customization within the blockchain ecosystem.

1) The Modular Blockchain Paradigm

Modular blockchains differ from the traditional monolithic architecture, where all functionalities are bundled into a single layer. Modular blockchains adopt a modular design, decomposing the blockchain into multiple specialized components. This functional separation provides blockchains with greater flexibility, scalability, and room for innovation.

2) Modular Blockchain Projects and Use Cases

Modular blockchains represented by Ethereum are well-known, and in recent years, some promising modular blockchain projects have emerged, each solving specific challenges and opportunities:

Celestia: The project focuses on creating a decentralized data availability layer, ensuring that all transaction data is accessible to all nodes in the network. This allows other modules (such as the execution layer) to be built on top of Celestia, leveraging its secure and scalable data infrastructure.

Fuel: The project is developing a modular execution layer that can process transactions in parallel, significantly increasing throughput and reducing transaction fees. Fuel's modular design facilitates integration with other blockchain components, creating a versatile and efficient ecosystem.

Dymension: The project aims to build a modular blockchain network capable of supporting various decentralized applications (dApps). By separating consensus, execution, and data availability into different layers, Dymension aims to achieve high scalability and high security.

10. Telegram Games: Attracting Users to the Crypto Realm

In 2024, Telegram became a key platform for crypto gaming. Independent developers launched "play-to-earn" (P2E) games that blend entertainment and crypto rewards. Telegram's friendly bot infrastructure and large user base provided fertile ground for these projects.

Hamster Kombat: Players manage a crypto trading platform operated by hamsters, earning HMSTRToken on The Open Network (TON). Although player engagement and Token value declined significantly by the end of the year, it demonstrated the appeal of P2E games, attracting up to 3 million players at its peak.

Catizen: This game allows users to earn CATIToken through creative gameplay. While the concept resonated with many, the volatility of Token prices reflected the challenges of integrating games with the crypto market.

PAWS: As a rising star in the P2E ecosystem, PAWS attracted over 25 million players through its virtual pet care model, amassing a large user base in just a few days.

Although these games faced criticism for repetitive gameplay, excessive time investment, and the need for crypto investment to maximize rewards, they played a crucial role in the crypto narrative of 2024. Their success highlighted the potential and complexity of blending games with digital assets, becoming an important chapter in the evolution of the P2E ecosystem.

Citizen Game | Source: Citizen

11. Conclusion

2024 was filled with stories that reshaped the crypto industry and laid the foundation for future growth. Memecoins attracted audiences through humor and financial innovation, while prediction markets and decentralized physical infrastructure networks (DePINs) demonstrated how blockchain can solve real-world problems. Telegram games drew in a large number of new users to the crypto space through engaging "play-to-earn" models.

Liquid staking and restaking Tokens strengthened the staking ecosystem of Ethereum, providing users with more flexibility. Rollups addressed scalability issues, making Ethereum faster and more efficient, while modular blockchains introduced a new way to build highly customizable decentralized systems.

The industry also took steps to prepare for the quantum computing era, with quantum-resistant solutions becoming a key focus. The tokenization of real-world assets bridged the gap between traditional finance and blockchain, unlocking exciting opportunities and shaping a digitized future. AI agents and trading bots changed the way users interact with markets, driving automation and efficiency.

These developments highlighted the innovation and challenges in the blockchain world, showcasing its potential to have a profound impact on technology, finance, and culture. How the future will unfold remains to be seen.

Q&A

1) What were the main crypto trends in 2024?

The year 2024 highlighted several transformative trends, including the rise of Memecoins, the popularity of prediction markets, the progress of quantum-resistant cryptography, and the growth of decentralized physical infrastructure networks (DePINs). These stories played a crucial role in shaping the crypto landscape.

2) How will quantum computing impact the crypto industry by 2025?

Quantum computing poses a significant challenge by threatening the traditional cryptographic methods used in blockchains. To address this challenge, the industry accelerated the development of quantum-resistant solutions, such as lattice-based cryptography and quantum key distribution (QKD), to ensure the long-term security of blockchain networks.

3) Why were Memecoins so influential in 2024?

Memecoins like FLOKI and PEPE continued to attract attention from the crypto community by combining humor, cultural relevance, and community-driven initiatives. They also gained prominence through high-profile endorsements, such as the government efficiency project that mentioned Dogecoin involving Elon Musk.

4) What role did AI and trading bots play in the crypto market in 2024?

AI-driven trading bots and agents revolutionized crypto trading by automating decision-making processes. These tools increased market participation, but also raised ethical and regulatory concerns about market manipulation and fair trading.