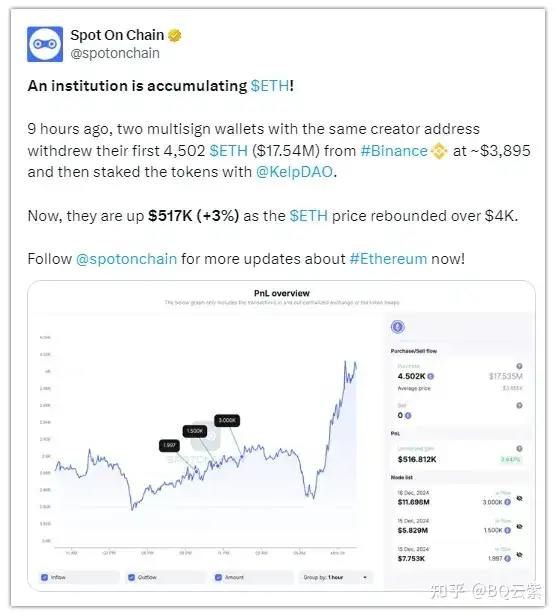

Followin' the price of Ethereum has surged again to $4,000, which is unlikely to be a coincidence. Just 6 hours before the price surge, two multi-signature wallets with a common creator address withdrew their first batch of ETH and staked them. Perhaps some new institutions have started accumulating Ethereum. Their unrealized profits grew to $517,754, then fell back to $157,570 as the ETH price dropped to $3,930.

Breakdown

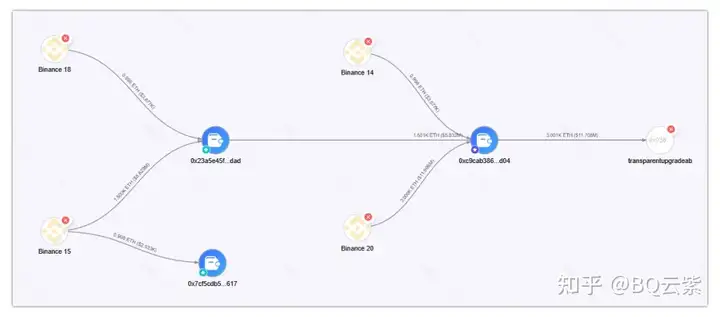

Two multi-signature wallets 0x23a...dad and 0xc9c...d04 withdrew a total of 4,502 ETH, worth $17.54, from Binance. This was the first withdrawal for these two wallets. Interestingly, these two multi-signature wallets share a common wallet creator 0x7cf...617. The withdrawal was executed when the ETH price was between $3,880 and $3,900. These tokens were then staked to KelpDAO.

Based on the amount and timing of these transactions, this behavior appears to be that of an institution. It perfectly timed the Ethereum trend, as the tokens reached $4,022 just 6 hours later. The staked tokens saw a 3% increase in value, creating $517,700 in unrealized profits. It's worth noting that multi-signature wallets are typically used by institutions.

Mysterious Institution

It's unclear whether this is an institution or a new fund. The wallets have no history, so they can't be traced. There are many possibilities.

These addresses could belong to a new fund, a DAO, or even a large investor testing the waters. One of the multi-signature wallets is 4 days old, while the other was created 15 hours ago. Even their creator wallet was created 51 days ago.

Correlation with ETH Price Trend

The most interesting part of these transactions is the timing. Were these transactions based on some analysis, as the timing perfectly aligns with Ethereum recovering to $4,000? Or vice versa? Did these transactions instill confidence in the market, driving the price higher? Whether it's a coincidence or a direct influence, it clearly shows that the market is sensitive to significant transactions.

Market Outlook

At the time of writing, Ethereum is trading at $3,930, down 0.28% in the past 24 hours. Before the decline, the token had risen 2.06% to $4,022. The price is facing resistance at the highs, with the moving average around $3,940 as the first line of support. The RSI has followed the price trend, dropping to 53.19, but remains stable. There is currently no reason for the market to decline. The 11.26% increase in trading volume indicates that traders are showing interest.

What to Expect?

Over time, we may discover who is behind this significant Ethereum transaction, but it's clear that institutions have also shown interest in ETH, following Bitcoin. The price is stabilizing around $4,000. The wallets staking ETH at this price level indicate that large investors are confident in the cryptocurrency. We're not sure if this is an institution, a new fund, a DAO, or a new major player entering the market. What are your thoughts on this? Please let us know.