Bit (BTC) has achieved an important milestone today. It broke through $106,000 in early Asian trading. As the price of the coin set a new record, the BTC-gold ratio also reached a new peak.

The price of Bit (BTC) has fallen 2% from the new all-time high, but there is still bullish pressure in the market.

Bit (BTC) surpasses gold in price appreciation

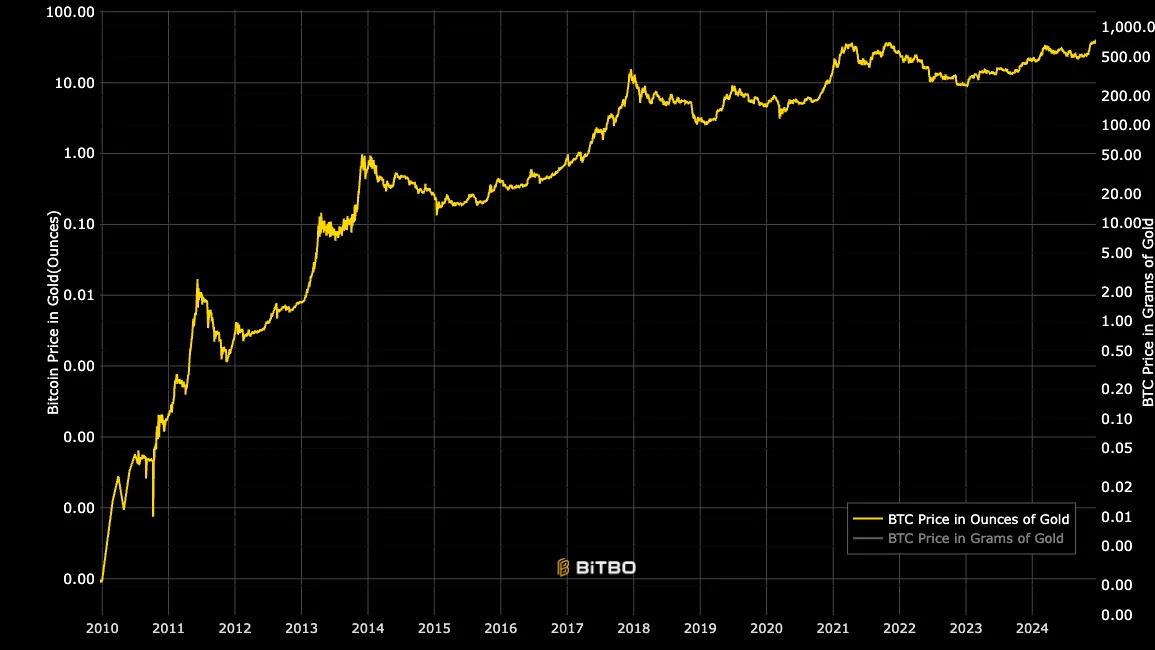

In the early Asian session on Monday, the price of Bit (BTC) reached an all-time high of $106,533 amid a surge in trading activity. This price increase pushed the BTC-gold ratio to a peak of 40 ounces of gold per Bit (BTC).

The BTC-gold ratio compares the price of one Bit (BTC) to the price of gold expressed in ounces. This provides the relative value of Bit (BTC) compared to the traditional store of value, gold.

An increase in the ratio indicates that Bit (BTC) is more valuable than gold, which suggests that investor confidence in Bit (BTC) as an asset is growing.

In a post on December 16th, famous trader Peter Brandt mentioned that the next target for this ratio is 89:1, meaning that 89 ounces of gold would be required to purchase one Bit (BTC).

Regarding the factors driving the rise of Bit (BTC), the on-chain analysis platform Sentiment emphasized in an post that the continuous accumulation by whales is primarily fueling the price increase.

"Bit (BTC) has reached $106.5K for the first time in its over 16-year history. Since the start of the bullish rally on October 10th, the number of wallets holding 100 Bit (BTC) or more has increased by 1,582, a 9.9% increase in a relatively short period," the data provider said.

Bit (BTC) price forecast, new all-time high?

At the time of reporting, Bit (BTC) is trading at $104,567, just below the recent price peak of $106,533, which now serves as a new resistance level. If Bit (BTC) whales continue to strengthen their accumulation efforts, the price of the coin could recover this high and move towards a new peak.

However, if profit-taking activity intensifies, the price of Bit (BTC) could lose its recent gains and drop to $94,344. If this support level weakens, the price of the coin could fall below $90,000 and trade at $84,776.