Introduction

Recently, the price of BTC has hit a new high, breaking through the $107,000 mark and setting a new record. This breakthrough reflects the continued strong bullish sentiment in the market, and has also led to widespread attention on the behavior of the cryptocurrency market. From on-chain indicators, the sustained rise in the BTC market is not only a reflection of investor sentiment, but is also closely related to the implementation of new accounting standards, which have changed the way companies report their holdings of cryptocurrencies.

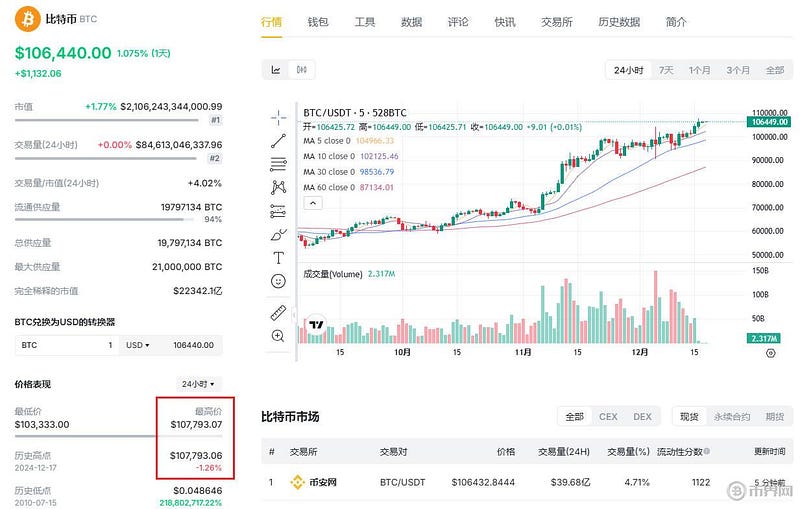

Latest price trend of BTC

TMMP and AVIV Ratio Reveal Market Trends

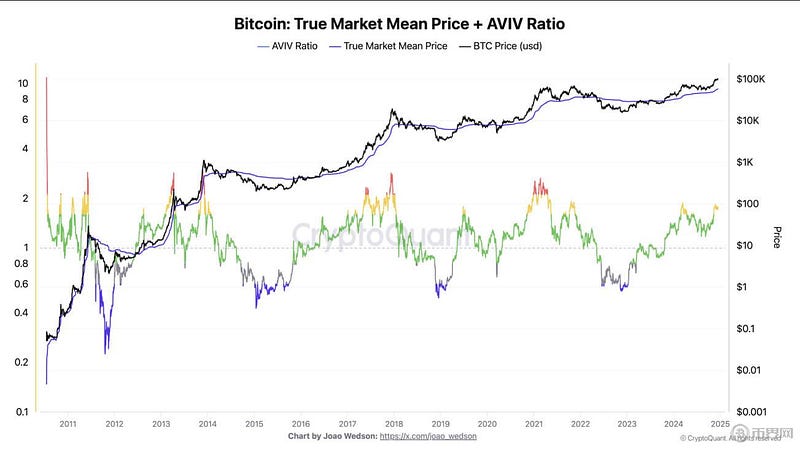

To understand the underlying reasons for the new high in the price of BTC, we can gain deep market insights by analyzing on-chain indicators. In particular, the True Market Median Price (TMMP) and the AVIV ratio provide core interpretations of the BTC market. TMMP represents the average acquisition cost of the market, calculated by dividing the investor's upper limit by the active supply, reflecting the overall cost basis of BTC in the secondary market.

As the price of BTC has gradually risen, the TMMP has shown a stable upward trend. This upward trend typically reflects the continued market interest of investors and the support for higher prices. More importantly, the correlation between TMMP and BTC price means that, over time, the market's acceptance of higher prices has increased, bringing substantial unrealized profits to investors. Historically, this phenomenon often occurs in the mature stage of a bull market, especially before increased volatility or correction.

Analyzing the AVIV ratio alongside TMMP can better reveal whether the market is in an overheated state. The AVIV ratio represents the ratio of active market valuation to realized valuation. When the market price of BTC is much higher than the realized valuation, the AVIV ratio will soar, usually indicating that the market has entered an overbought stage. In December 2024, the AVIV ratio reached levels historically associated with market overheating, similar to the performance in bull market phases such as 2013, 2017, and 2021.

However, it is worth noting that the AVIV ratio and TMMP in 2024 are more stable compared to historical levels, which may indicate a more mature and efficient market structure. In the long run, investor behavior has become more consistent, and the resilience of the market has also been enhanced, but the high level of the AVIV ratio still indicates that the market may face certain adjustment risks in the short term.

New Accounting Standards Bring Transformation to Crypto Companies

At the same time, another important change in the cryptocurrency market is the recent implementation of the new accounting standards by the Financial Accounting Standards Board (FASB). This new rule provides a more precise financial reporting method for US companies holding cryptocurrencies. Previously, due to the lack of clear accounting standards, companies could only classify cryptocurrencies as intangible assets and calculate the cost at the purchase price, and could only recognize impairment if the price fell. This meant that many companies faced the financial dilemma of being unable to accurately reflect the value of their cryptocurrency investments.

After the implementation of the new rules, companies can record their holdings of digital assets such as BTC at fair market value, and can also list their cryptocurrency holdings separately on their balance sheets. This change allows the fluctuations in cryptocurrency prices to be more transparently reflected in the financial statements, especially when the coin price rises, companies can record the unrealized gains in their net profit. This is particularly beneficial for large BTC investment companies like MicroStrategy, as it allows them to more accurately demonstrate the actual value and returns of their BTC investments.

In addition, the new accounting standards have also generated certain market responses, especially against the backdrop of BTC breaking through the $107,000 historical high, more companies may start to consider incorporating cryptocurrencies into their investment portfolios and utilizing this new accounting framework to optimize their financial reporting and capital allocation strategies.

BTC Price Breakthrough and the Future of Market Structure

Although the current AVIV ratio and TMMP indicators suggest that the BTC market may be approaching a local peak, with the growing presence of institutional investors and the derivatives market, this adjustment phase may not be too severe or prolonged. The breakthrough in BTC price and the implementation of new accounting standards are both driving the gradual maturation of the cryptocurrency market. This means that market volatility may decrease, and investor behavior may become more rational and consistent.

Overall, the strong rise in BTC price in 2024 is closely related to the gradual maturation of investor behavior, and is also influenced by the implementation of new accounting standards, which may further drive the market towards greater efficiency and transparency. In the future, with the combined effect of these factors, BTC and other cryptocurrencies may continue to move towards a more standardized and mature market environment.