Overall summary: Long-term bullish, short-term bearish

From a long-term perspective, I remain optimistic about the future of the Crypto market, as both the business cycle and liquidity cycle are continuing in a positive direction. However, in the short term, due to a pullback in liquidity, Crypto prices may experience increased volatility.

VX: TTZS6308

Some may ask: If you're bullish in the long run, why adjust your operations? This is because the Crypto market, as the global market with the highest risk preference, has extremely high volatility. Even in a bear market, BTC could potentially drop by as much as 80%. To improve the efficiency of capital utilization, I do not want to let my capital be trapped for a long time, and I also hope to avoid unnecessary psychological grinding - this is particularly important for improving the rate of return.

Please remember one thing: Excessive volatility is the enemy of returns!

December - the most important month of the year

December will become the most important month for the Crypto market in 2024, and the operational results will determine how much of the profit we can hold onto this year.

Based on observations of global liquidity, I believe the market may experience significant fluctuations in the future. In this case, protecting the profits we have already earned this year and avoiding giving back the gains becomes the top priority.

Risk preference and liquidity

The core driving factors of the Crypto market can be summarized into two aspects: the risk preference of capital and the abundance of global liquidity.

The level of risk preference is usually determined by the business cycle. For example, when a company's EPS (earnings per share) rises, it means that the company's profitability has increased, and after making money, it will have more capital to invest, and the market sentiment will also be more optimistic, and even willing to expand its business through borrowing, which will also drive the recovery of liquidity.

From the data, the current US PMI (Purchasing Managers' Index) reflecting the economic situation does not show any problems, and the PMI leading indicators published by many economists also show that the economy will present an upward trend in the next 3-6 months.

In addition, CPI (Consumer Price Index) data shows that inflation is still in a moderate downward channel and has not shown any abnormalities. This means that the slowdown in the job market is more of a structural adjustment rather than a comprehensive weakness, and inflation does not pose additional pressure. This clears the way for future interest rate cuts and the use of other monetary policy tools. After the CPI data was released, both the US stock market and the Crypto market rose.

From a long-term perspective, there is no overall problem with global liquidity. The recent liquidity fluctuations are mainly due to concerns about the uncertainty of policies after Trump's return to power, as well as the recent strong performance of the US dollar. These issues do not need to be over-interpreted.

Why are we concerned about the volatility of the Crypto market?

Although the long-term trend is positive, the Crypto market may still face significant volatility risks in the short term.

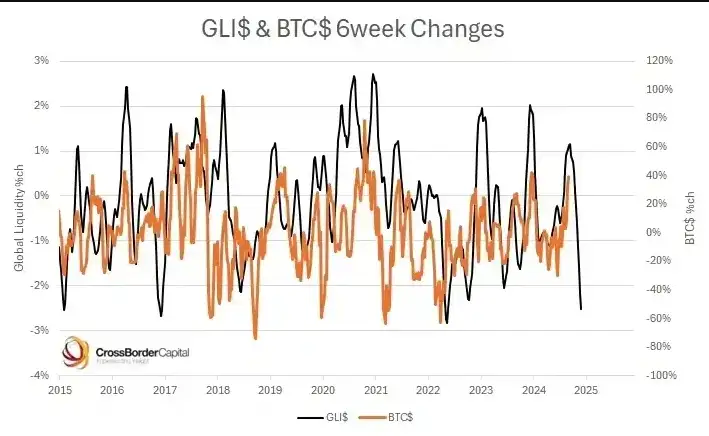

From the data provided by authoritative macroeconomic institutions, we can find some answers: (Global Liquidity Index) is a leading indicator of the 6-week rolling return rate of Bitcoin. The data shows that the 6-week growth rate of GLI is often able to predict the short-term performance of BTC prices. By observing the trend of liquidity, we can foresee that the pullback of liquidity in the next 6 weeks may trigger an adjustment in BTC prices. Another institution, Raoul's research data, also shows that liquidity will continue to decline in the next 6-12 weeks. This decline may lead to further fluctuations in the Crypto market.

Based on the above data, I take a cautious attitude towards the market outlook for the next 1 to 3 months.

How should we respond?

In response to the current market conditions, the following strategies need to be adopted:

First, the proportion of Altcoin holdings should be reduced. This is because the volatility of Altcoins is generally higher than BTC, and in the case of poor BTC performance, Altcoins usually perform worse, or even experience larger declines. Therefore, reducing the proportion of high-risk Altcoins is the top priority.

Secondly, the leverage ratio should be reduced. As the market may enter a phase of significant fluctuations, whether upwards or downwards, reducing the leverage ratio can effectively avoid the risk of liquidation and avoid unnecessary capital losses.

Finally, protect profits through options. For most BTC holders, if conditions permit, you can use options tools to hedge and protect the current profits. This method can both lock in some of the gains and reduce losses in the event of a market pullback.

In the Crypto market, volatility is the norm, but the ability to respond to volatility is the key to our success. December is the closing stage of the year's investment, and its importance cannot be overstated. We need to find a balance between risk and return, protect this year's profit, and at the same time prepare for future opportunities.

May every investor be able to move steadily forward, navigate the volatility, and embrace the broader market opportunities!