Observation of Bitcoin's Historical Cycles

(Figures 2-6 are included in the translation)Indicators Beyond Bitcoin

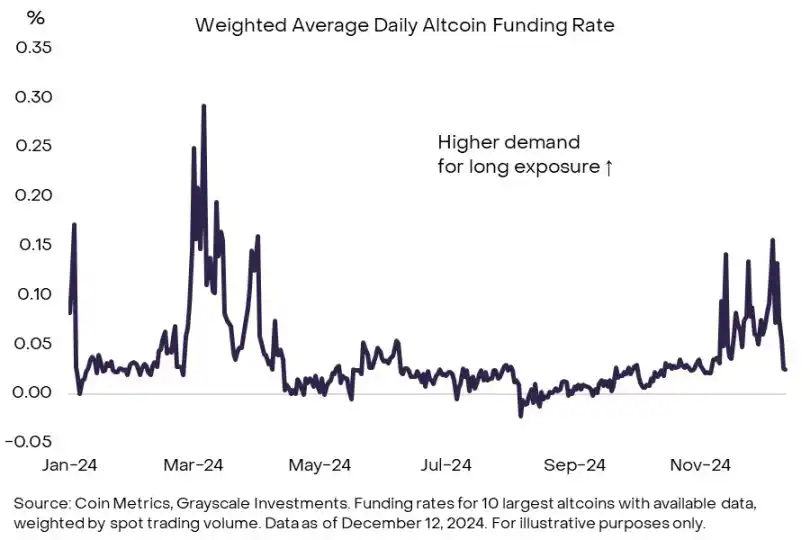

The cryptocurrency market is not just about Bitcoin, and signals from other industry sectors may also provide guidance on the market cycle status. We believe these indicators may be particularly important in the coming year, given the relative performance of Bitcoin and other crypto assets. In the past two market cycles, Bitcoin's dominance (Bitcoin's share of the total cryptocurrency market capitalization) peaked around two years into the bull market (Figure 7). Bitcoin's dominance has recently started to decline, around the two-year mark of the current market cycle. If this trend continues, investors should consider focusing on broader metrics to determine if cryptocurrency valuations are approaching a cyclical high point.Here is the English translation:For example, investors can monitor the funding rate, which is the cost of holding a long position in perpetual futures contracts. When speculative traders have high demand for leverage, the funding rate tends to rise. Therefore, the overall level of funding rates in the market can indicate the overall position of speculative traders. Figure 8 shows the weighted average funding rate of the 10 largest Altcoins after Bitcoin. Currently, the funding rate is clearly positive, indicating the demand for long positions by leveraged investors, although the funding rate has dropped sharply in the recent decline. Moreover, even at the current local high, the funding rate is still lower than the levels earlier this year and the highs of the previous cycle. Therefore, we believe that the current funding rate level indicates that the market's speculative nature has not yet reached its peak.

In contrast, the open interest (OI) of perpetual futures on Altcoins has reached relatively high levels. Before the major liquidation event on December 9, the open interest in Altcoin perpetual futures on the three major perpetual futures exchanges had reached nearly $54 billion (Figure 9). This indicates that the overall position of speculative traders is relatively high. After the large-scale liquidation, the Altcoin open interest fell by about $10 billion, but it is still at a high level. The high long positions of speculative traders may be consistent with the late stage of the market cycle, so continued monitoring of this indicator may be important.

The Bull Market Will Continue

Since the birth of Bitcoin in 2009, the cryptocurrency market has made great progress, and many features of the current crypto bull market are different from the past. Most importantly, the approval of spot Bitcoin and Ethereum ETFs in the US market has brought in $36.7 billion in net capital inflows and helped incorporate crypto assets into a broader traditional investment portfolio. Furthermore, we believe that the recent US election may bring more regulatory clarity to the market and help ensure the permanent position of crypto assets in the world's largest economy. This is a significant change compared to the past, when observers repeatedly questioned the long-term prospects of the crypto asset class. For these reasons, the valuations of Bitcoin and other crypto assets may not follow the historical patterns of the early days.

At the same time, Bitcoin and many other crypto assets can be viewed as digital commodities, and like other commodities, they may exhibit a certain degree of price momentum. Therefore, an assessment of on-chain indicators and Altcoin data may be helpful for investors to make risk management decisions. Grayscale Research believes that based on the overall indicator set, the crypto market is currently in the mid-stage of a bull market: indicators such as the MVRV ratio are far above the cycle lows, but have not yet reached the levels that marked the previous market tops. As long as the fundamentals (such as application adoption and macroeconomic conditions) are sound, we believe the crypto bull market will continue until 2025 and beyond.

Welcome to join the official BlockBeats community:

Telegram subscription group: https://t.me/theblockbeats

Telegram discussion group: https://t.me/BlockBeats_App

Twitter official account: https://twitter.com/BlockBeatsAsia