The long-awaited interest rate cut has arrived as scheduled, but the market has not been as enthusiastic and uplifted as usual.

In the early morning of December 19, Beijing time, the Federal Reserve announced its final interest rate decision of the year, deciding to lower the federal funds rate target range by 25 basis points to 4.25%-4.50%, successfully achieving the third consecutive rate cut. To date, the Federal Reserve has accumulated a 100-basis-point cut in this round of the rate cut cycle.

Even with the sell-the-fact behavior, the release of liquidity would be a huge boon for the risk market, but this time it is different. The US stock market fell first out of respect, pricing it in with their actions. Choice data shows that as of the market close on the 18th Eastern Time, the Nasdaq fell 3.56%, the S&P 500 index fell 2.95%, the Dow Jones Industrial Average plunged over 1,000 points, a 2.58% drop, marking the 10th consecutive day of decline, the longest streak since October 1974.

The crypto market followed suit, with Bitcoin briefly falling below $10,000, touching $9.9,000, ETH dropping over 7.2% at its peak, and the altcoin sector broadly declining over 10%. Why did this rate cut result in such an outcome?

01

Hawkish expectations trigger market panic, Powell slaps down Trump

A rate cut is good news, but the risk market speculation revolves around one word - expectations. Federal Reserve Chairman Powell issued rare hawkish remarks while cutting rates, stating that the December rate cut decision was more challenging but the "right decision", emphasizing that the Federal Reserve will be "more cautious" in considering future policy rate adjustments, and that the decision on whether to cut rates by 2025 will be based on future data rather than current forecasts, with the Federal Reserve only considering further rate cuts after inflation improves.

Compared to the relatively consistent voting in the past, this rate cut also saw dissent, with Cleveland Fed President Mester voting against the rate decision, believing the rate cut should be skipped, reflecting the growing resistance to rate cuts.

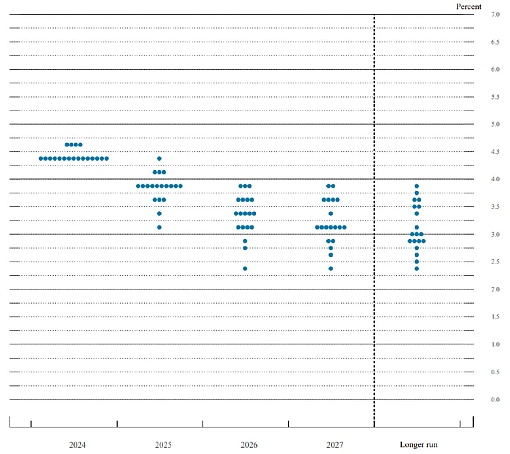

The economic outlook released by the Federal Reserve on the same day also showed an upward revision of the economic growth rate and a downward revision of the unemployment rate, indicating the Federal Reserve's hawkish stance. Looking at the dot plot, based on this outlook, 10 out of 19 Federal Open Market Committee members believe that by the end of 2025, the federal funds rate target range will be lowered to between 3.75% and 4%, and considering the so-called "more cautious" approach, with 25 basis points as the base, the Federal Reserve seems to be able to cut rates at most twice next year, a significant pullback from the 4 cuts expected in September.

Against this backdrop, the already priced-in December rate cut news led to a sharp sell-off in US stocks, which is understandable, as the outlook for a soft landing remains to be seen. In fact, from a macroeconomic perspective, the severity is still within manageable limits. Although the hawkish rhetoric has emerged, the 2025 rate cut consensus remains, with only a slight upward shift in the neutral rate. From the Federal Reserve's perspective, the hawkish rhetoric is most likely a preemptive warning to address the uncertainty of Trump's future governance, in order to retain some room to prevent the inflationary impact of Trump's policy proposals.

Although the rate cut expectations have had a significant impact on the risk market, the crypto disaster has been even worse. Powell's one sentence caused Bitcoin to plummet over 5% and further dragged down the crypto market. According to Coinglass data, as of 5 pm, over 260,000 people were liquidated globally in the past 24 hours, with a total of $780 million in liquidations, $661 million in long liquidations, and $118 million in short liquidations.

At the press conference, when asked whether the Federal Reserve would establish a Bitcoin national reserve, Powell replied, "We are not permitted to own Bitcoin. The Federal Reserve Act specifies what the Federal Reserve can own, and the Federal Reserve does not seek to change that. That is something Congress should consider, but the Federal Reserve does not wish to modify the law."

Powell's attitude undoubtedly reflects opposition to cryptocurrencies, with the Federal Reserve not considering including Bitcoin on its balance sheet and not wishing to discuss the issue. And within his current term, Powell has clearly stated that he will not resign, and Trump does not have the power to replace him.

Coincidentally, just recently, Trump once again made his usual "great" claims, saying he would do great things in the crypto space, and when asked whether the US would establish a Bitcoin strategic reserve similar to the oil reserve, he bluntly said, "Yes, I think so." Even earlier, an anonymous transition team source revealed that Trump hopes to see Bitcoin reach $150,000 during his term, as cryptocurrencies are "another stock market" to him, and given Trump's clear "the stock market is everything" governance philosophy, this message has a high degree of credibility.

And on December 17, market news surfaced again, saying that Trump plans to establish a strategic Bitcoin reserve (SBR) through an executive order, intending to use the Treasury Department's Exchange Stabilization Fund (ESF) to purchase Bitcoin, which has already exceeded $200 billion. On the same day, the Bitcoin Policy Institute drafted the full text of this executive order and stated that the order would take effect immediately after being signed by Trump upon taking office.

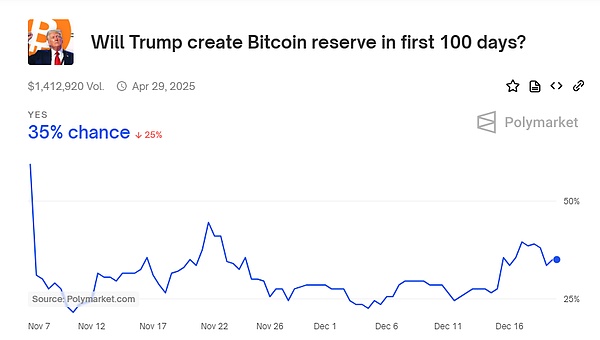

Amid a series of news stimuli, the plan for a national Bitcoin reserve seems to be just within reach, and the market has high hopes for it, with the Polymarket vote on the Bitcoin reserve growing from 25% to 40%, and Bitcoin surging yesterday, briefly challenging the $110,000 mark. But now, Powell's remarks are a direct slap in the face of Trump, and if the Federal Reserve does not cooperate at the level, the so-called national reserve will obviously face strong obstacles.

02

The Federal Reserve has no interest, the Bitcoin national reserve faces daunting challenges

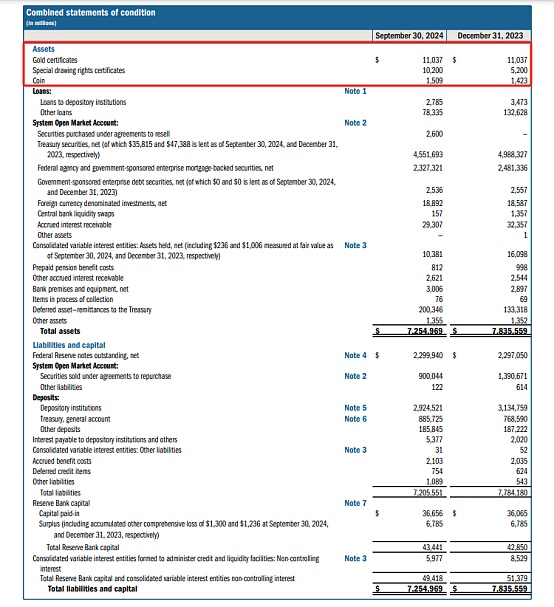

Taking the "Bitcoin Bill" proposed by Senator Cynthia Lummis as an example, this bill requires the government to purchase up to 1 million bitcoins over 5 years, with a maximum of 200,000 per year. Calculated at $10,000 per Bitcoin, excluding purchase premiums, the government would need to raise at least $100 billion. In terms of detailed operations, the funding can be composed of three parts: 1) using the Federal Reserve's Treasury remittances, up to $6 billion per year, but this scenario is less likely as the Federal Reserve's balance sheet is still in a loss position, with losses exceeding $200 billion, and the Federal Reserve has not remitted any funds to the Treasury since September 2023; 2) transferring funds from the Federal Reserve's capital surplus account to the Treasury's general fund, a method used in the FAST (Fixing America's Surface Transportation) Act, but if used to purchase Bitcoin, it would likely raise widespread public doubts about the Federal Reserve's independence; 3) the most feasible option is to adjust the fair value of the Treasury's gold reserves based on market prices, allowing the Federal Reserve to monetize the earnings on the official value of the Treasury's gold reserves. According to the Federal Reserve's financial statements, the Federal Reserve's official reserve assets include gold, special drawing rights, and coins, of which the gold represents Treasury gold certificates valued at slightly over $42.22 per troy ounce, with a nominal value of $11 billion, but if calculated at a market price of $2,700, the reserves would reach $703.4 billion. In fact, regardless of how Bitcoin is purchased, the US Treasury would need the full support of the Federal Reserve.