The Federal Reserve cut interest rates by 25 basis points as expected. However, the crypto market has undergone dramatic changes, with BTC sliding from $105,000 after the Fed's decision to as low as $99,000. Ethereum also dropped from around $4,000 to around $3,500.

VX: 'TTZS6308'

Except for a few altcoins, the majority of the altcoin market is in a downward trend.

In terms of contract data, the 24-hour network-wide liquidation reached $674 million, with $577 million in long positions liquidated, involving over 237,000 traders. The crypto market is in a state of distress.

Hawkish Fed Rate Cut

Crypto assets are increasingly influenced by macroeconomic factors. Yesterday's article "Accelerated Rate Cuts Exacerbate Volatility, Rate Cuts Remain a Key Factor Affecting Next Year's Market Trend" and the day before's "Bitcoin Keeps Bleeding, Buying the Dips Requires Caution, Don't Rush In" both clearly told everyone that the recent market is unstable, and it's better to wait for a dip before considering buying the dips. And sure enough, today we saw a waterfall sell-off.

The Fed announced a 25-basis-point cut in the benchmark policy rate, but hinted that the number of rate cuts in 2025 may be lower than previously expected (lower than the four projected in September, and also lower than the three expected by the market before the meeting). Powell described this shift as a "new phase" of monetary policy and emphasized that after the 100-basis-point rate cut in 2024, rates are now much closer to a neutral stance. Such a "hawkish" signal has led to a sell-off in US stocks and cryptocurrencies.

Powell stated that the rate cut decision made at this meeting was "quite difficult", and the risks faced by the Fed in achieving its dual goals of controlling inflation and promoting employment are roughly balanced, with significant progress made in controlling inflation. Although rates have already been cut by 100 basis points, they are still significantly suppressing economic activity, and the Fed is "on a path of further rate cuts". However, before further rate cuts, officials need to see more progress on the inflation front.

Additionally, Powell said the new US administration's policies have not yet been formally implemented, but the Fed has already done a lot of preparatory work, and when the specific policies are finally seen, it will be able to conduct a more careful and thoughtful assessment and formulate appropriate policy responses.

In his opening remarks, Powell said the US economy overall appears to be performing strongly and has made significant progress towards the Fed's goals over the past two years. The labor market has cooled from its previous overheating state but remains robust. Inflation levels are now closer to the Fed's 2% long-term target. He stated that even if the inflation rate next year only drops to 2.5%, the Fed could still cut rates next year as shown in the dot plot, as inflation will be moving in the right direction.

Just as Powell hinted at a slower pace of rate cuts, the US stock market fell, with the Dow Jones index potentially extending its losing streak to 10 consecutive trading days, which would be the longest single-day losing streak since October 1974. All 11 major sectors of the S&P 500 index declined, with real estate leading the losses.

The Fed's biggest problem right now is that despite the rate cuts, the financial environment is still tightening. Since September, long-term bond yields and mortgage rates have been rising, and the US dollar has appreciated, which also means a tightening of financial conditions. The continued appreciation of the US dollar also poses macroeconomic risks to Bitcoin, as the dollar's appreciation is often associated with a contraction in global money supply, which is generally unfavorable for Bitcoin and other cryptocurrencies. In my view, the tightening of liquidity and the strength of the US dollar are the biggest risks facing BTC...On the other hand, BTC's on-chain factors remain very favorable, especially the continued decline in exchange balances, which supports the hypothesis of an increasingly acute BTC supply shortage.

Although the market is in a pessimistic state, there are still catalysts worth looking forward to in January 2023. On January 20, Trump will officially take office as president. With policy tailwinds, institutions will be more willing to allocate funds to the crypto market, which will boost crypto asset prices. The crypto market often follows certain market superstitions, such as typically seeing a decent rally around the Lunar New Year.

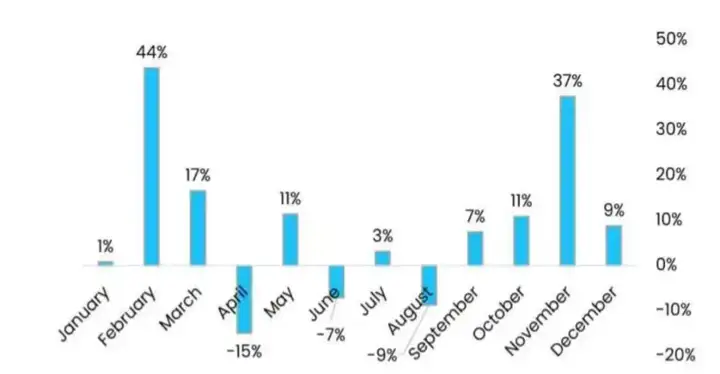

For example, Bitcoin's monthly return rate once exceeded 44% during the Lunar New Year in February this year. Next year, January 29 will be the Lunar New Year. Perhaps the market will see a turnaround in January.

Additionally, the FTX restructuring plan will take effect in early January, and the compensation funds will be paid out in fiat and stablecoins, which will bring billions of dollars back to the market.

Although January 2023 is worth looking forward to, one cannot be complacent. The market cycle fluctuates greatly, and investors need to pay attention to risk control.

After the big drop, the Asian countries have all woken up, and Japan's rate hike expectations have not materialized, leading to a lukewarm market rebound, indicating that Asian capital can no longer stem the tide, which is the result of being consumed by multiple "wolf cries".

Don't be too pessimistic, in January 2023 there will be the "King" Trump's inauguration. This time the King is really coming to be the emperor, with the Senate all belonging to him, making it easy to push things through Congress later on. Today, Powell said the Fed does not have the qualification to buy Bitcoin and does not want to seek legislative changes to promote this, but if Trump insists on Congress passing legislation, it is not impossible for the US to establish a Bitcoin reserve. So what we see as negative news today may actually be positive tailwinds for the future.

Additionally, in January there will be the FTX compensation, with $16 billion in fiat or stablecoins to be paid out, some of which will flow back into the crypto market. Combined with the resumption of US ETFs, the January market outlook is still worth looking forward to. So this dip is most likely to occur at the end of December or early January, which is a point worth watching for capital looking to cash out this round.

When everyone is in panic and doubting the bull market is over, that is the time to gear up. The market always goes against human nature, so it's best to avoid the noise and invest based on your own logic.