Approximately $1.25 billion was liquidated in the cryptocurrency market over the past 24 hours. The market has dropped by almost 10%.

Bit temporarily fell below $96,000, and meme coins suffered the biggest losses on Thursday.

Inflation Forecast, Massive Crypto Market Adjustment

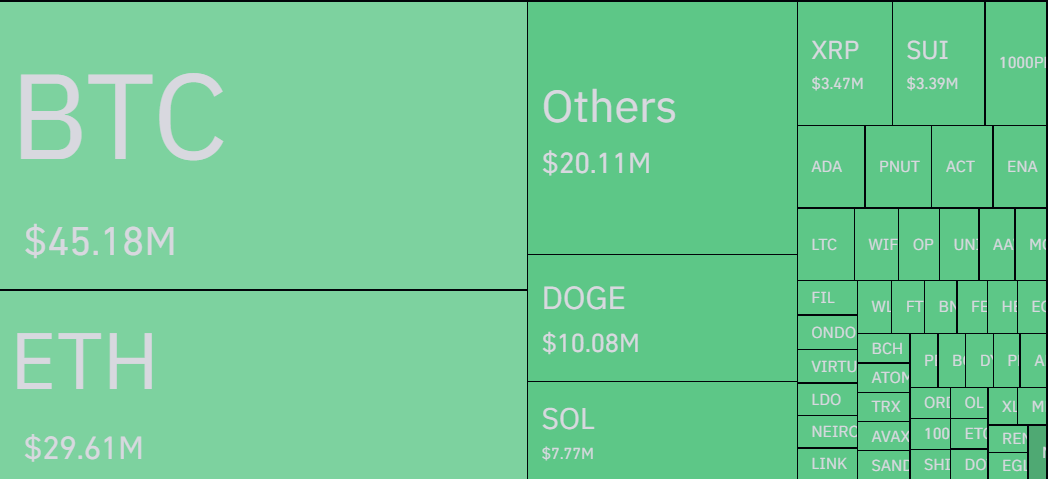

According to data from the cryptocurrency derivatives data platform Coinglass, Bit recorded over $45 million in liquidations today, and Ethereum had nearly $30 million liquidated. This occurred after the Federal Reserve (Fed) raised rates by 25bp on Wednesday.

Rate hikes are usually positive for cryptocurrencies, as lower rates signify an accommodative monetary policy. However, the market was impacted by the Fed's 2025 outlook. Jerome Powell said the Fed expects high inflation and two rate cuts next year.

While the scale of the liquidations is significant, the impact on the stock market is more severe. Around $1.5 trillion was wiped out in the US markets. These large-scale liquidations have raised concerns about a potential downtrend cycle.

"Everyone, the bull market is officially over, and I sincerely thank you all. I will be deleting all crypto-related social media and logging out." An influencer posted on X (formerly Twitter).

However, most analysts view today's liquidations as a short-term correction.

"Bit market sentiment. The same story every time. The market is not designed for the majority to win. Corrections are a natural part of a bull market," popular analyst 'Titan of Crypto' wrote.

Other analysts, such as Philakone, emphasized that such liquidations typically occur during the end-of-year bull season. He also predicted that bullish sentiment would return after December 17th and last until the first week of January.

Meanwhile, some analysts are forecasting an 'Altcoin Season'. The increase in Bit liquidations could weaken Bit's dominance in the coming months, providing more opportunities for major altcoins like Ethereum and Solana.

"If you think Altcoin Season is over, you should know this: The total altcoin market cap (excluding BTC and ETH) is around $1.05 trillion. This is approaching the previous all-time high of the altcoin market in November 2021. The last time something similar happened was in February 2021, when this altcoin market cap tested the previous high of January 2018," Lark Davis wrote.

While the Fed's outlook impacted the market today, Bit has still risen by nearly 130% this year. The key is that the various developments in the cryptocurrency industry outweigh these macroeconomic factors.

MicroStrategy, led by Michael Saylor, holds nearly 2% of the Bit supply and has been making consecutive purchases since November. The company bought $1.2 billion worth of BTC in December when the asset was above $10,000.

Other listed companies, such as MARA and Riot Platforms, have also pursued similar Bit acquisition strategies this month. Potential regulatory changes can also be expected, as global lawmakers in several countries are advocating for Bit reserves.

Therefore, while macroeconomic factors have raised temporary downside signals, the long-term outlook for 2025 remains positive.

Decrease in Exchange BTC Supply... Potential for Bit Supply Shock

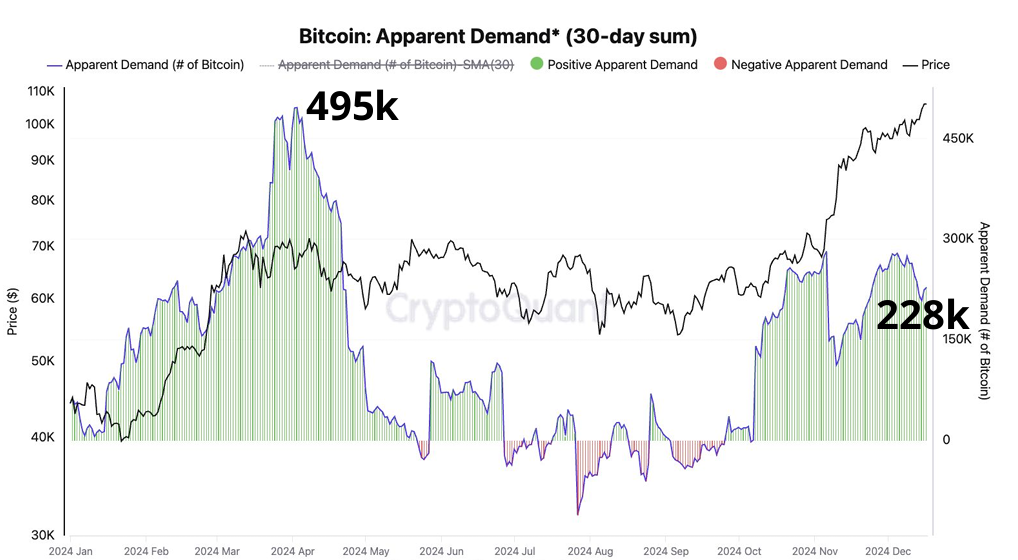

Another reason to believe Bit will continue its bullish trend is the ratio of supply and demand.

According to data from the on-chain platform CryptoQuant, the Bit market is showing signs of a potential supply shock as the supply of sellable BTC decreases and demand increases. Bit demand is increasing, and accumulation addresses are adding 495,000 Bit per month.

Meanwhile, the stablecoin market capitalization has reached $200 billion, signaling new liquidity. Optimism about crypto-friendly policies and potential US initiatives is further fueling demand.

On the sell-side, liquidity is at 3.397 million Bit, the lowest since 2020. This includes exchanges, miners, and OTC desks. The inventory-to-sales ratio, which measures the period the current supply can meet demand, has plummeted from 41 months in October to 6.6 months, emphasizing tightening market conditions.

Therefore, these supply shocks and macroeconomic factors could be the main catalysts for today's liquidations.