The shitcoins on CEX have crashed hard. If they are not strong shitcoins, they have basically fallen back to the launch stage. Even the strong shitcoins have dropped a lot. No need to worry too much about the spot market, but it's disastrous for contract users.

In the past 24 hours, the entire network had $1.023 billion in liquidations, with over 300,000 people liquidated. Cherish your life, stay away from contracts. This time, the long positions have been blown up, and next it will be the short positions. Let's wait for the rebound this weekend and next week, but the reversal may not be ready yet.

Nothing much to say about the long-term BTC trend, it just keeps going up. I'm very optimistic about next year's market. On the 4-hour level, there is clear support around $95,000. Let's see the rebound this weekend and next week before Christmas, as the Westerners will be on holiday. This year's market is just like this, next year will be even crazier. This year is just a rehearsal, also telling us what aspects and tracks the market likes to focus on. Everyone must summarize a lot. Without continuous innovation to drive the market, the secondary market will be difficult to operate.

Summary of the recent market and operations

The market is like this - just when you think the hope is coming, it will give you a blow.

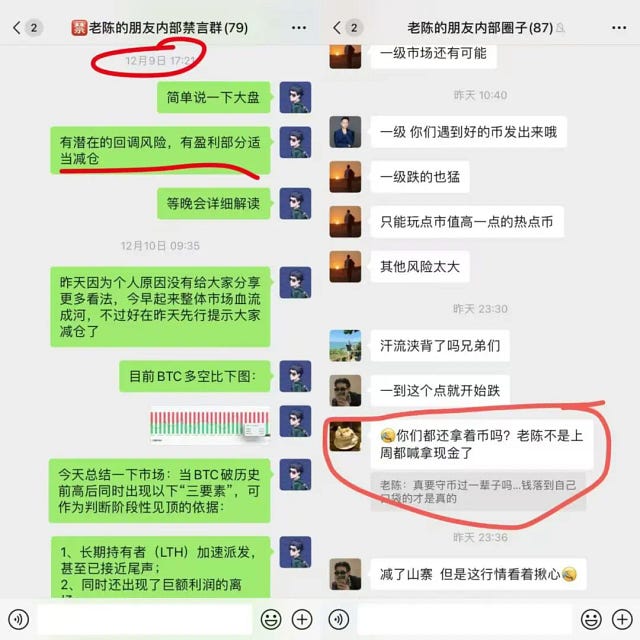

On the 9th, after BTC reached a new high, there were signs of capital retreat. I suggested VIPs to reduce their shitcoin positions and hold cash!

On the 12th, ETH broke through $4k first, and BTC continued to hit new highs. I chose to take a light position and tried to deploy G, with a small 10% stop loss, but didn't expect the shitcoins to be crazily drained. But I can still accept it.

On the 16th, I thought BTC's uptrend could at least reach $11-12k, but it only reached $108,000. I don't know if the big players saw my post and deliberately didn't pull it up. Yesterday I said BTC wouldn't fall below $98,000 and would just have a normal pullback and accumulation, but today it fell below and I don't know how it will go.

After a period of trading, it's still necessary to stop and think sometimes.

Opportunities come from the dips. Control your position size and choose the right coins. Don't touch the weak shitcoins! Buy the big dips, buy the small dips in batches to pick up the chips. Hopefully there will be a big one after this adjustment next year.

BTC has dipped to $95,700, where is the bottom? Where are the shitcoin opportunities?

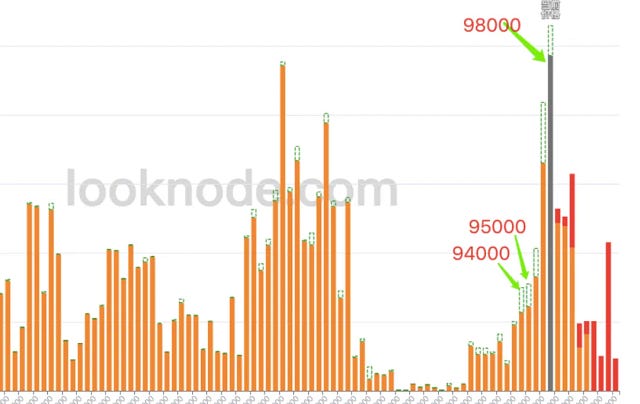

First, let's look at the K-line and on-chain data: BTC's URPD data shows strong support at $94,000 and $95,000. From the daily K-line, although it broke above $100,000 on 12.5 and then crashed to around $90,500, the subsequent declines have been stable above $94,000. So now it's about watching the market sentiment and the impact of bullish and bearish events. How much can the bearish sentiment push it below $94,000?

Note: A short-term dump does not mean a break of support. It requires problems with the on-chain coin distribution to be considered a true breakdown of support. In other words, even if the price falls below $94,000 on the K-line, as long as it quickly recovers, it's not considered a breakdown. After all, data is dead, but human emotions are "alive".

Then let's look at the events affecting sentiment, i.e. the macro and fundamentals: There's the PCE data tonight. Powell's previous speech was already quite clear - there's unlikely to be a rate cut in January. It's just about how the market interprets the data. The bearish factors aren't that severe. The main thing is that it's the weekend soon, when there's low liquidity. Then on the 23rd, MSTR will officially enter the Nasdaq 100. This is a real bullish event for the capital inflow. Hopefully this can bring some positive sentiment to the market, and then it's the 24th and 25th, when the US stock market is closed.

BTC is a 24/7 market without market makers, so it's all about the specific market sentiment. So before the market holiday, if MSTR's official entry into the Nasdaq 100 can bring some positive sentiment, BTC may be able to pass through the Christmas period smoothly without too much trouble. If the sentiment is bad at this time node, the market may not look good. Of course, we still need to wait and see the reaction of the Americans after Christmas. Then it's New Year's.

By now, you should have a basic understanding of the upcoming BTC trend. Then let's look at the manipulation by the big players. BTC also needs to decline to harvest the hot money in the market. It needs to make those high-position bag holders surrender their chips. But BTC's harvesting is not like shitcoins, where they just pull it up and then 90-degree line down, or even wipe out in one wave.

Now it's in a high-level oscillation waiting for a new direction. The new direction will be Q1 next year. In simple terms, the "big players" haven't finished distributing their chips yet. They need to pull it back up and then distribute the chips again. So based on the $95,700 price, the downside is limited.

Finally, let's talk about the shitcoins, which are also what you guys are concerned about.

If you want to buy the deeper dips, just watch the further downside of BTC at $95,700 and the downside extent of the shitcoins. I've mentioned before that whether to deploy in batches or all at once depends on your personal preference. As for buying the dips, I've also provided some thoughts in previous articles. Or if you're afraid, you can wait for it to stabilize and then get in. After all, no one can buy at the absolute bottom.

The bull market has basically started. With the easing of policies, there will be many opportunities waiting for us to deploy. The group will regularly recommend wealth codes to help everyone seize the upcoming bull market and realize our goals and dreams in the crypto world!

Group content:

Mainly spot trading. There will be market analysis to identify trend opportunities for early deployment, potential coin recommendations for early layout, and following the cycle changes in the market. Shitcoin recommendations when opportunities arise, with a focus on spot trading.

We will choose more strong coins, trying to get a few high-leverage targets, as the market is stirring again and will definitely need coins with strong wealth effect to ignite the new bull market. Grab one and make a big profit, grab a few and make a killing.

Reasonable position control, with mainstream coins as the bottom, and shitcoins for value-added.